Is ETHBTC safe?

Pros

Cons

Is ETHBTC Safe or Scam?

Introduction

ETHBTC is a forex broker that has emerged in the crowded trading landscape, positioning itself as a platform for forex and cryptocurrency trading. Established in 2020, ETHBTC claims to offer a user-friendly trading experience with access to various financial instruments. However, as with any brokerage, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market has its share of scams and unregulated entities, making it imperative for traders to evaluate the legitimacy and safety of their chosen brokers carefully. This article aims to provide an objective analysis of ETHBTC, assessing its regulatory status, company background, trading conditions, customer experience, and overall safety.

To conduct this investigation, we analyzed multiple sources, including user reviews, regulatory databases, and expert evaluations. Our assessment framework focuses on key areas such as regulatory compliance, company history, customer feedback, and risk factors associated with trading on the platform. By synthesizing this information, we aim to answer the pressing question: Is ETHBTC safe?

Regulation and Legitimacy

The regulatory environment is a critical factor in determining the safety of any forex broker. A well-regulated broker is typically subject to stringent oversight, which helps protect traders' funds and ensures fair trading practices. In the case of ETHBTC, the broker claims to be regulated by the National Futures Association (NFA). However, our research indicates significant discrepancies in this claim.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | 0536274 | United States | Not Valid |

Despite presenting a license number, it appears that ETHBTC is not registered with the NFA, raising serious concerns about its legitimacy. The lack of proper regulation is a significant red flag, suggesting that the broker may operate without the necessary oversight to ensure the safety of customer funds. Furthermore, the absence of regulatory compliance can lead to higher risks of fraud and financial loss. Therefore, it is essential for traders to consider these regulatory aspects when evaluating whether ETHBTC is safe for trading.

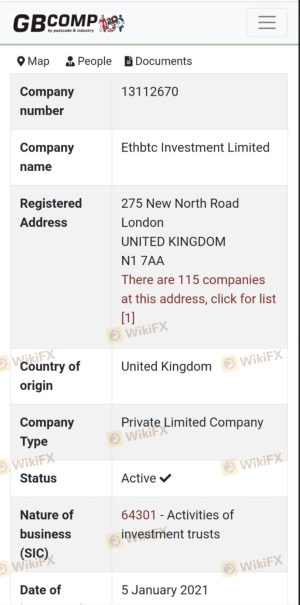

Company Background Investigation

ETHBTC Investment Limited, the entity behind ETHBTC, was established in 2020, but detailed information regarding its ownership structure and management team is notably scarce. This lack of transparency is concerning, as reputable brokers usually provide comprehensive information about their founders and key personnel, including their qualifications and experience in the financial industry.

The absence of clear ownership details raises questions about the broker's accountability and operational integrity. Moreover, the broker's website lacks essential information such as terms and conditions, which further diminishes its credibility. In a market where trust is paramount, the inability to verify the company's background and management experience poses a significant risk to potential clients. Therefore, it is crucial for traders to be cautious and consider the implications of such opacity when determining if ETHBTC is safe.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's profitability and overall experience. ETHBTC claims to provide competitive trading conditions, but our analysis reveals some concerning aspects. The broker's fee structure appears to be less favorable than industry standards, which could lead to increased trading costs for users.

| Fee Type | ETHBTC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 25 pips | 1.5 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Disclosed | Varies |

The spread of 25 pips for major currency pairs is alarmingly high compared to the industry average of around 1.5 pips. Such inflated spreads can significantly erode a trader's profits, making it difficult to achieve sustainable returns. Additionally, the lack of transparency regarding commissions and overnight interest rates raises further concerns about hidden fees that could be detrimental to traders.

In summary, the trading conditions at ETHBTC do not align with industry standards, which could indicate a potential risk for traders. Therefore, it is essential for prospective clients to carefully evaluate these factors when considering whether ETHBTC is safe for trading.

Client Fund Security

The security of client funds is paramount when assessing the safety of a broker. ETHBTC's website does not provide adequate information regarding its fund protection measures, which is a significant concern. A trustworthy broker should have clear policies regarding fund segregation, investor protection, and negative balance protection.

Unfortunately, ETHBTC appears to lack these essential safeguards, which can expose traders to substantial financial risks. Without proper fund segregation, clients' money may be at risk in the event of the broker's insolvency. Additionally, the absence of negative balance protection means that traders could potentially lose more than their initial investment, leading to severe financial consequences.

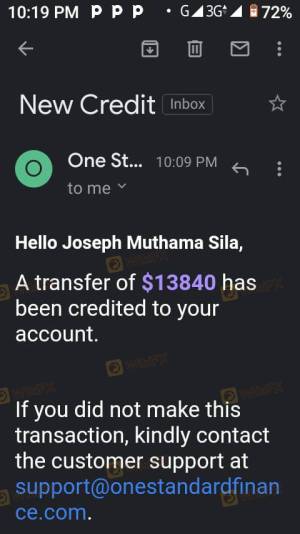

Moreover, there have been reports of withdrawal issues and complaints from users who struggled to access their funds. Such historical issues further compound concerns about the security of client assets. Therefore, it is crucial for traders to be aware of these risks and consider whether ETHBTC is safe for their investments.

Customer Experience and Complaints

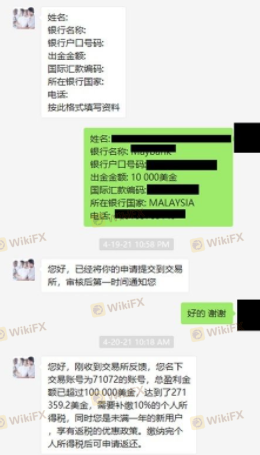

Customer feedback is a valuable indicator of a broker's reliability and operational integrity. In the case of ETHBTC, numerous complaints have surfaced regarding withdrawal difficulties and poor customer service. Users have reported challenges in accessing their funds and receiving timely responses from the support team.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or No Response |

| Poor Customer Service | Medium | Inconsistent Support |

The prevalent issue of withdrawal problems is particularly alarming, as it suggests potential operational inefficiencies or even fraudulent practices. Additionally, the lack of responsive customer support can exacerbate traders' frustrations during critical situations, leading to a negative overall experience.

Several users have shared their experiences of being unable to withdraw funds, with some reporting that they were asked to pay additional fees or taxes before their withdrawals could be processed. Such practices are often indicative of withdrawal scams, further raising the question of whether ETHBTC is safe for traders.

Platform and Trade Execution

The trading platform's performance is another crucial aspect of a broker's reliability. ETHBTC utilizes the MetaTrader 5 (MT5) platform, which is widely recognized for its advanced features and user-friendly interface. However, user feedback indicates that the platform may experience stability issues, which can hinder trading efficiency.

Moreover, the quality of order execution is of paramount importance. Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes. If a broker manipulates the trading environment or fails to execute orders promptly, it can lead to substantial financial losses for traders.

In conclusion, while the MT5 platform is reputable, the reported issues with execution quality raise concerns about the overall reliability of ETHBTC. Traders should be cautious and consider these factors when determining if ETHBTC is safe for their trading activities.

Risk Assessment

Evaluating the risks associated with trading on a particular platform is essential for informed decision-making. In the case of ETHBTC, several key risk areas have emerged from our analysis.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Financial Risk | High | High spreads and withdrawal issues can lead to losses. |

| Operational Risk | Medium | Platform stability and execution quality concerns. |

| Customer Service Risk | Medium | Poor support responsiveness can exacerbate trading issues. |

Given these risk factors, it is crucial for traders to exercise caution when considering ETHBTC as a trading option. To mitigate these risks, traders should conduct thorough research, avoid investing more than they can afford to lose, and consider using alternative, well-regulated brokers.

Conclusion and Recommendations

Based on the comprehensive analysis presented in this article, it is evident that ETHBTC raises several red flags regarding its legitimacy and safety. The lack of proper regulation, transparency issues, unfavorable trading conditions, and numerous customer complaints all contribute to a concerning picture of this broker.

In light of these findings, we advise potential traders to approach ETHBTC with extreme caution. If you are considering trading in the forex market, it may be prudent to explore alternative brokers that are well-regulated and have established a positive reputation within the trading community. Some recommended alternatives include brokers regulated by the FCA or ASIC, which have demonstrated a commitment to protecting client funds and ensuring fair trading practices.

In conclusion, while ETHBTC may present itself as a viable trading option, the substantial risks and concerns highlighted in this analysis suggest that it may not be the safest choice for traders. Therefore, it is crucial to prioritize safety and regulatory compliance when selecting a forex broker, as these factors play a vital role in safeguarding your investments.

Is ETHBTC a scam, or is it legit?

The latest exposure and evaluation content of ETHBTC brokers.

ETHBTC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ETHBTC latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.