BCP Group 2025 Review: Everything You Need to Know

Executive Summary

BCP Group has established itself as an active participant in the forex and fixed income markets. The company offers a well-regulated trading environment suitable for investors seeking diversified investment opportunities. This bcp group review reveals a company with strong regulatory oversight and significant market presence, particularly in emerging markets fixed income securities.

The broker's key strengths lie in its active trading desk operations and comprehensive regulatory framework. BCP Securities operates under multiple regulatory jurisdictions. The company is registered with the SEC, ACRA, and CNMV, while maintaining FINRA membership status. The company has demonstrated substantial market activity, with approximately $20 billion in secondary trading volume recorded in 2016.

BCP Group primarily attracts investors interested in fixed income markets. The broker offers access to global bonds and corporate securities. The broker's experienced trading desk, with an average of 14 years of market experience among sales and trading professionals, provides institutional-level expertise for clients seeking exposure to emerging markets fixed income securities.

While the company shows strong regulatory compliance and market activity, potential clients should note that specific account conditions and user experience details require direct inquiry with the broker for comprehensive evaluation.

Important Notice

Regional Entity Differences: BCP Group operates across multiple jurisdictions with varying regulatory requirements. The company maintains registrations with different regulatory bodies including the SEC in the United States, ACRA in Singapore, and CNMV in Spain. Investors should familiarize themselves with the specific regulatory framework applicable to their region. They should also understand how these differences may affect their trading conditions and investor protections.

Review Methodology: This evaluation is based on publicly available information and regulatory filings. Some aspects of the broker's services may not be fully covered due to limitations in publicly accessible data. Potential clients are advised to conduct their own due diligence and contact the broker directly for detailed information about specific services and conditions.

Rating Framework

Broker Overview

Company Background and Establishment

BCP Securities, Inc. was founded in 1989. The company is headquartered in Greenwich, Connecticut. The company has built a reputation as a specialized broker-dealer focusing on emerging markets fixed income securities. With over three decades of market experience, BCP has evolved from serving approximately 200 clients in 1999 to managing relationships with over 2,000 clients by 2016. This demonstrates consistent growth and market expansion.

The BCP Group also encompasses BCP Group P&O Clinics, established in 2013 as an investor-backed orthotic and prosthetic practice management company based in Nashville, Tennessee. This diversification shows the group's expansion beyond financial services into healthcare-related sectors. However, the primary focus for trading services remains with BCP Securities.

Business Model and Market Focus

BCP Securities operates primarily as a broker-dealer specializing in fixed income markets. The company has particular expertise in emerging markets securities. The company's business model centers around providing institutional-quality trading services for global bonds and corporate securities. According to available data, BCP maintains one of the most active trading desks in emerging markets fixed income, processing over 2,000 trades monthly on average.

The broker operates under comprehensive regulatory oversight. The company is registered with the Securities and Exchange Commission, the Accounting and Corporate Regulatory Authority of Singapore, and Comisión Nacional del Mercado de Valores in Spain. Additionally, the company maintains membership with the Financial Industry Regulatory Authority, ensuring compliance with industry standards and providing additional client protections. This bcp group review confirms the broker's commitment to regulatory compliance across multiple jurisdictions.

Regulatory Jurisdictions: BCP Group operates under multiple regulatory frameworks. BCP Securities is registered with the SEC in the United States, ACRA in Singapore, and CNMV in Spain. The company's FINRA membership provides additional regulatory oversight and client protection measures.

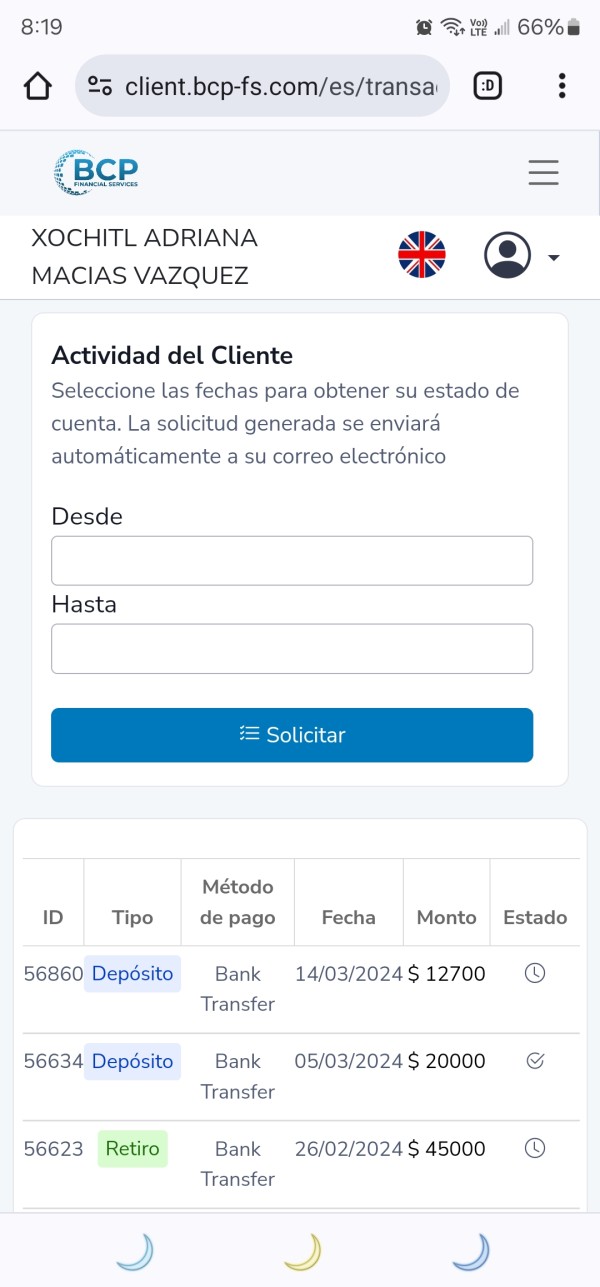

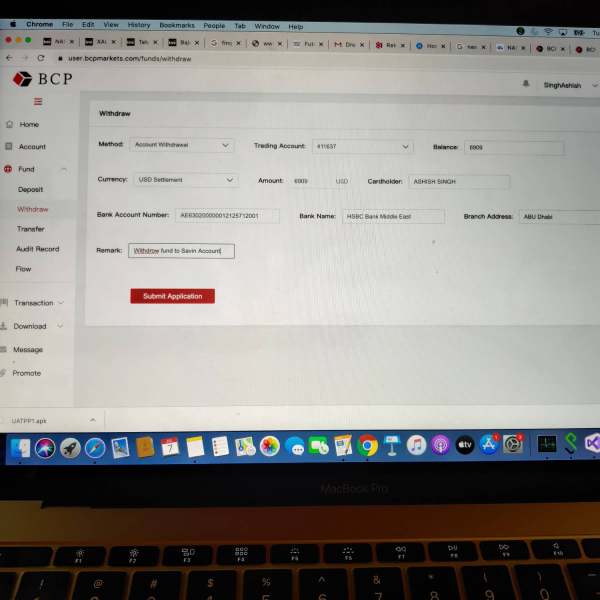

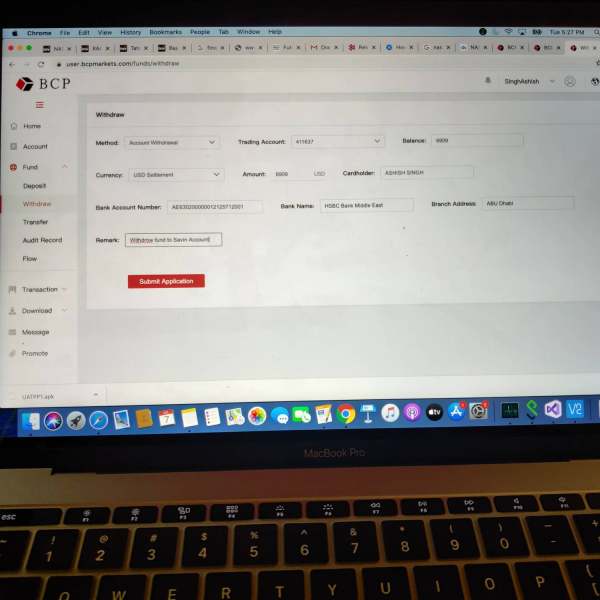

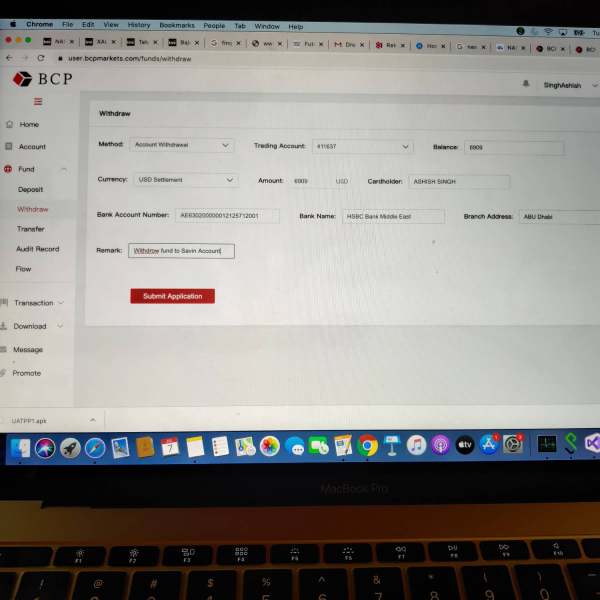

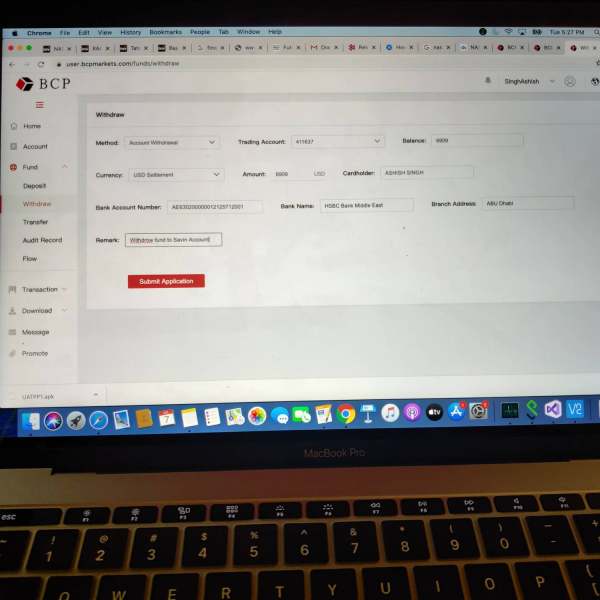

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available public materials. This would require direct inquiry with the broker.

Minimum Deposit Requirements: The minimum deposit requirements for opening accounts with BCP Group are not specified in publicly available information.

Bonus and Promotional Offers: Details regarding promotional offers or bonus programs are not mentioned in the available documentation.

Tradeable Assets: BCP Group specializes in fixed income securities. The broker offers access to global bonds and corporate securities. The broker's focus on emerging markets provides clients with opportunities in specialized market segments.

Cost Structure: Specific information about trading costs, spreads, and commission structures is not detailed in the publicly available materials reviewed for this assessment.

Leverage Ratios: Leverage information is not specified in the available documentation.

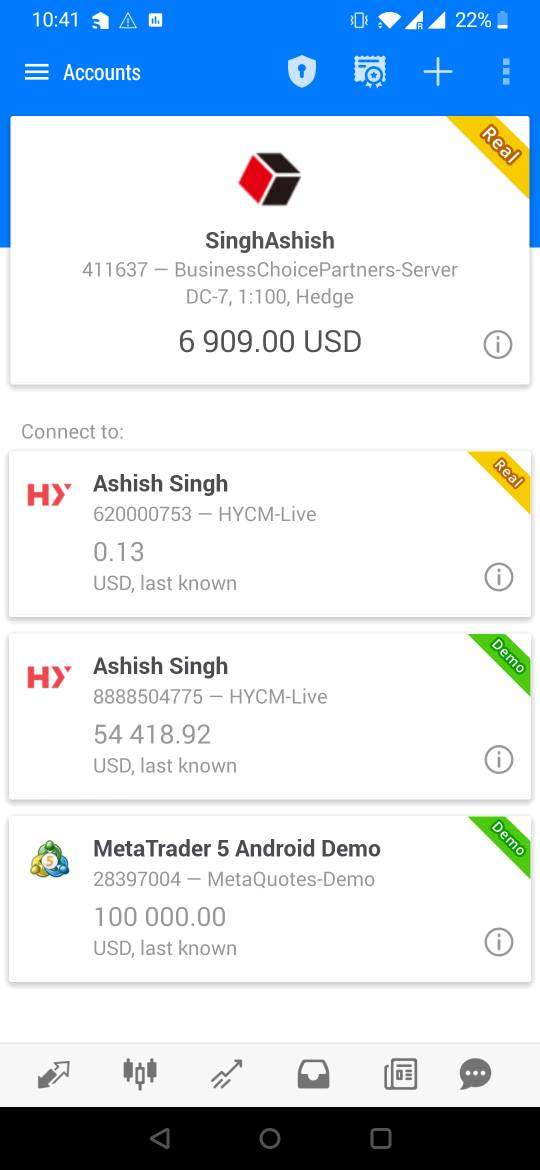

Platform Options: Trading platform details are not comprehensively covered in the available public information.

Geographic Restrictions: Specific geographic limitations are not detailed in the reviewed materials.

Customer Support Languages: Information about supported languages for customer service is not specified in available documentation.

This bcp group review indicates that while the broker demonstrates strong regulatory compliance and market activity, detailed operational information requires direct communication with the company.

Detailed Rating Analysis

Account Conditions Analysis

The specific account conditions offered by BCP Group are not comprehensively detailed in publicly available materials. This makes it challenging to provide a thorough evaluation of this aspect. The broker appears to cater primarily to institutional and sophisticated retail clients interested in fixed income markets, particularly emerging markets securities.

Given the company's focus on specialized fixed income trading and its substantial client base growth from 200 to over 2,000 clients between 1999 and 2016, it can be inferred that BCP offers competitive account structures. However, without specific information about account types, minimum balance requirements, or special features, potential clients would need to contact the broker directly for detailed account condition information.

The broker's regulatory standing with multiple authorities suggests that account opening procedures would follow standard KYC and AML protocols required by SEC, ACRA, CNMV, and FINRA regulations. This bcp group review recommends that prospective clients inquire directly about specific account features, Islamic account availability, and any specialized account types that may be offered.

The absence of detailed public information about account conditions prevents a comprehensive scoring of this category. However, the broker's regulatory compliance suggests adherence to industry standards for client account management and protection.

BCP Group demonstrates strong capabilities in trading tools and resources, particularly in the fixed income sector. The company operates one of the most active trading desks in emerging markets fixed income. This indicates access to sophisticated trading infrastructure and market connectivity. With approximately $20 billion in secondary trading volume in 2016, the broker clearly maintains robust trading capabilities.

The broker's specialization in global bonds and corporate securities suggests access to comprehensive fixed income trading tools and market data. The trading desk processes over 2,000 trades monthly on average. This indicates efficient order management systems and execution capabilities. The 14-year average market experience of sales and trading professionals provides valuable human resources for client support and market analysis.

However, specific details about research resources, analytical tools, educational materials, or automated trading support are not detailed in available public information. The broker's institutional focus suggests that sophisticated trading tools are likely available. However, the exact nature and scope of these resources would require direct inquiry.

The company's longevity and growth in client base suggest that the tools and resources provided meet market demands. However, this evaluation is limited by the lack of detailed public information about specific platform features and analytical resources.

Customer Service and Support Analysis

Information about BCP Group's customer service and support infrastructure is not detailed in publicly available materials. This makes it difficult to provide a comprehensive evaluation of this critical aspect. The broker's growth from 200 to over 2,000 clients suggests effective client relationship management. However, specific details about support channels, response times, and service quality are not publicly documented.

The company's regulatory compliance across multiple jurisdictions and FINRA membership indicates adherence to customer protection standards required by these regulatory bodies. The average tenure of over 10 years for professional staff suggests stability and experience in client service delivery.

Given the broker's institutional focus and specialization in emerging markets fixed income, it can be inferred that customer support would be tailored to sophisticated investors with specific needs in these market segments. However, without specific information about support channels, availability hours, multilingual support, or response time metrics, this category cannot be adequately scored.

Potential clients interested in BCP Group's services would need to directly inquire about customer service capabilities. This includes available communication channels, support hours, and the specific expertise available for emerging markets fixed income trading.

Trading Experience Analysis

BCP Group demonstrates strong trading experience capabilities, particularly in emerging markets fixed income securities. The broker's substantial trading volume of approximately $20 billion in secondary trading in 2016 indicates significant market activity and liquidity access. The processing of over 2,000 trades monthly on average suggests efficient execution capabilities and active market participation.

The company's specialization in global bonds and corporate securities, combined with its focus on emerging markets, provides clients with access to specialized market segments. These may not be readily available through general retail brokers. The 14-year average market experience of the sales and trading team indicates deep market knowledge and execution expertise.

Platform stability and execution quality metrics are not specifically detailed in available information. However, the high trading volumes suggest reliable trading infrastructure. The broker's institutional focus implies access to professional-grade trading technology. However, specific details about platform features, mobile trading capabilities, or advanced order types are not publicly documented.

The trading environment appears to benefit from good liquidity based on the substantial trading volumes reported. However, without specific information about execution speeds, slippage rates, or platform reliability metrics, this bcp group review can only assess trading experience based on volume indicators and market activity levels.

Trust and Reliability Analysis

BCP Group demonstrates strong trust and reliability credentials through its comprehensive regulatory framework and long-standing market presence. The company's registration with multiple regulatory authorities including the SEC, ACRA, and CNMV, along with FINRA membership, provides substantial regulatory oversight and client protection measures.

The broker's establishment in 1989 and consistent growth over more than three decades indicates stability and market credibility. The expansion from 200 clients in 1999 to over 2,000 clients by 2016 suggests successful client retention and business growth. This typically correlates with reliable service delivery.

The company's specialization in emerging markets fixed income and substantial trading volumes indicate established market relationships and liquidity access. The average tenure of over 10 years for professional staff suggests organizational stability and continuity in service delivery.

However, specific information about fund safety measures, segregated account structures, insurance coverage, or third-party audits is not detailed in publicly available materials. While regulatory compliance provides baseline protection, additional safety measures would require direct verification with the broker.

The absence of documented negative events or regulatory actions in available information suggests a clean compliance record. However, comprehensive due diligence would require checking regulatory databases for any historical issues or sanctions.

User Experience Analysis

User experience evaluation for BCP Group is limited by the absence of detailed public information about client interfaces, platform usability, and customer feedback. The broker's institutional focus and specialization in emerging markets fixed income suggests that user experience is tailored to sophisticated investors rather than general retail traders.

The substantial client base growth from 200 to over 2,000 clients indicates positive user retention. This typically correlates with satisfactory user experience. However, specific details about platform design, ease of use, account opening procedures, or client satisfaction metrics are not available in public documentation.

Given the broker's specialization and institutional focus, the user experience is likely designed for clients with specific fixed income trading requirements rather than general forex or CFD trading. The complexity of emerging markets fixed income trading suggests that the user interface and experience would be tailored to sophisticated users familiar with these market segments.

Without specific user feedback, interface screenshots, or usability studies, this category cannot be adequately assessed. Potential clients would need to request platform demonstrations or trial access to evaluate the user experience firsthand.

Conclusion

This bcp group review reveals a broker with strong regulatory credentials and significant market presence in emerging markets fixed income securities. BCP Group's comprehensive regulatory framework, including registrations with SEC, ACRA, and CNMV, along with FINRA membership, provides substantial credibility and client protection measures.

The broker is particularly well-suited for investors interested in fixed income markets, especially those seeking exposure to emerging markets securities. The company's substantial trading volumes and experienced professional team make it an attractive option for sophisticated investors requiring specialized market access.

However, the main limitations identified in this review include the lack of detailed public information about account conditions, user experience, and specific service features. While the regulatory compliance and market activity indicators are positive, potential clients would need to conduct direct inquiries to fully evaluate the broker's suitability for their specific trading requirements.