Is axacoin safe?

Business

License

Is Axacoin Safe or a Scam?

Introduction

In the rapidly evolving landscape of the foreign exchange (forex) market, Axacoin has emerged as a broker attracting attention from traders worldwide. Positioned within the competitive realm of forex trading, Axacoin claims to offer a range of trading services and features that appeal to both novice and seasoned traders. However, the influx of unregulated brokers in the market has heightened the need for traders to carefully evaluate the legitimacy and safety of their chosen brokerage. This article aims to provide an objective analysis of Axacoin, exploring its regulatory standing, company background, trading conditions, customer experiences, and overall safety. The investigation draws on various sources, including user reviews, regulatory databases, and expert opinions, to assess whether Axacoin is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety and legitimacy. Axacoin's regulatory framework is crucial for protecting traders' interests and ensuring fair trading practices. A broker operating under a reputable regulatory authority typically adheres to strict guidelines, which can significantly reduce the risks associated with trading.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Regulated | N/A | N/A | Unverified |

Unfortunately, Axacoin appears to operate without any regulatory oversight, which raises significant concerns. The absence of regulation means that traders have limited recourse in the event of disputes or financial mishaps. Additionally, unregulated brokers often lack the transparency and accountability that regulated entities are required to maintain. The quality of regulation varies significantly across jurisdictions, with top-tier authorities such as the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC) offering robust protections for traders. In contrast, brokers like Axacoin, which operate without such oversight, may expose traders to higher risks of fraud and malpractice.

Company Background Investigation

Understanding the background of a brokerage is essential for assessing its credibility. Axacoin's history, ownership structure, and management team play a significant role in determining its trustworthiness. Unfortunately, detailed information about Axacoin's history and ownership is scarce, which is often a red flag in the brokerage industry. A lack of transparency regarding the company's origins and key personnel can indicate potential issues with accountability and reliability.

Moreover, the absence of publicly available information about the management team further complicates the assessment of Axacoin's credibility. A reputable brokerage typically provides information about its leadership, including their professional backgrounds and experience in the financial industry. This transparency helps build trust with potential clients. In the case of Axacoin, the lack of such disclosures raises concerns about its legitimacy and operational integrity.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. Axacoin claims to provide competitive trading conditions, but without transparent information, it is challenging to verify these claims. A comprehensive analysis of the brokers fee structure and trading policies is essential for understanding its overall value proposition.

| Fee Type | Axacoin | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of specific information regarding spreads, commissions, and overnight interest rates raises significant concerns about Axacoin's trading conditions. Traders should be wary of brokers that do not disclose their fee structures, as hidden fees can erode profitability and lead to unexpected costs. Additionally, the absence of a clear commission model can indicate potential issues with transparency and fairness in pricing. Traders are advised to remain cautious and seek brokers that provide clear and detailed information about their trading conditions.

Customer Funds Security

The security of customer funds is paramount in the forex trading environment. Traders need to ensure that their deposits are protected through robust security measures. Axacoin's approach to fund security is a critical aspect of assessing whether it is a safe trading option.

A reputable broker typically employs strict measures, such as segregated accounts for client funds, investor protection schemes, and negative balance protection policies. Unfortunately, Axacoin's website does not provide sufficient information on its fund security measures, leaving potential clients in the dark regarding the safety of their investments. The lack of transparency in this area is concerning, as it raises questions about how Axacoin manages and safeguards client funds.

Moreover, any historical issues related to fund security or disputes can further impact the broker's credibility. Traders should conduct thorough research to identify any past incidents involving Axacoin and assess how the broker responded to such issues.

Customer Experience and Complaints

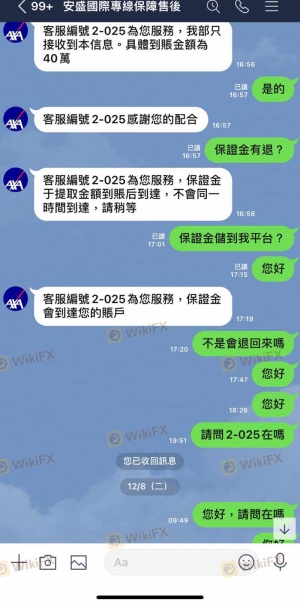

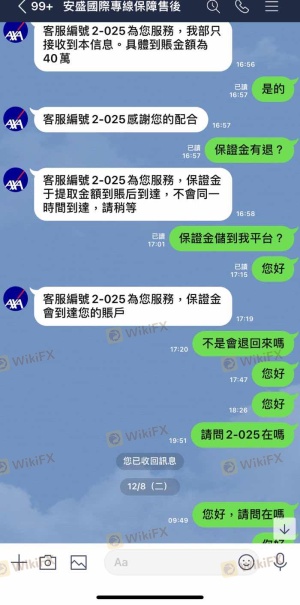

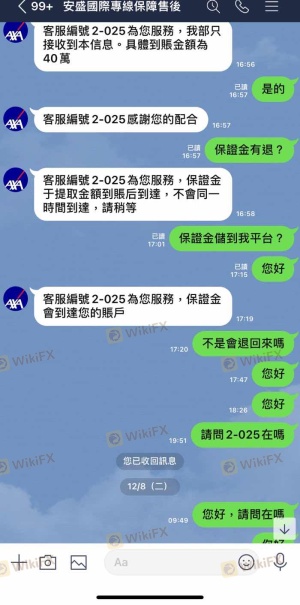

Customer feedback is a valuable source of information when evaluating a broker's reliability and service quality. Axacoin has received mixed reviews from users, with several complaints surfacing regarding withdrawal issues and customer support responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Average |

Common complaints often revolve around difficulties in withdrawing funds, which can indicate potential issues with the broker's financial practices. Users have reported delays in processing withdrawal requests, raising concerns about the broker's liquidity and operational integrity. Additionally, the quality of customer support has been criticized, with traders expressing frustration over unresponsive or inadequate assistance.

Two notable cases highlight these issues: one user reported being unable to withdraw funds for weeks, while another cited poor communication from the support team when seeking assistance. Such experiences can significantly impact a trader's confidence in the broker and should be taken seriously when assessing whether Axacoin is safe to trade with.

Platform and Execution

The performance and reliability of a trading platform are crucial for a positive trading experience. Axacoin's trading platform must be evaluated for its performance, stability, and user experience. Traders expect a seamless platform that allows for quick order execution and minimal slippage.

While specific details about Axacoin's platform performance are limited, the absence of user testimonials regarding execution quality raises concerns. A reliable broker should provide a platform that is stable and user-friendly, with efficient order execution. Any signs of platform manipulation or issues with order fulfillment can be detrimental to traders' success.

Risk Assessment

Using Axacoin as a trading platform involves several risks that potential clients should consider. The lack of regulation, transparency, and negative customer feedback contribute to a heightened risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Risk | High | Potential withdrawal issues. |

| Operational Risk | Medium | Lack of transparency and support. |

To mitigate these risks, traders are advised to conduct thorough research, avoid depositing large sums initially, and consider using regulated alternatives. Engaging with a broker that is transparent and well-regulated can significantly reduce exposure to potential scams.

Conclusion and Recommendations

In conclusion, the evidence suggests that Axacoin raises several red flags that warrant caution. The lack of regulatory oversight, transparency regarding its operations and management, and numerous customer complaints indicate that Axacoin may not be a safe trading option. Traders should be wary of investing with a broker that does not provide clear information about its fees, fund security measures, and customer support.

For traders seeking a more secure trading environment, it may be prudent to consider regulated alternatives. Brokers with established reputations and robust regulatory frameworks can provide greater peace of mind and better protections for traders' investments. Overall, potential clients should exercise caution and conduct thorough due diligence before engaging with Axacoin or any similar unregulated broker.

Is axacoin a scam, or is it legit?

The latest exposure and evaluation content of axacoin brokers.

axacoin Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

axacoin latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.