Is AllianzMarket safe?

Business

License

Is Allianzmarket Safe or Scam?

Introduction

Allianzmarket positions itself as an online trading platform that caters to a broad spectrum of traders, offering access to various financial instruments, including forex, commodities, and cryptocurrencies. However, in a rapidly evolving financial landscape, traders must exercise caution when selecting a broker. The potential for scams in the forex market necessitates thorough evaluations of brokers before committing funds. This article aims to analyze the legitimacy and safety of Allianzmarket by investigating its regulatory status, company background, trading conditions, fund security measures, customer experiences, and overall risk profile.

Regulation and Legitimacy

One of the most critical factors in assessing the safety of any trading platform is its regulatory status. Allianzmarket operates without any significant regulatory oversight, raising serious concerns about its legitimacy. The absence of regulation means there is no governing body to hold the broker accountable for its actions or to ensure the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulation is particularly alarming given that Allianzmarket claims to operate from Dominica, a jurisdiction known for its lax regulatory environment. This absence of oversight can lead to a higher risk of fund mismanagement and potential fraud. Furthermore, the company does not appear to have a history of compliance with any regulatory authority, which is a significant red flag for potential investors. When evaluating whether Allianzmarket is safe, the lack of regulatory oversight is a critical factor that cannot be ignored.

Company Background Investigation

Allianzmarket is reportedly owned by Commerz Group International Ltd, which is based in Dominica. The company has been in operation since 2020, but its history is marred by allegations of being involved in fraudulent activities. The management team behind Allianzmarket lacks transparency, and there is little information available about their professional backgrounds. This lack of disclosure raises questions about the company's credibility and operational integrity.

Moreover, the company's ownership structure appears convoluted, with multiple entities involved in its operations, including Commerz Tech Ltd, which allegedly handles payment processing. Such complexities can obscure accountability, making it difficult for traders to seek recourse in case of disputes. With the absence of clear information regarding the management team and their qualifications, it becomes increasingly challenging to ascertain whether Allianzmarket is safe for trading.

Trading Conditions Analysis

When evaluating a broker, it's essential to understand the trading conditions they offer. Allianzmarket claims to provide competitive spreads, high leverage, and various trading instruments. However, the overall fee structure lacks clarity, and there are reports of hidden fees that could significantly impact a trader's profitability.

| Fee Type | Allianzmarket | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.5 pips | 1.0 pips |

| Commission Structure | Varies | Flat fees |

| Overnight Interest Range | Up to 5% | 2-3% |

A notable concern is the broker's withdrawal policy, which allows them to refuse withdrawal requests at their discretion. This clause indicates a lack of commitment to customer service and can lead to potential fund access issues. Traders often report difficulties in withdrawing their funds, which raises serious concerns about whether Allianzmarket is safe for trading.

Client Fund Security

The safety of client funds is paramount in the forex trading environment. Allianzmarket does not offer segregated accounts or any investor protection schemes, which means that traders' funds are not guaranteed in case of insolvency or mismanagement. This lack of security measures places clients at significant risk.

Furthermore, the absence of negative balance protection means that traders could potentially lose more than their initial investment, exposing them to considerable financial risk. The historical context of the broker also highlights previous allegations of mishandling client funds, further questioning whether Allianzmarket is safe for traders.

Customer Experience and Complaints

Customer feedback is a vital component in evaluating the reliability of a trading platform. Reviews of Allianzmarket reveal a pattern of complaints regarding withdrawal issues, lack of customer support, and difficulties in executing trades. Many users report being unable to recover their funds after making initial deposits, which raises substantial red flags.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Availability | Medium | Inconsistent |

| Trade Execution Delays | High | Unresolved |

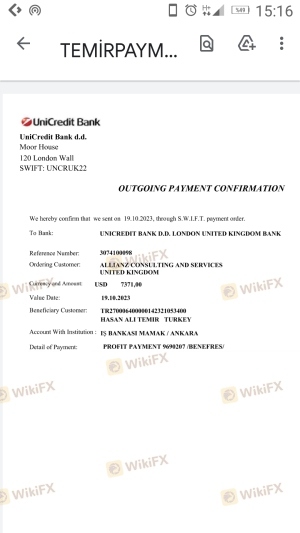

For example, one trader reported that after depositing funds, they were unable to withdraw their money due to vague policy explanations from the broker. Such experiences highlight the potential risks associated with trading on this platform and raise further doubts about whether Allianzmarket is safe.

Platform and Trade Execution

The trading platform offered by Allianzmarket claims to be user-friendly and equipped with advanced features. However, user feedback indicates that the platform is often unstable, leading to execution delays and slippage during high-volatility periods. These issues can severely impact a trader's ability to capitalize on market movements.

Additionally, there are reports of order rejections and manipulation, raising concerns about the integrity of the trading environment. The quality of execution is a critical factor for traders, and the issues reported by users further highlight the potential risks involved when trading with Allianzmarket.

Risk Assessment

Trading with unregulated brokers like Allianzmarket poses various risks. The absence of oversight, combined with poor customer service and fund security measures, creates an environment fraught with potential pitfalls.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Security Risk | High | No segregation of funds. |

| Withdrawal Risk | High | Difficulty in accessing funds. |

To mitigate these risks, traders are advised to conduct thorough due diligence, consider using regulated brokers, and avoid investing more than they can afford to lose. It is crucial to remain vigilant and proactive in protecting one's investments.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Allianzmarket is not a safe trading platform. The lack of regulation, poor customer feedback, and troubling reports of withdrawal issues all point to a high-risk environment for traders. Potential investors should be cautious and consider alternative, regulated brokers that offer better security and transparency.

For those looking to trade in the forex market, it is advisable to choose brokers that are regulated by reputable authorities such as the FCA, ASIC, or CySEC. These brokers typically provide better protection for client funds and are more accountable for their actions, ensuring a safer trading experience.

Is AllianzMarket a scam, or is it legit?

The latest exposure and evaluation content of AllianzMarket brokers.

AllianzMarket Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AllianzMarket latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.