Regarding the legitimacy of East Oriental Trading forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is East Oriental Trading safe?

Business

License

Is East Oriental Trading markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

Clone FirmLicense Type:

Market Making License (MM)

Licensed Entity:

INTERNATIONAL CAPITAL MARKETS PTY. LTD.

Effective Date: Change Record

2009-07-02Email Address of Licensed Institution:

compliance@icmarkets.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

INTERNATIONAL CAPITAL MARKETS PTY U 2 L 6 50 CARRINGTON ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0280144280Licensed Institution Certified Documents:

Is East Oriental Trading Safe or a Scam?

Introduction

East Oriental Trading is a forex broker that has garnered attention in the trading community due to its aggressive marketing strategies and promises of high returns. As with any financial service, it is crucial for traders to thoroughly evaluate the legitimacy and safety of such brokers before investing their hard-earned money. The forex market is rife with opportunities, but it also presents significant risks, particularly from unregulated or poorly regulated brokers. In this article, we will delve into the operational framework of East Oriental Trading, assessing its regulatory status, company background, trading conditions, customer feedback, and overall safety measures. Our investigation is based on a comprehensive analysis of available data, including user reviews, regulatory information, and industry standards.

Regulation and Legitimacy

A broker's regulatory status is a key indicator of its legitimacy and safety. East Oriental Trading has raised concerns among traders due to its suspicious regulatory status. According to sources, it operates under a license from a regulatory body that is often viewed as unreliable. Below is a table summarizing the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC (Clone Firm) | N/A | Australia | Unverified |

The lack of a credible regulatory license, particularly from top-tier authorities such as the FCA or ASIC, raises red flags regarding East Oriental Trading's operations. Regulatory bodies are essential for ensuring that brokers adhere to strict standards, providing a layer of protection for traders. The fact that East Oriental Trading is labeled as a "clone firm" suggests that it may not be operating under legitimate oversight, which could expose traders to significant risks. Furthermore, the broker's history of compliance is questionable, as it has been associated with high-risk practices and potential scams. Therefore, when considering whether East Oriental Trading is safe, the evidence suggests a need for caution.

Company Background Investigation

Understanding the company behind a forex broker is vital for assessing its trustworthiness. East Oriental Trading is relatively new to the market, with reports indicating it has been operational for only a few years. The company appears to be based in China, but there is limited information available regarding its ownership structure and management team. This lack of transparency is concerning; reputable brokers typically provide detailed information about their founders and key personnel.

The management teams background and professional experience are crucial in determining the broker's reliability. Unfortunately, East Oriental Trading does not disclose sufficient information about its leadership, which raises questions about its operational integrity. Transparency in a company's operations is essential for building trust with clients. The absence of clear information on East Oriental Trading's website regarding its ownership and management further complicates the assessment of its safety. In conclusion, the limited company background raises significant doubts about whether East Oriental Trading is safe for traders.

Trading Conditions Analysis

The trading conditions offered by a broker play a substantial role in the overall trading experience. East Oriental Trading's fee structure and trading conditions have been scrutinized, particularly for any unusual or problematic fees. Generally, a broker should provide competitive spreads and clear information on commissions and overnight interest rates.

Heres a comparison of core trading costs:

| Fee Type | East Oriental Trading | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Low |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | High | Moderate |

Reports indicate that East Oriental Trading may impose higher-than-average spreads on major currency pairs, which could significantly affect trading profitability. Additionally, the lack of clarity regarding commission structures raises concerns. Traders often prefer brokers with transparent fee disclosures, as hidden fees can erode profits and lead to distrust. The overall trading conditions at East Oriental Trading do not align with industry standards, prompting further investigation into whether East Oriental Trading is safe for potential investors.

Client Funds Security

The safety of client funds is paramount when evaluating a broker. East Oriental Trading claims to implement various security measures to protect client funds. However, the effectiveness of these measures is questionable given the broker's regulatory status. A thorough analysis of its fund safety measures reveals several gaps:

- Segregation of Funds: It is unclear whether East Oriental Trading maintains segregated accounts for client funds, a practice that protects traders' money in the event of broker insolvency.

- Investor Protection: There is no evidence of any investor protection schemes in place, which are typically offered by regulated brokers to safeguard clients' investments.

- Negative Balance Protection: The absence of negative balance protection policies could leave traders vulnerable to losing more than their initial investment.

Given these factors, the historical safety issues associated with East Oriental Trading raise concerns about its commitment to client fund protection. Traders should carefully consider these risks when assessing whether East Oriental Trading is safe and weigh the potential consequences of entrusting their funds to this broker.

Customer Experience and Complaints

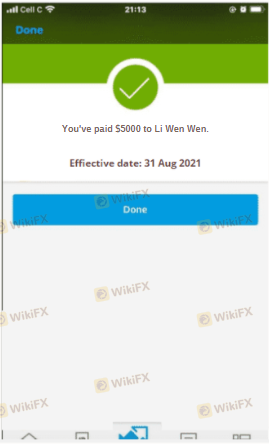

Customer feedback is an essential component of evaluating a broker's reliability. Reviews and complaints about East Oriental Trading indicate a mixed experience for many traders. Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and issues with trade execution. Below is a summary of the main complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

| Trade Execution Problems | High | Unresolved |

Several users have reported being unable to withdraw their funds after making initial deposits, which is a significant red flag. Additionally, complaints about slow and unhelpful customer service further exacerbate concerns about the broker's reliability. One case involved a trader who deposited funds but faced numerous challenges when attempting to withdraw, leading to frustration and distrust in the broker. Such experiences contribute to the perception that East Oriental Trading may not be a safe choice for traders.

Platform and Execution

The trading platform is a critical aspect of the trading experience. East Oriental Trading offers a platform that has received mixed reviews regarding its performance and reliability. Users have reported issues with order execution, including slippage and rejection of orders, which can be detrimental to trading strategies.

The overall user experience on the platform is crucial for traders, and any signs of manipulation or performance issues should be taken seriously. The lack of transparency regarding how orders are executed and whether there are any signs of platform manipulation raises further questions about whether East Oriental Trading is safe. Traders should be cautious and consider these factors before engaging with the broker.

Risk Assessment

Engaging with East Oriental Trading presents several risks that potential traders should be aware of. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises significant concerns. |

| Financial Risk | High | Lack of investor protection and fund segregation. |

| Operational Risk | Medium | Issues with customer service and trade execution. |

Given these risks, it is advisable for traders to exercise extreme caution when considering East Oriental Trading. It is essential to implement risk mitigation strategies, such as using smaller trade sizes and not investing more than one can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that East Oriental Trading is not a safe broker. The combination of questionable regulatory status, lack of transparency, and numerous customer complaints raises significant concerns about the broker's legitimacy and reliability. Traders should be particularly wary of the high risks associated with this broker and consider seeking alternatives that offer better regulatory oversight and customer support.

For traders looking for safer options, consider reputable brokers that are regulated by top-tier authorities, such as the FCA or ASIC. These brokers typically offer better trading conditions, enhanced security for client funds, and a more transparent operational framework. Always conduct thorough research and due diligence before engaging with any broker in the forex market.

Is East Oriental Trading a scam, or is it legit?

The latest exposure and evaluation content of East Oriental Trading brokers.

East Oriental Trading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

East Oriental Trading latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.