Is ElastosTrade safe?

Business

License

Is Elastostrade Safe or Scam?

Introduction

Elastostrade is a relatively new player in the forex market, positioning itself as a broker that offers various trading options, including forex, CFDs, and cryptocurrencies. As the financial landscape continues to evolve, traders must be vigilant in assessing the legitimacy and safety of trading platforms. This is particularly crucial in the forex market, where unregulated brokers can pose significant risks to investors. This article aims to provide a thorough investigation into the safety and reliability of Elastostrade, utilizing a combination of qualitative assessments and quantitative data to evaluate its regulatory status, company background, trading conditions, and customer experiences.

Regulation and Legitimacy

The regulatory environment is a critical aspect when evaluating the safety of any forex broker. A broker's licensing and oversight can significantly influence the level of protection offered to customers. Unfortunately, Elastostrade is reported to be an unregulated broker, which raises serious concerns about its legitimacy and the security of client funds. Below is a summary of the regulatory information related to Elastostrade:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight is a major red flag, indicating that clients have no recourse should disputes arise. Moreover, the lack of transparent regulatory history suggests that Elastostrade may not adhere to the best practices typically expected from licensed brokers. This lack of regulation can lead to potential issues such as mismanagement of funds and unaccountable business practices, raising the question: Is Elastostrade safe?

Company Background Investigation

Understanding the company behind a trading platform is essential for assessing its reliability. Elastostrade appears to have a limited history, with no significant milestones or achievements publicly documented. The ownership structure remains opaque, which is another cause for concern. Without clear information about the management team and their qualifications, it's difficult to ascertain the level of expertise guiding the company's operations.

Moreover, the transparency of a broker is vital for building trust among clients. Unfortunately, Elastostrade has not provided adequate information about its operations, leading to skepticism regarding its legitimacy. The lack of accessible information about the company's history and management raises important questions: Is Elastostrade safe for traders looking for a reliable platform?

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions they offer can significantly impact a trader's experience. Elastostrade claims to provide competitive trading conditions, but the specifics of its fee structure are not clearly outlined. Understanding the cost of trading is crucial, as hidden fees can erode profits. Below is a comparison of the core trading costs associated with Elastostrade and the industry average:

| Fee Type | Elastostrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | N/A | $0-$10 per trade |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding fees is concerning and can lead to unexpected costs for traders. Additionally, any unusual or hidden fee policies could indicate that the broker is not operating in the best interests of its clients. Thus, potential traders should carefully consider: Is Elastostrade safe given its unclear fee structure?

Client Fund Safety

The safety of client funds is paramount when it comes to trading. A reputable broker should implement robust security measures, including segregated accounts and investor protection policies. However, Elastostrade's lack of regulation raises significant concerns about the safety of client funds. There is no evidence to suggest that the broker employs measures such as fund segregation or negative balance protection.

Furthermore, the absence of any history regarding fund security issues or disputes only adds to the uncertainty surrounding Elastostrade. Without a solid foundation of security measures, traders may be putting their investments at risk. This leads us to question: Is Elastostrade safe for your hard-earned money?

Customer Experience and Complaints

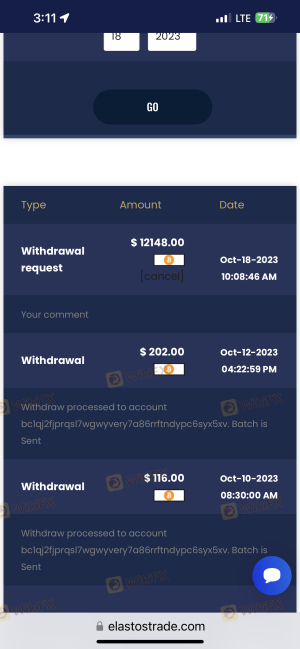

Customer feedback is an essential component of evaluating a broker's reliability. A review of user experiences reveals a pattern of complaints, primarily centered around withdrawal issues and poor customer service. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Blocking | High | Poor |

| Customer Service Issues | Medium | Poor |

Several users have reported difficulties in withdrawing their funds, often citing long delays and unresponsive customer support. In some cases, traders have claimed that their accounts were blocked without clear explanations. These issues raise significant concerns about the trustworthiness of Elastostrade. Therefore, potential clients must consider: Is Elastostrade safe, given the prevalent negative experiences?

Platform and Execution

The performance of a trading platform is crucial for a seamless trading experience. Traders expect a stable and user-friendly interface that allows for quick execution of trades. However, reports indicate that Elastostrade's platform may suffer from stability issues, including slippage and order rejections. This can severely impact trading outcomes and lead to frustration among users.

Moreover, any signs of platform manipulation, such as artificially widening spreads during high volatility, should be taken seriously. This raises the question: Is Elastostrade safe when it comes to platform reliability and trade execution?

Risk Assessment

Evaluating the risks associated with trading on Elastostrade is crucial for potential clients. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | Lack of transparency in fund management. |

| Customer Service Risk | Medium | Poor response to client complaints. |

Given the high-risk levels in multiple categories, traders should approach Elastostrade with caution. To mitigate these risks, it is advisable to conduct thorough research, utilize demo accounts, and avoid investing significant amounts until the broker's reliability is established. Thus, it is imperative to ask: Is Elastostrade safe, and what steps can be taken to protect your investment?

Conclusion and Recommendations

In conclusion, the investigation into Elastostrade raises several red flags regarding its safety and legitimacy. The absence of regulatory oversight, unclear trading conditions, and negative customer experiences collectively suggest that traders should exercise extreme caution. The question remains: Is Elastostrade safe?

For traders seeking a reliable platform, it may be prudent to consider alternative brokers that are well-regulated and have demonstrated a commitment to transparency and customer service. Some reliable alternatives include brokers that are regulated by established authorities such as the FCA or ASIC. Always prioritize safety and due diligence when choosing a trading platform to safeguard your investments.

Is ElastosTrade a scam, or is it legit?

The latest exposure and evaluation content of ElastosTrade brokers.

ElastosTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ElastosTrade latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.