Is Finexgm safe?

Business

License

Is Finexgm A Scam?

Introduction

Finexgm is a forex broker that has emerged in the trading landscape, claiming to offer a range of trading services including forex, cryptocurrencies, commodities, and indices. Established in 2020, Finexgm positions itself as a competitive player in the market, attracting traders with promises of low spreads and high leverage. However, the rise of online trading has also brought about an increase in fraudulent activities, making it crucial for traders to thoroughly evaluate the legitimacy of forex brokers before engaging with them. This article aims to investigate whether Finexgm is a safe trading platform or a potential scam. Our analysis is based on extensive research, including reviews from regulatory bodies, user feedback, and financial assessments, providing a comprehensive overview of Finexgm's credibility.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. A regulated broker is subject to oversight by financial authorities, which helps protect traders' interests. Unfortunately, Finexgm has not been found to be regulated by any recognized financial authority. This lack of regulation raises significant concerns about the safety of funds and the overall reliability of the broker.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

Without regulation, traders have no recourse for legal protection should issues arise. Furthermore, the absence of a regulatory framework often correlates with higher risks, as unregulated brokers can engage in practices that may not align with industry standards. The lack of oversight means that if traders encounter problems, they have limited options for recourse or recovery of funds. This situation underscores the importance of trading with brokers who are licensed and regulated by reputable authorities.

Company Background Investigation

Finexgm is operated by Saint Vincent Capital Ltd., a company registered in Saint Vincent and the Grenadines. Since its inception in 2020, the broker has aimed to attract traders by offering a digital account opening process and a variety of trading instruments. However, information regarding the ownership and management team of Finexgm is scarce. The lack of transparency surrounding the company's leadership raises questions about its operational integrity and accountability.

Moreover, the absence of detailed information about the management teams qualifications and experience is concerning. A reputable broker typically provides information about its executives and their professional backgrounds to instill confidence in potential clients. The lack of such disclosures may indicate a lack of accountability, making it harder for traders to trust the broker's operations.

Trading Conditions Analysis

When evaluating a forex broker, the overall cost of trading is a crucial factor. Finexgm claims to offer competitive spreads and leverage options; however, the specifics of these costs are often vague. Traders need to be aware of any hidden fees or unusual pricing policies that could affect their profitability.

| Fee Type | Finexgm | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2+ pips | 1-2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Finexgm appear to be higher than the industry average, which could significantly impact traders' profitability. Additionally, the lack of clarity regarding commissions and overnight interest rates could lead to unexpected costs. Traders should be cautious of brokers that do not provide transparent fee structures, as this could be indicative of potential scams.

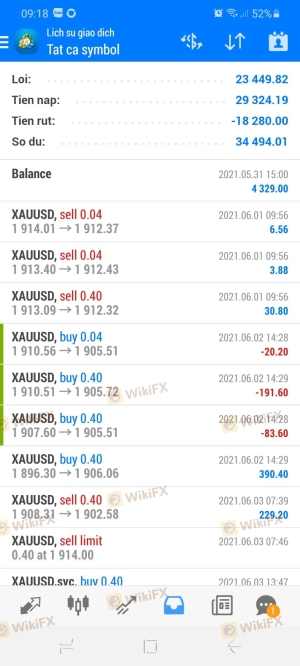

Client Funds Security

The safety of client funds is paramount in forex trading. A reputable broker should implement robust security measures to protect traders' deposits. Unfortunately, Finexgm has not provided clear information regarding its fund security protocols. There is no evidence of segregated accounts or investor protection policies, which are standard practices among regulated brokers.

The absence of these safety measures raises red flags about the broker's commitment to safeguarding client funds. Traders should be particularly wary of brokers that do not offer clear information about how they protect client money, as this could lead to significant financial losses in the event of mismanagement or fraud.

Customer Experience and Complaints

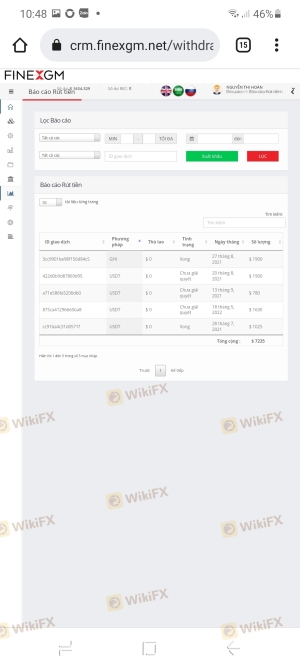

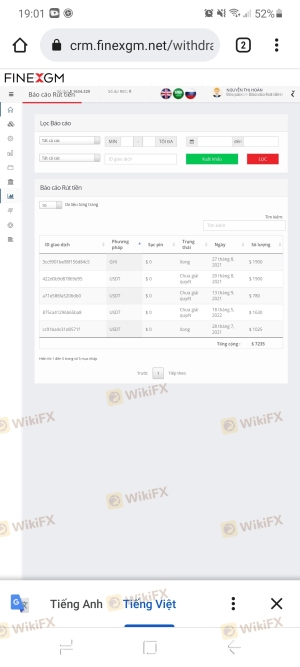

Analyzing customer feedback is essential for understanding the overall experience with a broker. Reports indicate that Finexgm has received multiple complaints from users, primarily concerning withdrawal issues. Many clients have reported difficulties in accessing their funds, which is a common red flag associated with fraudulent brokers.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Access Problems | Medium | Poor |

The pattern of complaints suggests that Finexgm may not prioritize customer support or resolution of issues, further eroding trust in the broker. Traders should be cautious when dealing with brokers that have a history of unresolved complaints, as this can indicate systemic issues with the broker's operations.

Platform and Trade Execution

The trading platform's performance is another critical aspect of a broker's reliability. Finexgm utilizes the MetaTrader 4 platform, which is known for its user-friendly interface and advanced trading tools. However, user reviews suggest that the platform may suffer from stability issues, slow execution speeds, and occasional slippage.

These performance issues can significantly impact trading outcomes, leading to potential losses. Traders should be wary of platforms that do not consistently deliver reliable execution, as this could hinder their trading strategies and overall experience.

Risk Assessment

Engaging with Finexgm carries various risks that traders should be aware of. The lack of regulation, combined with reports of withdrawal issues and poor customer service, indicates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Platform stability concerns |

To mitigate these risks, traders should consider using smaller amounts for initial deposits and conduct thorough due diligence before committing significant funds. Engaging with well-regulated brokers can also offer an added layer of security.

Conclusion and Recommendations

Based on the evidence gathered, it is clear that Finexgm raises several red flags that suggest it may not be a safe trading platform. The lack of regulation, poor customer feedback, and unclear trading conditions all contribute to a perception of risk and potential fraud. Traders should approach Finexgm with caution and consider alternative brokers that offer better regulatory oversight and customer support.

For those seeking a more secure trading environment, it is advisable to consider brokers that are regulated by top-tier authorities such as the FCA or ASIC. These brokers provide greater transparency, better customer service, and more robust protections for traders' funds. Always remember to conduct thorough research and due diligence before engaging with any broker to ensure your trading experience is both safe and profitable.

Is Finexgm a scam, or is it legit?

The latest exposure and evaluation content of Finexgm brokers.

Finexgm Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Finexgm latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.