ethbtc 2025 Review: Everything You Need to Know

Executive Summary

Our comprehensive ethbtc review reveals a broker with mixed user feedback. This broker requires careful consideration from potential traders who want to invest their money safely. Based on available user reviews, ethbtc gets both positive and neutral responses from its clients. However, the overall assessment remains cautious and suggests more research is needed.

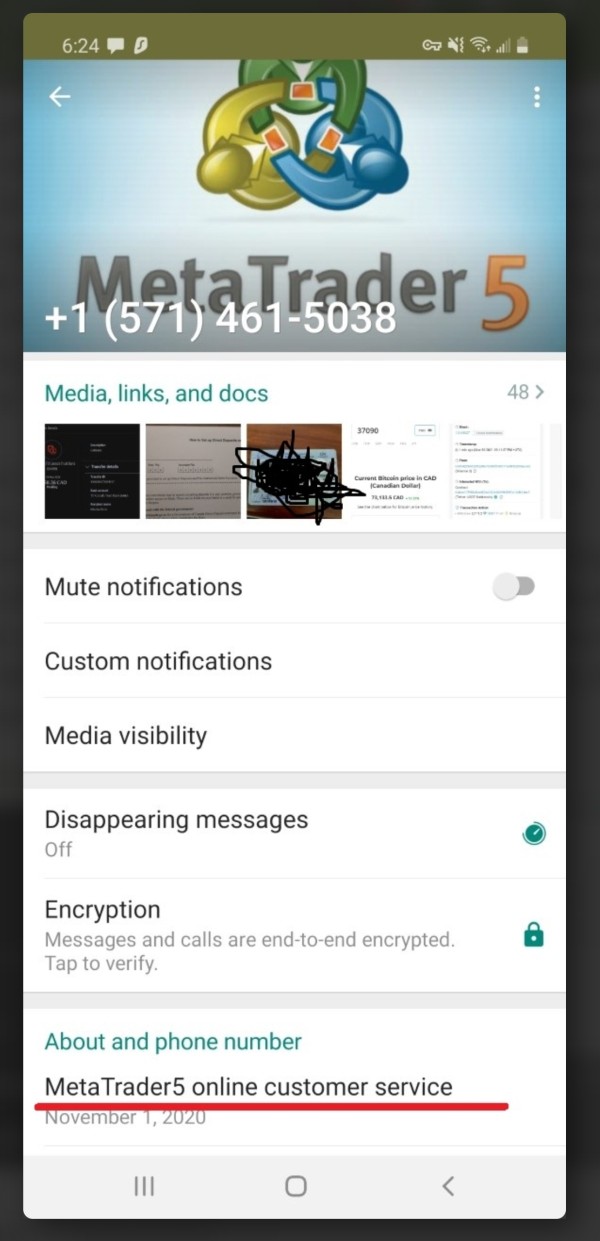

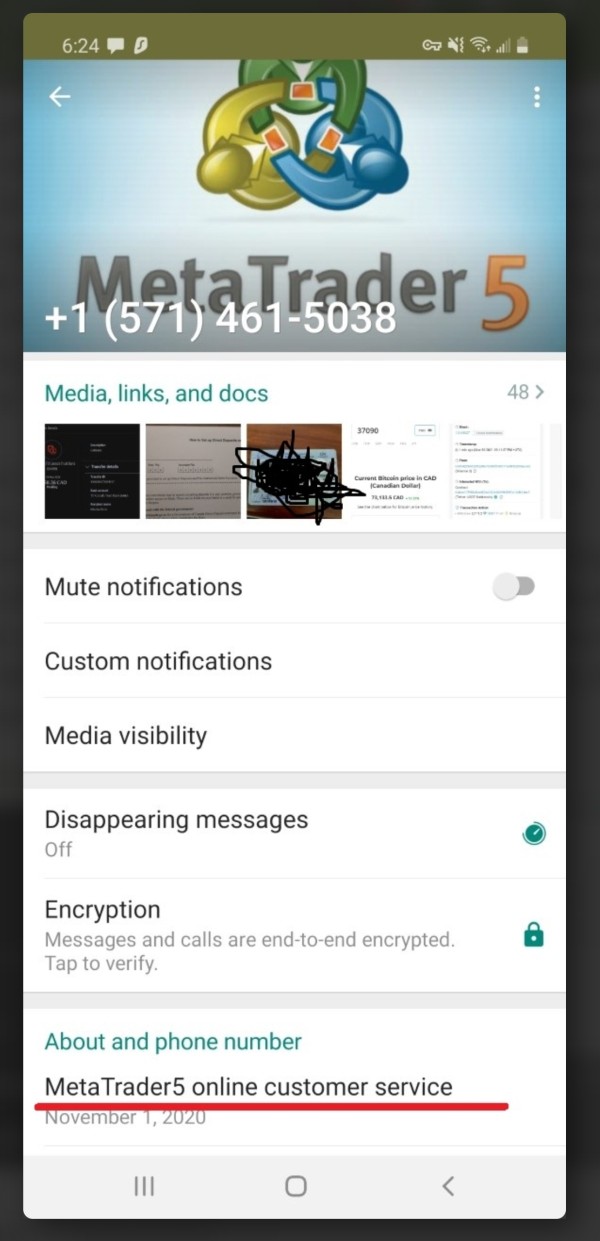

The broker primarily serves investors interested in forex trading. It especially focuses on those seeking exposure to cryptocurrency pairs such as ETH/BTC trading opportunities that have become popular recently. The platform uses MetaTrader 5 as its primary trading interface, which represents one of its key technological offerings.

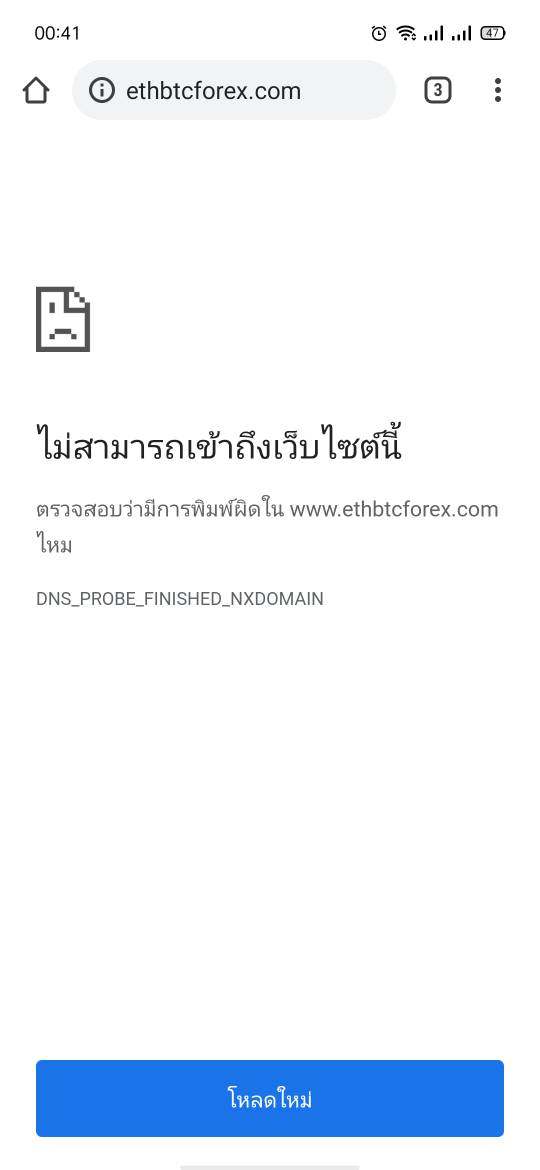

However, the limited availability of comprehensive user feedback creates concerns. The absence of detailed regulatory information in public sources makes thorough research necessary for prospective clients who want to trade safely. According to available market observations, ethbtc positions itself within the competitive forex trading landscape.

Traders should approach with measured expectations and conduct independent research before committing funds. The broker appears to cater specifically to forex market participants, with particular emphasis on cryptocurrency trading pairs that appeal to modern investors. While some users report satisfactory experiences, the overall consensus suggests that potential clients should exercise caution.

They should perform comprehensive background checks before engaging with the platform.

Important Disclaimers

Prospective traders should note that specific regulatory information for ethbtc was not detailed in available public sources. This means users must independently verify the broker's licensing status and regulatory compliance before investing any money. This ethbtc review is based primarily on user feedback analysis and general market observations rather than comprehensive regulatory documentation.

The evaluation methodology employed focuses on available user testimonials and publicly accessible information. However, given the limited scope of detailed operational data, investors are strongly advised to conduct their own thorough research before making decisions. This research should include verification of regulatory status, terms of service, and risk disclosures before making any trading decisions.

Cross-regional regulatory differences may apply, and users should confirm compliance with their local jurisdiction's requirements.

Rating Framework

Broker Overview

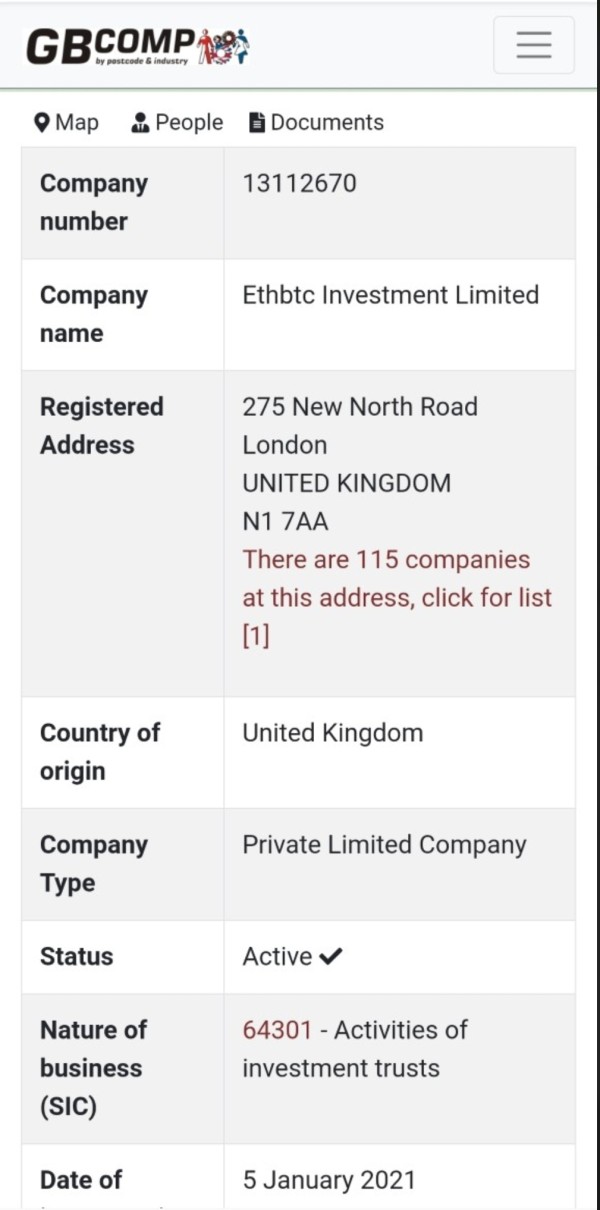

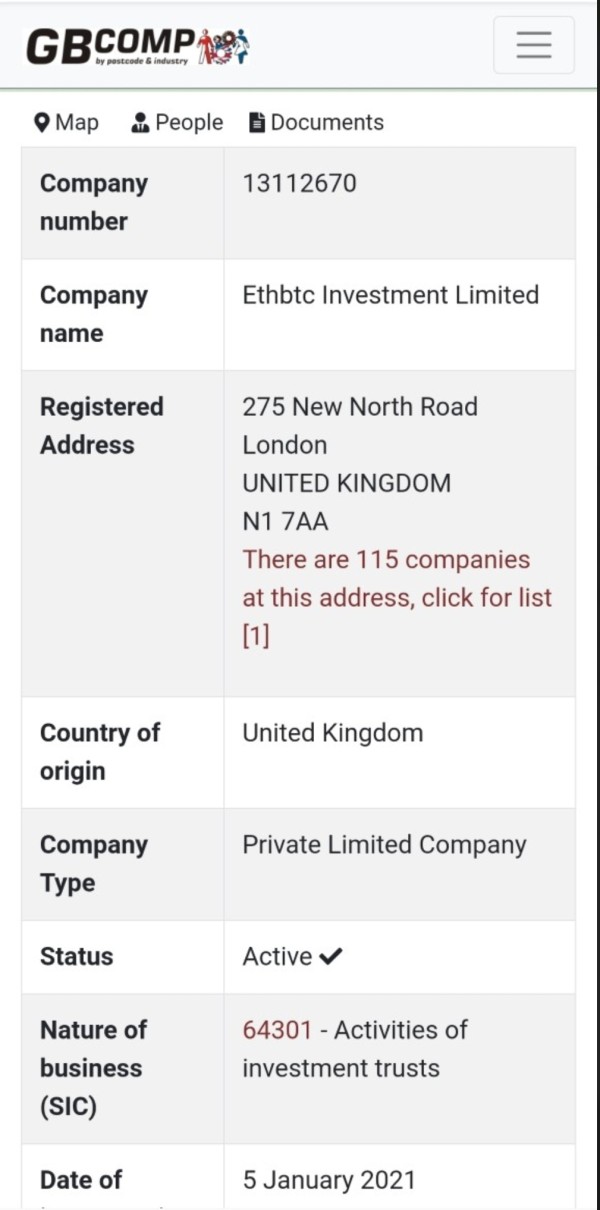

ethbtc operates as a forex broker with particular focus on cryptocurrency trading pairs. It most notably focuses on ETH/BTC exchanges that have gained popularity among modern traders. While specific establishment dates and comprehensive company background information remain unavailable in public sources, the broker positions itself within the competitive forex trading sector.

The platform's business model centers on providing access to foreign exchange markets. It shows apparent specialization in digital asset trading pairs that appeal to modern traders seeking cryptocurrency exposure in their portfolios. The broker's operational approach appears to target retail forex traders interested in both traditional currency pairs and emerging cryptocurrency markets.

However, the absence of detailed company history and founding information in available sources creates concerns. This suggests potential clients should seek additional verification of the broker's operational timeline and corporate structure before investing money. The platform uses MetaTrader 5 as its primary trading infrastructure, indicating alignment with industry-standard trading technology.

This choice suggests the broker aims to provide familiar trading environments for experienced forex traders. It also potentially attracts newcomers through recognized platform interfaces that many traders already know how to use. The asset class focus on ETH/BTC trading indicates specialization in cryptocurrency forex markets, though the full range of available trading instruments remains unclear from available documentation.

Regulatory oversight information was not specified in accessible sources. This creates a significant information gap that potential clients must address through independent verification before proceeding with any investments.

Regulatory Status: Available sources do not specify particular regulatory jurisdictions or licensing authorities overseeing ethbtc operations. Potential clients must independently verify regulatory compliance and licensing status before engaging with the platform to ensure their investments are protected.

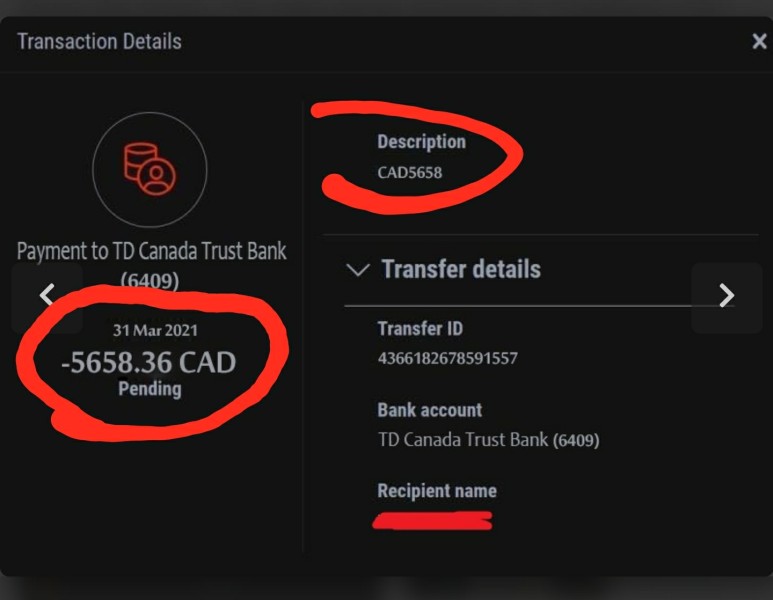

Deposit and Withdrawal Methods: Specific information regarding available funding methods, processing times, and associated fees was not detailed in accessible sources. This requires direct inquiry with the broker for comprehensive payment options that suit individual trader needs.

Minimum Deposit Requirements: Exact minimum deposit amounts and account funding thresholds were not specified in available documentation. This makes it necessary to contact the broker directly for current requirements that may affect your ability to start trading.

Promotional Offers: Details regarding welcome bonuses, trading incentives, or promotional campaigns were not available in public sources. However, traders should inquire directly about current offers and associated terms that might provide additional value for new accounts.

Tradable Assets: The broker offers ETH/BTC forex trading pairs, indicating specialization in cryptocurrency exchange markets. The complete range of available trading instruments beyond this cryptocurrency pair remains unspecified in available sources and requires further investigation.

Cost Structure: Specific information regarding spreads, commission rates, overnight fees, and other trading costs was not detailed in accessible documentation. Traders should request comprehensive fee schedules directly from the broker before account opening to understand all potential costs involved.

Leverage Options: Available leverage ratios and margin requirements were not specified in public sources. This requires direct verification of trading conditions and risk parameters that could significantly impact your trading strategy.

Platform Selection: ethbtc primarily uses MetaTrader 5 as its trading platform, providing users with industry-standard charting tools, technical analysis capabilities, and automated trading functionality. This platform choice aligns with industry standards and offers familiar interfaces for experienced traders.

Geographic Restrictions: Specific jurisdictional limitations or restricted territories were not detailed in available sources.

Customer Support Languages: Available support languages and communication channels were not specified in accessible documentation.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of ethbtc's account conditions faces significant limitations due to insufficient publicly available information. This information gap affects our ability to assess specific account types, structures, and associated benefits that traders typically expect. This ethbtc review finds that potential clients lack access to comprehensive details about different account tiers, minimum balance requirements, or specialized account features.

These features might cater to various trader profiles and investment levels. The absence of detailed account opening procedures and verification requirements in available sources creates uncertainty for prospective clients seeking to understand the onboarding process. Without specific information about account types such as standard, premium, or professional classifications, traders cannot adequately assess whether the broker's offerings align with their trading needs.

They also cannot determine if the account options match their capital requirements and investment goals. Furthermore, the lack of information regarding special account features creates additional concerns for diverse trader demographics. These features include Islamic accounts for Sharia-compliant trading or managed account options that some traders specifically seek.

The unclear minimum deposit structure and potential account maintenance fees represent additional concerns. These concerns particularly affect cost-conscious traders evaluating the platform's accessibility and affordability for their trading budget. User feedback regarding account conditions remains limited, with available testimonials providing insufficient detail about the practical experience of account management.

This includes funding procedures and account-related customer service interactions that can significantly impact the trading experience.

ethbtc's use of MetaTrader 5 represents its primary technological strength in the competitive forex market. This platform provides users with access to professional-grade trading tools, comprehensive charting capabilities, and automated trading functionality that meets industry standards. The MT5 platform offers advanced technical analysis tools, multiple timeframe analysis, and algorithmic trading support through Expert Advisors.

These features meet industry standards for trading technology and provide the tools that professional traders expect. However, the evaluation reveals significant gaps in additional resources beyond the core trading platform that many traders consider essential. Available sources do not specify whether ethbtc provides supplementary research tools, market analysis reports, or economic calendar integration.

Many traders consider these resources essential for informed decision-making and successful trading strategies. The absence of detailed information about educational resources, trading guides, or market commentary limits the platform's value proposition for developing traders. These traders often rely on educational materials to improve their skills and understanding of market dynamics.

The lack of documentation regarding mobile trading applications creates uncertainty about the broker's technological ecosystem. It also raises questions about web-based platform alternatives and additional trading tools beyond MT5 that modern traders often expect. Modern traders often expect comprehensive digital solutions including mobile apps, browser-based trading, and integrated research platforms that enhance their trading experience.

User testimonials regarding tool effectiveness and resource quality remain insufficient in available sources.

Customer Service and Support Analysis

The assessment of ethbtc's customer service capabilities faces substantial limitations due to insufficient user feedback. This limitation also stems from lack of detailed support infrastructure information in available sources that would help evaluate service quality. This creates significant uncertainty about the broker's commitment to client support and problem resolution effectiveness.

Available documentation does not specify customer service channels or the quality of support that traders can expect. This includes whether the broker offers live chat, phone support, email assistance, or ticket-based systems that modern traders typically require. The absence of information regarding support availability hours, response time commitments, or multilingual assistance capabilities limits potential clients' ability to assess service accessibility.

It also affects their ability to evaluate service quality that could impact their trading experience significantly. User experiences with customer support remain largely undocumented in accessible sources, preventing evaluation of actual service quality. This prevents assessment of problem resolution effectiveness and staff knowledge levels that could be crucial during trading emergencies.

The lack of specific testimonials about support interactions creates concerns about the broker's reliability. This includes testimonials about complaint handling and technical assistance that create a significant information void for prospective clients. The unclear support structure raises concerns about the broker's capacity to handle client inquiries, technical issues, or account-related problems effectively.

Without documented service level agreements, escalation procedures, or support quality metrics, traders cannot adequately assess whether the broker provides reliable assistance when needed.

Trading Experience Analysis

The trading experience evaluation centers primarily on ethbtc's MetaTrader 5 platform implementation. This platform provides industry-standard functionality for forex trading activities that most professional traders expect from a modern broker. MT5 offers comprehensive charting tools, technical indicators, and order management capabilities that meet professional trading requirements for most market participants.

However, this ethbtc review identifies significant gaps in user feedback regarding actual trading conditions. These gaps include information about execution quality and platform performance under various market conditions that can significantly impact trading success. Available sources lack specific testimonials about order execution speed, slippage rates, or platform stability during high-volatility periods.

This creates uncertainty about practical trading experience that traders will actually encounter when using the platform. The absence of detailed information about mobile trading capabilities limits assessment of the overall trading ecosystem. This also affects evaluation of platform customization options and integration with third-party tools that many traders consider essential.

Modern traders often require seamless cross-device functionality and personalized trading environments. However, these features may not be adequately documented for ethbtc's offerings, making it difficult to assess their availability. Furthermore, the lack of specific data about trading conditions affects the ability to evaluate the broker's competitive position.

This includes information about typical spreads, execution models, and liquidity provision that directly impact trading costs and success.

Trust and Security Analysis

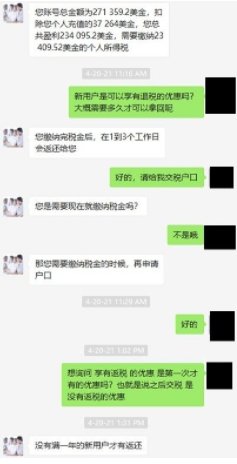

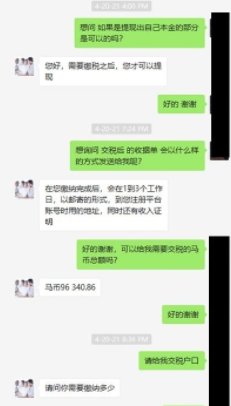

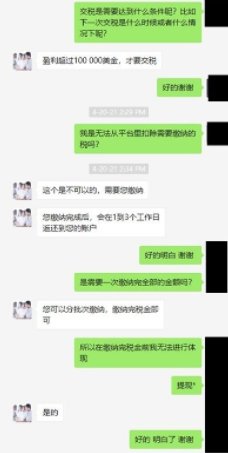

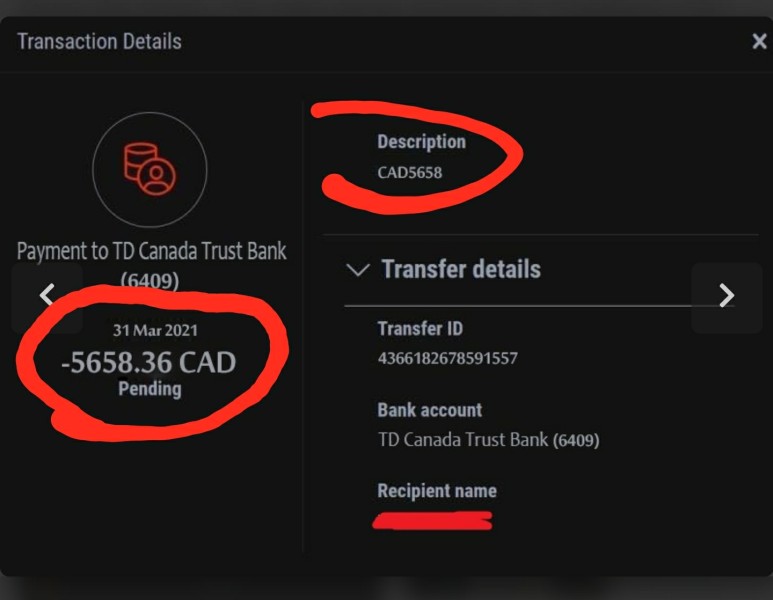

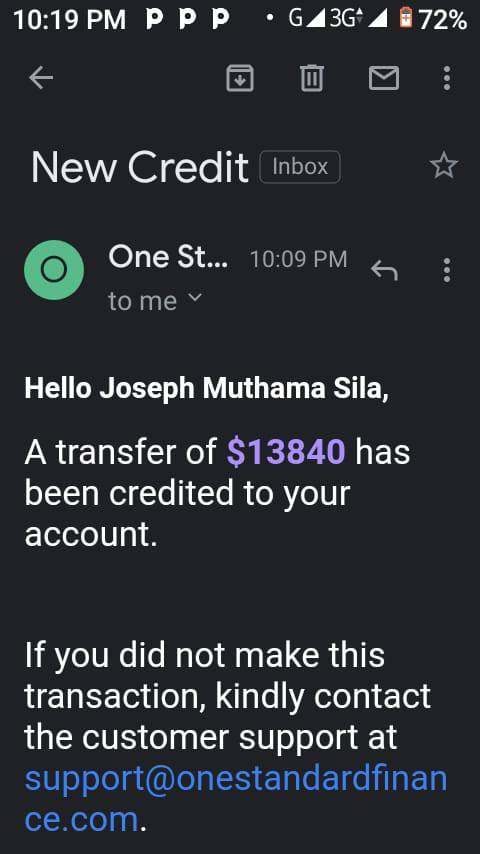

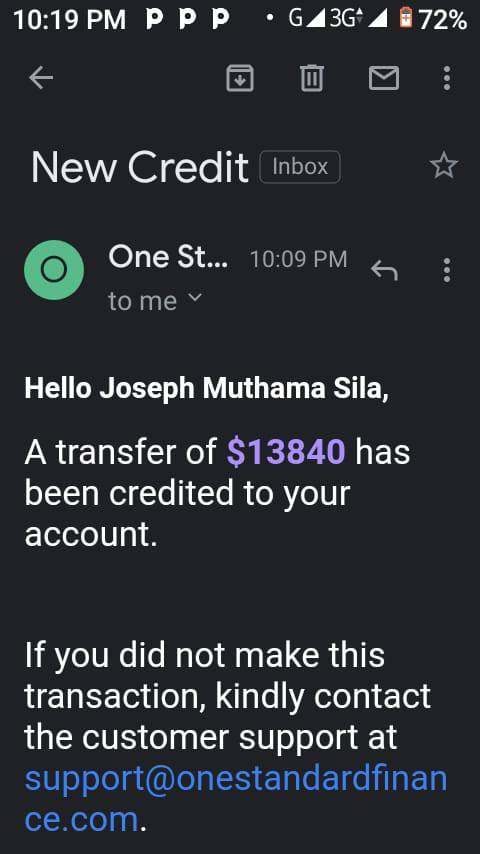

The trust and security evaluation reveals significant concerns that warrant careful consideration from potential clients. Available sources indicate discussions about ethbtc's legitimacy, including specific inquiries about whether the broker represents a fraudulent operation that could put trader funds at risk. These discussions raise immediate red flags for prospective traders considering investing their money with this broker.

The absence of clear regulatory information in publicly accessible sources represents a fundamental transparency issue. This issue undermines confidence in the broker's operational legitimacy and raises questions about proper oversight of trading activities. Legitimate forex brokers typically maintain clear regulatory disclosure, licensing information, and compliance documentation.

However, this information was not evident in available materials about ethbtc, which creates serious concerns about regulatory compliance. The lack of detailed information about client fund protection measures creates additional security concerns for potential investors. This includes information about segregated account policies and insurance coverage that protect trader funds in case of broker insolvency.

Professional brokers usually provide comprehensive information about fund safety protocols. They also provide information about regulatory compliance measures and risk management procedures that appear absent from ethbtc's public documentation. User discussions about potential fraudulent activity, combined with insufficient regulatory transparency, create a concerning pattern.

This pattern suggests elevated risk for potential clients who might consider investing with this broker.

User Experience Analysis

The user experience assessment reveals mixed feedback with limited comprehensive testimonials available in accessible sources. Available user evaluations suggest a range of experiences from positive to neutral, though the overall consensus indicates that potential clients should approach with caution. They should also conduct thorough research before committing to the platform or investing significant amounts of money.

The absence of detailed user interface descriptions limits understanding of the practical client onboarding experience. This also affects understanding of registration process feedback and verification procedure testimonials that could help potential clients prepare for account opening. Modern traders expect streamlined account opening, efficient verification processes, and intuitive platform navigation.

However, these features remain inadequately documented for ethbtc, making it difficult to assess the actual user experience. User satisfaction indicators appear limited in available sources, with insufficient feedback about overall trading satisfaction. This includes limited information about platform usability and service quality that could significantly impact the trading experience.

The lack of comprehensive user reviews covering various aspects of the trading experience creates significant information gaps. These gaps affect understanding of everything from initial registration through ongoing platform use that potential clients need to evaluate. The target user profile appears to focus on forex traders interested in cryptocurrency pairs, particularly ETH/BTC trading opportunities.

However, the limited user testimonials and mixed feedback suggest that the broker may not consistently meet trader expectations across various experience levels.

Conclusion

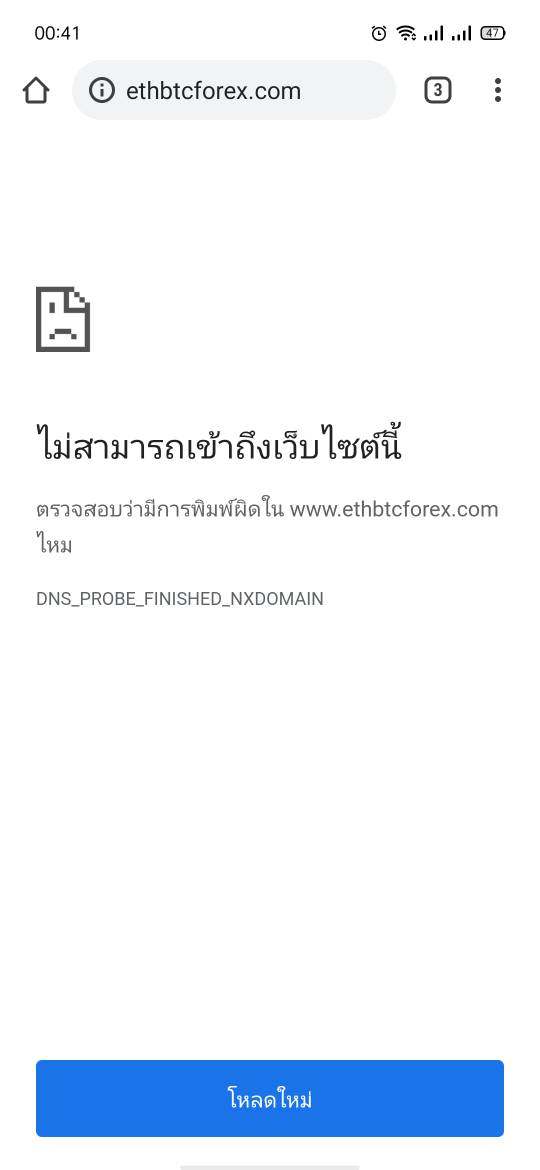

This comprehensive ethbtc review concludes with a neutral assessment that emphasizes the need for careful evaluation by potential clients. While the broker offers MetaTrader 5 platform access and specializes in ETH/BTC trading opportunities, significant information gaps and trust concerns warrant cautious consideration before investing money. The platform appears most suitable for forex traders specifically interested in cryptocurrency trading pairs.

However, the limited regulatory transparency and mixed user feedback suggest that alternative brokers with clearer operational credentials may provide more reliable trading environments. The primary advantages include access to industry-standard MT5 technology that many traders are familiar with and appreciate. The main disadvantages center on insufficient regulatory information and limited user testimonials that make it difficult to assess the broker's reliability.

Prospective clients should prioritize independent verification of regulatory status before proceeding with any investments. They should also conduct comprehensive review of terms and conditions and careful evaluation of alternative brokers before making final decisions about engaging with ethbtc's services.