Fomoso 2025 Review: Everything You Need to Know

Fomoso has garnered significant attention in the online trading community, but the consensus surrounding this broker is overwhelmingly negative. Many reviews label it as unregulated and potentially a scam, with numerous complaints regarding withdrawal issues and poor customer service. This review will delve into the key features and user experiences associated with Fomoso, highlighting both the advantages and disadvantages of trading with this broker.

Note: It is crucial to consider that Fomoso operates under various entities across different regions, which can impact regulatory oversight and user experience. This review aims to provide a fair and accurate assessment based on multiple sources.

Rating Overview

We rate brokers based on user feedback, regulatory status, and overall trading experience.

Broker Overview

Founded in 2017, Fomoso is marketed as a comprehensive trading platform for forex and CFDs. It primarily operates through the MetaTrader 4 (MT4) platform, a popular choice among traders for its user-friendly interface and robust technical analysis tools. The broker claims to offer a diverse range of trading instruments, including over 600 assets across forex, commodities like gold and silver, and various indices. However, the lack of a regulatory framework raises significant concerns regarding the safety of client funds and the overall integrity of the trading platform.

Detailed Breakdown

Regulatory Environment

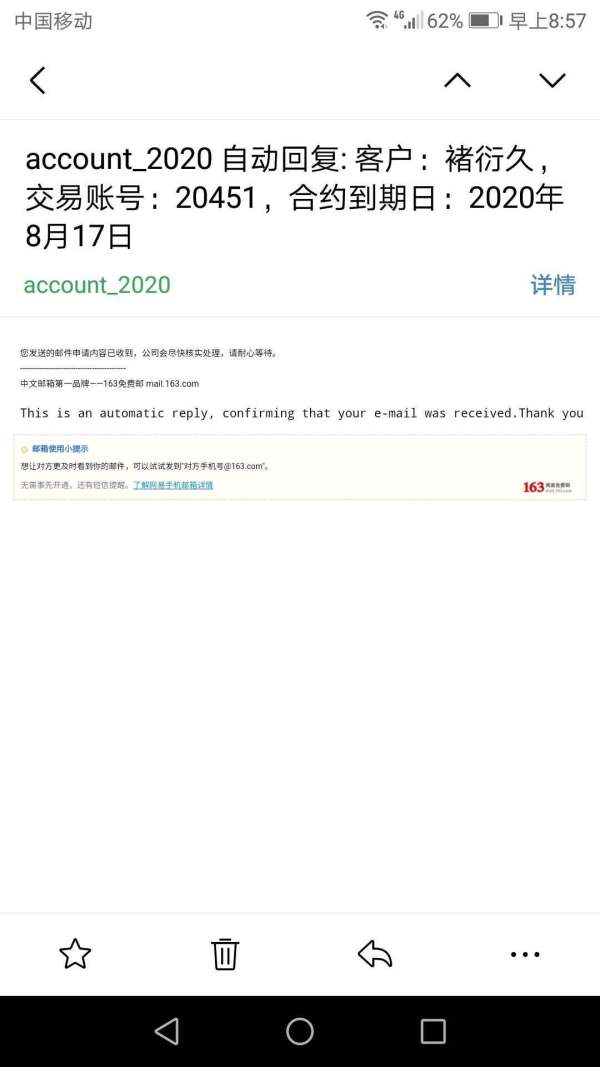

Fomoso is unregulated, which is a major red flag for potential investors. It claims to be overseen by the U.S. Financial Crimes Enforcement Network (FinCEN), but this agency does not issue licenses for forex trading, nor does it regulate forex brokers. Furthermore, a search of the National Futures Association (NFA) database reveals that Fomoso is not a member, meaning it lacks any legitimate regulatory oversight. This absence of regulation exposes traders to increased risks, as they do not have the protections typically afforded by a regulated broker.

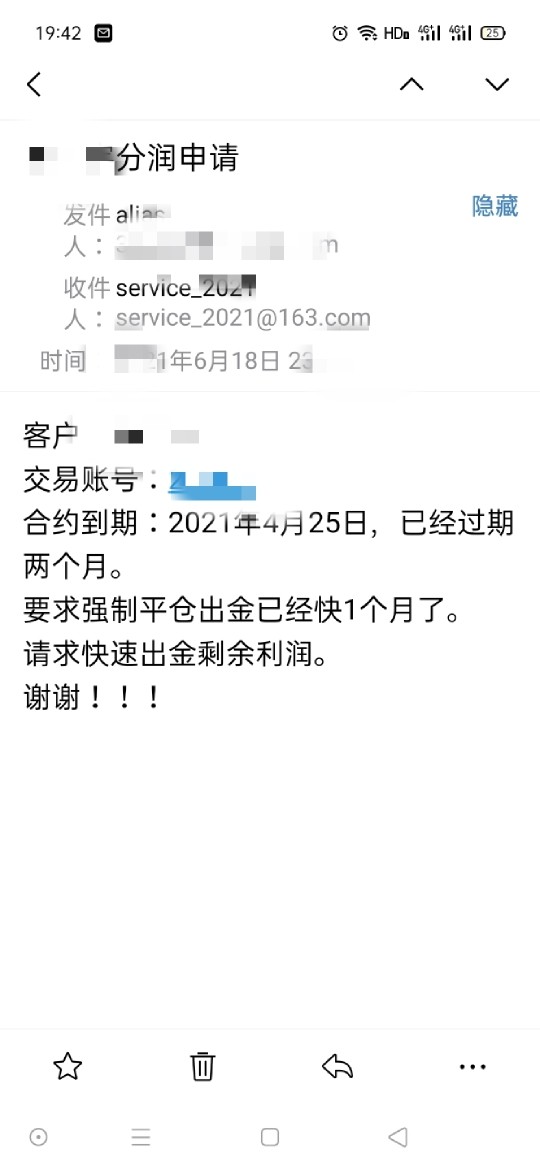

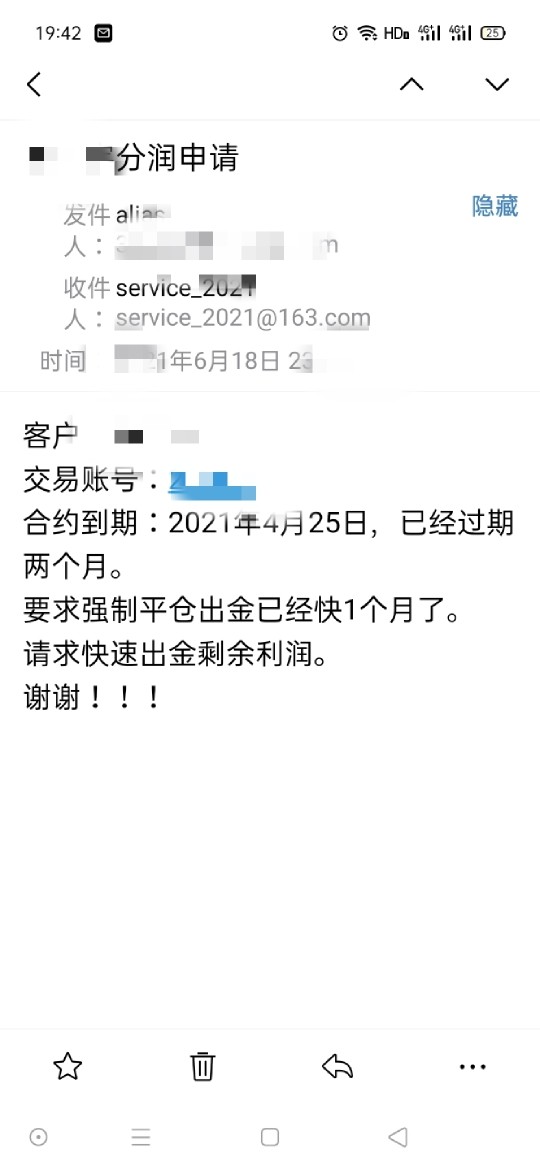

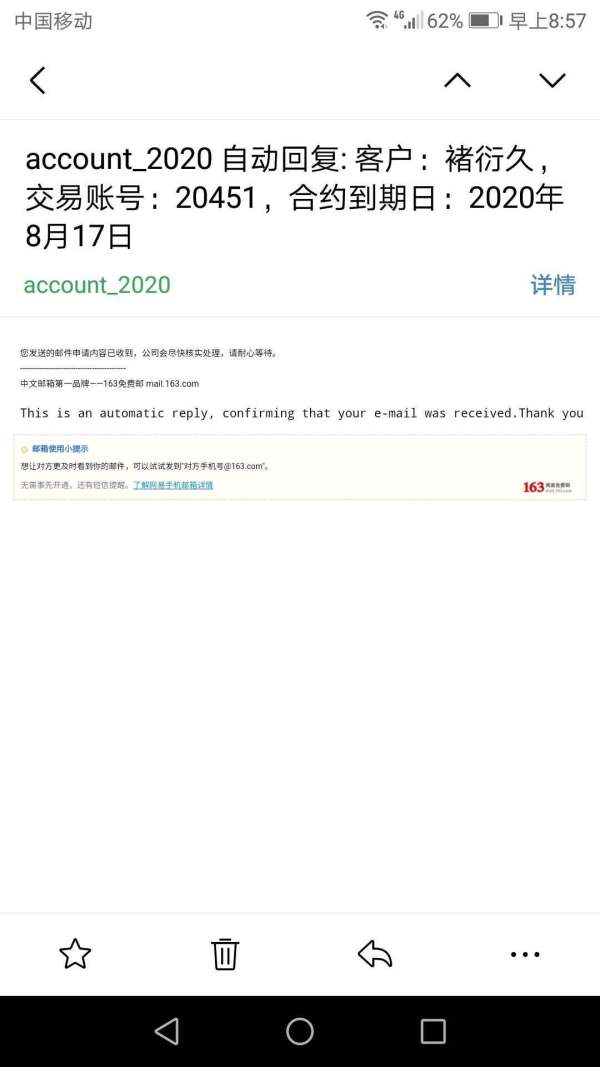

Deposit and Withdrawal Options

Fomoso offers limited options for deposits and withdrawals, primarily relying on bank transfers and small-amount internet banking. This restriction can be inconvenient for many traders who prefer more flexible payment methods like PayPal or Skrill. Additionally, Fomoso imposes a minimum withdrawal limit of $50 and charges a flat fee of $10 for withdrawals, which can accumulate over time, especially for those who need to move funds frequently.

Minimum Deposit

The minimum deposit for opening a trading account with Fomoso varies by account type. The mini account requires a minimum deposit of $100, while the standard account requires $3,000, and the pro account demands a hefty $50,000. This tiered structure can be a barrier for novice traders or those with limited capital.

Available Trading Instruments

Fomoso claims to offer over 600 trading instruments, which include forex pairs, commodities like spot gold and silver, and various indices. This wide variety of assets allows traders to diversify their portfolios and engage in multiple markets from a single platform. However, the lack of regulation raises questions about the fairness of the trading conditions and the execution of trades.

Costs

The costs associated with trading on Fomoso are concerning. Many reviews indicate that the spreads are significantly high, with reports suggesting that traders can lose up to 30% of their funds due to excessive spreads and fees. Moreover, the lack of transparency regarding commissions and additional costs further complicates the trading experience.

Leverage

Fomoso offers varying leverage options depending on the account type, with the standard account allowing leverage of up to 200:1, while the mini and pro accounts are capped at 100:1. While high leverage can amplify profits, it also increases the potential for significant losses, especially when trading with an unregulated broker.

Fomoso primarily utilizes the MetaTrader 4 platform, which is known for its extensive features and user-friendliness. However, the absence of a proprietary platform raises concerns about the broker's commitment to providing a secure and reliable trading environment. The MT4 platform, while robust, is only as trustworthy as the broker that offers it, and Fomoso's lack of regulation casts doubt on its reliability.

Restricted Regions

Fomoso does not clearly specify which regions are restricted from trading, but the absence of regulatory oversight suggests that traders from certain jurisdictions should exercise caution. Potential clients should verify the legality of trading with Fomoso in their respective regions before opening an account.

Customer Support Languages

Fomoso's customer support is primarily available in Chinese (Simplified), which may limit accessibility for non-Chinese speakers. Users have reported long wait times and inadequate responses from customer service, further compounding the negative user experience.

Rating Recap

In conclusion, the Fomoso review indicates that this broker is fraught with issues that potential traders should carefully consider. The lack of regulation, poor customer service, and numerous complaints about withdrawal difficulties suggest that Fomoso may not be a safe or reliable option for trading. Prospective clients are strongly advised to conduct thorough research and consider regulated alternatives before investing their funds with Fomoso.