Is Gitex Capital safe?

Business

License

Is Gitex Capital A Scam?

Introduction

Gitex Capital is an online forex and CFD broker that has recently entered the trading market, aiming to attract both novice and experienced traders. However, the rapid growth of online trading has led to an influx of brokers, some of which may not operate with the integrity and transparency that traders expect. As such, it is crucial for prospective investors to carefully evaluate the legitimacy and safety of any brokerage before committing their funds. This article aims to provide a comprehensive analysis of Gitex Capital, focusing on its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment. Our investigation is based on various online reviews, regulatory warnings, and user feedback to determine whether Gitex Capital is indeed safe or a potential scam.

Regulation and Legitimacy

In the realm of online trading, regulation plays a vital role in ensuring the safety and security of client funds. A regulated broker is typically required to adhere to strict guidelines, including maintaining segregated accounts and providing investor protection. Unfortunately, Gitex Capital operates without any regulatory oversight, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

Gitex Capital claims to be registered in Saint Vincent and the Grenadines (SVG), a jurisdiction known for its lack of strict financial regulations. The SVG Financial Services Authority (FSA) does not issue licenses for forex brokers, meaning that Gitex Capital operates without any regulatory framework. This absence of oversight is a red flag for potential investors, as it indicates that there are no legal protections in place for clients' funds. Additionally, Gitex Capital has been blacklisted by several regulatory bodies, including the Spanish CNMV and the Romanian ASF, for operating without proper authorization. This lack of regulation and the presence of warnings from reputable authorities strongly suggest that Gitex Capital is not a safe option for trading.

Company Background Investigation

Gitex Capital is owned by Sanguine Solutions Ltd., a company that has a questionable reputation in the financial industry. Established in 2021, this company is relatively new and lacks a proven track record. Furthermore, Sanguine Solutions Ltd. is associated with other fraudulent entities, including a blacklisted broker known as Revolut Expert. The management team behind Gitex Capital remains largely anonymous, with little information available regarding their professional backgrounds or experience in the trading industry. This lack of transparency raises concerns about the broker's reliability and trustworthiness. Without clear information about the company's ownership and management, it becomes increasingly difficult for potential clients to assess whether Gitex Capital is a safe choice for their trading activities.

Trading Conditions Analysis

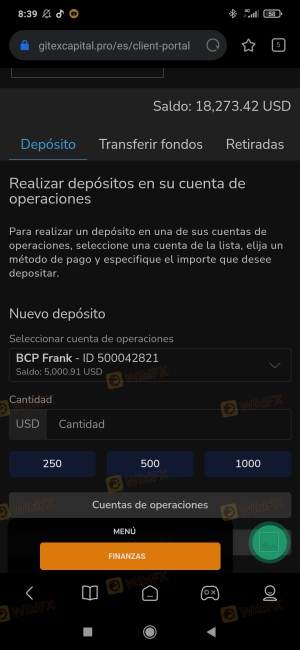

When evaluating a broker, understanding the trading conditions they offer is essential. Gitex Capital presents a range of trading accounts with varying minimum deposit requirements, starting at $250 for the simplest account. However, the overall fee structure appears to be quite opaque, with unclear commission policies and potential hidden fees.

| Fee Type | Gitex Capital | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.18 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Gitex Capital are higher than the industry average, which could significantly impact trading profitability. Additionally, the broker's policy on bonuses, which requires clients to meet a trading volume of 25 times the deposit and bonus amount before withdrawals can be made, raises further concerns. Such conditions can trap traders in a cycle of trading without the ability to access their funds, making it difficult for clients to determine if Gitex Capital is safe for their investments.

Client Fund Security

The security of client funds is paramount when considering a broker. Gitex Capital lacks essential safety measures, such as segregated accounts, which are critical for protecting clients' funds from misuse. In the event of financial difficulties, clients have no assurance that their investments will be secure. Furthermore, Gitex Capital does not provide negative balance protection, which means traders could potentially lose more than their initial investment. The absence of these safeguards is alarming and suggests that Gitex Capital is not a safe environment for traders looking to protect their capital.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Unfortunately, Gitex Capital has received numerous complaints from clients, primarily concerning withdrawal issues and poor customer service. Many users report being unable to withdraw their funds, with some claiming that their requests are met with delays or outright denials.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

Several clients have shared their experiences of being pressured to deposit more funds to access their initial investments. This pattern of behavior is often indicative of a scam, as it suggests that Gitex Capital may be employing tactics to trap clients into investing more money without the intention of allowing withdrawals. Such reports further reinforce the notion that Gitex Capital is not a safe broker.

Platform and Trade Execution

The trading platform offered by Gitex Capital is a web-based solution that lacks many features found in industry-standard platforms like MetaTrader 4 or 5. Users have reported issues with platform stability, slow execution times, and high slippage rates. These factors can severely impact trading performance and raise concerns about the broker's operational integrity. Moreover, there are indications of potential platform manipulation, where trades may not be executed as intended, further jeopardizing traders' investments.

Risk Assessment

Using Gitex Capital poses several risks that traders should be aware of. The combination of unregulated status, high fees, lack of transparency, and numerous client complaints paints a concerning picture of the broker's operations.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Risk | High | Lack of fund security measures. |

| Operational Risk | Medium | Platform stability issues. |

To mitigate these risks, potential clients should consider trading with regulated brokers that offer clear terms, transparent operations, and robust fund protection measures.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Gitex Capital is not a safe option for traders. Its unregulated status, high fees, lack of transparency, and numerous complaints indicate that it operates more like a scam than a legitimate brokerage. Traders should exercise extreme caution when considering this broker and be aware of the potential risks involved. For those seeking a reliable trading experience, it is advisable to explore alternative brokers that are regulated and have a proven track record of client satisfaction. Always prioritize safety and due diligence when navigating the forex trading landscape.

Is Gitex Capital a scam, or is it legit?

The latest exposure and evaluation content of Gitex Capital brokers.

Gitex Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Gitex Capital latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.