Is Bitcoin Mining Signals safe?

Business

License

Is Bitcoin Mining Signals A Scam?

Introduction

Bitcoin Mining Signals is a forex broker that claims to offer trading signals and strategies aimed at enhancing the efficiency of Bitcoin mining operations. In a rapidly evolving financial landscape, traders must exercise caution when selecting a broker, as the risk of scams and fraudulent activities is alarmingly high. This article aims to provide a comprehensive analysis of Bitcoin Mining Signals, evaluating its legitimacy, regulatory compliance, and overall trustworthiness. Our investigation is based on a thorough review of available online resources, regulatory databases, and customer feedback, employing a structured framework to assess the broker's safety and reliability.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its credibility and safety. Bitcoin Mining Signals operates without any valid regulation, which raises significant concerns about its legitimacy. A lack of oversight from recognized financial authorities often indicates a higher risk of fraud and malpractice. Below is a summary of the broker's regulatory standing:

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of any regulatory framework means that Bitcoin Mining Signals is not subject to the stringent requirements imposed by reputable financial regulators. This lack of oversight is a red flag, as it leaves traders vulnerable to potential losses without any recourse. Furthermore, the broker has been flagged by multiple sources as potentially problematic, indicating a history of complaints and issues related to its operations. Regulatory compliance is crucial for protecting client funds and ensuring fair trading practices; thus, the lack of regulation with Bitcoin Mining Signals is a significant cause for concern.

Company Background Investigation

Bitcoin Mining Signals Corporation is the entity behind the broker, but details regarding its history and ownership structure are scarce. The company claims to operate from a registered address in Odessa, Texas, but there is no verifiable information to substantiate its claims. This opacity raises questions about the management team and their qualifications. A reputable broker typically provides information about its founders and executive team, including their backgrounds and expertise in the financial sector. Unfortunately, Bitcoin Mining Signals lacks transparency in this regard, making it difficult for potential clients to assess the qualifications of those in charge.

In summary, the company's obscure background and lack of information about its management team contribute to the overall perception that Bitcoin Mining Signals may not be a trustworthy broker. The absence of transparency is a common characteristic of fraudulent operations, further supporting the notion that traders should approach this broker with caution.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions and fee structure is essential. Bitcoin Mining Signals presents a vague overview of its trading fees, which can often be a tactic used by less reputable brokers to obscure hidden costs. A detailed analysis of the broker's fee structure is crucial for potential clients to make informed decisions.

| Fee Type | Bitcoin Mining Signals | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1-2 pips |

| Commission Model | Not Specified | $0 - $10 per trade |

| Overnight Interest Range | Not Specified | 0.5% - 2% |

The lack of clear information regarding spreads, commissions, and overnight interest rates is concerning. Typically, reputable brokers provide transparent details about their fees, enabling traders to understand the costs associated with their trades. The absence of such information may indicate that Bitcoin Mining Signals could impose unexpected charges, potentially leading to greater losses for traders.

Overall, the unclear trading conditions and fee structure serve as another warning sign for traders considering Bitcoin Mining Signals. Without transparent and competitive fees, traders may find themselves at a disadvantage, further emphasizing the need for caution.

Client Fund Security

The safety of client funds is a critical aspect of any broker's operations. Bitcoin Mining Signals does not provide clear information regarding its fund security measures. Effective fund protection strategies typically include segregated accounts, investor protection schemes, and negative balance protection policies. Unfortunately, there is no evidence that Bitcoin Mining Signals implements any of these essential safety measures.

Traders should be aware that if a broker does not prioritize fund security, they could risk losing their investments without any means of recovery. Historical issues related to fund safety, such as withdrawal problems or accusations of fraud, can further erode trust in a broker. Therefore, the lack of clear fund security measures at Bitcoin Mining Signals is alarming and raises significant concerns about the safety of clients' investments.

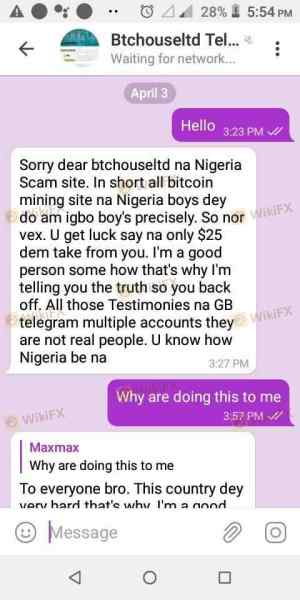

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. In the case of Bitcoin Mining Signals, numerous complaints have surfaced regarding withdrawal issues, lack of customer support, and aggressive marketing tactics. A summary of the primary complaint types is presented below:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Misleading Marketing Practices | High | Poor |

Many users have reported difficulties in withdrawing their funds, which is a common tactic used by fraudulent brokers to trap clients' investments. Additionally, the overall customer support experience has been described as inadequate, with many traders feeling neglected and frustrated.

One notable case involved a trader who was unable to withdraw their funds after repeated attempts to contact customer support. This lack of responsiveness and transparency is a recurring theme in many complaints about Bitcoin Mining Signals, further solidifying the perception that it may not be a safe trading environment.

Platform and Trade Execution

The trading platform's performance is another vital aspect of a broker's operations. Bitcoin Mining Signals offers a platform that has been described as unstable, with frequent outages and slow execution times. Traders have reported experiencing slippage and rejections of orders, which can significantly impact their trading outcomes.

The following factors are critical when evaluating the trading platform:

- Stability: Frequent outages can hinder trading activities and lead to missed opportunities.

- Execution Quality: Delays in order execution can result in unfavorable trade outcomes, especially in volatile markets.

- Manipulation Signs: Any signs of platform manipulation, such as sudden price changes or restrictions on trading, should be taken seriously.

Given the reported performance issues, it is essential for traders to consider whether they are willing to risk their investments with a broker that may not provide a reliable trading environment.

Risk Assessment

Using Bitcoin Mining Signals comes with several risks that potential clients should be aware of. The following risk assessment summarizes the primary concerns associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation, high fraud risk. |

| Fund Security Risk | High | Lack of transparent fund protection measures. |

| Customer Support Risk | Medium | Poor response to customer inquiries. |

| Platform Reliability Risk | High | Frequent outages and execution issues. |

To mitigate these risks, traders should conduct thorough research before engaging with Bitcoin Mining Signals. Seeking alternative brokers with robust regulatory oversight, transparent fee structures, and positive customer feedback is advisable.

Conclusion and Recommendations

In conclusion, the evidence suggests that Bitcoin Mining Signals operates in a manner that raises numerous red flags. The absence of regulation, unclear trading conditions, and a history of customer complaints indicate that this broker may not be a safe option for traders. Is Bitcoin Mining Signals safe? The overwhelming consensus from various analyses points to a high likelihood of fraudulent behavior, making it essential for potential clients to exercise extreme caution.

For traders seeking reliable alternatives, consider brokers that are regulated by recognized financial authorities, have transparent fee structures, and provide excellent customer support. Such brokers are more likely to offer a secure trading environment and protect clients' investments. Always prioritize safety and due diligence when selecting a forex broker to ensure a positive trading experience.

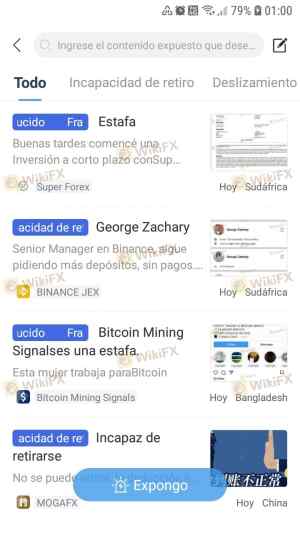

Is Bitcoin Mining Signals a scam, or is it legit?

The latest exposure and evaluation content of Bitcoin Mining Signals brokers.

Bitcoin Mining Signals Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Bitcoin Mining Signals latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.