Is BI-FINANCE.TECH safe?

Business

License

Is bi finance tech A Scam?

Introduction

In the rapidly evolving world of forex and cryptocurrency trading, bi finance tech has emerged as a player, positioning itself as a comprehensive trading platform. However, the influx of online trading platforms has made it essential for traders to exercise caution and conduct thorough evaluations before committing their funds. The potential for scams and fraudulent activities in this sector has led to a heightened need for due diligence. This article aims to assess the safety and reliability of bi finance tech through a structured analysis, focusing on regulatory compliance, company background, trading conditions, customer safety, user experiences, platform performance, and risk factors.

Regulation and Legitimacy

The regulatory status of a trading platform is a critical factor in determining its legitimacy. A regulated broker is subject to oversight, which can provide a layer of security for traders. Upon reviewing bi finance tech's regulatory framework, it is evident that the platform operates without proper regulatory oversight. The following table summarizes the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation raises significant concerns regarding the platform's credibility. Regulatory bodies such as the Financial Conduct Authority (FCA) in the UK are tasked with ensuring that trading platforms adhere to strict guidelines designed to protect traders. The lack of any licensing information or regulatory verification for bi finance tech suggests that it may not be a safe option for traders. Furthermore, the platform has been flagged by the FCA, indicating serious concerns about its operations. This lack of regulatory oversight is a red flag for potential investors, emphasizing the need for caution when considering bi finance tech.

Company Background Investigation

A comprehensive understanding of a trading platform's history, ownership structure, and management team is essential in evaluating its reliability. Bi finance tech claims to be based in the UK, but details regarding its ownership and management remain vague. The platform was registered in September 2022, and there is little information available about its founders or the experience of its management team.

Transparency is a key indicator of a trustworthy company, and bi finance tech's lack of information regarding its ownership and operational structure raises concerns. A credible trading platform should provide clear details about its leadership and operational history to instill confidence among traders. Given the current lack of transparency surrounding bi finance tech, potential investors should be wary and consider whether they are comfortable engaging with a company that does not disclose such fundamental information.

Trading Conditions Analysis

Understanding the trading conditions offered by a platform is vital for traders looking to maximize their investments. Bi finance tech presents multiple investment plans with varying minimum deposits, but the overall fee structure appears opaque. Below is a comparison of core trading costs:

| Fee Type | bi finance tech | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Not disclosed | Varies widely |

| Commission Model | Not disclosed | Varies widely |

| Overnight Interest Range | Not disclosed | Varies widely |

The absence of clear information regarding spreads, commissions, and overnight interest rates is concerning. Typically, reputable brokers provide this information upfront, allowing traders to make informed decisions. The lack of transparency in bi finance techs pricing structure could lead to unexpected costs for traders, further complicating their trading experience. Therefore, it is crucial for potential investors to approach bi finance tech with caution, as unclear trading conditions could indicate underlying issues.

Customer Fund Safety

The safety of customer funds is paramount when evaluating any trading platform. Bi finance tech's lack of regulatory oversight raises questions about its fund security measures. A reliable broker typically offers segregated accounts for client funds, investor protection schemes, and negative balance protection policies. Unfortunately, bi finance tech has not provided any information regarding these essential safety measures.

The absence of such protections could expose traders to significant risks, particularly in the event of financial disputes or platform insolvency. Historical incidents involving unregulated brokers often highlight the challenges faced by traders trying to recover their funds. Therefore, potential investors must consider the implications of trading with a platform that lacks robust fund safety measures, as this could result in severe financial losses.

Customer Experience and Complaints

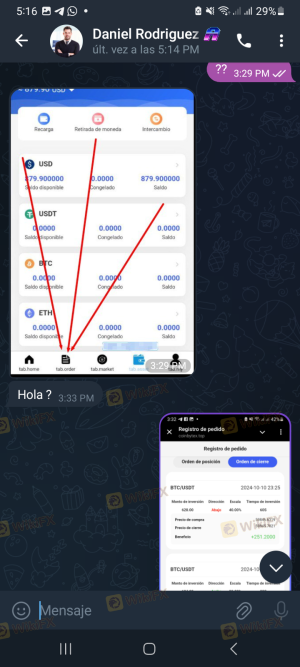

Analyzing customer feedback is crucial in understanding the overall experience associated with bi finance tech. Numerous online reviews and forums indicate a pattern of dissatisfaction among users. Common complaints include difficulty withdrawing funds, lack of customer support, and unclear terms and conditions. Below is an assessment of the primary complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Availability | Medium | Poor |

| Transparency Concerns | High | Poor |

The high severity of complaints related to fund withdrawals and customer support is particularly alarming. Traders have reported challenges in accessing their funds, which is often a hallmark of fraudulent platforms. Additionally, the quality of customer responses has been deemed unsatisfactory, leaving many users feeling unsupported. This negative feedback reinforces the notion that bi finance tech may not be a safe option for traders, highlighting the need for potential investors to exercise extreme caution.

Platform and Trade Execution

The performance of a trading platform is another critical aspect of its reliability. Bi finance tech claims to provide a user-friendly interface, but user reviews paint a different picture. Traders have reported issues with order execution quality, including slippage and rejections. These factors can significantly impact trading outcomes and raise concerns about the platform's integrity.

In the absence of verified performance metrics, it is challenging to ascertain the true functionality of bi finance tech's trading platform. Traders should be wary of platforms that do not provide transparent information regarding execution quality, as this can be indicative of potential manipulation or inefficiencies.

Risk Assessment

Using bi finance tech carries inherent risks, primarily due to its unregulated status and lack of transparency. Below is a risk scorecard summarizing the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unregulated platform raises concerns. |

| Fund Security | High | Lack of safety measures for client funds. |

| Customer Support | Medium | Poor response to user complaints. |

| Trading Conditions | High | Opaque fee structure and unclear terms. |

Given the high-risk levels associated with bi finance tech, potential investors should carefully consider their options. Engaging with an unregulated platform poses significant challenges, and traders should be prepared for potential losses.

Conclusion and Recommendations

After a thorough analysis of bi finance tech, it is evident that the platform raises numerous red flags. The lack of regulation, transparency, and customer support, combined with a high volume of complaints, strongly suggests that bi finance tech is not a safe option for traders. Potential investors should exercise extreme caution and consider alternative, regulated platforms that offer a higher degree of security and reliability.

For traders seeking safer alternatives, it is advisable to explore well-established brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC. These brokers typically provide greater transparency, better customer support, and robust fund protection measures, ensuring a more secure trading environment. In summary, engaging with bi finance tech poses significant risks, and traders are encouraged to seek safer options to protect their investments.

Is BI-FINANCE.TECH a scam, or is it legit?

The latest exposure and evaluation content of BI-FINANCE.TECH brokers.

BI-FINANCE.TECH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BI-FINANCE.TECH latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.