Is Abans Group safe?

Pros

Cons

Is Abans Group Safe or Scam?

Introduction

Abans Group is a financial services provider that has gained attention in the forex market for its diverse offerings, including trading in forex pairs, commodities, and cryptocurrencies. Established in 2022, the company has positioned itself as a player in the increasingly competitive realm of online trading. However, the rise of unregulated brokers has made it crucial for traders to thoroughly evaluate the legitimacy and safety of their chosen platforms. Traders must exercise caution and conduct due diligence to avoid potential scams and protect their investments. This article aims to investigate the safety and legitimacy of Abans Group by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risks.

Regulation and Legitimacy

The regulatory status of a broker is one of the most important factors that determine its credibility and safety. Abans Group operates as an unregulated entity, which raises significant concerns regarding investor protection and compliance with industry standards. The absence of oversight from recognized regulatory bodies can lead to increased risks for traders, including the potential for fraud and mismanagement of funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that Abans Group does not adhere to the strict standards enforced by top-tier regulators, such as the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission). This absence of oversight can result in a lack of transparency, higher risks for clients, and limited recourse in the event of disputes. Furthermore, there have been numerous complaints from clients regarding withdrawal issues, which further underscores the potential risks associated with trading with an unregulated broker like Abans Group.

Company Background Investigation

Abans Group was founded in 2022 and has quickly expanded its operations in the financial services sector. However, the companys relatively short history raises questions about its stability and reliability. The ownership structure of Abans Group is not entirely transparent, and there is limited information available regarding its management team and their professional backgrounds.

The founder, Abhishek Bansal, is described as a new-age entrepreneur with a vision for innovation in financial services. While his leadership might be promising, the lack of a seasoned management team with extensive industry experience could be a red flag for potential investors. Transparency in company operations and clear communication of policies are essential for building trust with clients, and the current opacity surrounding Abans Group raises concerns about its commitment to these principles.

Trading Conditions Analysis

When assessing the safety of a broker, it is vital to analyze the trading conditions they offer. Abans Group claims to provide competitive trading fees, but the absence of clear and detailed information on their fee structure can be alarming. Traders should be wary of any hidden fees or unfavorable terms that could impact their profitability.

| Fee Type | Abans Group | Industry Average |

|---|---|---|

| Spread for Major Pairs | 1.5 pips | 1.0 pips |

| Commission Structure | Up to 5% | 0-2% |

| Overnight Interest Rate | Varies | Varies |

The spreads offered by Abans Group are reportedly higher than the industry average, which could lead to increased trading costs for clients. Additionally, the commission structure, which can go up to 5%, is significantly higher than that of many regulated brokers. This fee structure raises questions about the overall cost-effectiveness of trading with Abans Group and could deter potential clients.

Customer Funds Safety

The safety of customer funds should be a primary concern for any trader. Abans Group has not provided clear information regarding its fund protection measures. The lack of regulatory oversight means that there are no guarantees for the safety of client funds, which could be at risk in the event of financial difficulties faced by the broker.

Key areas of concern include:

- Segregation of Funds: There is no indication that client funds are kept in segregated accounts, which is a standard practice among regulated brokers to protect clients in case of insolvency.

- Investor Protection: Without regulation, there are no investor protection schemes in place, leaving clients vulnerable to losing their investments without any recourse.

- Negative Balance Protection: The absence of negative balance protection policies could lead to clients owing more than their initial investment, especially in volatile market conditions.

Customer Experience and Complaints

Customer feedback is a crucial element in evaluating the credibility of a broker. Reviews and complaints about Abans Group indicate a pattern of dissatisfaction among clients, particularly concerning withdrawal issues and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Poor Customer Service | Medium | Average |

| Lack of Transparency | High | Poor |

Several clients have reported difficulties in withdrawing their funds, with some claiming that their requests were ignored or delayed for extended periods. This raises significant concerns about the reliability of Abans Group and its commitment to customer satisfaction. The companys response to complaints appears inadequate, further eroding trust among its user base.

Platform and Execution

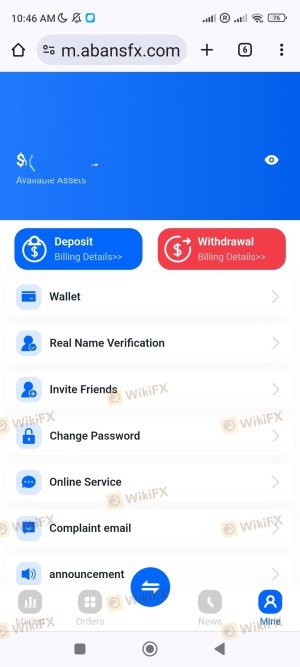

The trading platform offered by Abans Group is a critical factor in the overall trading experience. While the broker claims to provide a robust trading environment, the lack of transparency regarding platform performance and execution quality is concerning.

Traders have reported instances of slippage and order rejections, which can significantly affect trading outcomes. The absence of a reliable platform can lead to frustration and financial losses for traders, making it essential to assess the execution quality before committing funds to a broker like Abans Group.

Risk Assessment

Using Abans Group for trading comes with inherent risks that potential clients should carefully consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Possible platform issues |

The overall risk level associated with trading with Abans Group is high due to its unregulated status and the lack of transparency regarding its operations. Traders should proceed with caution and consider alternative options that offer better protection and reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that Abans Group poses significant risks for potential clients. The lack of regulation, coupled with numerous complaints and a concerning fee structure, raises red flags about the broker's legitimacy. Is Abans Group safe? Given the available information, it is prudent for traders to exercise caution and consider alternative, reputable brokers that provide regulatory oversight and a proven track record of customer satisfaction.

For traders seeking safer alternatives, it is advisable to look for brokers regulated by top-tier authorities such as the FCA or ASIC. These brokers typically offer better protection for client funds, transparent fee structures, and responsive customer service. By prioritizing safety and reliability, traders can make more informed decisions that align with their financial goals.

Is Abans Group a scam, or is it legit?

The latest exposure and evaluation content of Abans Group brokers.

Abans Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Abans Group latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.