Is APJFX safe?

Business

License

Is APJFX Safe or a Scam?

Introduction

APJFX is a forex broker that has positioned itself within the competitive landscape of the foreign exchange market since its establishment in 2017. Operating out of the United Kingdom, APJFX offers various trading services and account types to cater to a diverse clientele. However, as with any financial service, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The forex market is rife with both legitimate opportunities and potential scams, making it imperative for traders to assess the safety and reliability of their chosen platforms.

In this article, we will investigate whether APJFX is a safe broker or if it exhibits characteristics of a scam. Our evaluation will incorporate various aspects, including regulatory compliance, company background, trading conditions, customer feedback, and risk assessments. By synthesizing data from multiple sources, we aim to provide a comprehensive overview of APJFX's operations and its standing in the forex market.

Regulation and Legitimacy

Regulatory oversight is a fundamental aspect of a broker's legitimacy and safety. APJFX claims to be regulated by the Financial Conduct Authority (FCA) in the UK; however, recent reports indicate that its license has been revoked. This raises significant red flags regarding its operational legitimacy. Regulatory bodies like the FCA enforce strict guidelines to protect investors and ensure fair trading practices.

Heres a summary of APJFX's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 766959 | United Kingdom | Revoked |

The revocation of APJFX's FCA license suggests that the broker may not adhere to the necessary regulatory standards. This is a serious concern for potential investors, as trading with an unregulated broker can expose them to significant financial risks. Additionally, no other regulatory body appears to oversee APJFX, further complicating its legitimacy. The absence of regulatory support can leave traders vulnerable to fraudulent activities and untrustworthy practices.

Company Background Investigation

APJFX is operated by Alpha Jet Financial Group Limited, which has been in existence since 2017. The company‘s transparency regarding its ownership and management structure is limited, raising questions about its operational integrity. A broker’s history and the backgrounds of its management team are critical components in assessing its credibility.

However, information on the management team of APJFX is sparse, making it challenging to evaluate their qualifications and experience in the financial sector. A lack of transparency can be a potential warning sign, suggesting that the broker may not prioritize accountability or customer trust.

In terms of information disclosure, APJFX appears to have inadequate communication regarding its operations, which could hinder investors ability to make informed decisions. A broker that does not provide clear and accessible information about its management and operational history may not be acting in the best interests of its clients.

Trading Conditions Analysis

The trading conditions offered by APJFX include various account types, each with differing minimum deposits and leverage options. However, the overall fees and costs associated with trading on this platform raise concerns. The broker requires a minimum deposit of $5,000, which is significantly higher than the industry average, potentially limiting access for many retail traders.

Heres a comparison of core trading costs:

| Cost Type | APJFX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.3 pips | 1.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

The spreads offered by APJFX are higher than the industry average, which may impact traders' profitability. Additionally, the commission structure is not clearly defined, leaving traders uncertain about the costs they may incur. Such ambiguity can lead to unexpected expenses, which is particularly concerning for those who are new to forex trading.

Client Fund Security

The safety of client funds is paramount when considering whether a broker is safe. APJFX claims to implement measures for fund protection, such as segregating client accounts. However, the lack of regulatory oversight raises questions about the effectiveness of these measures.

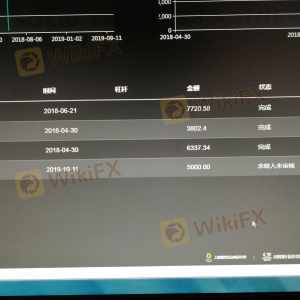

Investors should be aware that without a governing body to enforce compliance, there is little assurance that their funds are adequately protected. Furthermore, there have been reports of clients experiencing difficulties with fund withdrawals, indicating potential issues with the broker's financial practices. Historical complaints suggest that some users have been unable to access their funds, which could signify deeper operational problems.

Customer Experience and Complaints

Customer feedback is a vital indicator of a brokers reliability. A review of user experiences with APJFX reveals a troubling pattern of complaints, particularly concerning withdrawal issues. Many clients have reported being unable to withdraw their funds, and attempts to contact customer service have often gone unanswered.

Heres a summary of the main complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

Several users have expressed frustration over lengthy delays in fund withdrawals, with some alleging that the broker has absconded with their money. These complaints are serious and suggest a lack of accountability on the part of APJFX, raising significant concerns about its operational integrity.

Platform and Execution

APJFX utilizes the MetaTrader 4 platform, which is widely regarded for its user-friendly interface and robust functionality. However, user reviews indicate that there have been issues with order execution, including slippage and rejections. Such problems can significantly impact trading performance and raise concerns about the broker's reliability.

The quality of trade execution is a critical factor for traders, as delays or errors can lead to substantial financial losses. If APJFX is unable to provide a stable and efficient trading environment, it may not be a suitable choice for serious traders.

Risk Assessment

Engaging with APJFX carries various risks that potential investors should consider. A summary of the key risk areas is outlined below:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No active regulation; FCA license revoked. |

| Financial Risk | High | Reports of withdrawal issues and absconding. |

| Operational Risk | Medium | Customer service issues and execution delays. |

To mitigate these risks, traders should exercise caution when engaging with APJFX. It may be wise to limit initial investments and thoroughly monitor any trading activities.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that APJFX raises significant concerns regarding its safety and legitimacy. The revocation of its FCA license, coupled with numerous complaints about withdrawal issues and poor customer service, indicates that this broker may not be a reliable choice for traders.

For those considering forex trading, it is advisable to seek out brokers with solid regulatory backing and a proven track record of customer satisfaction. Alternatives include well-regulated brokers with transparent practices and positive user feedback.

In summary, potential investors should approach APJFX with caution and consider safer, more reputable options available in the market.

Is APJFX a scam, or is it legit?

The latest exposure and evaluation content of APJFX brokers.

APJFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

APJFX latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.