Regarding the legitimacy of Ascot Prime forex brokers, it provides FSA and WikiBit, .

Is Ascot Prime safe?

Business

License

Is Ascot Prime markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

AfterPrime Ltd

Effective Date:

--Email Address of Licensed Institution:

jeremy@afterprime.comSharing Status:

No SharingWebsite of Licensed Institution:

https://afterprime.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 8B, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4373284Licensed Institution Certified Documents:

Is Ascot Prime Safe or Scam?

Introduction

Ascot Prime is a forex broker that has emerged in the competitive landscape of online trading, claiming to provide access to a wide range of financial instruments and trading platforms. As with any financial service, it is crucial for traders to conduct thorough research before engaging with a broker, especially in the forex market, where the potential for both profit and loss is significant. The purpose of this article is to evaluate the safety and legitimacy of Ascot Prime by examining its regulatory status, company background, trading conditions, and overall customer experience. Our investigation is based on a comprehensive review of various sources, including user feedback, regulatory databases, and financial analysis reports.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its reliability and safety. Ascot Prime claims to be licensed by the Seychelles Financial Services Authority (FSA), which is often regarded as a less stringent regulatory body compared to those in more developed financial jurisdictions. Below is a summary of Ascot Prime's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 05 | Seychelles | Suspicious Clone |

Despite holding this license, it has been flagged as a "suspicious clone" by various regulatory watchdogs. This raises significant concerns regarding the legitimacy of its operations. The term "suspicious clone" indicates that the broker may not be operating under the regulations it claims, potentially misleading clients about its legitimacy. The low score of 1.48 out of 10 on platforms like WikiFX further underscores the risks associated with trading through Ascot Prime.

Regulatory quality and compliance history are paramount when assessing whether Ascot Prime is safe. A lack of transparency in its regulatory status, coupled with negative reviews from users about withdrawal issues, suggests that prospective clients should exercise caution. Without robust regulatory oversight, traders may find themselves vulnerable to potential fraud or mismanagement of funds.

Company Background Investigation

Ascot Prime operates under the name R Capital Group Ltd and is reportedly based in Seychelles. Established in 2019, the company claims to provide various trading services, including forex and CFDs. However, the limited information available about its ownership structure and management team raises concerns about transparency.

The absence of publicly available information regarding the company's executives and their professional backgrounds is troubling. A reputable brokerage typically provides detailed information about its management team, including their qualifications and experience in the financial industry. This lack of transparency can be a red flag, indicating potential operational risks.

Moreover, Ascot Prime's website does not disclose its physical address or provide direct contact information, which further complicates the ability to verify its legitimacy. In a world where trust is paramount, the inability to ascertain who is behind the broker adds another layer of concern regarding whether Ascot Prime is safe for traders.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. Ascot Prime advertises competitive spreads and leverage ratios, with claims of offering spreads starting from 0.0 pips and leverage up to 1:400. However, such high leverage can be a double-edged sword; while it allows traders to control larger positions, it also amplifies the risk of significant losses.

The following table outlines the core trading costs associated with Ascot Prime:

| Cost Type | Ascot Prime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 1.7 pips | 1.0 - 2.0 pips |

| Commission Model | None disclosed | $5 - $10 per lot |

| Overnight Interest Range | High | Moderate |

While the advertised low spreads may seem attractive, the lack of clarity regarding commission structures and overnight interest rates can be concerning. Traders should be wary of hidden fees that may not be immediately apparent. Furthermore, the imposition of a $25 inactivity fee is another cost that could erode a trader's account balance, especially for those who may not trade frequently.

In summary, while Ascot Prime presents itself as a competitive broker, the potential for hidden costs and high-risk leverage raises questions about whether Ascot Prime is safe for all traders, particularly those who are inexperienced.

Customer Funds Security

The safety of customer funds is a paramount consideration when evaluating any broker. Ascot Prime claims to implement various security measures, including the segregation of client funds and the use of reputable banking institutions for transactions. However, the actual effectiveness of these measures remains unclear due to the lack of regulatory oversight.

It is crucial for traders to understand the implications of fund segregation. When a broker segregates client funds, it means that these funds are kept separate from the broker's operational funds, providing a layer of protection in case of insolvency. However, Ascot Prime's lack of detailed information about its banking partners and the effectiveness of its fund protection policies raises significant concerns.

Additionally, the absence of negative balance protection policies means that traders could potentially lose more than their initial investment, especially when trading with high leverage. Historical complaints regarding withdrawal issues further exacerbate concerns about the safety of funds held with Ascot Prime. These factors collectively lead to the conclusion that traders should carefully consider whether Ascot Prime is safe for their investments.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability and service quality. Reviews of Ascot Prime reveal a mixed bag of experiences, with several users reporting difficulties in withdrawing funds and receiving timely support. The following table summarizes the primary types of complaints associated with Ascot Prime:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/non-responsive |

| Platform Stability | Medium | Acknowledged issues |

| Customer Support | High | Limited availability |

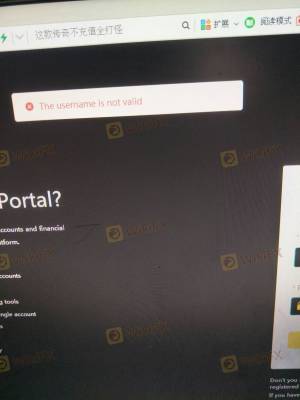

Common complaints include the inability to withdraw funds, long response times from customer support, and issues with platform stability. For instance, one user reported that after depositing funds, they were unable to access their account for withdrawals, leading to frustration and financial loss. Such patterns of complaints suggest systemic issues within the broker's operational framework, raising serious doubts about whether Ascot Prime is safe for traders.

Platform and Trade Execution

The trading platform used by a broker can significantly influence the trading experience. Ascot Prime offers the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their user-friendly interfaces and advanced trading tools. However, user reviews indicate that there may be issues related to platform stability and execution quality.

Traders have reported instances of slippage and order rejections, which can adversely affect trading outcomes. This raises concerns about the broker's execution practices and whether trades are being processed fairly. Moreover, any signs of platform manipulation or unfair practices could further erode trust in the broker.

Overall, while Ascot Prime utilizes reputable trading platforms, the reported issues with order execution and stability lead to questions about whether Ascot Prime is safe for traders seeking reliable execution.

Risk Assessment

When evaluating the overall risk associated with trading through Ascot Prime, several factors come into play. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of robust regulatory oversight |

| Fund Security | High | Concerns over fund protection measures |

| Customer Support | Medium | Slow response times to complaints |

| Trading Conditions | Medium | High leverage and unclear fees |

The cumulative risk profile suggests that trading with Ascot Prime carries significant potential pitfalls. Traders should approach this broker with caution, particularly those who are new to trading or lack experience in managing high-risk environments. It is advisable for traders to consider risk mitigation strategies, such as setting strict stop-loss orders and limiting the use of high leverage.

Conclusion and Recommendations

In conclusion, while Ascot Prime presents itself as a competitive forex broker, a thorough examination raises substantial concerns regarding its safety and reliability. The lack of strong regulatory oversight, coupled with negative user experiences and complaints about fund withdrawals, strongly suggests that traders should be wary of engaging with this broker.

For traders seeking a safe and reliable trading environment, it may be prudent to consider alternative brokers with established reputations and robust regulatory frameworks. Some recommended alternatives include brokers that are fully regulated in major jurisdictions, offer transparent fee structures, and have a proven track record of positive customer feedback. Overall, exercising due diligence and caution is essential when evaluating whether Ascot Prime is safe for your trading needs.

Is Ascot Prime a scam, or is it legit?

The latest exposure and evaluation content of Ascot Prime brokers.

Ascot Prime Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ascot Prime latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.