Is KFD safe?

Pros

Cons

Is KFD a Scam?

Introduction

KFD, a forex broker established in 2017, positions itself as a player in the competitive foreign exchange market. With claims of providing a user-friendly trading platform and a variety of trading options, KFD aims to attract both novice and experienced traders. However, as the forex market becomes increasingly saturated, it is crucial for traders to exercise caution and thoroughly evaluate any broker before committing their funds. This article aims to analyze the credibility of KFD, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The investigation is based on data gathered from various reputable sources, including user reviews and regulatory disclosures, to provide a comprehensive evaluation of whether KFD is safe or a potential scam.

Regulation and Legitimacy

Understanding the regulatory status of a broker is essential in determining its legitimacy. Regulatory bodies oversee brokers to ensure they comply with certain standards, protecting traders from fraud and malpractice. KFD operates under the auspices of the Financial Service Providers Register (FSPR) in New Zealand. However, recent reports indicate that KFD's license has been revoked, raising significant concerns regarding its operational legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 443906 | New Zealand | Revoked |

The revocation of KFD's license is a critical red flag, as it suggests a lack of oversight and accountability. In the past three months, multiple user complaints have surfaced, indicating issues such as withdrawal difficulties and alleged scams. The absence of a valid regulatory license means that KFD is not obligated to adhere to any regulatory standards, putting traders at risk. Therefore, the question remains: Is KFD safe? The answer leans towards caution, as the revoked status of its license casts doubt on its reliability.

Company Background Investigation

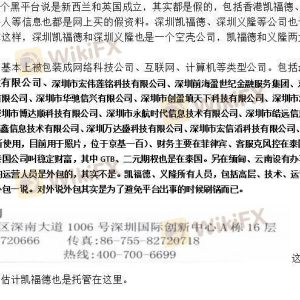

KFD was founded by Kerford Group Limited, which has been operational for approximately five to ten years. The company's history reveals a commitment to forex trading, but its transparency regarding ownership and management remains questionable. A thorough investigation into the management team reveals a lack of publicly available information about their qualifications and experience in the financial sector.

Transparency is vital for building trust between a broker and its clients. KFD's limited disclosure of its corporate structure and management team raises concerns about its accountability. Moreover, the absence of clear information regarding its financial stability and operational history further complicates the assessment of its credibility. Given these factors, potential traders must approach KFD with caution, as the lack of transparency may indicate underlying issues that could affect their trading experience.

Trading Conditions Analysis

KFD claims to offer competitive trading conditions, but a closer examination of its fee structure reveals potential pitfalls. The broker utilizes the MetaTrader 4 (MT4) platform, which is popular among traders for its functionality. However, the overall cost structure appears to be less favorable when compared to industry averages.

| Fee Type | KFD | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.5 pips | 1.0 pips |

| Commission Structure | Varies | $0 - $5 |

| Overnight Interest Range | 1.5% | 1.0% |

The spreads offered by KFD are higher than the industry average, which may eat into traders' profits. Additionally, the variability in commission structures can lead to unexpected costs, especially for frequent traders. These factors contribute to a less-than-ideal trading environment, prompting the question of Is KFD safe? While the MT4 platform is reputable, the overall cost of trading with KFD may not be conducive to successful trading.

Customer Funds Security

The safety of customer funds is paramount when assessing the credibility of a forex broker. KFD claims to implement measures to protect client funds, including segregated accounts and negative balance protection. However, the lack of regulatory oversight raises concerns about the effectiveness of these measures.

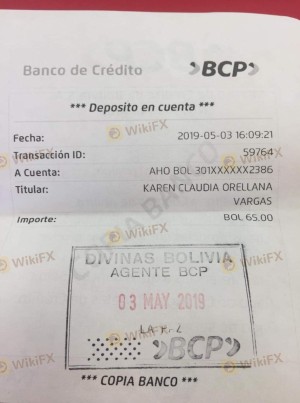

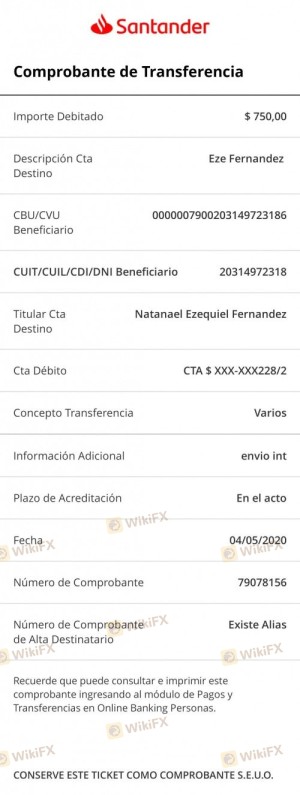

In the past, KFD has faced allegations of mishandling customer funds, with reports of users being unable to withdraw their deposits. Such incidents highlight potential vulnerabilities in KFD's operations, making it imperative for traders to question whether their funds would be secure with this broker. The absence of a robust regulatory framework further exacerbates these concerns, leading to a cautious stance regarding the safety of funds held with KFD.

Customer Experience and Complaints

Customer feedback is a critical component in evaluating a broker's reliability. Reviews of KFD reveal a mix of experiences, with several users reporting significant issues. Common complaints include difficulties in withdrawing funds, unresponsive customer service, and allegations of scams.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Average |

| Alleged Scams | High | Poor |

Notably, several users have reported instances where they were unable to access their funds, leading to frustration and distrust. The company's response to these complaints has been criticized as inadequate, with many users feeling ignored. Such patterns of negative feedback raise serious concerns about KFD's operational integrity and customer support. Therefore, potential traders must carefully consider these experiences when asking themselves, Is KFD safe?

Platform and Trade Execution

The performance and reliability of the trading platform are crucial for any forex trader. KFD offers the MT4 platform, which is known for its user-friendly interface and extensive features. However, user reviews indicate that the platform may suffer from stability issues, including lag and execution delays.

Additionally, concerns have been raised regarding order execution quality, with reports of slippage and rejected orders. These issues can significantly impact trading outcomes, leading to losses for traders. While the MT4 platform has its advantages, the execution problems reported by KFD users suggest that traders may face challenges when trading through this broker.

Risk Assessment

In light of the various factors discussed, it is essential to assess the overall risk associated with trading with KFD. While the broker may offer a functional trading platform, the lack of regulation, numerous customer complaints, and questionable trading conditions present significant risks.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | Medium | High fees and variable commissions |

| Operational Risk | High | Poor customer service and unresolved issues |

| Security Risk | Medium | Allegations of mishandling customer funds |

Given these risks, traders should proceed with caution. It is advisable to conduct thorough research and consider alternative brokers with better regulatory standing and customer feedback.

Conclusion and Recommendations

In conclusion, while KFD presents itself as a forex broker with potential, the evidence suggests a range of concerns that cannot be overlooked. The revoked regulatory license, numerous customer complaints, and questionable trading practices indicate that KFD may not be a safe option for traders. Therefore, it is crucial for potential clients to consider these factors carefully before proceeding.

For those seeking a reliable trading experience, it is recommended to explore alternative brokers that are well-regulated and have positive customer feedback. Brokers with strong regulatory oversight, transparent operations, and positive reviews from users can provide a safer trading environment. Ultimately, traders must prioritize their safety and security when choosing a broker, and with KFD's current standing, it may be wise to look elsewhere.

Is KFD a scam, or is it legit?

The latest exposure and evaluation content of KFD brokers.

KFD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KFD latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.