Is OPSON safe?

Business

License

Is Opson Safe or a Scam?

Introduction

Opson is a forex broker that has emerged in the competitive landscape of online trading. With promises of diverse trading opportunities and appealing returns, it seeks to attract both novice and experienced traders. However, the need for caution is paramount in the forex market, where unregulated brokers can pose significant risks to investors. Traders must meticulously assess the credibility of any brokerage before committing their funds, as the absence of proper regulation can lead to potential scams, loss of capital, and a lack of recourse for recovery.

This article investigates the legitimacy of Opson by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The findings are based on a comprehensive review of available online resources, user feedback, and industry standards. Through this structured approach, we aim to provide a balanced perspective on whether Opson is safe for trading or if it should be considered a scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. A regulated broker is subject to strict oversight, ensuring that it adheres to industry standards designed to protect traders. Unfortunately, Opson lacks regulation from any major financial authority, raising serious concerns about its safety and reliability.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of a regulatory framework means that Opson is not obligated to follow any specific guidelines that protect clients interests. This lack of oversight can lead to unethical practices, including the mishandling of client funds and refusal to process withdrawals. Furthermore, the Australian Securities and Investments Commission (ASIC) has issued warnings against Opson, categorizing it as an unlicensed financial service provider. This is a significant red flag for potential investors, as it indicates that Opson operates outside of the legal protections that regulated brokers must adhere to.

Company Background Investigation

Opson International Technology Services Co., Limited, the entity behind the Opson brand, claims to operate out of Hong Kong. However, there is scant information available regarding its history, ownership structure, or the backgrounds of its management team. This lack of transparency is troubling, as legitimate companies typically provide detailed information about their operations and leadership.

The companys website does not disclose any information about its founders or the team, which is a common practice among reputable brokers. The absence of such critical information may suggest that Opson is attempting to conceal its true identity or operational history. Additionally, reports indicate that Opson has connections to other known scam brokers, further diminishing its credibility.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Opson advertises a range of trading products, including forex, CFDs, and commodities. However, the specifics regarding spreads, commissions, and fees are not clearly outlined on its platform, which is a significant concern for potential traders.

| Fee Type | Opson | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies by broker |

| Commission Structure | N/A | Varies by broker |

| Overnight Interest Range | N/A | Varies by broker |

The lack of transparency in Opson's fee structure raises questions about potential hidden costs that could impact profitability. Many users have reported high and unexpected fees, which are often a hallmark of unregulated brokers. This opacity can lead to a frustrating trading experience, especially for those who are not familiar with the intricacies of forex trading.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. Opson's lack of regulation means that there are no guarantees in place to protect client money. Regulated brokers are required to keep client funds in segregated accounts, ensuring that these funds are protected in the event of bankruptcy or operational failures. Unfortunately, Opson does not provide any information on whether it employs such protective measures.

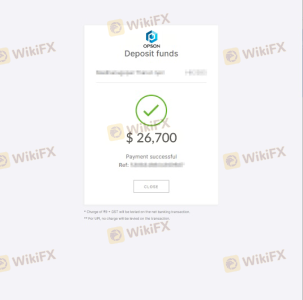

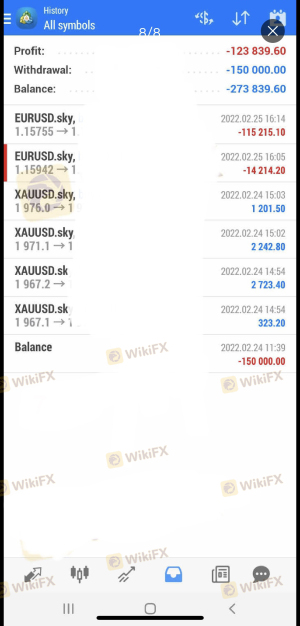

Additionally, there is no evidence of investor compensation schemes or negative balance protection policies. This lack of safeguards increases the risk of losing funds, as there are no formal structures in place to recover lost investments. Historical complaints from users about difficulties in withdrawing funds further exacerbate these concerns, suggesting that Opson may not prioritize the safety of its clients capital.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reputation. Reviews of Opson indicate a pattern of negative experiences, with many users reporting issues related to withdrawal processes, poor customer service, and unresponsive support teams.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Poor |

| Transparency Concerns | High | Poor |

Common complaints include difficulties in accessing funds, high-pressure sales tactics, and a lack of communication from customer support. Many users have expressed frustration over being unable to retrieve their investments after making deposits, indicating that Opson may engage in practices that are characteristic of scam operations.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for a positive trading experience. Opson claims to offer a trading platform that supports various instruments, yet there is little information available regarding its functionality and execution quality. Reports from users suggest that the platform may be prone to bugs and issues, which can hinder trading effectiveness.

Concerns about order execution quality, slippage, and rejections have been raised by users, indicating that Opson may not provide the level of service expected from a legitimate broker. Any signs of platform manipulation or irregular trading practices can further erode trust in the broker and raise alarms about its overall safety.

Risk Assessment

Engaging with Opson presents several risks that potential traders should consider before investing. The absence of regulation, coupled with the negative feedback from users, creates a high-risk environment for investors.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight or protection for clients |

| Fund Safety Risk | High | Lack of safeguards for client funds |

| Customer Service Risk | Medium | Poor response to client inquiries and issues |

| Platform Reliability | High | Reports of bugs and execution issues |

To mitigate these risks, it is advisable for traders to conduct thorough research and consider alternative, regulated brokers that offer better protection for their investments. Utilizing brokers with a proven track record and strong regulatory oversight can significantly reduce the likelihood of encountering issues.

Conclusion and Recommendations

In conclusion, the evidence suggests that Opson is not a safe option for traders. The lack of regulation, coupled with numerous complaints regarding fund safety and customer service, raises significant red flags. Potential investors should be wary of engaging with Opson, as the risks outweigh the potential benefits.

For traders seeking reliable alternatives, it is recommended to explore brokers that are well-regulated and have a history of positive customer feedback. These brokers typically provide better security for funds and a more transparent trading environment, ensuring a safer trading experience. Always prioritize due diligence and research to protect your investments in the forex market.

Is OPSON a scam, or is it legit?

The latest exposure and evaluation content of OPSON brokers.

OPSON Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OPSON latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.