Regarding the legitimacy of Alphadyne Asset Management forex brokers, it provides FSA and WikiBit, .

Is Alphadyne Asset Management safe?

Pros

Cons

Is Alphadyne Asset Management markets regulated?

The regulatory license is the strongest proof.

FSA Inst Deriv Trading License (AGN)

Financial Services Agency

Financial Services Agency

Current Status:

UnverifiedLicense Type:

Inst Deriv Trading License (AGN)

Licensed Entity:

株式会社アリスタゴラ・アドバイザーズ

Effective Date:

2008-03-04Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都港区愛宕二丁目5番1号 愛宕グリーンヒルズMORIタワー39階Phone Number of Licensed Institution:

03-6452-8840Licensed Institution Certified Documents:

Is Alphadyne Asset Management Safe or Scam?

Introduction

Alphadyne Asset Management is a financial services firm that primarily engages in asset management and corporate finance services, positioning itself within the foreign exchange (forex) market. Founded in 2005, the firm has garnered attention for its complex investment strategies, which include macro and fixed-income relative value investing. However, as the forex market is rife with both opportunities and risks, traders must exercise caution when evaluating brokers like Alphadyne. The importance of due diligence cannot be overstated, as the lack of proper regulation can lead to significant financial losses. This article aims to provide a comprehensive assessment of Alphadyne Asset Management's safety and legitimacy based on its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

When assessing whether Alphadyne Asset Management is safe, the first aspect to consider is its regulatory status. Regulation serves as a safeguard for investors, ensuring that brokers operate under strict guidelines designed to protect client funds. Unfortunately, Alphadyne Asset Management has garnered a reputation for being unregulated, which raises serious concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0557600 | United States | Unauthorized |

As indicated in the table, Alphadyne is listed as unauthorized by the National Futures Association (NFA), which means it lacks valid regulatory oversight. This absence of regulation is alarming, as it means there is no governing body to monitor its operations, making it risky for potential investors. The company's history of compliance is also questionable, with reports indicating that its regulatory status has been marked as abnormal. The lack of a robust regulatory framework can expose traders to potential fraud and misconduct, making it imperative to consider these factors before engaging with the broker.

Company Background Investigation

Alphadyne Asset Management has a relatively short history but has made significant strides since its inception. Founded in 2005 by Philippe Khuong-Huu and Bart Broadman, the firm has expanded its operations to include multiple offices worldwide, including locations in New York, London, and Tokyo. Despite its growth, the ownership structure remains somewhat opaque, with limited publicly available information about its stakeholders.

The management team boasts a wealth of experience in the financial sector, with Khuong-Huu previously serving as the head of the global interest rate products group at Goldman Sachs. However, the lack of transparency regarding the firm's ownership and the backgrounds of its senior executives raises questions about its operational integrity. Furthermore, the firm's disclosure practices appear to be inadequate, as it does not provide sufficient information about its financial health and operational methodologies. This lack of transparency is a red flag when evaluating whether Alphadyne Asset Management is safe for potential investors.

Trading Conditions Analysis

In terms of trading conditions, Alphadyne Asset Management offers various financial instruments, including forex, commodities, and indices. However, the absence of a demo account and the lack of transparency regarding its fees can be concerning. The overall fee structure and trading conditions play a crucial role in determining the broker's attractiveness to traders.

| Fee Type | Alphadyne Asset Management | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

As depicted in the table, Alphadyne does not provide clear information about its trading costs, which can be a significant drawback for potential clients. The lack of transparency regarding spreads and commissions may lead to hidden costs that could erode profits. This ambiguity raises further concerns about whether Alphadyne Asset Management is safe for traders looking for clarity and fairness in their trading conditions.

Client Fund Security

The security of client funds is another critical factor to consider when evaluating a broker's reliability. Alphadyne Asset Management's approach to safeguarding client assets remains unclear, especially given its unauthorized regulatory status. The firm does not appear to have robust measures in place for fund segregation, investor protection, or negative balance protection.

Historically, firms lacking proper regulatory oversight have been known to engage in practices that put client funds at risk. Without a credible regulatory framework, traders may find it difficult to recover their investments should any issues arise. Consequently, potential clients must weigh these risks seriously when assessing whether Alphadyne Asset Management is safe for investment.

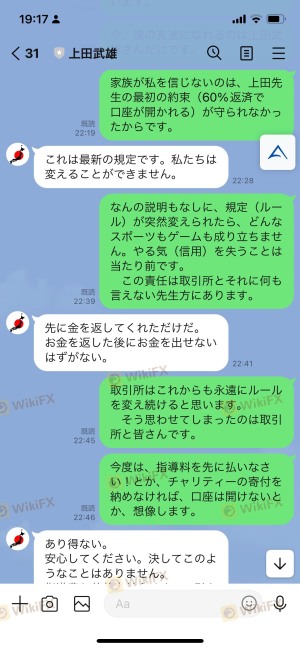

Customer Experience and Complaints

Customer feedback is often a valuable indicator of a broker's reliability. Reviews and testimonials for Alphadyne Asset Management reveal a mixed bag of experiences. While some clients have reported satisfactory interactions, others have raised concerns about the firm's responsiveness to complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Communication | Medium | Inconsistent |

| Transparency Concerns | High | Poor |

Common complaints include difficulties in withdrawing funds and inadequate communication from the customer service team. Such issues can significantly impact a trader's experience and raise questions about the firm's commitment to customer satisfaction. As traders consider whether Alphadyne Asset Management is safe, they should take these complaints into account.

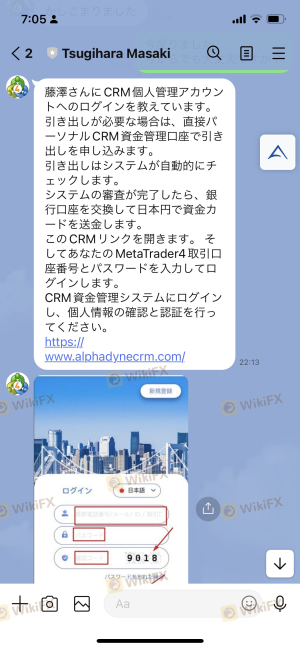

Platform and Execution

The performance and reliability of a trading platform are crucial for successful trading. Alphadyne Asset Management reportedly offers the widely used MetaTrader 4 platform, which is known for its user-friendly interface and robust features. However, concerns about order execution quality, slippage, and potential platform manipulation have been raised.

Traders have reported experiencing delays in order execution, which can be detrimental in a fast-moving market. Such issues may lead to increased trading costs and missed opportunities, further complicating the evaluation of whether Alphadyne Asset Management is safe for trading.

Risk Assessment

Using Alphadyne Asset Management comes with several risks that traders must consider. The absence of regulatory oversight, combined with the company's opaque fee structure and customer service issues, creates a significant risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight increases fraud risk. |

| Financial Transparency | High | Opaque fee structure can lead to hidden costs. |

| Customer Service | Medium | Inconsistent responses can affect trading experience. |

To mitigate these risks, traders should conduct thorough research and consider alternative, well-regulated brokers that offer clearer fee structures and better customer support.

Conclusion and Recommendations

In conclusion, Alphadyne Asset Management presents several red flags that raise concerns about its safety and legitimacy. The absence of regulatory oversight, coupled with a lack of transparency and mixed customer feedback, suggests that traders should approach this broker with caution. While some may find the trading conditions appealing, the risks associated with investing through an unregulated broker outweigh the potential benefits.

For those considering engaging with Alphadyne, it is crucial to conduct thorough due diligence and weigh the potential risks carefully. If you are a trader seeking a safe and reliable broker, consider exploring well-regulated alternatives that offer transparent fees and robust customer support. Ultimately, the question remains: Is Alphadyne Asset Management safe? Based on the available evidence, it is advisable to proceed with caution.

Is Alphadyne Asset Management a scam, or is it legit?

The latest exposure and evaluation content of Alphadyne Asset Management brokers.

Alphadyne Asset Management Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Alphadyne Asset Management latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.