Is GANN MARKETS safe?

Pros

Cons

Is Gann Markets A Scam?

Introduction

Gann Markets is a forex and CFD broker that has been operating since 2018, positioning itself as a platform for both novice and experienced traders. With claims of providing competitive trading conditions and a user-friendly interface, Gann Markets aims to attract a diverse clientele. However, as with any financial service, it is essential for traders to exercise caution and thoroughly evaluate the trustworthiness of a broker before committing their funds. This is particularly true in the forex market, where regulatory oversight can vary significantly between brokers, and the potential for financial loss is high.

In this article, we will investigate the safety and legitimacy of Gann Markets. Our evaluation will be based on a comprehensive analysis of regulatory status, company background, trading conditions, customer safety measures, user experiences, platform performance, and potential risks. By synthesizing data from various reputable sources and customer feedback, we aim to provide a fair assessment of whether Gann Markets is a safe option for traders or if there are red flags that warrant caution.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its safety. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards and protects traders' interests. Unfortunately, Gann Markets operates without robust regulatory oversight. It claims to be registered in Saint Vincent and the Grenadines, but this jurisdiction is known for its lax regulatory environment, which raises concerns about the broker's legitimacy.

Heres a summary of Gann Markets' regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unverified |

The absence of a reputable regulatory body overseeing Gann Markets means that traders do not have the same level of protection they would enjoy with a broker regulated by authorities such as the FCA (Financial Conduct Authority) or ASIC (Australian Securities and Investments Commission). This lack of oversight can lead to potential issues regarding the safety of funds, trade execution, and overall business practices. Moreover, Gann Markets has been criticized for making unverified claims about its regulatory status, which adds to the skepticism surrounding its operations.

Company Background Investigation

Gann Markets was founded in 2018, and while it promotes itself as a global broker, details about its ownership and management team remain vague. The company claims to offer a diverse range of trading instruments, including forex pairs, commodities, stocks, and cryptocurrencies. However, the lack of transparency regarding its ownership structure and the qualifications of its management team raises questions about its operational integrity.

A broker's management team plays a crucial role in its reputation and reliability. In Gann Markets' case, there is limited information available about the individuals behind the company, which can be a red flag for potential investors. Transparency is vital in the financial sector, and a lack of clear information can lead to distrust among traders.

Furthermore, the companys historical compliance with industry standards is not well-documented. Without a track record of regulatory compliance, it is challenging to assess whether Gann Markets operates ethically or has faced any disciplinary actions in the past. This uncertainty can significantly impact traders' confidence when considering whether to engage with Gann Markets.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Gann Markets claims to provide competitive spreads and various account types to cater to different trading styles. However, the overall fee structure and any hidden costs are crucial factors that traders must consider.

Gann Markets presents the following core trading costs:

| Fee Type | Gann Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.7 pips | 0.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While Gann Markets offers a minimum spread of 0.7 pips on major currency pairs, this is slightly higher than the industry average. Additionally, the absence of a commission model on standard accounts may seem appealing; however, traders should be aware that this could be offset by wider spreads, leading to higher overall trading costs.

Moreover, Gann Markets imposes an inactivity fee of $10 after 100 days of account inactivity, which is not uncommon but can be a disadvantage for occasional traders. Such fees can accumulate and impact profitability, especially for those who prefer to trade infrequently.

Client Funds Safety

The safety of client funds is paramount when choosing a broker. Gann Markets claims to implement certain security measures, but specific details on fund protection mechanisms are scarce. The broker does not provide clear information regarding the segregation of client funds or participation in investor protection schemes, which are essential for safeguarding traders' capital.

The absence of segregated accounts means that client funds could potentially be at risk in the event of the broker's financial difficulties. Furthermore, Gann Markets does not offer negative balance protection, which is a critical feature that prevents traders from owing the broker money if their account balance falls below zero due to leveraged trading.

Historically, there have been no reported incidents of fund mismanagement or security breaches involving Gann Markets, but the lack of transparency regarding their safety protocols raises concerns. Traders should approach this broker with caution, especially considering the potential risks associated with unregulated entities.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Gann Markets has received mixed reviews from users, with some praising its trading platform and execution speed, while others have raised concerns about withdrawal delays and customer support quality.

Common complaint patterns include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Support Issues | Medium | Inconsistent |

| Platform Downtime | Medium | Limited explanation |

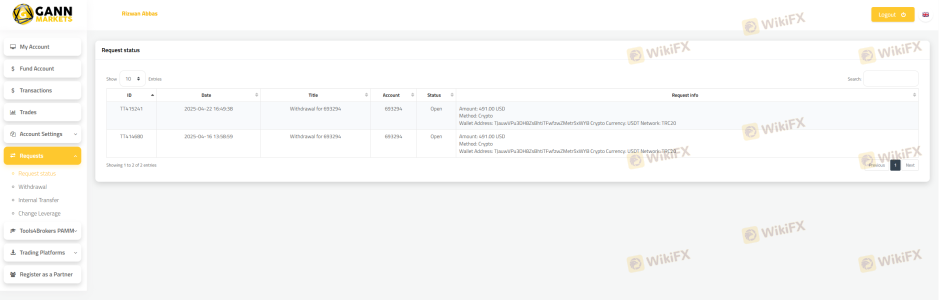

For instance, some users have reported significant delays in processing withdrawals, which can be frustrating and raise doubts about the broker's liquidity. Additionally, the quality of customer support has been criticized for being slow and unresponsive, particularly during peak trading hours.

One typical case involved a trader who requested a withdrawal that took over two weeks to process, despite the broker's stated timelines. This experience left the trader feeling uneasy about the broker's reliability and commitment to customer satisfaction.

Platform and Trade Execution

The trading platform is a crucial component of a broker's service offering. Gann Markets utilizes the popular MetaTrader 4 (MT4) platform, which is known for its robust features and user-friendly interface. However, the platform's performance, stability, and execution quality are vital factors that can significantly influence a trader's experience.

Many users report that Gann Markets provides a stable trading environment with minimal slippage and quick order execution. However, some have experienced occasional platform downtime, which can hinder trading opportunities, especially during volatile market conditions. Moreover, there are no clear indications of platform manipulation or unfair practices reported by users.

Overall, while the platform offers the necessary tools for effective trading, any instances of downtime can be detrimental, especially for traders who rely on timely execution to capitalize on market movements.

Risk Assessment

Traders must be aware of the risks associated with using any broker, particularly one that operates without robust regulatory oversight. Using Gann Markets presents several key risks:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases potential for fraud. |

| Fund Safety Risk | High | Absence of fund segregation and negative balance protection. |

| Customer Support Risk | Medium | Mixed reviews on responsiveness and effectiveness. |

| Operational Risk | Medium | Occasional platform downtime can disrupt trading. |

To mitigate these risks, traders should consider starting with a small investment and utilize risk management strategies such as setting stop-loss orders. Additionally, conducting thorough research and staying informed about market conditions can help traders navigate potential pitfalls.

Conclusion and Recommendations

In conclusion, while Gann Markets offers some appealing features such as a low minimum deposit and access to a well-known trading platform, the overall assessment raises significant concerns about its safety and legitimacy. The lack of robust regulatory oversight, unclear safety measures for client funds, and mixed customer feedback suggest that potential traders should proceed with caution.

For those considering Gann Markets, it is crucial to weigh the risks against the benefits. If you are a beginner or risk-averse trader, it may be advisable to explore more established and regulated alternatives. Brokers such as IG, OANDA, or Forex.com offer a more secure trading environment with comprehensive regulatory oversight and better customer support.

In summary, is Gann Markets safe? The evidence suggests that it may not be the best choice for traders seeking a secure and reliable trading experience.

Is GANN MARKETS a scam, or is it legit?

The latest exposure and evaluation content of GANN MARKETS brokers.

GANN MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GANN MARKETS latest industry rating score is 2.15, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.15 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.