Is FX Corp safe?

Pros

Cons

Is Fx Corp Safe or Scam?

Introduction

Fx Corp is a forex and CFD brokerage that has garnered attention in the financial trading community. Operating under the name Fx Corp Limited, this brokerage claims to offer a range of trading services, including access to various financial instruments like currency pairs, commodities, and indices. However, as with any financial institution, it is crucial for traders to exercise caution and conduct thorough due diligence before engaging with Fx Corp. The forex market is rife with potential pitfalls, and many traders have fallen victim to unscrupulous brokers. This article aims to evaluate the safety and legitimacy of Fx Corp by examining its regulatory status, company background, trading conditions, client fund security, customer experience, platform performance, and overall risk profile. Our investigation is based on a comprehensive review of available online sources, user feedback, and industry standards.

Regulation and Legitimacy

Regulation is a cornerstone of trust in the financial services industry, offering a layer of protection for traders. The absence of regulatory oversight raises significant red flags, as it indicates a lack of accountability and transparency. Fx Corp claims to be regulated, but there is scant evidence to support this assertion. In fact, many reviews suggest that Fx Corp operates without proper regulatory oversight, which could expose clients to various risks.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of a credible regulatory body overseeing Fx Corp is alarming. Regulatory authorities, such as the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA), impose strict rules and guidelines that brokers must adhere to. These regulations include maintaining sufficient capital reserves, ensuring client fund segregation, and providing transparent trading conditions. Fx Corp's apparent failure to meet these standards raises questions about its legitimacy and operational integrity.

Company Background Investigation

Understanding the companys history, ownership structure, and management team is essential for assessing its reliability. Fx Corp claims to have been established in 2013, but there is limited information available regarding its operational history or ownership. The lack of transparency about who runs the company and their professional backgrounds is concerning.

A well-established brokerage typically provides detailed information about its founders and management team, including their experience in the financial sector. However, Fx Corp has not disclosed this information, which is a significant red flag. Without a clear understanding of the people behind a brokerage, traders are left in the dark regarding the company's operational ethos and commitment to ethical practices.

Trading Conditions Analysis

Evaluating the trading conditions offered by Fx Corp is vital for understanding the costs associated with trading. A competitive trading environment typically includes transparent fee structures, low spreads, and favorable commission rates. However, many reviews indicate that Fx Corp may not provide competitive trading conditions.

| Fee Type | Fx Corp | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.7 pips | 0.2 - 0.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Fx Corp are higher than the industry average, which could significantly impact a trader's profitability. Additionally, the lack of clarity regarding commission structures and overnight interest rates raises concerns about hidden fees. Traders should be wary of brokers that do not clearly outline their fee structures, as this can lead to unexpected costs and diminished returns.

Client Fund Security

The safety of client funds is paramount in the forex trading industry. Reputable brokers implement stringent measures to protect client deposits, including fund segregation, investor compensation schemes, and negative balance protection. However, there is little information available about Fx Corp's security measures.

Fx Corp does not appear to offer any client fund protection mechanisms. The absence of segregated accounts and investor compensation schemes means that clients may be at risk of losing their funds in the event of the broker's insolvency. Furthermore, any historical issues related to fund security or client complaints regarding withdrawals should be taken seriously, as they can indicate deeper systemic problems within the brokerage.

Customer Experience and Complaints

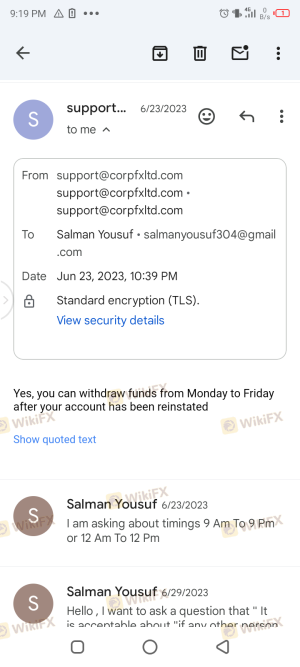

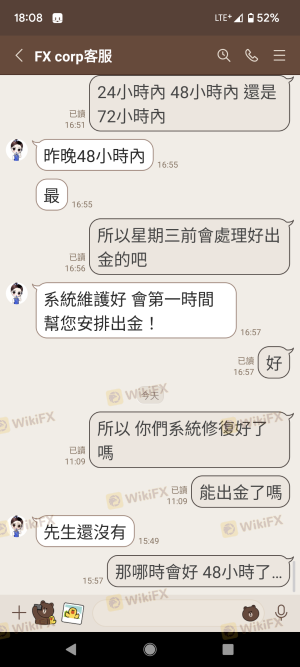

Customer feedback is invaluable for assessing a broker's reliability and service quality. Numerous reviews highlight a pattern of negative experiences among Fx Corp clients. Common complaints include difficulties in fund withdrawals, poor customer service, and a lack of responsiveness to client inquiries.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Transparency | High | Poor |

One notable case involved a client who reported being unable to withdraw funds after multiple requests. The broker's response was inadequate, leading to frustration and distrust. Such complaints suggest a concerning trend that potential clients should carefully consider before engaging with Fx Corp.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. A reliable platform should offer stability, user-friendly features, and efficient order execution. However, many reviews indicate that Fx Corp's platform may not meet these standards.

Issues such as slippage, order rejections, and a lack of advanced trading tools have been reported. These factors can significantly hinder a trader's ability to execute strategies effectively. Furthermore, any signs of platform manipulation, such as discrepancies between quoted prices and actual execution, should raise alarm bells for potential users.

Risk Assessment

Engaging with Fx Corp presents several risks that traders should be aware of. The combination of regulatory uncertainty, negative customer feedback, and questionable trading conditions contributes to an elevated risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unregulated broker with no oversight. |

| Fund Security | High | Lack of protection for client deposits. |

| Customer Support | Medium | Poor response to client complaints. |

| Trading Conditions | High | Higher spreads and unclear fees. |

Traders should consider these risks seriously and seek to mitigate them by conducting thorough research and potentially choosing more reputable alternatives.

Conclusion and Recommendations

In conclusion, based on the gathered evidence, Fx Corp does not appear to be a safe option for traders. The lack of regulatory oversight, combined with negative customer experiences and questionable trading conditions, raises significant concerns about the legitimacy of this brokerage.

For traders seeking to engage in forex trading, it is advisable to consider regulated brokers with proven track records of reliability and transparency. Alternatives with robust regulatory frameworks and positive customer feedback should be prioritized to ensure a safer trading experience.

In summary, if you are contemplating trading with Fx Corp, it is crucial to weigh the risks and consider other reputable options in the market.

Is FX Corp a scam, or is it legit?

The latest exposure and evaluation content of FX Corp brokers.

FX Corp Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FX Corp latest industry rating score is 1.41, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.41 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.