Is Etofx Markets safe?

Business

License

Is Etofx Markets Safe or a Scam?

Introduction

Etofx Markets is a forex brokerage that has emerged in the online trading landscape, offering various trading instruments and services to its clients. As the forex market is known for its volatility and potential for profit, it has also attracted a fair share of scams and unreliable brokers. Therefore, it is essential for traders to exercise caution when selecting a brokerage for their trading activities. This article aims to provide a comprehensive analysis of Etofx Markets to determine whether it is a safe trading option or a potential scam. Our investigation includes a review of regulatory compliance, company background, trading conditions, customer experiences, and risk assessment, utilizing various sources and expert opinions to form an objective conclusion.

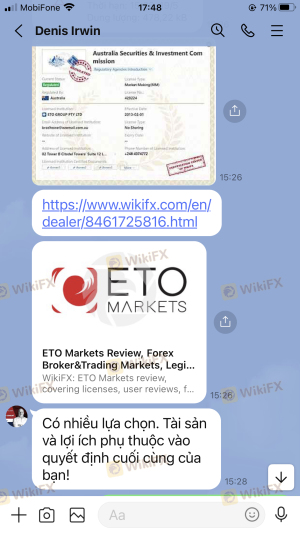

Regulation and Legitimacy

Regulation is a crucial factor in assessing the safety of any trading platform. A regulated broker is typically subject to strict oversight, which helps protect traders from potential fraud and ensures that they adhere to industry standards. Unfortunately, Etofx Markets is unregulated, raising significant concerns about its legitimacy. Below is a summary of its regulatory status:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that traders using Etofx Markets do not have the same level of protection as they would with a regulated broker. This lack of oversight raises questions about the firm's operational practices and its ability to safeguard client funds. Moreover, the lack of transparency regarding the company's location and ownership further complicates the trustworthiness of the broker. Without a regulatory framework, there is no recourse for traders if issues arise, such as withdrawal problems or disputes over fund management.

Company Background Investigation

Etofx Markets Limited claims to be based in the United Kingdom; however, there is a notable lack of information regarding its history, ownership structure, and management team. This lack of transparency is concerning, as potential clients have little insight into who is managing their investments. The absence of a clear corporate structure and the lack of publicly available information about the executive team raises red flags regarding the company's credibility.

Moreover, many reviews and reports indicate that Etofx Markets has been operational for only a short period, which suggests that it lacks the track record necessary to instill confidence among traders. A company with a solid history typically demonstrates reliability and stability, whereas a new or obscure company may not have the same reputation. In light of these factors, it is crucial for potential clients to approach Etofx Markets with caution, as the lack of transparency may indicate underlying issues.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience. A thorough examination of Etofx Markets reveals a mixed picture, with some competitive features but also concerning aspects. The following table summarizes the core trading costs associated with Etofx Markets:

| Cost Type | Etofx Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.6 pips | 1.0 pips |

| Commission Model | $3 per trade | $5 per trade |

| Overnight Interest Range | Variable | Variable |

While Etofx Markets offers competitive spreads and a lower commission structure, the overall fee structure may still contain hidden costs or unfavorable terms that are not immediately apparent. Some traders have reported unexpected fees and difficulties in withdrawing funds, which could indicate a lack of transparency in the broker's fee policies. Therefore, it is essential for traders to carefully read the terms and conditions before engaging with Etofx Markets.

Customer Funds Safety

The safety of client funds is of paramount importance when evaluating a forex broker. In the case of Etofx Markets, the lack of regulation poses significant risks to client funds. Without regulatory oversight, there are no guarantees regarding the segregation of client funds or any investor protection measures in place. The absence of these safeguards means that clients' money could be at risk if the broker encounters financial difficulties or engages in unethical practices.

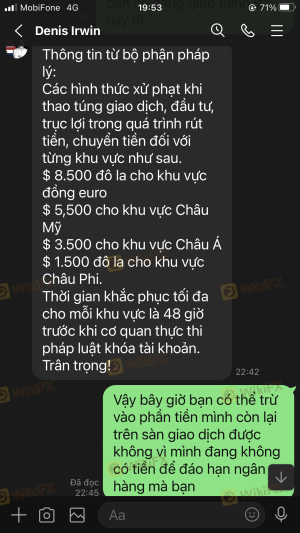

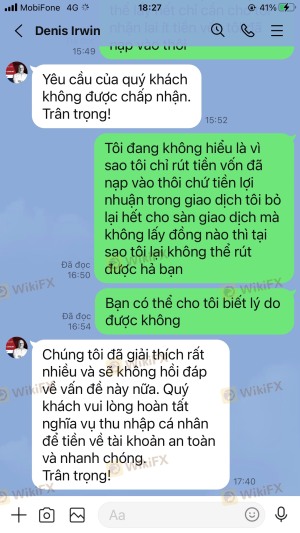

Furthermore, there have been reports of clients facing challenges when attempting to withdraw their funds from Etofx Markets. Clients have alleged that the broker imposes various obstacles, such as requiring additional deposits or claiming that accounts are not in a "safe zone" for withdrawals. These practices are alarming and suggest that the broker may not prioritize the safety and accessibility of client funds, raising further doubts about its legitimacy and reliability.

Customer Experience and Complaints

Customer feedback is a vital component of assessing a broker's reputation. A review of user experiences with Etofx Markets reveals a troubling pattern of complaints. Many clients have reported issues related to fund withdrawals, poor customer service, and a lack of responsiveness from the broker. The following table summarizes the main types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Misleading Information | High | Unresponsive |

One typical case involved a trader who attempted to withdraw their funds but was met with repeated excuses from the broker, ultimately leading to frustration and a sense of being scammed. This pattern of complaints raises serious concerns about the trustworthiness of Etofx Markets and suggests that potential clients should be wary of engaging with this broker.

Platform and Execution Quality

The quality of a trading platform can significantly affect a trader's experience. Etofx Markets offers several trading platforms, including MetaTrader 4 and cTrader. However, user reviews indicate that the platforms may suffer from stability issues and occasional downtime. Additionally, reports of slippage and rejected orders have surfaced, which can be detrimental to traders, especially during volatile market conditions.

While some traders have praised the user-friendly interface of the platforms, the overall performance and reliability remain questionable. Any signs of platform manipulation or execution issues could further undermine the broker's credibility and raise concerns about its operational integrity.

Risk Assessment

Engaging with Etofx Markets carries several risks that potential clients should consider. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated, no investor protection |

| Fund Safety | High | Lack of fund segregation and protection |

| Withdrawal Issues | High | Reports of difficulties withdrawing funds |

| Platform Reliability | Medium | Stability issues and execution problems |

To mitigate these risks, potential clients are advised to conduct thorough research, consider alternative brokers with solid regulatory frameworks, and avoid investing more than they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that Etofx Markets is not a safe trading option. The lack of regulation, transparency, and numerous complaints from users raise significant red flags about the broker's reliability and trustworthiness. Potential clients should be cautious and consider the risks associated with this broker before proceeding.

For traders looking for safer alternatives, it is recommended to explore brokers that are regulated by reputable authorities, offer transparent fee structures, and have a proven track record of customer satisfaction. Some reliable options include brokers like IG, OANDA, and Forex.com, which are known for their regulatory compliance and positive user experiences.

In light of the concerns surrounding Etofx Markets, it is prudent for traders to prioritize safety and reliability in their trading endeavors.

Is Etofx Markets a scam, or is it legit?

The latest exposure and evaluation content of Etofx Markets brokers.

Etofx Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Etofx Markets latest industry rating score is 1.41, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.41 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.