Is Fx Liquidity safe?

Pros

Cons

Is Fx Liquidity Safe or Scam?

Introduction

Fx Liquidity is a forex broker that positions itself within the competitive landscape of the foreign exchange market. As a relatively new player, it has attracted attention from traders seeking diverse trading options and potentially lucrative conditions. However, the forex market is fraught with risks, and traders must exercise caution when evaluating brokers. This article aims to provide a comprehensive analysis of Fx Liquidity, focusing on its regulatory status, company background, trading conditions, customer safety, and user experiences. The investigation is based on a review of multiple sources, including regulatory databases, user testimonials, and expert analyses, to ensure a balanced view of whether Fx Liquidity is safe or a scam.

Regulation and Legitimacy

One of the key factors in assessing the safety of any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards and practices. Unfortunately, Fx Liquidity is currently unregulated, which raises significant concerns about its legitimacy and operational transparency. Below is a summary of the regulatory information regarding Fx Liquidity:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation means that Fx Liquidity does not have to comply with established financial standards or undergo regular audits, which can expose traders to higher risks. Furthermore, the lack of a regulatory framework suggests that there are no investor protection mechanisms in place, making it difficult for clients to seek recourse in case of disputes. The quality of regulation is pivotal; brokers under stringent regulatory oversight are generally considered safer as they are required to maintain transparency and protect client funds. Given Fx Liquidity's lack of regulation, potential investors should be cautious and consider the implications of trading with an unregulated entity.

Company Background Investigation

Fx Liquidity's company history and ownership structure are crucial in determining its reliability. Established recently, the broker claims to offer a range of trading instruments and competitive trading conditions. However, limited information is available about its management team and their professional backgrounds. The lack of transparency regarding the company's ownership raises further red flags. In a market where trust is paramount, a broker's opacity can lead to skepticism among traders.

Moreover, the companys operational history is essential to assess its stability and reliability. Without a track record of compliance or a history of successful operations, traders may find it challenging to trust Fx Liquidity with their investments. A thorough background check reveals that Fx Liquidity is incorporated in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment. This situation often attracts brokers looking to operate with minimal oversight, which can be a warning sign for potential clients. Therefore, while Fx Liquidity presents itself as a viable trading option, its lack of transparency and regulatory oversight necessitates a cautious approach from traders.

Trading Conditions Analysis

The trading conditions offered by Fx Liquidity are another critical aspect to consider when assessing whether it is safe or a scam. The broker provides a range of account types, each with varying minimum deposit requirements, spreads, and commission structures. However, the overall fee structure appears to be somewhat opaque, making it difficult for traders to fully understand the costs associated with trading.

Below is a comparison of core trading costs associated with Fx Liquidity:

| Fee Type | Fx Liquidity | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable (from 1.6 pips) | 1.0 - 1.5 pips |

| Commission Structure | Varies (up to $4 per lot) | $3 - $6 per lot |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Fx Liquidity are on the higher end of the spectrum compared to industry averages, which may affect profitability, especially for high-frequency traders. Additionally, the commission structure lacks clarity, making it challenging for traders to calculate their total trading costs accurately. Such ambiguities can lead to unexpected expenses and diminish the overall trading experience. Given these factors, potential clients should carefully evaluate the trading conditions before committing capital to Fx Liquidity.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. Fx Liquidity's approach to fund security is concerning, as it lacks robust measures to protect client deposits. The absence of segregated accounts means that client funds may not be held separately from the broker's operational funds, increasing the risk of loss in the event of financial difficulties.

Furthermore, there are no investor protection schemes in place, which could leave traders vulnerable in case of insolvency or mismanagement. The lack of negative balance protection is another significant risk factor, as it exposes traders to the possibility of losing more than their initial investment. Historically, many unregulated brokers have faced scrutiny over their handling of client funds, leading to disputes and financial losses for traders. Therefore, potential clients must weigh these risks carefully and consider whether they are comfortable trading with a broker that does not prioritize fund safety.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. In the case of Fx Liquidity, user reviews are mixed, with some traders expressing satisfaction with the trading platform and execution speed, while others have raised concerns about withdrawal issues and customer support responsiveness. Common complaints include difficulties in withdrawing funds, lack of timely communication, and unclear fee structures.

The table below summarizes the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Inconsistent |

| Fee Transparency | Medium | Unclear |

For instance, one user reported prolonged delays in processing withdrawal requests, which can significantly impact the trading experience. Another trader noted that customer support was often unresponsive, leading to frustration when seeking assistance. These issues highlight the potential risks associated with trading with Fx Liquidity. Traders should be aware that a lack of effective customer service can exacerbate problems and lead to further dissatisfaction.

Platform and Trade Execution

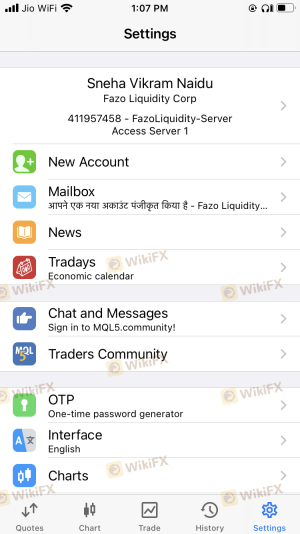

The performance and reliability of a trading platform are critical for successful trading. Fx Liquidity offers the widely-used MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust features. However, the platform's stability and execution quality have been called into question by some users, who reported instances of slippage and order rejections.

A thorough assessment of order execution quality reveals that while Fx Liquidity aims to provide competitive execution speeds, the absence of regulatory oversight raises concerns about potential market manipulation. Traders should be cautious and monitor their trades closely, especially during volatile market conditions, to avoid unexpected slippage or execution issues.

Risk Assessment

Using Fx Liquidity comes with inherent risks that traders must consider. The lack of regulation, unclear fee structures, and potential withdrawal issues contribute to a higher overall risk profile. Below is a summary of the key risk areas associated with trading with Fx Liquidity:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Financial Risk | Medium | Lack of fund protection measures. |

| Operational Risk | Medium | Potential issues with withdrawals and customer support. |

| Market Risk | Medium | Possible slippage and execution problems. |

To mitigate these risks, traders should conduct thorough research, consider starting with a small investment, and maintain a diversified trading portfolio. Additionally, seeking alternative brokers with better regulatory standing and customer service may provide more secure trading environments.

Conclusion and Recommendations

In conclusion, while Fx Liquidity presents itself as a potential trading option, the evidence suggests that it may not be the safest choice for traders. The lack of regulation, unclear trading conditions, and customer complaints raise significant concerns about its legitimacy. Therefore, potential investors should exercise caution when considering whether to trade with Fx Liquidity.

For traders seeking safer alternatives, it is advisable to consider brokers that are well-regulated, transparent about their fee structures, and have a proven track record of customer satisfaction. Options such as brokers regulated by tier-1 authorities, offering robust fund protection and reliable customer service, may provide a more secure trading experience. Ultimately, traders must prioritize their safety and due diligence when navigating the forex market, ensuring they choose brokers that align with their trading goals and risk tolerance.

Is Fx Liquidity a scam, or is it legit?

The latest exposure and evaluation content of Fx Liquidity brokers.

Fx Liquidity Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fx Liquidity latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.