Is EED safe?

Business

License

Is EED A Scam?

Introduction

EED, a forex broker operating in the global trading arena, has gained attention for its range of trading services. As with any broker, traders must exercise caution and conduct thorough evaluations before committing their funds. The forex market, while lucrative, is also rife with potential pitfalls, including scams and unregulated brokers. Therefore, understanding the legitimacy of a broker like EED is crucial for any trader looking to protect their investments. This article will investigate EED's regulatory status, company background, trading conditions, and customer experiences to determine whether EED is safe or a potential scam.

Regulation and Legitimacy

The regulatory environment is a critical factor in assessing the safety of any forex broker. Regulation provides a framework for accountability and investor protection. EED currently operates without any significant regulatory oversight, which raises concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a regulatory body overseeing EED means that traders have limited recourse in case of disputes or issues related to fund security. Regulatory agencies, such as the FCA in the UK or ASIC in Australia, enforce strict guidelines that protect traders from fraudulent practices. Without such oversight, EED's operations may lack transparency and accountability, making it a riskier option for traders.

The quality of regulation is paramount. Brokers regulated by top-tier authorities are subject to rigorous compliance checks and must adhere to stringent standards. In contrast, EEDs lack of regulation suggests a need for caution. Past compliance issues, if any, could further tarnish its reputation, making it essential for potential clients to carefully consider their options before engaging with EED.

Company Background Investigation

EED's history and ownership structure play a significant role in its perceived legitimacy. Established in the United Kingdom, EED has positioned itself as a broker catering to a diverse clientele. However, the details surrounding its ownership and management team remain somewhat opaque.

The management teams professional experience is a crucial indicator of a broker's reliability. If the leaders behind EED lack substantial experience in the financial sector, it may raise red flags regarding their ability to operate a trustworthy brokerage. Transparency in company operations is also vital; brokers that willingly disclose their ownership structure and management details typically foster greater trust among their clients.

However, EED has not been forthcoming with detailed information about its ownership or management. This lack of transparency can be a significant deterrent for potential clients, as it raises questions about the broker's accountability and operational integrity. Without a clear understanding of who runs the company, traders may find it challenging to ascertain whether EED is a safe option or if it operates under potentially deceptive practices.

Trading Conditions Analysis

Understanding the trading conditions offered by EED is essential for evaluating its overall safety and reliability. The broker provides various trading instruments, but the cost structure is a critical area of concern.

EED's fee structure includes spreads, commissions, and overnight interest rates, which can significantly impact traders' profitability. A transparent fee structure is crucial for traders to make informed decisions.

| Fee Type | EED | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1-3 pips |

| Commission Model | N/A | $5 per lot |

| Overnight Interest Range | High | Low to Moderate |

Reports suggest that EED may impose higher-than-average spreads, particularly on major currency pairs. This could result in increased trading costs, which may not be justifiable compared to other brokers in the market. Additionally, the absence of a clear commission structure raises concerns about potential hidden fees that could further erode traders profits.

In conclusion, the trading conditions at EED appear less favorable compared to industry standards. Traders should carefully consider these factors when evaluating whether EED is safe for their trading activities.

Client Fund Security

The security of client funds is paramount when assessing any broker's safety. EED's approach to fund security has been called into question due to its lack of regulatory oversight.

A credible broker typically segregates client funds from its operational funds, ensuring that traders' money is protected in the event of the broker's insolvency. Additionally, investor protection mechanisms, such as negative balance protection, are essential to safeguard clients against market volatility.

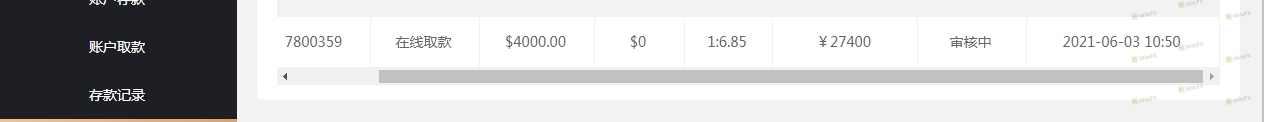

EED has not provided clear information regarding its fund security measures. The absence of fund segregation and investor protection policies can leave traders vulnerable to significant losses. Furthermore, any historical issues related to fund security, such as complaints about withdrawal difficulties, should be thoroughly investigated. Without a solid foundation of security, the question of "Is EED safe?" becomes increasingly relevant.

Customer Experience and Complaints

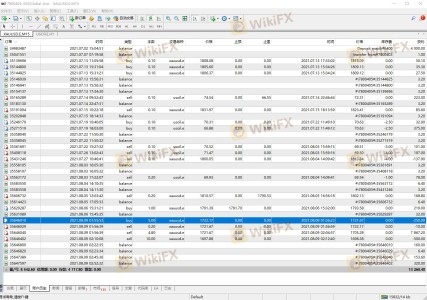

Analyzing customer feedback is vital for understanding the overall experience with a broker. Reviews of EED indicate a mix of positive and negative experiences, with several users reporting issues related to withdrawals and customer service responses.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

Common complaints include difficulties in withdrawing funds and slow customer service responses. Such issues can significantly impact traders' trust and confidence in the broker. For instance, one user reported being unable to withdraw their profits, leading to suspicions about the broker's legitimacy.

These patterns of complaints suggest that EED may not be adequately addressing customer concerns, raising further questions about its operational integrity. A broker that fails to respond effectively to client issues may not be a safe choice for traders.

Platform and Trade Execution

The trading platform's performance is crucial for a seamless trading experience. EED offers access to popular trading platforms, but the quality of execution can vary.

Traders have reported mixed experiences with order execution, including instances of slippage and rejected orders. Such issues can adversely affect trading outcomes, particularly in volatile market conditions.

Overall, the platform's stability and execution quality are vital indicators of whether EED is a reliable broker. If traders experience frequent technical issues, it may suggest that EED is not a safe option for executing trades effectively.

Risk Assessment

Engaging with EED comes with a range of risks that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of clear security measures |

| Customer Service Risk | Medium | Poor response to complaints |

The lack of regulation and transparency raises significant concerns about EED's safety. Traders should be cautious and consider these risks when deciding to engage with this broker. Implementing risk mitigation strategies, such as starting with a small deposit and utilizing demo accounts, can help minimize potential losses.

Conclusion and Recommendations

In conclusion, the investigation into EED reveals several red flags that suggest it may not be a safe option for traders. The absence of regulatory oversight, coupled with concerns about fund security and customer service, raises significant doubts about the broker's legitimacy.

For traders considering EED, it is imperative to weigh the risks and explore alternative brokers with solid regulatory frameworks and positive customer feedback. Brokers like FXTM, IG, and OANDA offer more transparent trading conditions and regulatory protections, making them safer choices in the forex market.

Ultimately, the question "Is EED safe?" leans towards a cautious "no," and traders should approach this broker with significant reservations.

Is EED a scam, or is it legit?

The latest exposure and evaluation content of EED brokers.

EED Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

EED latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.