Is Foya Limited safe?

Business

License

Is Foya Limited A Scam?

Introduction

Foya Limited is a brokerage firm that has recently entered the forex market, claiming to offer a range of trading services across various financial instruments. With the allure of high leverage and competitive spreads, Foya Limited positions itself as an attractive option for traders. However, the importance of thoroughly evaluating forex brokers cannot be overstated. The forex market, while offering significant opportunities, is also fraught with risks, particularly when it comes to unregulated or suspicious brokers. Traders must exercise caution and conduct due diligence to protect their investments. This article will investigate Foya Limited's regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment to determine whether Foya Limited is safe or a potential scam.

Regulation and Legitimacy

Regulation is a critical factor in assessing the legitimacy of any brokerage firm. A regulated broker is subject to oversight by a recognized financial authority, which helps ensure compliance with industry standards and protects traders' interests. In the case of Foya Limited, the firm claims to be regulated by the National Futures Association (NFA) in the United States. However, investigations reveal discrepancies regarding its regulatory status, raising concerns about its authenticity.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0542141 | United States | Unauthorized |

The absence of valid regulatory information and the dubious nature of its claimed license suggest that Foya Limited may not be operating under the rigorous standards expected of legitimate brokers. The lack of oversight can expose traders to various risks, including the potential for fraud and mismanagement of funds. A broker's regulatory quality significantly impacts its reliability, and Foya Limited's questionable status warrants serious consideration from potential clients.

Company Background Investigation

Foya Limited, incorporated in the United Kingdom, has been operational for approximately 1-2 years. The company's rapid emergence in the forex market raises questions about its long-term viability and commitment to regulatory compliance. The ownership structure of Foya Limited is not entirely transparent, with beneficial owners identified as Danni Wang and Hao Chen, holding 51% and 49% of the shares, respectively. This lack of clarity regarding ownership can create concerns about accountability and governance.

The management team behind Foya Limited has a questionable track record, with minimal experience in the forex industry. This lack of expertise may hinder the firm's ability to provide reliable services and support to its clients. Transparency and information disclosure are fundamental to establishing trust in a brokerage, and Foya Limited's limited communication regarding its operations and management further exacerbates concerns about its legitimacy.

Trading Conditions Analysis

Foya Limited advertises a range of trading conditions that may initially appear appealing to potential clients. However, a closer examination reveals potential pitfalls. The broker requires a minimum deposit of $250, which is relatively high compared to industry standards, and offers leverage of up to 1:500. While high leverage can amplify profits, it also significantly increases risk exposure.

| Fee Type | Foya Limited | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.0 pips | 1.0 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The lack of clarity surrounding commissions and overnight interest rates raises red flags for potential traders. Additionally, the absence of a demo account restricts novice traders from practicing and developing their skills before committing real funds. This lack of educational resources and transparency regarding fees can lead to unexpected costs and a negative trading experience.

Client Fund Safety

Client fund safety is paramount when considering a brokerage. Foya Limited's policies regarding fund security are not well-documented, raising concerns about the measures in place to protect clients' investments. It is crucial for brokers to implement fund segregation, investor protection schemes, and negative balance protection to ensure that clients' funds are secure and accessible.

Unfortunately, Foya Limited has not provided sufficient information regarding these safety measures. The absence of a clear outline of fund security protocols can create uncertainty for potential clients, especially in light of reports indicating difficulties with fund withdrawals and access. Historical issues related to fund safety and withdrawal problems can significantly impact a trader's confidence in a broker.

Customer Experience and Complaints

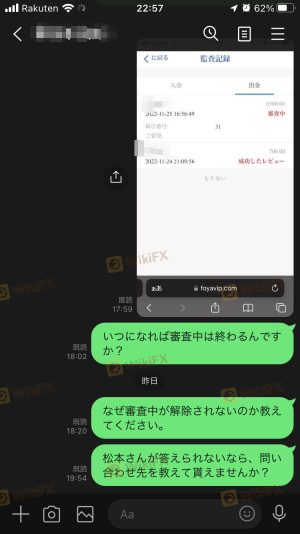

Analyzing customer feedback is essential for understanding the overall experience with a brokerage. Reports from users of Foya Limited indicate a pattern of dissatisfaction, particularly regarding withdrawal issues. Many clients have expressed frustration with delayed processing of withdrawal requests and a lack of responsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | Medium | Poor |

| Account Access Issues | High | Poor |

Several users have described their experiences as distressing, with claims of being unable to access their funds even after multiple requests. Such complaints highlight a concerning trend that raises questions about the broker's reliability and commitment to customer service. The lack of effective resolution to these issues further compounds the perception of Foya Limited as a potentially unsafe broker.

Platform and Execution

The trading platform provided by Foya Limited is not explicitly specified, which is a significant concern for traders seeking a reliable and user-friendly interface. A robust trading platform is essential for executing trades efficiently and analyzing market data. The absence of detailed information regarding the platform's performance, stability, and user experience can create uncertainty for potential clients.

Moreover, the quality of order execution, including slippage and rejection rates, is vital for traders. If a broker's platform exhibits signs of manipulation or poor execution quality, it can significantly impact trading outcomes. Unfortunately, Foya Limited has not provided sufficient data to assess these critical aspects of its trading platform.

Risk Assessment

Engaging with Foya Limited presents a range of risks that traders should carefully consider. The combination of regulatory concerns, customer dissatisfaction, and unclear trading conditions creates an environment of uncertainty.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of valid regulatory oversight |

| Withdrawal Issues | High | Reports of difficulties accessing funds |

| Transparency Risk | Medium | Limited information on fees and execution |

To mitigate these risks, potential clients should conduct thorough research and consider alternative brokers with established regulatory frameworks and positive reputations. Engaging with a broker that provides clear information, responsive customer support, and reliable trading conditions is essential for ensuring a positive trading experience.

Conclusion and Recommendations

In conclusion, the investigation into Foya Limited raises significant concerns regarding its legitimacy and safety. The combination of questionable regulatory status, reports of withdrawal issues, and a lack of transparency creates an environment that may not be conducive to safe trading. While Foya Limited offers attractive trading conditions, the potential risks associated with engaging with this broker cannot be overlooked.

Traders are advised to exercise caution when considering Foya Limited as their brokerage choice. For those seeking a more reliable trading experience, it may be prudent to explore alternative brokers that offer robust regulation, transparent fee structures, and positive customer feedback. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is Foya Limited a scam, or is it legit?

The latest exposure and evaluation content of Foya Limited brokers.

Foya Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Foya Limited latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.