Is Berat safe?

Pros

Cons

Is Berat Safe or Scam?

Introduction

Berat Limited, an online forex broker, has emerged as a point of interest in the trading community, primarily due to its aggressive marketing strategies and claims of being a top-tier trading platform. However, as with any financial service, it is crucial for traders to conduct thorough due diligence when assessing the credibility of such brokers. The forex market, while offering lucrative opportunities, also harbors risks, especially from unregulated or unscrupulous entities. This article aims to evaluate whether Berat Limited is a safe trading option or a potential scam, utilizing a comprehensive assessment framework that includes regulatory status, company background, trading conditions, customer safety, user feedback, and overall risk evaluation.

Regulatory and Legitimacy

The regulatory environment is a fundamental aspect of any trading platform's credibility. A regulated broker is typically subject to stringent operational standards, providing a layer of protection for traders' funds. In the case of Berat Limited, the situation appears concerning. According to multiple sources, Berat Limited operates without any valid regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulatory oversight means that Berat Limited does not adhere to any recognized financial standards, which raises significant red flags regarding the safety of traders' funds. The broker claims to be headquartered in Hong Kong, yet it lacks a license from the Securities and Futures Commission (SFC), which is a critical governing body in that region. This lack of regulation can lead to potential issues such as fund mismanagement, lack of transparency, and inadequate support for traders in case of disputes. Given these factors, it is prudent to conclude that Berat is not safe for traders seeking a reliable and secure trading environment.

Company Background Investigation

Understanding the companys background is essential to gauge its legitimacy. Berat Limited claims to have been established in 2013, but domain checks reveal that the website was registered in 2021. This discrepancy raises questions about the company's actual history and credibility. The ownership structure of Berat Limited remains opaque, with no clear information available regarding its founders or management team.

The lack of transparency in the company's operations is concerning. In a well-regulated environment, brokers are required to disclose key information about their management and ownership, allowing traders to assess the experience and integrity of those running the platform. The absence of such disclosures may indicate that the company is attempting to shield itself from scrutiny, further suggesting that Berat may not be safe for investors.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer can significantly impact a trader's experience. Berat Limited presents a range of trading instruments, but the overall fee structure and trading costs are crucial to understand. Reports indicate that Berat's fee structure is not competitive and may include hidden charges that are not clearly disclosed to users.

| Fee Type | Berat Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Medium |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | High | Medium |

The lack of clarity regarding commissions and spreads can lead to unexpected costs for traders, making it challenging to assess the true cost of trading on the platform. Additionally, any unusual fees or conditions that are not standard in the industry can be a sign of a potentially exploitative business model. This further reinforces the notion that Berat may not be safe for traders looking for a transparent trading environment.

Client Fund Safety

Client fund safety is a critical aspect of any trading platform. It is essential to understand how a broker manages client funds, including whether they are segregated from the company's operational funds. In the case of Berat Limited, there is little to no information available regarding their fund safety measures. The absence of segregated accounts or investor protection schemes is a significant concern, as it leaves traders vulnerable to potential financial losses in the event of the broker's insolvency or mismanagement.

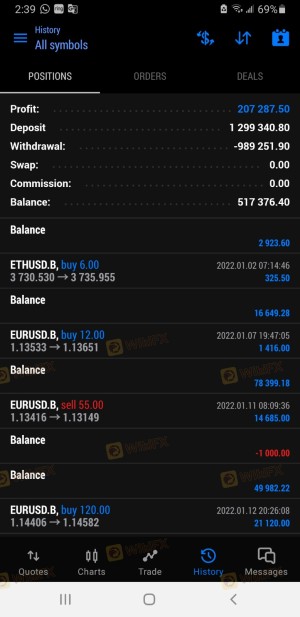

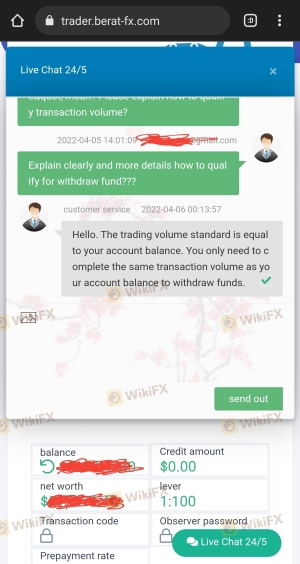

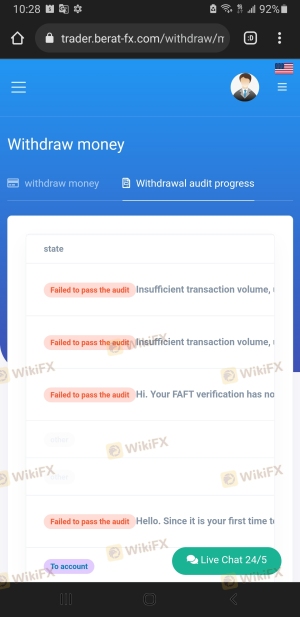

Moreover, there have been reports of clients experiencing difficulties in withdrawing their funds, which is a common tactic employed by fraudulent brokers. Such practices include imposing unreasonable withdrawal conditions or fees, which can lead to a loss of investor confidence. Given the lack of transparency and the reported issues surrounding fund withdrawals, it is reasonable to conclude that Berat is not safe for traders who prioritize the security of their investments.

Customer Experience and Complaints

The experiences of existing customers provide valuable insights into the reliability of a broker. In the case of Berat Limited, numerous complaints have surfaced regarding withdrawal issues and poor customer service. Many users have reported being unable to access their funds, often citing unreasonable demands for additional fees or excessive trading volume requirements before withdrawals can be processed.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Poor |

The pattern of complaints suggests a troubling trend that aligns with behaviors commonly associated with scam brokers. For instance, one user reported that they were unable to withdraw their funds unless they paid an additional tax fee, which was not substantiated by any legitimate regulatory authority. Such experiences indicate that Berat may not be safe and that potential traders should exercise extreme caution.

Platform and Trade Execution

The performance of a trading platform is crucial for a trader's success. A reliable platform should provide stable execution, minimal slippage, and a user-friendly interface. However, many users have reported issues with Berats trading platform, including frequent downtime and execution delays. These problems can severely impact trading performance, leading to missed opportunities and financial losses.

Additionally, there are concerns about the possibility of platform manipulation, where brokers might interfere with trade execution to benefit their positions. Such practices are highly unethical and further emphasize the risks associated with trading on unregulated platforms. The reported issues with execution quality suggest that Berat is not safe for traders who require a dependable trading environment.

Risk Assessment

Engaging with an unregulated broker like Berat Limited poses several risks for traders. The lack of oversight, transparency, and customer support increases the likelihood of financial loss and exploitation.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight or regulation |

| Financial Risk | High | Potential loss of funds due to mismanagement |

| Operational Risk | Medium | Issues with platform stability and execution |

To mitigate these risks, traders should consider using well-regulated brokers with a proven track record. Additionally, conducting thorough research and seeking feedback from other traders can provide insights into a broker's reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that Berat is not safe for traders. The lack of regulation, transparency, and customer support, combined with numerous complaints about withdrawal issues, paints a concerning picture of this broker. Traders looking for a secure trading environment should be wary of engaging with Berat Limited.

For those seeking reliable alternatives, consider brokers that are well-regulated and have a positive reputation in the trading community. Always prioritize platforms that offer clear fee structures, excellent customer service, and robust security measures to protect your investments.

Is Berat a scam, or is it legit?

The latest exposure and evaluation content of Berat brokers.

Berat Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Berat latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.