Gann 2025 Review: Everything You Need to Know

Gann Markets, established in 2018, has garnered attention in the trading community for its competitive trading conditions and the use of the popular MetaTrader 4 platform. However, the broker's regulatory status and user experiences present a mixed bag of opinions. Notably, while it offers a diverse range of trading instruments, concerns about its lack of robust regulation and customer support have emerged as significant drawbacks.

Note: It is essential to consider that Gann operates under different entities across regions, which may affect user experiences and regulatory protections. This review aims to provide a fair and accurate overview based on comprehensive research.

Ratings Overview

We evaluate brokers based on multiple criteria, including user feedback, expert opinions, and factual data.

Broker Overview

Gann Markets is a forex and CFD broker that has been operational since 2018. It primarily targets traders in Turkey and neighboring regions but has expanded its reach internationally. The broker offers trading on the well-known MetaTrader 4 platform, which is favored by many traders for its user-friendly interface and robust analytical tools. Gann provides access to a wide range of assets, including over 60 currency pairs, commodities, stocks, indices, and cryptocurrencies. However, it is important to note that Gann is registered in Saint Vincent and the Grenadines and operates under tier-3 regulation, raising concerns about investor protection and security.

Detailed Analysis

Regulatory Landscape:

Gann Markets is registered in Saint Vincent and the Grenadines, which is known for its lenient regulatory environment. According to sources, Gann claims to be regulated by the Financial Services Commission (IFSC) in Belize, but there is no verifiable evidence to support this claim, leading to skepticism about its regulatory legitimacy (source). The absence of strict regulatory oversight can pose risks for traders, as unregulated brokers lack accountability regarding fund safety and operational transparency.

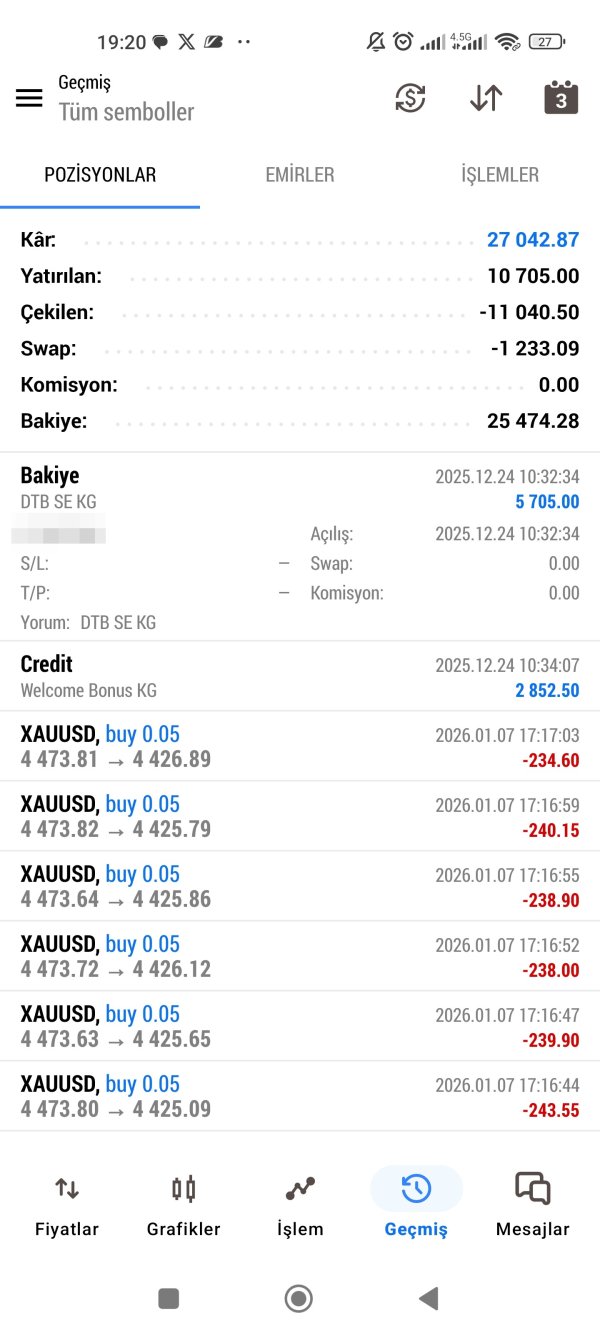

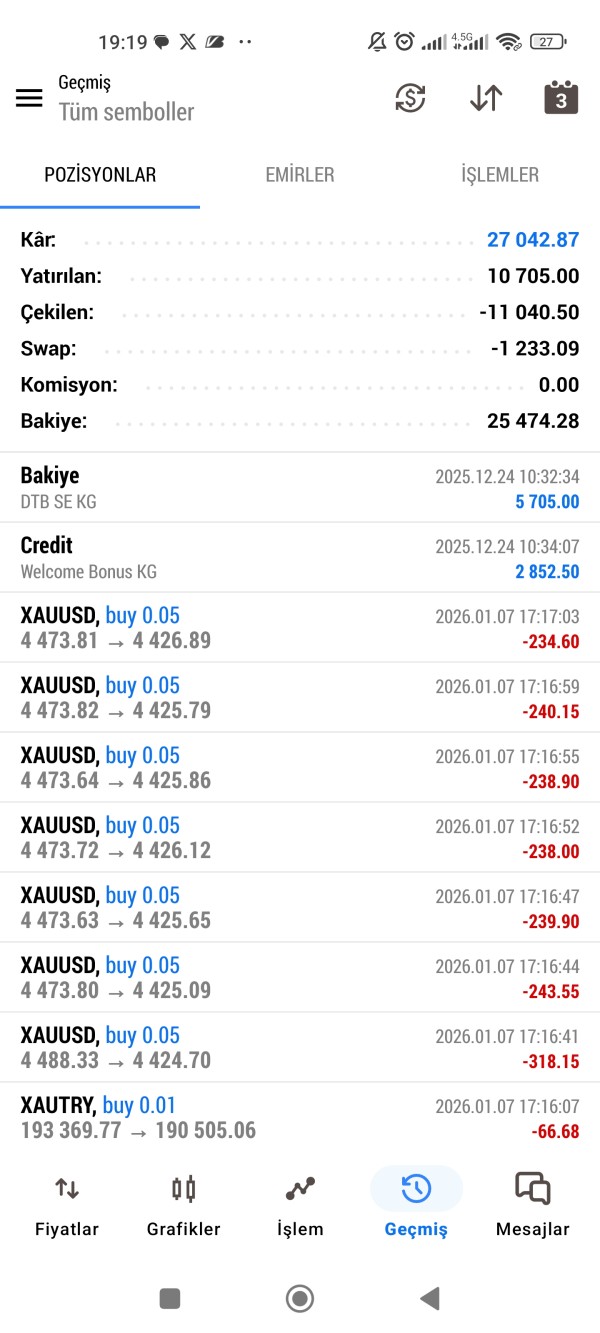

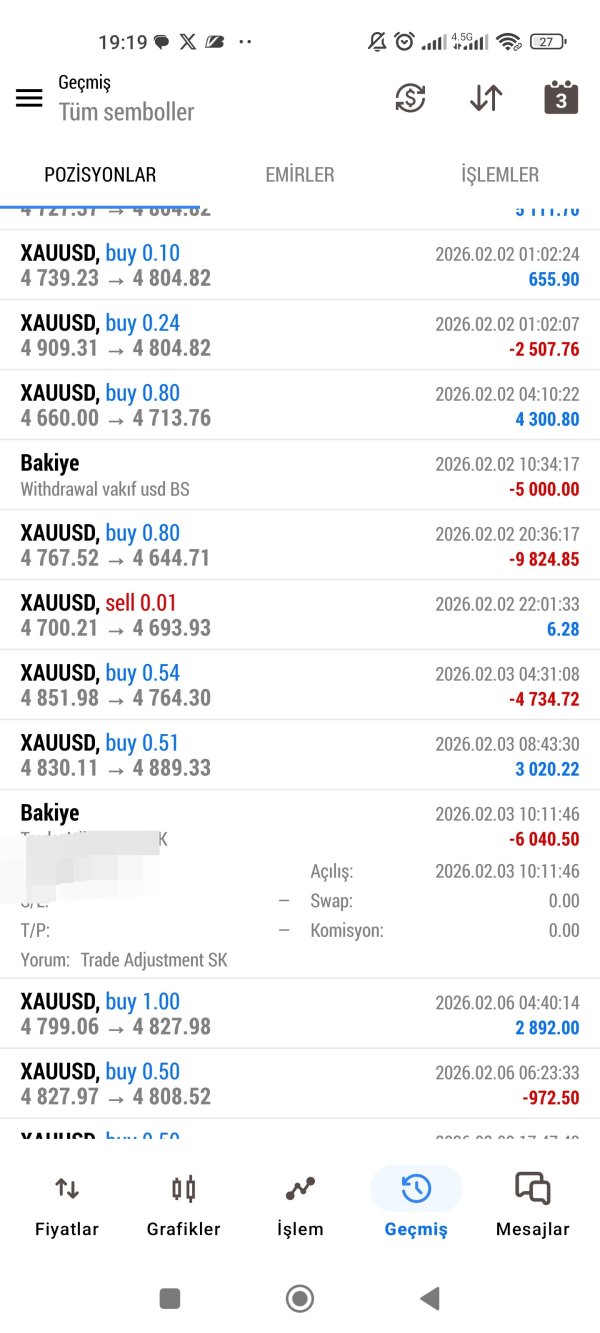

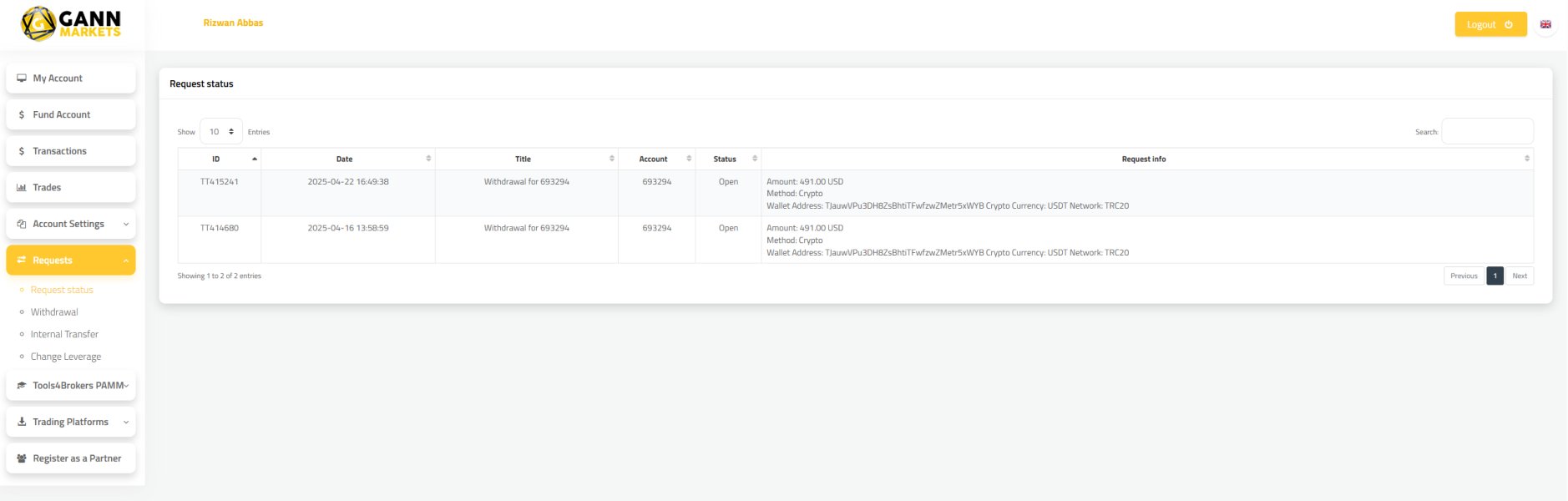

Deposit and Withdrawal Options:

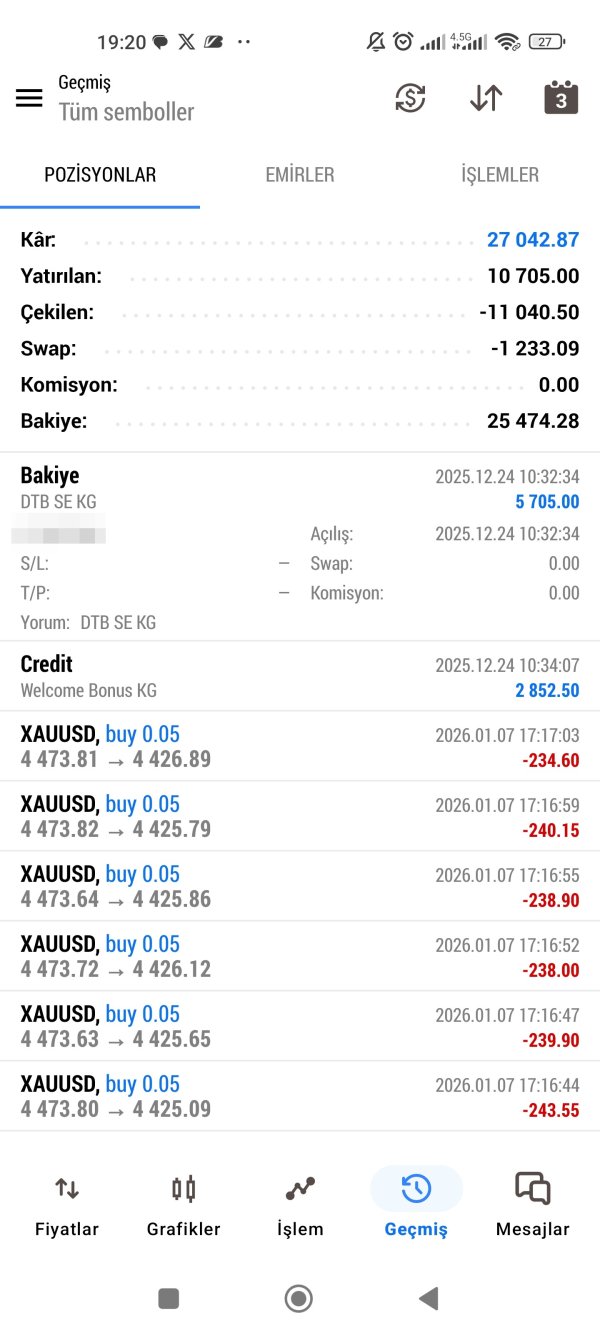

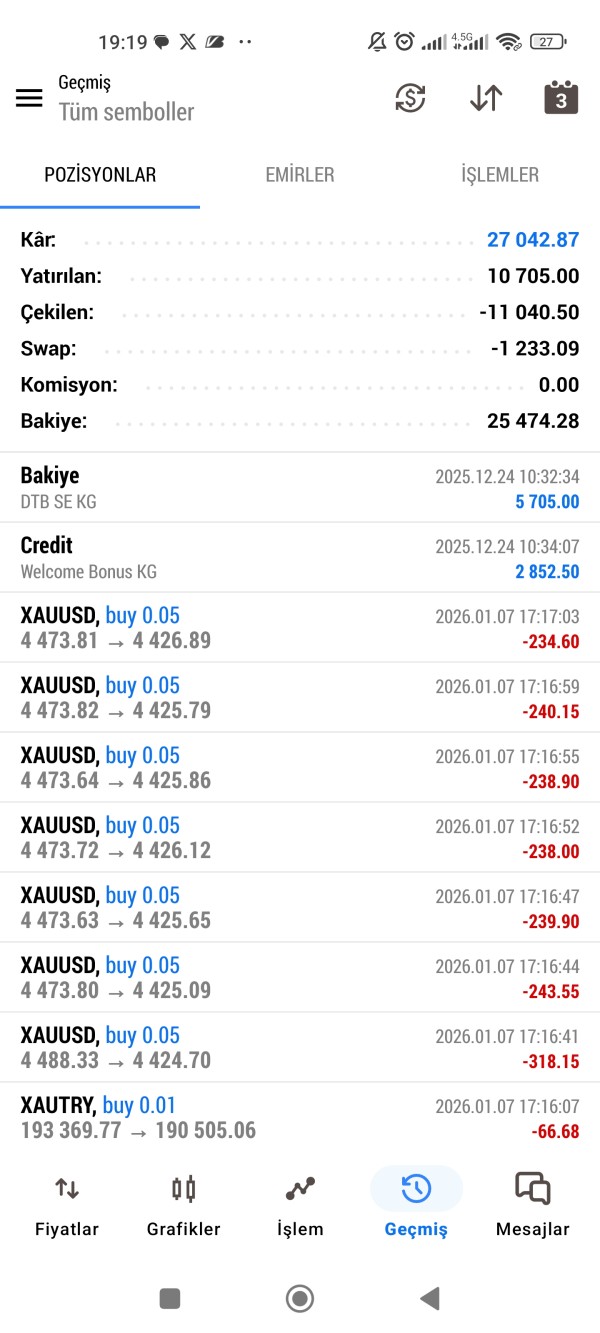

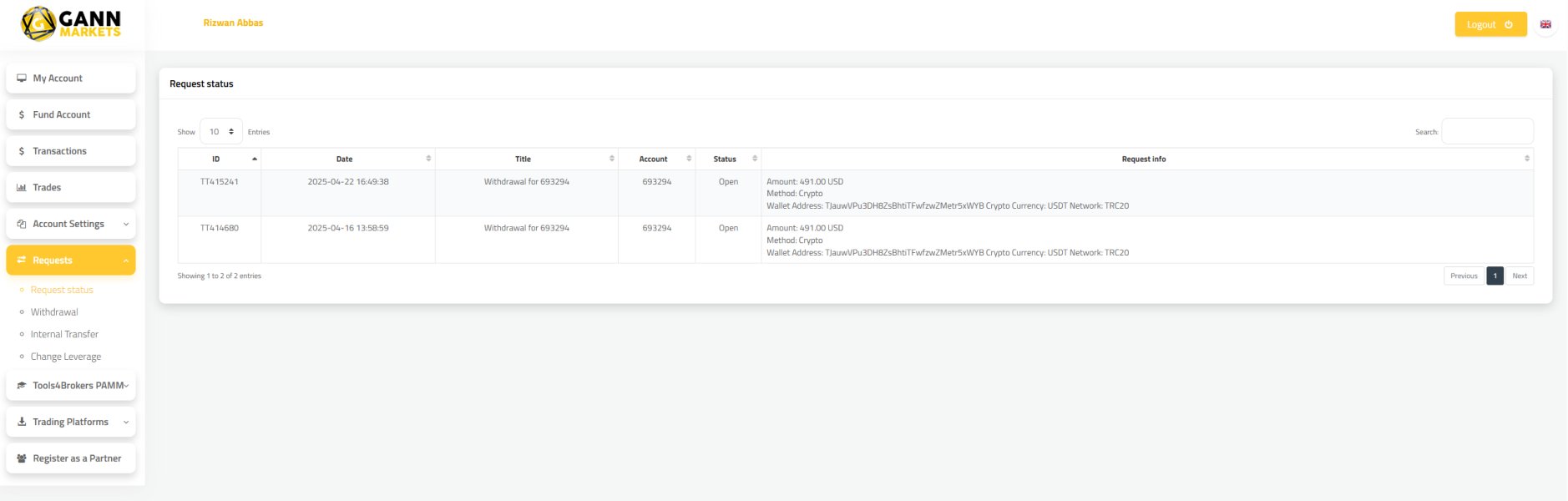

The minimum deposit required to open an account with Gann Markets is $100, which is relatively standard in the industry. The broker supports various payment methods, including credit/debit cards, bank transfers, and e-wallets. However, users have reported delays in withdrawal processing, with some methods taking up to 30 days (source). While there are no direct fees for deposits or withdrawals, third-party fees may apply, which could add to the overall costs of trading.

Promotions and Bonuses:

Gann Markets offers several promotional bonuses, including a welcome bonus for new traders. However, the terms surrounding these bonuses can be restrictive, often requiring traders to meet certain trading volume thresholds before they can withdraw their bonus funds (source). This practice is common among many brokers but can be a point of contention for traders looking for more straightforward conditions.

Asset Classes Available:

Gann Markets provides a broad selection of trading instruments, including forex, commodities, stocks, indices, and cryptocurrencies. With over 60 currency pairs available, traders can diversify their portfolios effectively. However, the overall asset universe is smaller compared to competitors, which may limit trading opportunities for some users (source).

Cost Structure:

The cost of trading with Gann Markets varies depending on the account type. Standard accounts typically have higher spreads, starting from 0.7 pips, while ECN accounts offer tighter spreads starting from 0.1 pips but come with a commission of $7 per lot (source). Traders should be mindful of these costs, especially during periods of high volatility when spreads may widen.

Leverage Options:

Gann Markets offers leverage of up to 1:400, which can amplify both potential profits and losses. High leverage is attractive for experienced traders but poses significant risks, particularly for beginners who may not fully understand the implications of leveraged trading (source).

Customer Support Availability:

Customer service at Gann Markets is available through multiple channels, including email, phone, and live chat. However, user reviews indicate that response times can be inconsistent, particularly when using email support (source). The lack of 24/7 availability may also hinder traders who require immediate assistance during trading hours.

Repeated Ratings Overview

Detailed Breakdown of Ratings

-

Account Conditions (6.0):

Gann Markets offers a standard account with a minimum deposit of $100. The account types available cater to both novice and experienced traders, but the absence of cent accounts and limited educational resources are notable drawbacks.

Tools and Resources (4.5):

The educational resources provided by Gann are basic and may not adequately prepare new traders for the complexities of the market. More comprehensive training materials would greatly enhance the platform's appeal.

Customer Service and Support (5.0):

While Gann offers various customer support channels, the inconsistency in response times and limited availability on weekends can deter traders seeking prompt assistance.

Trading Setup (Experience) (6.5):

The trading experience on the MetaTrader 4 platform is generally positive, with a user-friendly interface. However, the lack of advanced trading tools and features compared to competitors is a downside.

Trust Level (4.0):

The lack of robust regulatory oversight raises concerns about the safety of funds and the overall trustworthiness of Gann Markets. Traders should exercise caution when considering this broker.

User Experience (5.5):

User reviews reflect a mix of satisfaction and frustration. While some traders appreciate the low spreads and variety of trading instruments, others report issues with withdrawals and customer service.

In conclusion, Gann Markets presents itself as a viable option for traders seeking a straightforward trading experience with competitive spreads and a variety of instruments. However, potential users should weigh the risks associated with its unregulated status and the mixed feedback regarding customer support and withdrawal processes. As always, conducting thorough research and understanding the inherent risks of trading with an unregulated broker is essential.