Is Agapepip safe?

Business

License

Is Agapepip Safe or Scam?

Introduction

Agapepip is a relatively new player in the online forex and cryptocurrency trading market, positioning itself as a straight-through processing (STP) broker. With promises of competitive spreads and advanced trading platforms, it aims to attract both novice and experienced traders. However, as the forex market evolves, so do the risks associated with trading, making it essential for traders to conduct thorough evaluations of their chosen brokers. This article investigates whether Agapepip is a safe platform or a potential scam by analyzing its regulatory status, company background, trading conditions, customer fund security, and user experiences. The investigation is based on various online sources and user reviews, focusing on critical indicators that can help assess the legitimacy of Agapepip.

Regulatory Status and Legitimacy

Regulation is a cornerstone of trust in the financial services industry. Brokers regulated by reputable authorities are subject to stringent oversight, ensuring they comply with laws designed to protect traders. Unfortunately, Agapepip is an unregulated entity, which raises significant concerns about its legitimacy. The absence of regulation means that Agapepip operates outside the law, making it vulnerable to engaging in fraudulent practices without accountability.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulatory oversight is a major red flag. Regulated brokers are required to maintain segregated accounts for client funds, ensuring that traders' money is protected. Without such regulations, Agapepip's clients may find their funds at risk, as the broker is not bound by any rules governing proper fund management. Additionally, reports from various scam reporting websites indicate that Agapepip has been associated with numerous complaints regarding fund withdrawals and customer service, further corroborating concerns about its reliability.

Company Background Investigation

Understanding a broker's background is crucial in assessing its legitimacy. Agapepip claims to have been in operation since May 2022, but its actual history and ownership structure remain opaque. The company's website lacks transparency regarding its management team and operational practices, which is a cause for concern.

The absence of identifiable ownership can be a tactic used by fraudulent brokers to evade accountability. A legitimate broker would typically provide clear information about its founders and management team, along with their professional qualifications and experience. Without this information, potential clients are left in the dark about who is handling their funds, which is a significant risk factor when considering whether "Is Agapepip safe."

Trading Conditions Analysis

When evaluating a broker, it's essential to analyze the trading conditions they offer. Agapepip claims to provide competitive trading fees, but various user reviews suggest that hidden fees and high withdrawal charges are common complaints among traders.

| Fee Type | Agapepip | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | 0.1 - 0.5% |

| Overnight Interest Range | High | Low to Moderate |

The above table highlights that while Agapepip markets itself with attractive trading conditions, many users have reported unexpected fees that significantly impact their trading profitability. Such practices can lead to a negative trading experience and raise questions about the broker's integrity. Therefore, its crucial for traders to consider these factors when assessing whether "Is Agapepip safe."

Client Fund Security

The safety of client funds is paramount in the forex trading landscape. Agapepip does not provide clear information regarding its fund security measures. Trusted brokers typically offer segregated accounts to protect client deposits and ensure they are not misused for operational expenses.

Moreover, the absence of investor protection schemes means that if Agapepip were to face financial difficulties or close down, clients might lose their entire investment without any recourse. Historical complaints about fund withdrawal issues further exacerbate concerns about the safety of client funds. Given these factors, potential clients should be wary and consider the implications of trading with an unregulated broker like Agapepip.

Customer Experience and Complaints

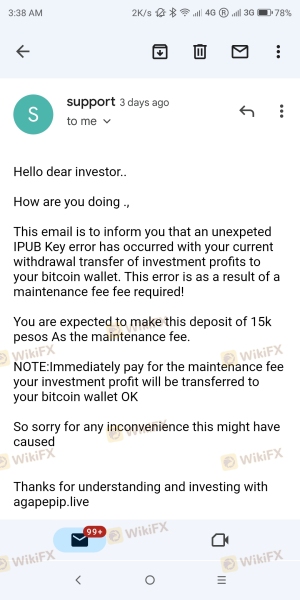

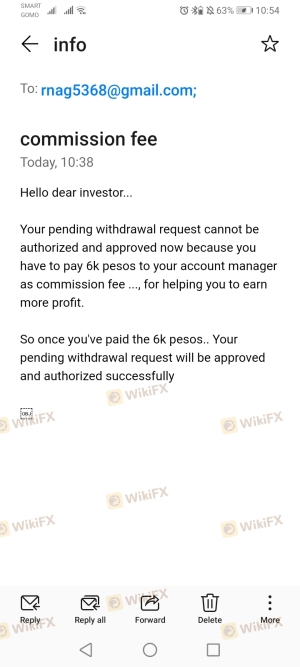

Customer feedback is a vital indicator of a broker's reliability. Reviews and testimonials from Agapepip users have been largely negative, with common complaints revolving around difficulty in withdrawing funds, unresponsive customer support, and unexpected fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | High | Poor |

| Fee Transparency | Medium | Minimal |

One notable case involved a trader who reported being unable to access their funds after multiple requests for withdrawal, only to be met with excuses and delays. Such experiences raise serious questions about Agapepip's commitment to customer service and transparency, leading many to question whether "Is Agapepip safe."

Platform and Execution

A broker's trading platform is crucial for a seamless trading experience. While Agapepip claims to offer a robust trading interface, user reviews indicate issues with platform stability and execution quality. Reports of slippage and rejected orders are common, which can significantly affect a trader's performance.

Traders have also expressed concerns about potential platform manipulation, where brokers may influence market conditions to their advantage. These issues highlight the need for potential clients to conduct thorough research before trading with Agapepip.

Risk Assessment

Using Agapepip for trading involves several risks that traders must consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of fund protection measures |

| Customer Support Risk | Medium | Poor response to client inquiries |

Given these risks, traders should exercise caution and consider alternative options. It is advisable to start with a demo account or a small deposit to gauge the broker's reliability before committing significant funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Agapepip raises several red flags regarding its legitimacy and safety. The lack of regulation, poor customer feedback, and opaque operational practices all contribute to the conclusion that Agapepip may not be a safe option for traders.

For those considering trading in the forex market, it is crucial to prioritize safety and choose regulated brokers with transparent practices and positive user reviews. Alternatives such as well-established brokers with solid regulatory backing should be considered to ensure a more secure trading experience. Always remember to ask yourself, "Is Agapepip safe?" before making any investment decisions.

Is Agapepip a scam, or is it legit?

The latest exposure and evaluation content of Agapepip brokers.

Agapepip Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Agapepip latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.