Is Boll Financial safe?

Business

License

Is Boll Financial Safe or a Scam?

Introduction

Boll Financial, a forex broker operating primarily in New Zealand, has garnered attention in the trading community for its offerings in the foreign exchange market. However, the importance of rigorously evaluating forex brokers cannot be overstated. Traders are often vulnerable to scams, and the consequences of engaging with an untrustworthy broker can be severe, including financial loss and difficulty in withdrawing funds. Therefore, it is crucial to assess the legitimacy and safety of Boll Financial before committing any capital.

This article aims to provide a comprehensive analysis of Boll Financial by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The evaluation will draw upon various sources, including reviews, regulatory databases, and user feedback, to present an unbiased perspective on whether Boll Financial is safe or potentially a scam.

Regulation and Legitimacy

The regulatory landscape plays a vital role in determining the credibility of a forex broker. A broker operating under strict regulations is generally considered safer, as regulatory bodies enforce compliance with financial standards and protect investors' interests. In the case of Boll Financial, the broker operates without valid regulatory oversight, which raises significant red flags regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | New Zealand | Unverified |

The absence of a regulatory license for Boll Financial is concerning. Without oversight from a reputable authority, traders face heightened risks, including potential fraud and the inability to recover funds in case of disputes. Historical compliance records indicate that Boll Financial has a dubious reputation, with multiple complaints regarding its practices, including allegations of locking positions and preventing withdrawals. This lack of regulatory protection amplifies the question: Is Boll Financial safe? The evidence suggests that it is not.

Company Background Investigation

Boll Financial is registered as Boll Financial Holdings Limited, with its operational base in New Zealand. The company appears to have a relatively short history, having been established within the last decade. However, the specifics surrounding its ownership structure and management team remain unclear, which is a worrying sign for potential investors. Transparency is crucial in the financial industry, and the inability to find detailed information about the company's leadership raises concerns about its operational integrity.

The management team's qualifications and experience in the financial sector are critical to assessing the broker's reliability. Unfortunately, there is a lack of publicly available information regarding the backgrounds of key personnel at Boll Financial, making it difficult to gauge their expertise and commitment to ethical trading practices. This opacity further fuels skepticism about whether Boll Financial is safe for traders seeking a trustworthy broker.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including fees and spreads, is essential. Boll Financial's fee structure has been reported to contain several unusual policies that could be detrimental to traders. For example, there have been complaints concerning hidden fees and unfavorable trading conditions that do not align with industry standards.

| Fee Type | Boll Financial | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | Unclear | Varies by broker |

| Overnight Interest Range | High | Moderate |

The spreads offered by Boll Financial are reportedly higher than those of many competitors, which can significantly impact profitability. Additionally, the lack of clarity surrounding commission structures raises concerns about potential hidden costs that could erode traders' capital. Thus, traders must consider whether Boll Financial is safe in terms of its trading conditions, as the evidence points toward a potentially exploitative fee structure.

Customer Funds Security

The safety of customer funds is a paramount concern for traders when selecting a broker. Boll Financial's approach to safeguarding client funds remains ambiguous, with no clear policies regarding fund segregation or investor protection measures. This lack of transparency raises questions about the broker's commitment to ensuring the security of traders' capital.

It is crucial for brokers to implement robust measures such as segregating client funds from operational funds and offering negative balance protection to mitigate risks associated with trading losses. Unfortunately, there are no indications that Boll Financial adheres to these best practices, making it imperative for traders to critically assess whether Boll Financial is safe in terms of fund security.

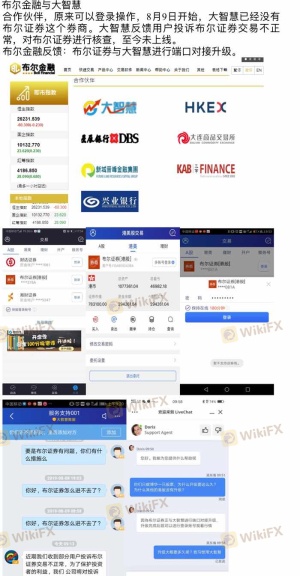

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall experience with a broker. Reviews of Boll Financial indicate a pattern of dissatisfaction among users, with common complaints related to withdrawal issues and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

| Misleading Information | High | Poor |

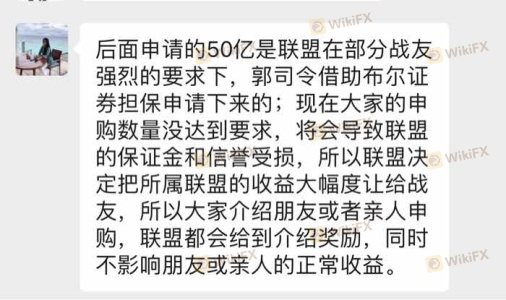

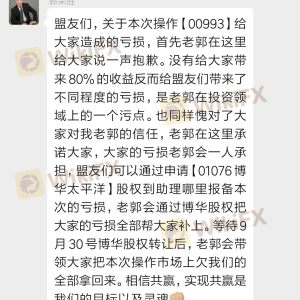

Several users have reported being unable to withdraw their funds, leading to allegations of the broker engaging in fraudulent practices. The lack of effective communication from the company further exacerbates these issues, leaving traders feeling vulnerable and unsupported. Given the severity of these complaints, it raises a critical question: Is Boll Financial safe? The overwhelming evidence suggests that it may not be a reliable choice for traders.

Platform and Trade Execution

The performance and reliability of a broker's trading platform are crucial for ensuring a positive trading experience. Boll Financial's platform has received mixed reviews, with users reporting issues related to stability and order execution.

Concerns about slippage and high rejection rates for orders have been noted, which can significantly impact trading outcomes. Traders expect a seamless experience, and any signs of manipulation or unfair practices can lead to a loss of trust in the broker. Thus, the question of whether Boll Financial is safe becomes increasingly relevant in light of these technical issues.

Risk Assessment

Engaging with Boll Financial presents several risks that potential traders should be aware of. The absence of regulation, coupled with a lack of transparency and numerous customer complaints, creates an environment fraught with uncertainty.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid oversight |

| Financial Risk | High | Unclear fee structure |

| Operational Risk | Medium | Platform stability issues |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Boll Financial. It is advisable to start with small investments and monitor the broker's practices closely. Additionally, seeking out alternative brokers with a solid regulatory framework and positive user feedback can provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the safety and legitimacy of Boll Financial. The absence of regulatory oversight, coupled with a history of customer complaints and questionable trading conditions, suggests that traders should exercise caution.

For those considering engaging with Boll Financial, it is crucial to weigh the risks carefully and consider alternative brokers that offer a more secure trading environment. Reliable options typically include brokers regulated by top-tier authorities, which provide better protection for investors' funds and a transparent trading experience. Ultimately, the question remains: Is Boll Financial safe? The overwhelming consensus is that it poses considerable risks for traders, and caution is advised.

Is Boll Financial a scam, or is it legit?

The latest exposure and evaluation content of Boll Financial brokers.

Boll Financial Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Boll Financial latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.