Is Dakras safe?

Business

License

Is Dakras Safe or Scam?

Introduction

Dakras Markets Limited, a financial trading company headquartered in London, UK, has emerged in the forex market since its inception in October 2020. It claims to offer a wide range of trading instruments, including foreign exchange, precious metals, oil, and various indices. However, the rapid growth of online trading has also attracted a myriad of unregulated brokers, making it imperative for traders to exercise caution and conduct thorough evaluations before committing their funds. In this article, we will critically assess whether Dakras is a safe trading option or a potential scam, using a structured framework that encompasses regulatory compliance, company background, trading conditions, customer experience, and risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is a cornerstone of its legitimacy and safety in the financial markets. For traders, a regulated broker ensures adherence to stringent compliance measures, promoting fair trading practices and protecting investor interests. In the case of Dakras, it operates without any clear regulatory oversight, raising significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | United Kingdom | Unregulated |

Dakras is not registered with the Financial Conduct Authority (FCA) in the UK, which is the primary regulatory body overseeing financial activities in the region. Additionally, the National Futures Association (NFA) in the United States has labeled Dakras as unauthorized. This lack of regulatory oversight is alarming, as it exposes traders to increased risks, including potential fraud and mismanagement of funds.

The absence of a reputable regulatory framework raises questions about Dakras's commitment to transparency and investor protection. Traders should be wary of engaging with brokers lacking regulatory credentials, as these entities may not adhere to the same compliance standards as their regulated counterparts. Overall, the unregulated status of Dakras casts a shadow over its credibility, leading us to question: Is Dakras safe?

Company Background Investigation

Understanding the companys history and ownership structure provides valuable insights into its credibility. Dakras Markets Limited claims to have been established in 2002, but registration records indicate that it was incorporated in October 2020. This discrepancy raises red flags about its operational history and the authenticity of its claims.

The management team behind Dakras has not been extensively detailed in available resources, which further complicates the assessment of the company's credibility. A transparent broker typically provides information about its leadership, including their professional backgrounds and experience in the financial industry. However, in Dakras's case, the lack of detailed disclosures limits the ability to evaluate the competence and reliability of its management.

Moreover, the overall transparency of Dakras is questionable, as there is limited information available regarding its operational practices and financial health. In light of these factors, potential traders must tread carefully. The question remains: Is Dakras safe? The absence of clear ownership information and management backgrounds raises concerns about the broker's reliability and operational integrity.

Trading Conditions Analysis

A broker's trading conditions, including fees and spreads, play a crucial role in determining its overall value proposition. Dakras claims to offer competitive trading conditions, but a closer examination reveals potential pitfalls that traders should be aware of.

| Fee Type | Dakras | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.1 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Moderate |

The spread for major currency pairs starts at 2.1 pips, which is higher than the industry average of 1.5 pips. This discrepancy indicates that trading with Dakras could be more costly, potentially affecting profitability. Additionally, the commission model remains unclear, which can lead to unexpected charges for traders.

Furthermore, the use of floating spreads can lead to unpredictable trading costs, especially during volatile market conditions. This lack of transparency regarding fees and commissions raises concerns about the broker's practices, reinforcing the question: Is Dakras safe? Traders should be diligent in understanding the full scope of trading costs before engaging with Dakras to avoid any unpleasant surprises.

Customer Funds Security

The safety of customer funds is paramount in the forex trading landscape. Traders need assurance that their deposits are secure and that the broker employs robust measures to protect their investments. Unfortunately, Dakras's approach to fund security appears to be lacking.

Dakras does not provide clear information regarding the segregation of client funds, which is a critical practice among regulated brokers. Segregation ensures that client funds are held in separate accounts, protecting them from being used for the broker's operational expenses. Additionally, there is no mention of investor protection measures or negative balance protection policies, which can further jeopardize traders' financial security.

Historically, unregulated brokers have been associated with various security issues, including fund mismanagement and fraud. The lack of transparency surrounding Dakras's fund security measures raises significant concerns about the safety of client assets, prompting the question: Is Dakras safe? Traders must consider these risks seriously before deciding to invest their hard-earned money with this broker.

Customer Experience and Complaints

Customer feedback is an essential component of assessing a brokers reliability and service quality. Analyzing user experiences can provide valuable insights into common issues and the company's responsiveness to complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| High Fees | Moderate | Unclear Explanation |

| Platform Stability | High | Frequent Glitches |

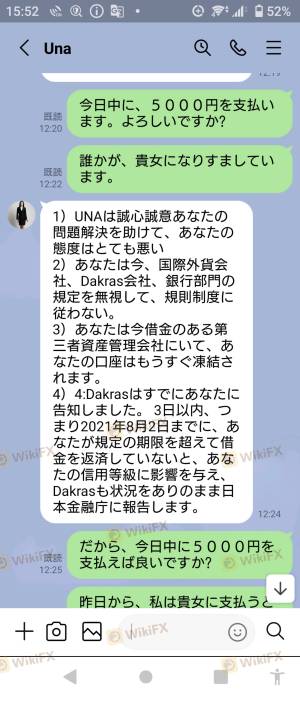

Reports indicate that customers have experienced significant challenges with Dakras, particularly concerning withdrawal issues and platform stability. Many users have reported delays in processing withdrawals, leading to frustration and distrust. Additionally, the platform has been described as experiencing frequent glitches, which can severely impact trading performance.

The company's response to these complaints has been criticized for its lack of timeliness and clarity. Traders expect prompt and transparent communication from their brokers, especially when facing issues that affect their funds. The overall negative sentiment surrounding customer experiences raises critical concerns about Dakras's reliability, once again leading us to ponder: Is Dakras safe?

Platform and Trade Execution

The performance of a trading platform is vital for executing trades efficiently and effectively. A reliable platform should provide a seamless user experience, stable performance, and quick order execution. However, feedback regarding Dakras's platform has been mixed.

Users have reported issues with order execution quality, including slippage and order rejections. Such problems can significantly impact trading outcomes, especially for those employing high-frequency trading strategies. Additionally, there are concerns about potential platform manipulation, where brokers may engage in practices that disadvantage traders.

Given the importance of a stable and efficient trading platform, these reported issues further exacerbate the concerns surrounding Dakras's overall safety. Traders must ask themselves: Is Dakras safe? The platform's performance and execution quality are critical factors that should not be overlooked when considering this broker.

Risk Assessment

Engaging with any trading broker comes with inherent risks, and Dakras is no exception. A comprehensive risk assessment can help traders understand the potential pitfalls associated with using this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses risks. |

| Fund Security Risk | High | Lack of transparency regarding fund protection. |

| Trading Cost Risk | Medium | Higher spreads than industry average. |

| Customer Service Risk | High | Slow response times to complaints. |

The overall risk profile of Dakras is concerning, particularly due to its unregulated status and lack of transparency regarding fund security. Traders should be aware of these risks and take necessary precautions before committing their capital. It is advisable to seek alternative options with stronger regulatory oversight and better customer service records.

Conclusion and Recommendations

Based on the comprehensive analysis presented, it is evident that Dakras Markets Limited poses several red flags that warrant caution. The lack of regulatory oversight, combined with customer complaints regarding withdrawal issues and platform performance, raises significant concerns about the broker's legitimacy.

In summary, the question remains: Is Dakras safe? The evidence suggests that potential traders should exercise extreme caution when considering this broker. For those seeking reliable trading options, it is advisable to explore alternatives that are well-regulated, transparent in their operations, and have a proven track record of positive customer experiences.

Investors are encouraged to conduct thorough due diligence and prioritize safety and security in their trading endeavors.

Is Dakras a scam, or is it legit?

The latest exposure and evaluation content of Dakras brokers.

Dakras Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Dakras latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.