Is NCM safe?

Pros

Cons

Is NCM Safe or Scam?

Introduction

NCM Investment, formerly known as Noor Capital Markets, has positioned itself as a notable player in the forex market since its establishment in 2009. With a focus on providing trading services across various financial instruments, including forex, commodities, and CFDs, it aims to cater to both individual and institutional traders. However, as the forex trading landscape is fraught with risks, it is crucial for traders to conduct thorough evaluations of brokers before committing their funds. This article investigates whether NCM is a safe trading option or if there are underlying concerns that potential clients should be aware of. Our analysis is based on a comprehensive review of regulatory status, company background, trading conditions, customer experiences, and the overall safety of client funds.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. NCM Investment operates under several regulatory bodies, which provides a layer of security for traders. Below is a table summarizing the core regulatory information:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| Capital Markets Authority (CMA) | AP/2017/0009 | Kuwait | Verified |

| Labuan Financial Services Authority (FSA) | MB/22/0092 | Labuan, Malaysia | Verified |

| Securities and Commodities Authority (SCA) | 703036 | UAE | Verified |

| Capital Markets Board (CMB) | 022 | Turkey | Verified |

| Jordan Securities Commission (JSC) | 18/01533/1/3 | Jordan | Verified |

The presence of multiple regulatory licenses suggests that NCM Investment adheres to certain operational standards. However, it is worth noting that these licenses are not from top-tier regulatory bodies like the FCA or ASIC, which are known for their stringent compliance requirements. The quality of regulation varies significantly, and while NCM is compliant with the regulations of the authorities mentioned, the lack of top-tier oversight raises questions about the overall security and transparency of the broker. Additionally, historical compliance records indicate that while there have been no significant regulatory violations reported, the broker's regulatory framework may not offer the same level of investor protection as those with higher-tier licenses.

Company Background Investigation

NCM Investment has a history that spans over a decade, establishing itself in the Middle Eastern financial markets. Founded in Kuwait, the company has expanded its operations to several countries, including the UAE, Turkey, and Jordan. The ownership structure of NCM Investment is not widely disclosed, which is a common practice among many brokers. However, the management team appears to have a solid background in finance and trading, contributing to the broker's operational capabilities.

The company's transparency regarding its operations and ownership could be improved. While NCM does provide basic information about its services and regulatory compliance, the lack of detailed disclosures about its management team and corporate governance practices may lead to concerns about accountability. Transparency is crucial in building trust, especially in the financial sector, where clients need assurance that their funds are managed responsibly and ethically.

Trading Conditions Analysis

When assessing whether NCM is safe, it is essential to analyze the trading conditions it offers. Traders are often concerned about costs associated with trading, including spreads, commissions, and overnight interest rates. Below is a comparison of NCM's core trading costs against industry averages:

| Cost Type | NCM Investment | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.0 - 2.0 pips | 1.0 - 1.5 pips |

| Commission Structure | No commissions on forex | Varies, often includes commission-based accounts |

| Overnight Interest Range | Varies by asset | Varies by asset |

NCM's spread on major currency pairs is slightly higher than the industry average, which may affect profitability for traders, particularly those engaging in high-frequency trading. Furthermore, while the absence of commissions on forex trading is appealing, the potential for higher spreads may offset this benefit. Traders should also be aware of any hidden fees that could arise during the deposit or withdrawal process, as transparency in fee structures is a vital aspect of broker reliability.

Client Fund Security

The safety of client funds is paramount when determining if NCM is a safe trading option. NCM Investment claims to prioritize the security of client funds by implementing fund segregation practices. This means that client funds are kept separate from the broker's operational funds, reducing the risk of loss in the event of financial difficulties faced by the broker.

However, it is crucial to note that NCM does not participate in investor compensation schemes, which could leave traders vulnerable in the event of insolvency. Additionally, the absence of negative balance protection raises concerns, as traders could potentially lose more than their initial investment. Historical records indicate that while there have been no major incidents of fund mismanagement, the lack of comprehensive investor protection measures may deter some potential clients.

Customer Experience and Complaints

Analyzing customer feedback is essential in evaluating whether NCM is safe. Reviews from users indicate a mixed experience, with some praising the platform's ease of use and customer support, while others highlight issues regarding withdrawal processes and responsiveness. Below is a summary of common complaints and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response time |

| Customer Support Availability | Medium | Limited to business hours |

| Transparency Issues | High | Lack of detailed information |

Several users have reported difficulties in withdrawing their funds, with some stating that their requests were delayed for weeks. The company's response to these complaints has been criticized for being slow and unhelpful, which raises concerns about the overall customer service quality. A few notable cases involved clients who struggled to get their issues resolved, leading to frustration and distrust towards the broker.

Platform and Trade Execution

The performance of the trading platform is another critical aspect that influences whether NCM is a safe choice for traders. NCM offers the popular MetaTrader 5 (MT5) platform, which is known for its robust features and user-friendly interface. However, the quality of order execution, including slippage and rejection rates, is vital in determining the overall trading experience.

Users have reported that while the platform is generally stable, there are occasional issues with order execution during high volatility periods. This can lead to slippage, which may affect trading outcomes, particularly for those employing scalping strategies. Overall, while the platform provides a solid foundation for trading, traders should remain vigilant regarding execution quality during critical market events.

Risk Assessment

Using NCM Investment comes with a set of risks that traders must consider. Below is a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Multiple but lower-tier regulations |

| Fund Security Risk | High | No investor compensation scheme |

| Customer Service Risk | Medium | Mixed reviews on support responsiveness |

| Trading Cost Risk | Medium | Higher spreads than average |

To mitigate these risks, traders are advised to conduct thorough research before opening an account, utilize demo accounts for practice, and ensure they understand the fee structures and trading conditions fully. Additionally, maintaining a diversified trading strategy can help manage potential losses.

Conclusion and Recommendations

In conclusion, while NCM Investment demonstrates several positive attributes, such as regulatory compliance and a user-friendly trading platform, there are notable concerns that potential clients should consider. The absence of top-tier regulation, investor compensation schemes, and mixed customer feedback regarding fund withdrawals raises red flags about the broker's overall safety.

For traders seeking reliability, it is advisable to explore alternative brokers with stronger regulatory frameworks and proven track records. Brokers like IG, OANDA, and Forex.com, which offer comprehensive customer protection and transparent trading conditions, may be more suitable options for those prioritizing safety. Ultimately, due diligence is crucial, and traders should weigh the pros and cons carefully before deciding to engage with NCM Investment.

Is NCM a scam, or is it legit?

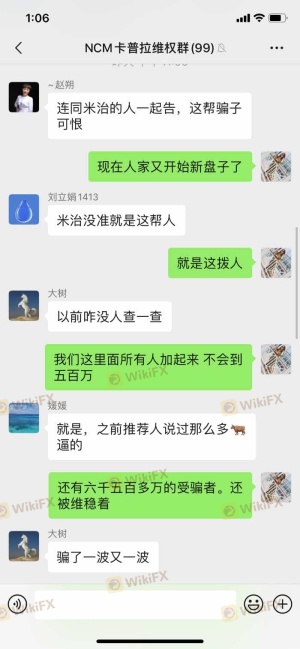

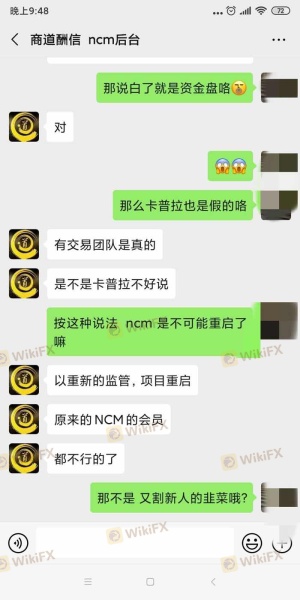

The latest exposure and evaluation content of NCM brokers.

NCM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NCM latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.