Berat 2025 Review: Everything You Need to Know

Summary

This berat review shows serious concerns about this forex broker. Potential investors must think carefully before choosing this broker. Based on available information, Berat operates without proper regulatory oversight, which creates serious red flags about investor fund safety and operational transparency.

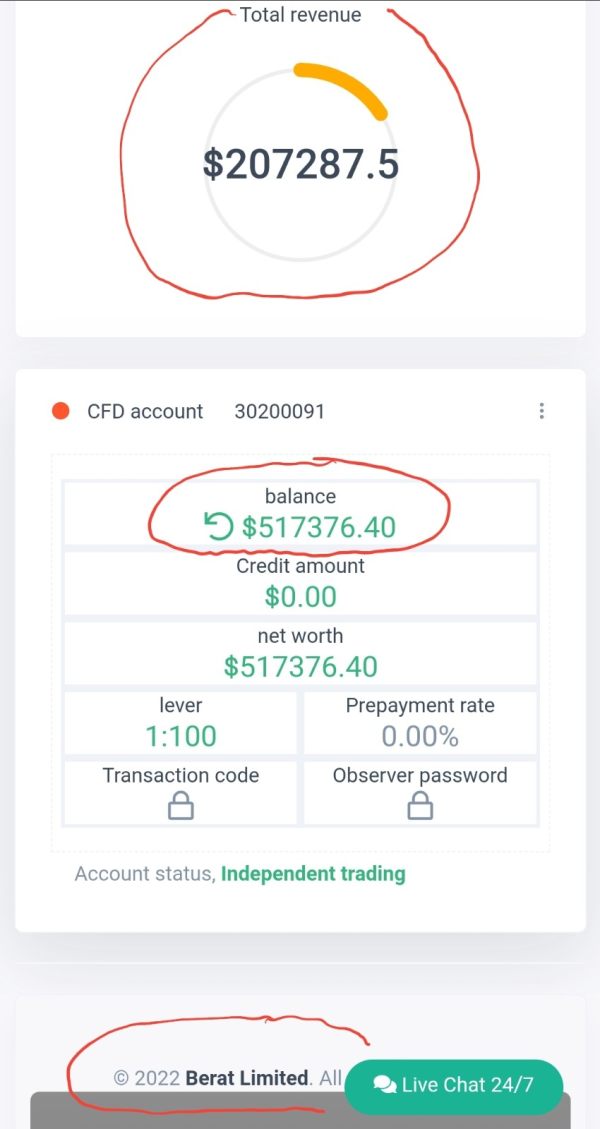

The broker has received an overall rating of 1.00. This rating shows extremely poor user satisfaction and performance across multiple evaluation criteria. Unlike established brokers that provide comprehensive trading conditions, platform details, and transparent fee structures, Berat lacks essential information about spreads, commissions, minimum deposits, and available trading platforms.

This absence of basic trading information makes it difficult for traders to make informed decisions. The target user demographic for Berat remains unclear due to insufficient information about account types, trading tools, and service offerings. Most concerning is the lack of regulatory protection, which means traders have limited recourse if issues arise with fund withdrawals or dispute resolution.

Important Notice

This evaluation is based on limited available information and user feedback data. The assessment methodology relies on publicly accessible broker information, regulatory status verification, and user rating compilations. Traders should exercise extreme caution when considering unregulated brokers, as they operate without oversight from financial authorities that typically protect investor interests.

Cross-regional entity differences have not been identified in available materials. This suggests either limited global operations or insufficient disclosure of international business structures.

Rating Framework

Broker Overview

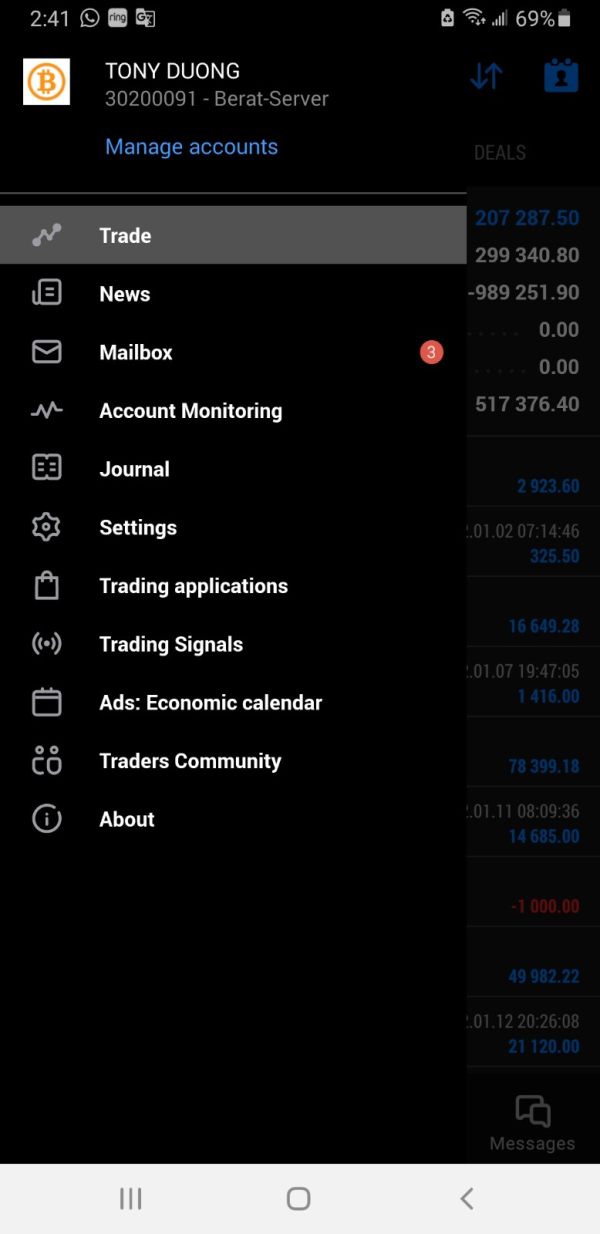

Information about Berat's establishment date, company background, and primary business model remains unavailable. This lack of transparency regarding corporate history and operational foundation represents a significant concern for potential investors seeking a reliable trading partner. Established brokers typically provide detailed company information, including founding dates, management teams, and business development milestones.

The absence of clear business model information makes it difficult to understand how Berat generates revenue. Without this fundamental information, traders cannot properly evaluate the broker's alignment with their trading strategies and cost expectations. Regarding trading platforms and asset categories, specific details have not been disclosed in available materials.

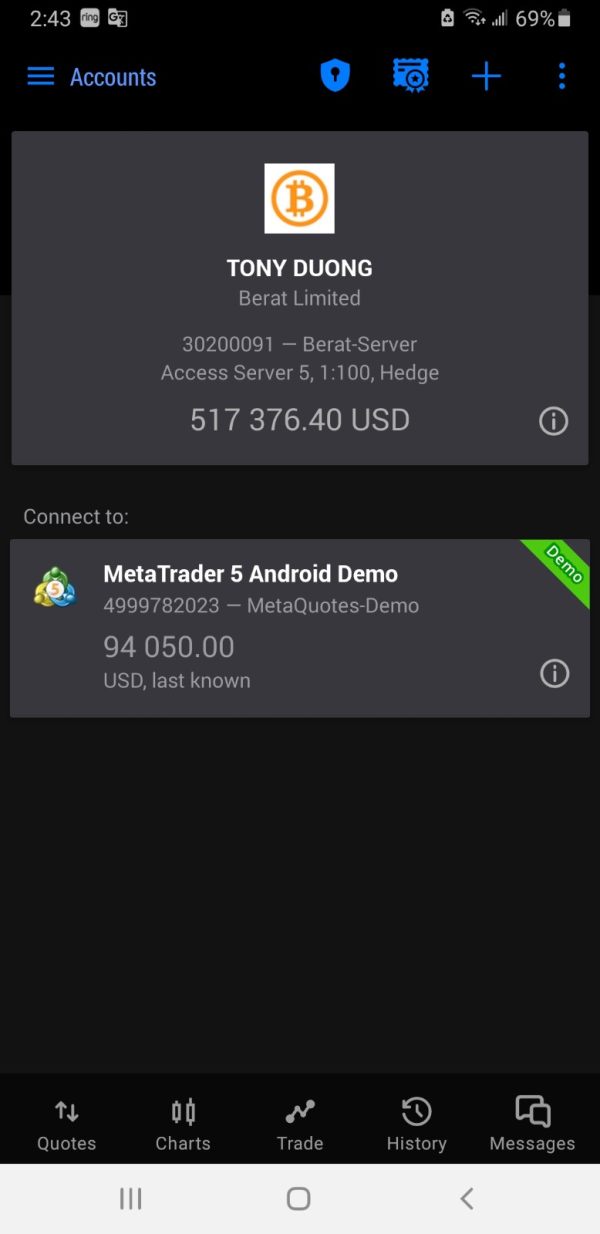

Most reputable brokers offer popular platforms like MetaTrader 4, MetaTrader 5, or proprietary solutions. The lack of such information in this berat review highlights the broker's limited transparency. The most significant concern involves regulatory status, as Berat operates without oversight from recognized financial authorities.

This unregulated status means the broker is not bound by investor protection requirements, segregated fund mandates, or operational transparency standards.

Regulatory Status: Berat operates without regulation from recognized financial authorities. This creates substantial risks for investor fund protection and dispute resolution mechanisms.

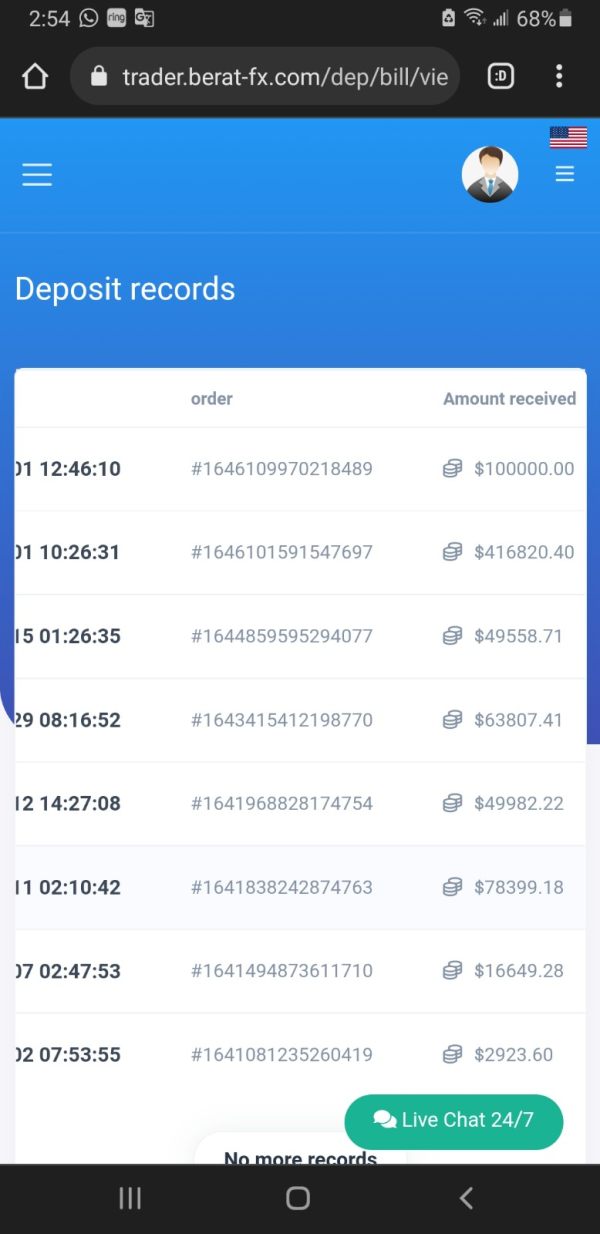

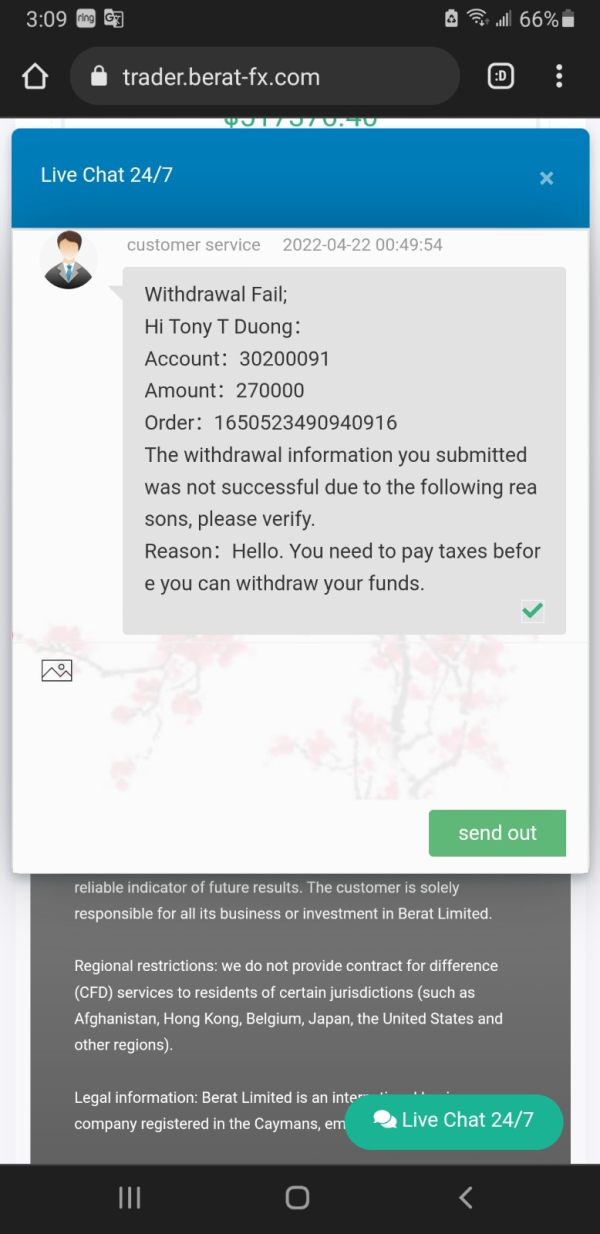

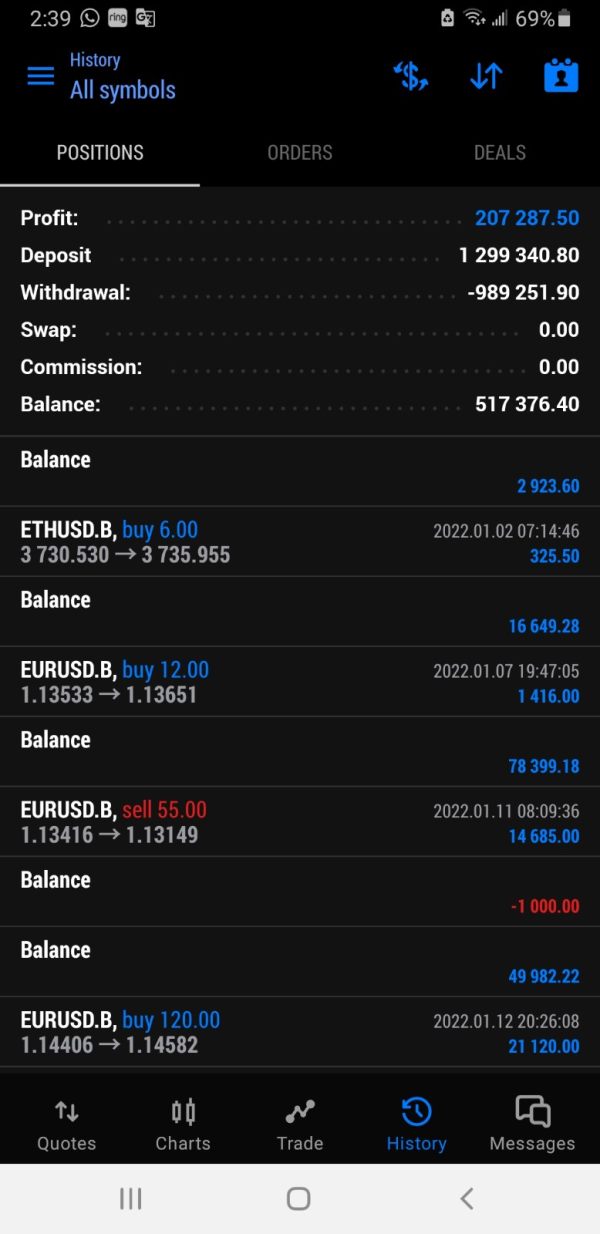

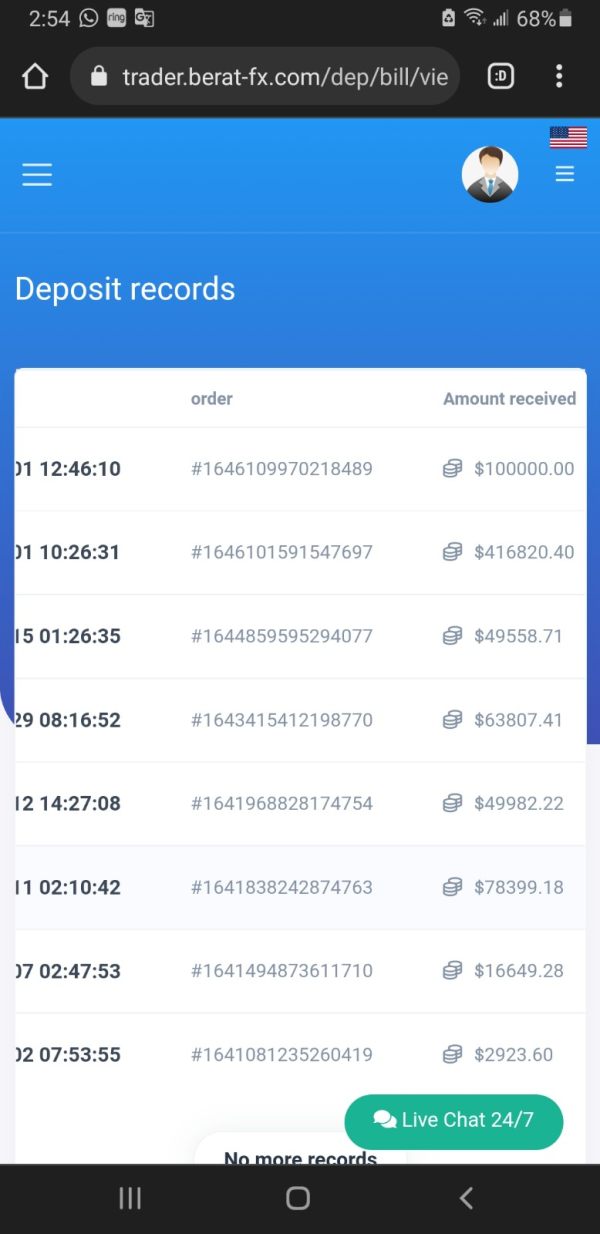

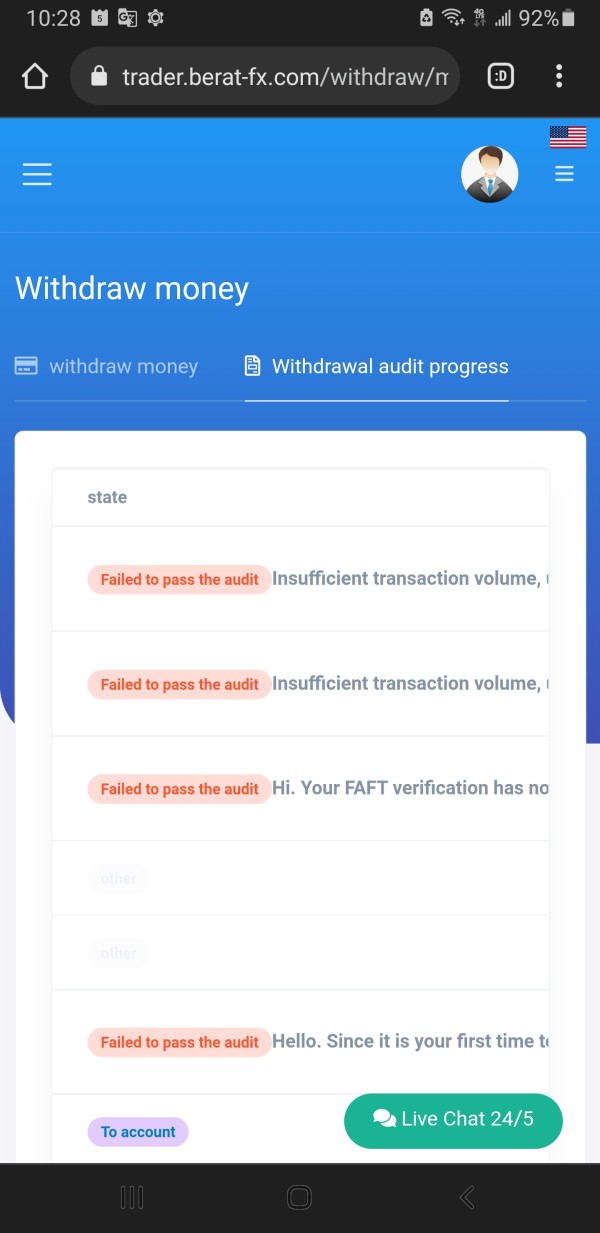

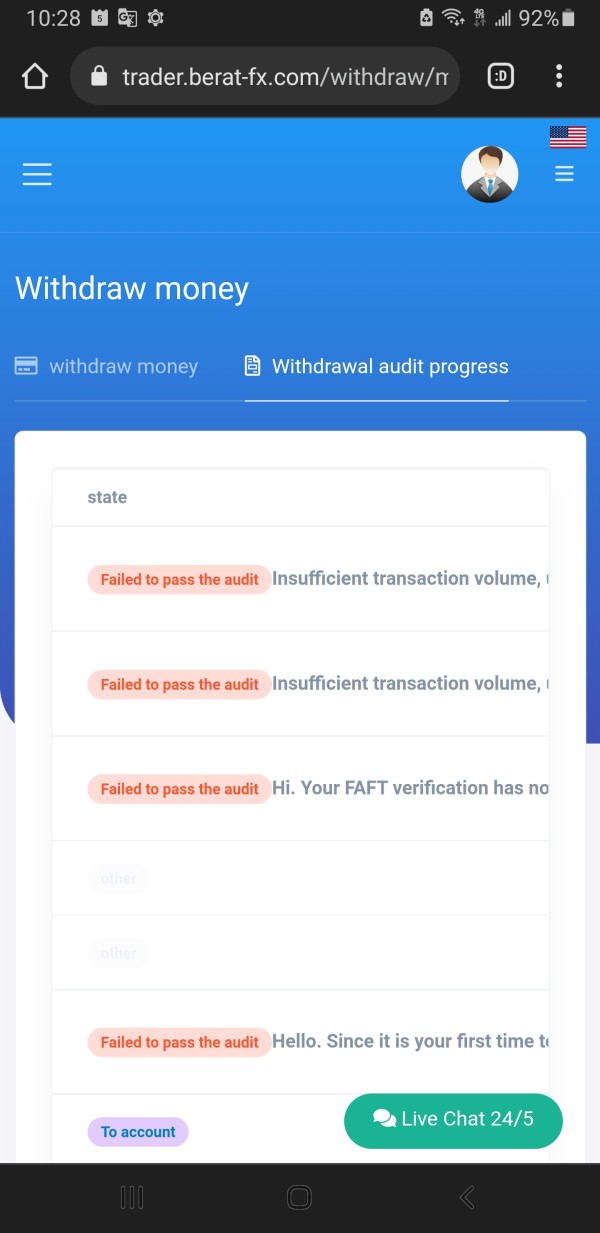

Deposit and Withdrawal Methods: Specific information about payment processing options, transaction timeframes, and associated fees has not been disclosed.

Minimum Deposit Requirements: Exact minimum deposit amounts for account opening have not been specified. This makes it difficult for traders to plan their initial investment allocation.

Bonus and Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not available.

Tradeable Assets: Comprehensive information about available trading instruments has not been provided. This includes forex pairs, commodities, indices, stocks, and cryptocurrency options.

Cost Structure: Critical information about spreads, commission rates, overnight financing charges, and withdrawal fees remains undisclosed. This prevents accurate trading cost calculations.

Leverage Ratios: Maximum leverage offerings and margin requirements for different account types and asset classes have not been specified in this berat review.

Platform Options: Trading platform availability has not been detailed in available sources. This includes desktop, web-based, and mobile applications.

Geographic Restrictions: Information about service availability in different countries and regulatory compliance requirements has not been disclosed.

Customer Support Languages: Available communication languages for customer service interactions have not been specified.

Detailed Rating Analysis

Account Conditions Analysis (1/10)

The account conditions evaluation reveals significant transparency issues. These issues contribute to the poor rating in this berat review. Without specific information about account types, minimum deposit requirements, or special features, potential traders cannot make informed decisions about their investment approach.

Traditional forex brokers typically offer multiple account tiers. These range from basic accounts for beginners to premium options for high-volume traders. Each account type usually features distinct minimum deposit requirements, spread conditions, and additional services.

The absence of such structured offerings suggests either limited service development or inadequate information disclosure. Account opening procedures and verification requirements remain unclear, making it difficult for prospective clients to understand the onboarding process timeline and documentation needs. Established brokers provide clear guidance about identity verification, address confirmation, and financial suitability assessments.

Special account features have not been mentioned in available materials. The overall rating of 1.00 reflects user dissatisfaction with account-related services and conditions.

The evaluation of trading tools and educational resources reveals substantial gaps in service offerings. These gaps justify the low rating. Professional forex brokers typically provide comprehensive analytical tools, including technical indicators, charting packages, economic calendars, and market research reports.

Educational resources represent another critical service area where information remains unavailable. Quality brokers offer webinar series, trading tutorials, market analysis articles, and strategy guides to help traders develop their skills and market understanding. Automated trading support has not been addressed in available broker information.

These features are increasingly important for traders seeking to implement systematic trading approaches. Research and analysis capabilities appear to be absent from the service portfolio. The overall rating of 1.00 suggests users have found the available tools and resources inadequate for their trading needs.

Customer Service and Support Analysis (1/10)

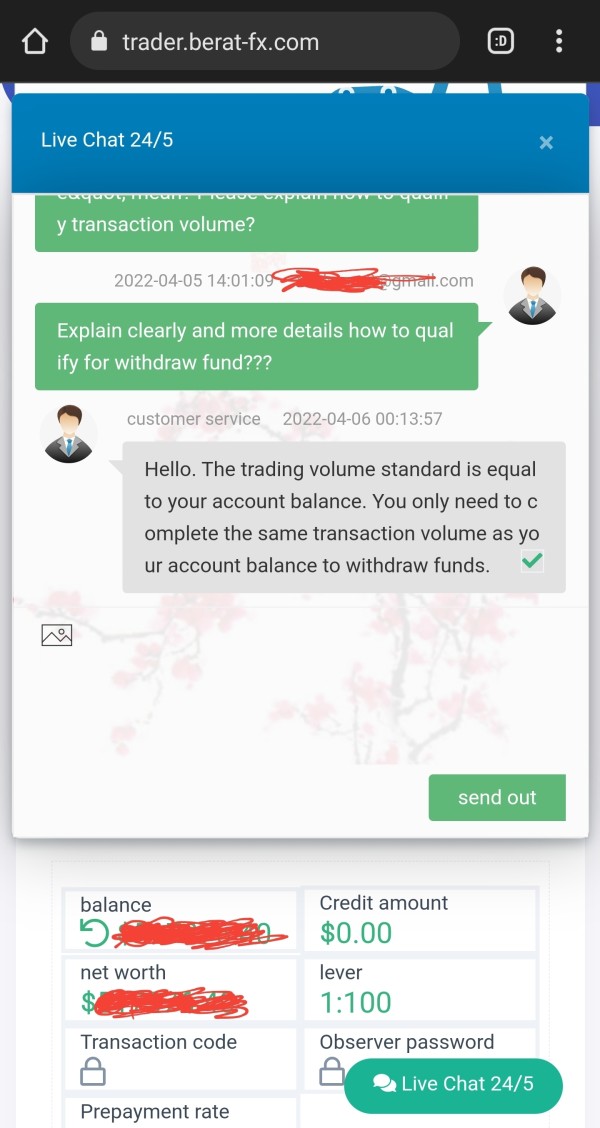

Customer service evaluation faces significant challenges due to limited information about support channels. Professional brokers typically offer multiple contact methods, including live chat, telephone support, email assistance, and comprehensive FAQ sections. Response time commitments and service level agreements have not been disclosed, making it impossible to assess the broker's dedication to client support excellence.

Quality brokers often guarantee response times and maintain support availability during major trading sessions. Multilingual support capabilities remain unclear, which could limit accessibility for international traders who prefer communication in their native languages. Global brokers usually provide support in major languages to serve diverse client bases effectively.

The overall rating of 1.00 indicates significant user dissatisfaction with customer service experiences. However, specific problem resolution examples and service quality testimonials are not available in accessible materials.

Trading Experience Analysis (1/10)

Platform stability and execution speed represent fundamental aspects of trading experience. These aspects remain unaddressed in available broker information. Professional trading platforms require reliable connectivity, fast order processing, and minimal downtime during market hours.

Order execution quality has not been documented. These factors significantly impact trading profitability and user satisfaction. Platform functionality completeness cannot be assessed due to insufficient information disclosure.

The berat review highlights this transparency gap as a major concern. Mobile trading capabilities and cross-device synchronization features have not been detailed, despite their importance for modern traders who require flexibility in market access and position management.

Trust Factor Analysis (1/10)

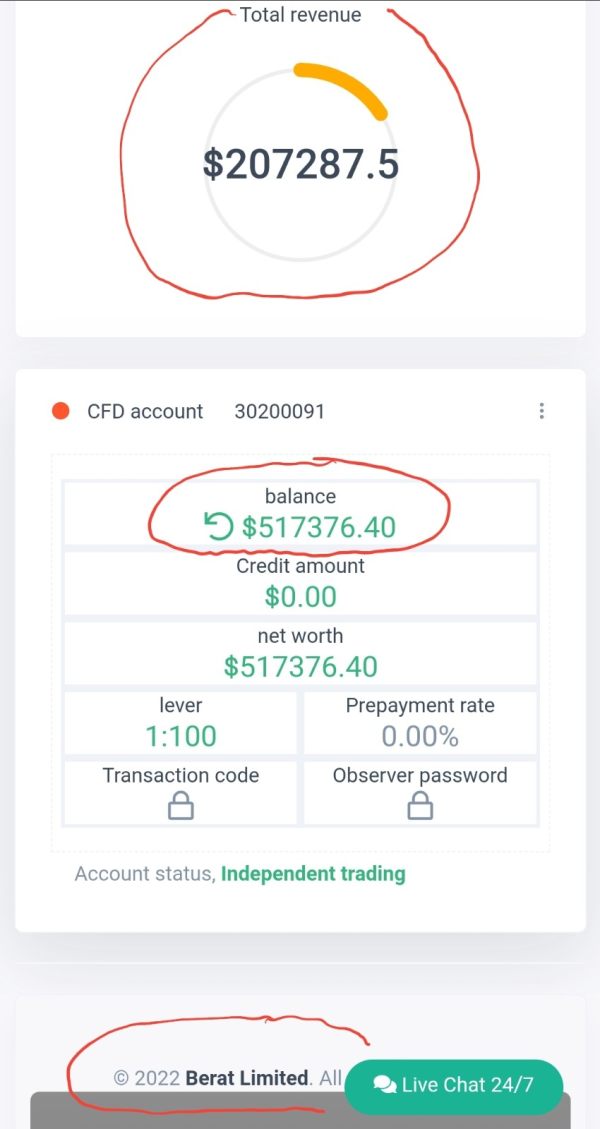

The trust evaluation reveals the most significant concern in this assessment. Berat's unregulated status means operating without oversight from recognized financial authorities. This means the broker is not subject to capital adequacy requirements, segregated fund mandates, or operational transparency standards.

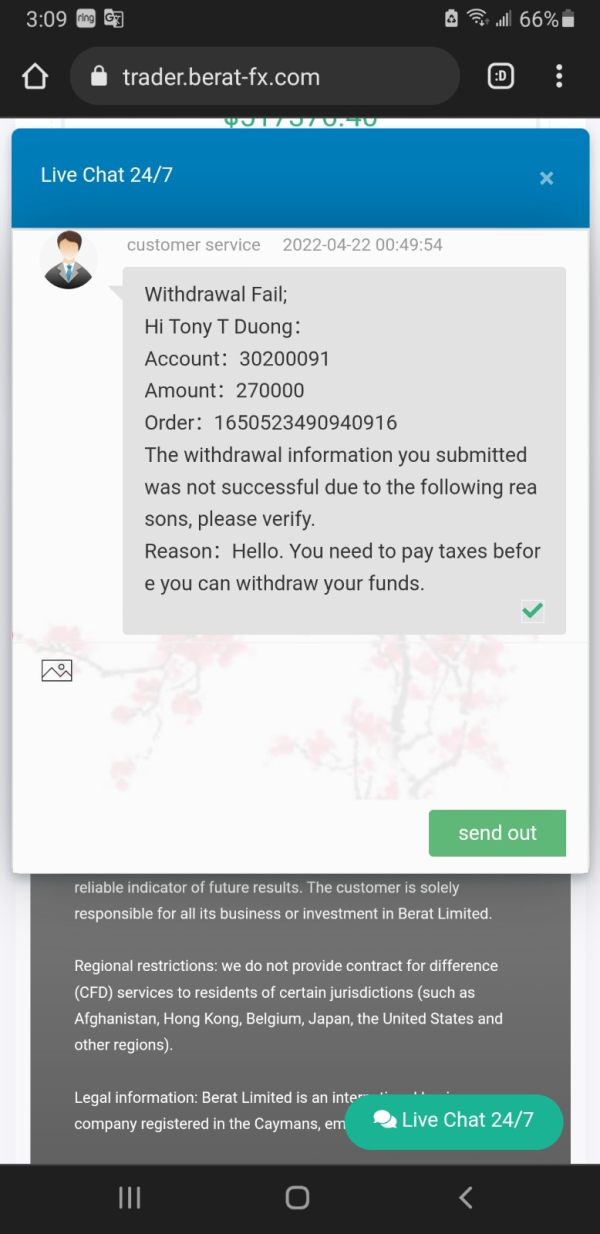

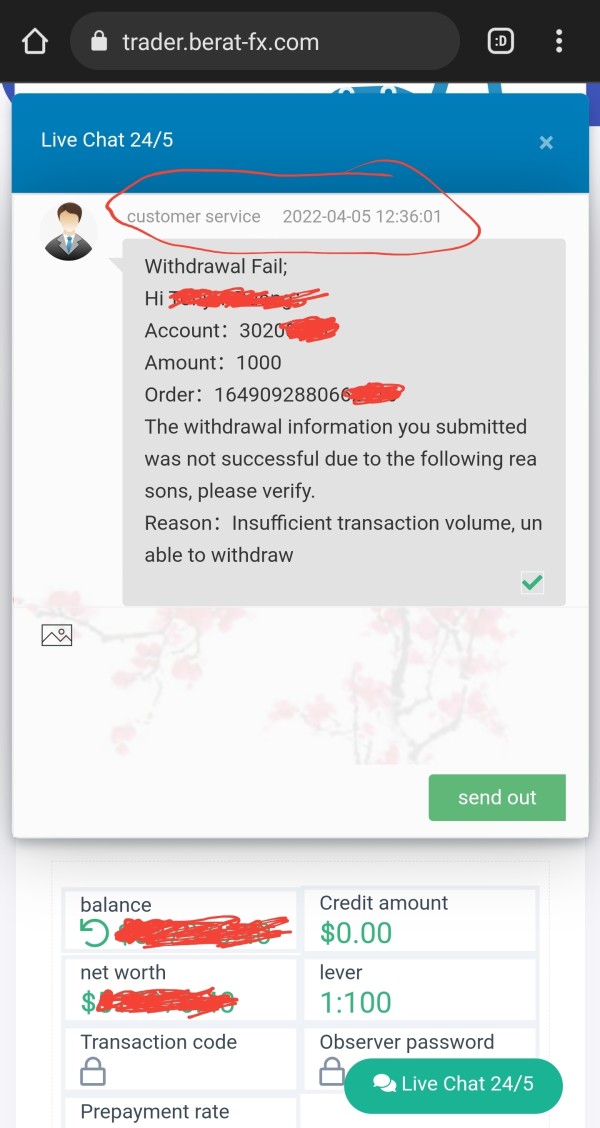

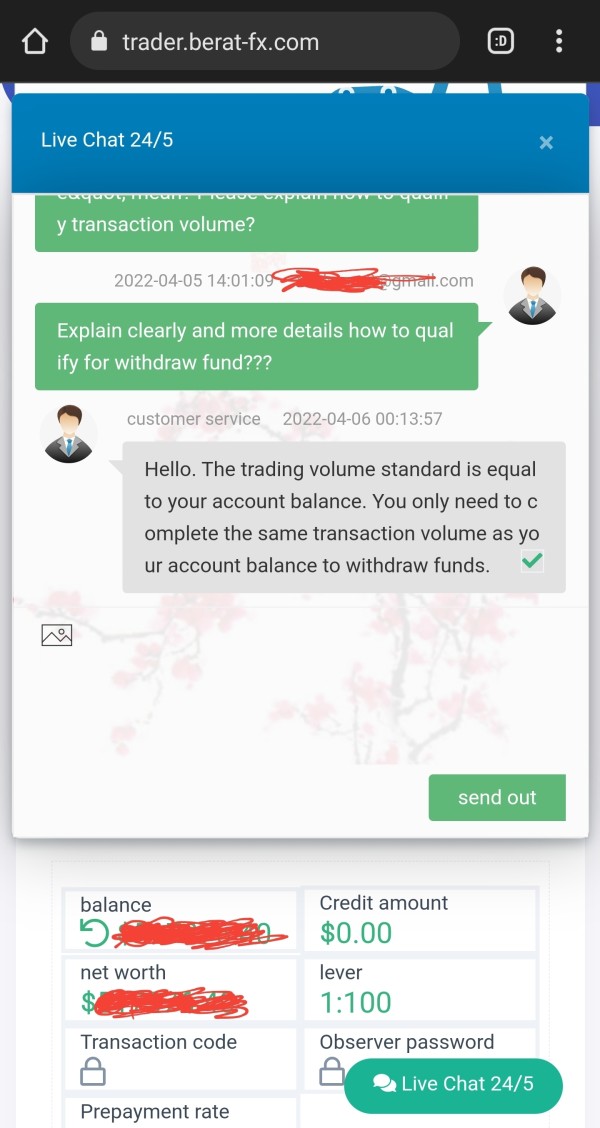

Fund safety measures have not been disclosed. Regulated brokers typically maintain client funds in separate accounts and provide clear protection mechanisms. Corporate transparency regarding ownership structure, financial statements, and operational procedures remains limited.

Reputable brokers usually provide detailed company information and maintain open communication about their business operations. Industry reputation and third-party evaluations are not readily available, making it difficult to assess peer recognition or professional standing within the forex industry. User feedback indicates concerns about safety and reliability.

User Experience Analysis (1/10)

Overall user satisfaction is reflected in the 1.00 rating. This suggests significant dissatisfaction with the broker's services and offerings. This rating indicates widespread negative feedback from users who have experienced the platform's services.

Interface design and usability assessment cannot be completed due to insufficient information about platform features and user interaction elements. Modern trading platforms require intuitive design and efficient navigation to support effective trading decisions. Registration and verification processes have not been detailed, making it difficult to evaluate the user onboarding experience and account setup efficiency.

Streamlined procedures typically contribute to positive user experiences. Fund operation experiences remain undocumented. These operational aspects significantly impact user satisfaction and platform credibility.

Conclusion

This comprehensive berat review reveals substantial concerns about the broker's suitability for forex trading. Operating without regulatory oversight represents the primary risk factor, as investors lack protection mechanisms typically provided by licensed financial authorities.

The absence of essential trading information makes it impossible to recommend Berat to any trader category. Whether beginners seeking educational support or experienced traders requiring advanced tools, the broker appears to fall short of industry standards. Given the extremely low user rating of 1.00 and the lack of transparency regarding fundamental business operations, potential investors should exercise extreme caution and consider regulated alternatives that provide comprehensive service information and investor protection measures.