Regarding the legitimacy of Furdfx forex brokers, it provides CYSEC and WikiBit, .

Is Furdfx safe?

Business

License

Is Furdfx markets regulated?

The regulatory license is the strongest proof.

CYSEC Derivatives Trading License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

Clone FirmLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

FOREX TB Ltd

Effective Date:

2015-04-07Email Address of Licensed Institution:

compliance@forextb.comSharing Status:

No SharingWebsite of Licensed Institution:

www.forextb.com, www.patronfx.comExpiration Time:

--Address of Licensed Institution:

138 Limassol Avenue, 2nd Floor, Office 108, 2015 Strovolos, Nicosia, CyprusPhone Number of Licensed Institution:

+357 22 266 707Licensed Institution Certified Documents:

Is Furdfx Safe or Scam?

Introduction

Furdfx is a forex broker established in 2019 and based in Cyprus. It operates in a highly competitive environment, catering to traders looking for opportunities in the foreign exchange market. Given the increasing number of forex scams and fraudulent brokers, it is essential for traders to conduct thorough evaluations of any broker before committing their funds. This article aims to critically assess the safety and legitimacy of Furdfx by analyzing its regulatory status, company background, trading conditions, customer fund security, and user experiences. The findings are based on a comprehensive review of multiple sources, including user feedback, regulatory information, and industry analyses.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety and legitimacy. Furdfx claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC), which is a recognized regulatory body in the European Union. Regulatory oversight is crucial as it sets standards for financial practices, ensuring that brokers adhere to strict guidelines designed to protect traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 272/15 | Cyprus | Verified |

The quality of regulation can significantly impact a broker's operations. CySEC is considered a mid-tier regulator, providing a reasonable level of investor protection. However, it is important to note that the broker has received a low score of 1.49 on WikiFX, indicating potential issues. Additionally, there have been several complaints regarding withdrawal difficulties, which raises red flags about the broker's compliance with regulatory standards. While no significant regulatory breaches have been reported, the low score and user complaints necessitate caution when considering whether Furdfx is safe for trading.

Company Background Investigation

Furdfx was founded in 2019, making it relatively new in the forex market. The company is operated by Forex TB Ltd, which is registered under CySEC regulations. However, the limited operational history raises concerns about its stability and long-term viability. A thorough investigation into the management team reveals that there is a lack of publicly available information regarding their professional backgrounds and experience in the financial industry. This lack of transparency can be a significant drawback, as experienced management is often a hallmark of reliable brokers.

Furthermore, the company's ownership structure is not clearly disclosed, which can lead to questions about accountability and transparency. In the current regulatory environment, brokers are expected to provide clear information about their ownership and management to build trust with potential clients. The absence of such information may cause traders to wonder whether Furdfx is safe to engage with, as it raises concerns about the broker's commitment to regulatory compliance and ethical business practices.

Trading Conditions Analysis

Furdfx offers a variety of trading conditions, including access to the MetaTrader 4 platform. However, the overall fee structure is a crucial aspect that traders need to consider. The broker's spreads, commissions, and overnight interest rates can significantly impact trading profitability.

| Fee Type | Furdfx | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 1.5 pips | 1.0 pips |

| Commission Model | None | Varies (0-5 pips) |

| Overnight Interest Range | 0.5% | 0.3% |

While Furdfx offers competitive spreads, the lack of transparency regarding commissions raises concerns. Traders should be wary of any hidden fees that could affect their overall trading costs. Additionally, the overnight interest rates appear to be higher than the industry average, which could impact long-term positions negatively. This analysis of trading conditions suggests that potential clients should carefully evaluate whether Furdfx is safe based on its fee structure and the potential for unexpected costs.

Customer Fund Security

Customer fund security is paramount when assessing any forex broker. Furdfx claims to implement various measures to ensure the safety of client funds, including segregated accounts that separate client funds from the broker's operational funds. This practice is essential as it protects traders' investments in the event of the broker facing financial difficulties.

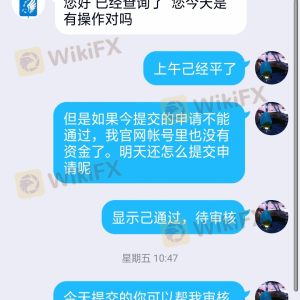

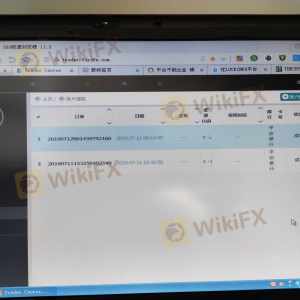

Moreover, Furdfx does not appear to offer negative balance protection, which is a safeguard that prevents traders from losing more than their initial deposits. This absence of protection can expose traders to significant risks, particularly in volatile market conditions. Historical complaints regarding withdrawal issues further exacerbate concerns about fund security. Users have reported difficulties in accessing their funds, which raises questions about the broker's reliability and commitment to safeguarding client assets. Therefore, traders must carefully consider these factors when evaluating whether Furdfx is safe for their investments.

Customer Experience and Complaints

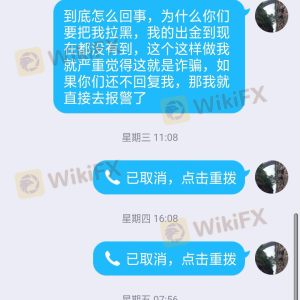

Customer feedback is a vital component in determining the overall reliability of a forex broker. Reviews and ratings can provide insights into the experiences of other traders using the platform. In the case of Furdfx, there have been multiple complaints regarding withdrawal delays and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

The predominant complaints revolve around difficulties in withdrawing funds, with users reporting that their requests have gone unanswered or delayed for extended periods. This pattern of complaints is alarming and indicates potential operational issues within the company. Moreover, the company's response to these complaints has been described as inadequate, further eroding trust among current and potential clients. As such, it is crucial for traders to weigh these experiences against their own risk tolerance when determining if Furdfx is safe for trading.

Platform and Trade Execution

The trading platform's performance is another critical aspect of a broker's reliability. Furdfx utilizes the MetaTrader 4 platform, which is widely recognized for its user-friendly interface and robust features. However, user experiences regarding platform stability and execution quality have been mixed. Reports of slippage and delayed order execution have surfaced, which can significantly impact trading outcomes.

Additionally, there have been concerns regarding the potential for platform manipulation, as some users have reported unusual price movements that could suggest unethical practices. Such issues raise significant concerns about the integrity of the trading environment provided by Furdfx. Therefore, prospective traders should consider these factors carefully when assessing whether Furdfx is safe for their trading activities.

Risk Assessment

Using Furdfx involves several risks that traders should be aware of. The combination of regulatory concerns, withdrawal issues, and mixed customer feedback contributes to an overall risk profile that is not favorable.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Potential issues with compliance |

| Fund Security Risk | High | Complaints about withdrawal difficulties |

| Customer Service Risk | High | Poor response to user complaints |

To mitigate these risks, traders should consider starting with a small investment and thoroughly testing the platform before committing larger sums. Additionally, maintaining an awareness of market conditions and withdrawal policies can help traders navigate potential pitfalls. Overall, the risks associated with Furdfx necessitate careful consideration.

Conclusion and Recommendations

In conclusion, while Furdfx presents itself as a legitimate forex broker, several factors raise concerns about its overall safety and reliability. The low regulatory score, history of withdrawal complaints, and insufficient transparency regarding its management and fees suggest that potential clients should proceed with caution.

For traders seeking a reliable and trustworthy broker, it may be prudent to explore alternatives that have demonstrated a commitment to regulatory compliance and superior customer service. Brokers regulated by top-tier authorities, such as the FCA or ASIC, may offer a more secure trading environment. Ultimately, it is essential for traders to conduct thorough research and consider their risk tolerance before engaging with any broker, including Furdfx.

Is Furdfx a scam, or is it legit?

The latest exposure and evaluation content of Furdfx brokers.

Furdfx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Furdfx latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.