Is Difx safe?

Pros

Cons

Is DIFX A Scam?

Introduction

DIFX, or Digital Financial Exchange, positions itself as a cross-asset trading platform that allows users to trade a variety of financial instruments, including cryptocurrencies, forex, stocks, and commodities. Established in 2021, DIFX aims to simplify trading by providing a unified platform for multiple asset classes. However, the rapid growth of online trading has also led to an increase in fraudulent activities, making it essential for traders to carefully evaluate the legitimacy of brokers like DIFX. This article investigates whether DIFX is a scam or a safe trading platform by analyzing its regulatory status, company background, trading conditions, customer safety measures, user experience, and associated risks.

Regulation and Legitimacy

The regulatory status of a trading platform is crucial for ensuring the safety of traders' funds and providing a framework for accountability. DIFX claims to be regulated by the National Futures Association (NFA), but investigations reveal that its regulatory status is unauthorized. This raises significant concerns about the safety of funds deposited with the broker.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0553220 | United States | Unauthorized |

The lack of valid regulation means that DIFX operates without oversight from any recognized financial authority, putting traders at risk. Without a regulatory body to enforce compliance, there are no guarantees regarding the safety of traders' investments. Furthermore, historical compliance issues and a lack of transparency regarding their operations exacerbate these concerns. Therefore, it is essential for potential users to consider these factors carefully when evaluating whether DIFX is safe.

Company Background Investigation

DIFX Limited, the entity behind DIFX, was established in Croatia in 2021. However, there is limited information available regarding its ownership structure and management team. This lack of transparency raises questions about the credibility of the platform. The absence of detailed information about the founders and key personnel in the organization hinders the ability to assess their qualifications and experience in the financial industry.

Moreover, the company's website does not provide comprehensive disclosures about its operational history, which is a red flag for potential investors. A credible broker typically shares information about its founding team, operational milestones, and any relevant partnerships. The lack of such information from DIFX suggests that traders should exercise caution before committing their funds.

Trading Conditions Analysis

When evaluating a trading platform, understanding the cost structure is essential. DIFX offers a variety of trading instruments, but its fees and commissions can significantly impact profitability. Although specific details about fees are not readily available, some reports indicate that users have encountered hidden fees and unusual withdrawal conditions, which can be detrimental to the trading experience.

| Fee Type | DIFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.4 pips | 1.0 pips |

| Commission Model | $12 per lot | $10 per lot |

| Overnight Interest Range | Not disclosed | 0.5% - 2.0% |

The comparison indicates that while DIFX may offer competitive spreads, the commission structure is higher than the industry average. Traders should be wary of any hidden fees that could affect their bottom line. Understanding the full cost of trading with DIFX is vital for making informed decisions.

Customer Funds Security

The safety of customer funds is paramount when selecting a trading platform. DIFX claims to implement various security measures, including segregated accounts for client funds and two-factor authentication for account access. However, the lack of regulation raises questions about the effectiveness of these measures.

Moreover, reports of users facing difficulties in withdrawing their funds further highlight potential issues with fund security. Historical complaints suggest that some traders have experienced delays or outright denials when attempting to access their money, which is a significant concern.

Customer Experience and Complaints

User feedback is a critical aspect of evaluating any trading platform. In the case of DIFX, customer reviews are mixed, with many users expressing dissatisfaction with the platform's customer support and withdrawal processes. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Limited availability |

| Hidden Fees | High | No clear explanation |

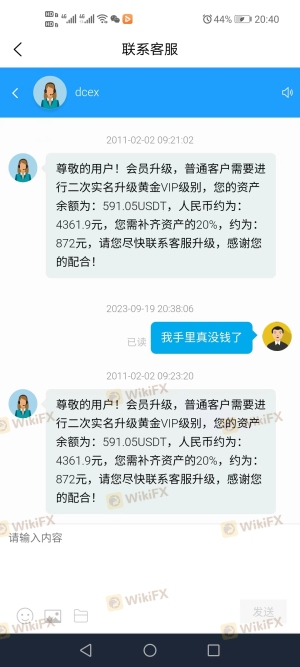

One notable case involved a trader who reported being unable to withdraw funds after being asked to upgrade their account to a "VIP" status, which required additional deposits. Such experiences raise serious questions about the platform's reliability and transparency.

Platform and Execution

DIFX utilizes the widely recognized MetaTrader 5 (MT5) platform, which is known for its user-friendly interface and advanced trading features. However, the quality of order execution and potential issues such as slippage and rejections are critical factors to consider. Reports suggest that users have experienced significant slippage during volatile market conditions, which can adversely affect trading outcomes.

Furthermore, any signs of platform manipulation, such as frequent order rejections or unusual price discrepancies, can indicate deeper issues within the trading environment. Traders should closely monitor their experiences on the platform to identify any potential red flags.

Risk Assessment

Trading with DIFX involves several risks that potential users should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Reports of withdrawal issues |

| Operational Risk | Medium | Mixed user feedback on platform |

To mitigate these risks, traders should consider using smaller amounts for initial trading, conduct thorough research, and stay informed about any changes in the platform's policies.

Conclusion and Recommendations

In conclusion, the evidence suggests that DIFX is not a safe trading platform. The lack of valid regulation, mixed user feedback, and reports of withdrawal issues raise significant concerns about its legitimacy. Traders should exercise extreme caution when considering whether to use DIFX for their trading activities.

For those seeking reliable alternatives, consider regulated brokers with a proven track record, transparent fee structures, and strong customer support. Brokers such as eToro, IG, and OANDA are well-regarded in the industry and provide a safer trading environment. Always prioritize your financial security and do thorough research before committing to any trading platform.

Is Difx a scam, or is it legit?

The latest exposure and evaluation content of Difx brokers.

Difx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Difx latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.