Regarding the legitimacy of EUROPEFX forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is EUROPEFX safe?

Business

License

Is EUROPEFX markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RevokedLicense Type:

Forex Execution License (STP)

Licensed Entity:

MAXIFLEX LTD

Effective Date:

2014-11-10Email Address of Licensed Institution:

info@maxiflexglobal.comSharing Status:

No SharingWebsite of Licensed Institution:

https://europefx.com/, www.europecapitalgroup.com, www.europestocks.comExpiration Time:

--Address of Licensed Institution:

46 Ayiou Athanasiou Avenue, Floor 3 /Office 301a, 4102 Limassol, CyprusPhone Number of Licensed Institution:

35725262767Licensed Institution Certified Documents:

Is EuropeFX a Scam?

Introduction

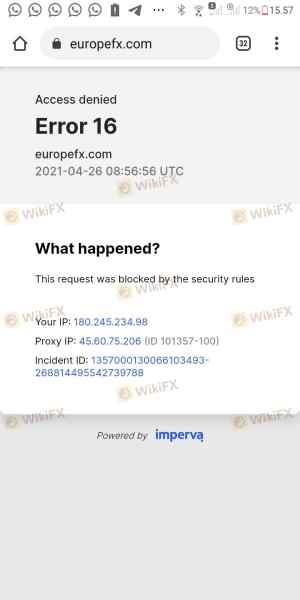

EuropeFX is a forex and CFD broker that positions itself as a gateway for traders looking to access various financial markets. Established in Cyprus, it claims to offer competitive trading conditions across multiple asset classes, including forex, commodities, stocks, and cryptocurrencies. However, the rise of online trading has also led to an increase in fraudulent schemes, making it essential for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to provide an objective analysis of EuropeFX, focusing on its legitimacy, regulatory standing, trading conditions, and customer experiences. The evaluation is based on comprehensive research from multiple credible sources, including user reviews, regulatory databases, and financial reports.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in assessing its legitimacy. EuropeFX is registered as a Cyprus Investment Firm (CIF) and is regulated by the Cyprus Securities and Exchange Commission (CySEC). However, the broker has faced scrutiny and regulatory challenges over the years, raising questions about its operational integrity.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| CySEC | 258/14 | Cyprus | Suspended |

The importance of regulation cannot be overstated. Regulatory bodies like CySEC impose strict guidelines to protect investors, including requirements for segregating client funds and providing negative balance protection. However, EuropeFX's license was suspended in October 2021 due to various compliance issues. This suspension indicates that the broker is currently operating without valid regulatory oversight, a significant red flag for potential investors.

Company Background Investigation

EuropeFX is operated by Maxiflex Ltd, a company that has had a tumultuous history in the financial sector. Founded in 2014, the broker initially gained a foothold by offering a range of trading services. However, its ownership structure has raised concerns, particularly regarding its past affiliations with binary options scams. The management team at EuropeFX has been criticized for a lack of transparency, and the broker's operational history is marred by investigations from financial regulators in various jurisdictions, including Australia.

The opacity surrounding the company's background and its management team adds to the skepticism about its operations. Transparency is crucial for building trust, and EuropeFX has not provided sufficient information to instill confidence in its clients.

Trading Conditions Analysis

When evaluating whether EuropeFX is safe, it is essential to scrutinize its trading conditions, particularly its fee structure. While the broker advertises competitive spreads, the lack of transparency regarding specific costs can be concerning.

| Fee Type | EuropeFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 0.2 pips |

| Commission Model | €20 per lot | €10 per lot |

| Overnight Interest Range | Variable | Variable |

The broker's commission structure appears to be higher than the industry average, especially for retail accounts. Additionally, EuropeFX imposes a withdrawal fee of €25, which can be considered excessive, particularly when many reputable brokers do not charge withdrawal fees at all. Such practices may indicate a profit model that relies on hidden fees rather than transparent trading conditions.

Client Fund Security

The safety of client funds is paramount when assessing any broker. EuropeFX claims to implement several measures to safeguard client deposits, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable, especially given the broker's regulatory challenges.

Historically, EuropeFX has faced issues concerning fund security, particularly when it operated in Australia. The Australian Securities and Investments Commission (ASIC) investigated the broker for failing to return client funds, which ultimately led to its cessation of operations in that region. This history of fund mismanagement raises serious concerns about the broker's current practices.

Customer Experience and Complaints

An essential aspect of evaluating whether EuropeFX is safe involves analyzing customer feedback and experiences. Numerous reviews indicate a pattern of complaints, particularly regarding withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Average |

| Customer Service Issues | High | Poor |

Many users have reported difficulties in withdrawing their funds, with some stating that their requests were ignored or delayed for extended periods. This pattern of complaints could suggest systemic issues within the broker's operations, further fueling suspicions about its legitimacy.

Platform and Execution

The trading platform is another critical area to evaluate when considering whether EuropeFX is safe. The broker offers the popular MetaTrader 4 (MT4) platform, which is known for its robust features and user-friendly interface. However, concerns have been raised about order execution quality, including instances of slippage and order rejections.

Traders have reported experiencing significant slippage during volatile market conditions, which can adversely affect trading outcomes. While slippage is common in the industry, excessive or frequent instances may indicate underlying issues with the broker's liquidity providers or execution practices.

Risk Assessment

The overall risk of trading with EuropeFX is elevated due to its regulatory issues, customer complaints, and transparency concerns.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operating without valid regulation |

| Financial Risk | Medium | High withdrawal fees and commissions |

| Operational Risk | High | Complaints about fund withdrawals |

Given these risks, potential traders should approach with caution and consider the implications of engaging with a broker that has a questionable reputation.

Conclusion and Recommendations

In summary, the evidence suggests that EuropeFX may not be a safe choice for traders. The broker's suspension by CySEC, history of regulatory issues, and numerous customer complaints raise significant red flags. While it does offer a range of trading instruments and platforms, these features do not compensate for the concerns regarding fund security and operational integrity.

For traders seeking a reliable broker, it is advisable to consider alternatives that are well-regulated and have a solid reputation. Brokers like AvaTrade, IC Markets, and others that are regulated by top-tier financial authorities may provide a more secure trading environment. Always conduct thorough research and due diligence before committing funds to any trading platform.

Is EUROPEFX a scam, or is it legit?

The latest exposure and evaluation content of EUROPEFX brokers.

EUROPEFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EUROPEFX latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.