AFMFX 2025 Review: Everything You Need to Know

Executive Summary

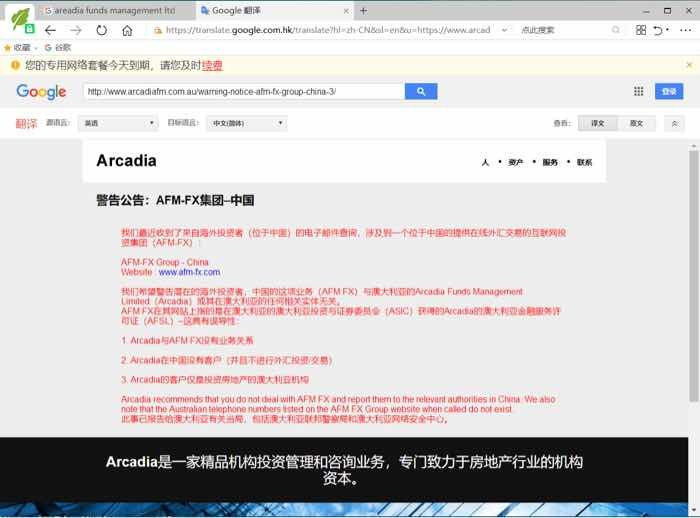

AFMFX is an international investment services provider based in Australia. The company offers complete financial market trading services to both institutional and retail clients around the world. This afmfx review looks at a broker that works under Australian Securities and Investments Commission regulation. ASIC provides regulatory oversight for the company's operations.

The broker focuses on Contract for Difference trading across spot and futures markets. AFMFX positions itself as a complete trading solutions provider. The company's business model focuses on delivering risk management and transfer solutions alongside traditional trading services. This approach helps meet diverse client needs in global financial markets.

AFMFX maintains compliance with Australian financial regulations as an ASIC-regulated entity. This adds credibility to its operations. The broker's international scope shows experience in managing cross-border trading requirements and regulatory compliance across different areas. However, we need to examine specific details about trading conditions, platform features, and customer service to provide a complete assessment of the broker's capabilities and suitability for different trader profiles.

Important Disclaimers

AFMFX operates across multiple areas as an international broker. Services offered may vary significantly depending on the client's location and applicable regulatory framework. Traders should verify the specific services, trading conditions, and regulatory protections available in their region before working with the broker.

This review uses available information about AFMFX's general business model and regulatory status. Specific trading conditions, fees, platform features, and customer service quality may require direct verification with the broker. Potential clients should conduct their own research and consider seeking independent financial advice before making trading decisions.

Rating Framework

Broker Overview

AFMFX operates as an Australian-based international investment services provider. The company serves a global clientele that includes both institutional investors and retail traders. The broker has established its presence in the competitive financial services sector by focusing on complete trading solutions and maintaining regulatory compliance through ASIC oversight.

The company's business model centers on providing Contract for Difference trading services. This enables clients to access various financial markets without directly owning underlying assets. This approach allows AFMFX to offer flexible trading opportunities across spot and futures markets. The strategy caters to different trading approaches and risk levels. The broker's emphasis on risk control and transfer solutions suggests a sophisticated approach to managing trading-related risks for its clients.

AFMFX's regulatory status under the Australian Securities and Investments Commission provides a framework for operational transparency and client protection. This afmfx review notes that ASIC regulation typically includes requirements for segregated client funds, adequate capitalization, and regular reporting. However, specific implementation details would require direct verification with the broker. The international scope of AFMFX's operations indicates experience in navigating complex regulatory environments across different areas.

Regulatory Jurisdiction: AFMFX operates under the supervision of the Australian Securities and Investments Commission. This ensures compliance with Australian financial services regulations and provides clients with regulatory protections available under this framework.

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods not detailed in available materials. This requires direct inquiry with the broker for current options and processing procedures.

Minimum Deposit Requirements: Minimum deposit requirements not specified in available materials. This would need verification directly with AFMFX for current account opening requirements.

Bonus Promotions: Information regarding promotional offers or bonus programs not detailed in available materials at the time of this review.

Tradeable Assets: AFMFX provides CFD trading services covering both spot and futures markets. This allows clients to access various financial instruments through derivative contracts rather than direct ownership.

Cost Structure: Specific information regarding spreads, commissions, and other trading costs not detailed in available materials. This requires direct inquiry for current pricing structure and fee schedules.

Leverage Ratios: Leverage ratios and margin requirements not specified in available materials. This would need verification with the broker for current offerings under applicable regulations.

Platform Options: Trading platform information not detailed in available materials. This requires direct verification of available platforms and their features.

Geographic Restrictions: Specific geographic restrictions or service limitations not detailed in available materials in this afmfx review.

Customer Support Languages: Available customer support languages not specified in available materials.

Detailed Rating Analysis

Account Conditions Analysis

The assessment of AFMFX's account conditions faces limitations due to limited publicly available information. We lack details about specific account types, minimum deposit requirements, and account features. Without detailed information about the range of account options, it becomes challenging to evaluate how well the broker accommodates different trader profiles and experience levels.

Account opening procedures, verification requirements, and the availability of specialized account types remain unclear from available materials. These include Islamic accounts or institutional accounts. The absence of specific information about account conditions makes it difficult to compare AFMFX's offerings with industry standards or assess their competitiveness in the market.

Potential clients considering AFMFX would need to contact the broker directly to understand available account types, associated benefits, and any restrictions or requirements. This afmfx review emphasizes the importance of obtaining detailed account information before making commitment decisions. This is particularly important regarding minimum deposits, maintenance fees, and any account-specific features that might impact the trading experience.

AFMFX's provision of CFD trading services indicates access to derivative instruments that can provide exposure to various financial markets. The broker's focus on complete trading solutions suggests some level of tool sophistication. However, specific details about research resources, analytical tools, and educational materials are not detailed in available materials.

The availability of both spot and futures market access through CFDs demonstrates some breadth in trading opportunities. This potentially allows clients to implement various trading strategies across different market conditions. However, without specific information about proprietary tools, third-party integrations, or research capabilities, it's difficult to assess the full scope of resources available to traders.

Educational resources, market analysis, and trading tools beyond basic CFD offerings remain unspecified in available materials. Potential clients interested in complete research and educational support would need to inquire directly about available resources. This includes market commentary, technical analysis tools, and educational programs that might enhance their trading capabilities.

Customer Service and Support Analysis

Information regarding AFMFX's customer service capabilities is not detailed in available materials. This includes available support channels, operating hours, and response times. The quality and accessibility of customer support represents a crucial factor for traders, particularly when dealing with time-sensitive trading issues or account-related inquiries.

We lack specific information about multilingual support, regional service availability, or specialized support for different client types. This makes it challenging to assess how well AFMFX serves its international client base. The broker's global operations suggest some level of international support capability. However, details regarding implementation and service quality remain unclear.

Support channel options such as phone, email, live chat, or dedicated account management are not specified in available materials. For traders considering AFMFX, direct evaluation of customer service responsiveness and effectiveness would be advisable before committing to the platform. This is particularly important for those requiring specialized support or operating in different time zones.

Trading Experience Analysis

The evaluation of AFMFX's trading experience faces significant limitations due to the absence of specific information. We lack details about trading platforms, execution quality, and user interface design. Platform stability, order execution speed, and the overall trading environment represent critical factors that directly impact trader success and satisfaction.

We don't have detailed information about available trading platforms, mobile accessibility, or platform-specific features. This makes it difficult to assess how AFMFX compares to industry standards in terms of technological capabilities and user experience. The quality of order execution, including slippage rates and execution speeds, remains unspecified in available materials.

Platform functionality, charting capabilities, and trading tools integration are not detailed in this afmfx review due to limited available information. Potential clients would need to evaluate platform performance through demo accounts or direct testing. This would help assess whether AFMFX's trading environment meets their specific requirements and trading style preferences.

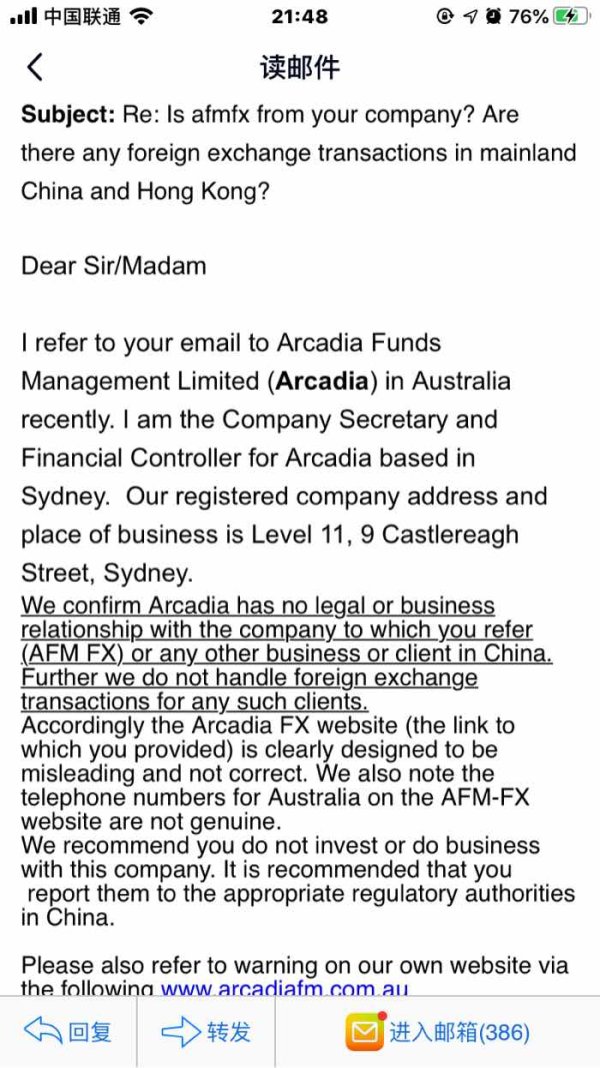

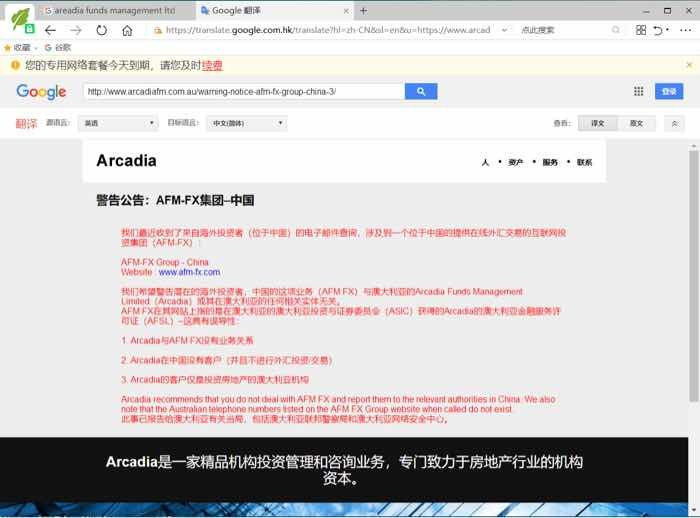

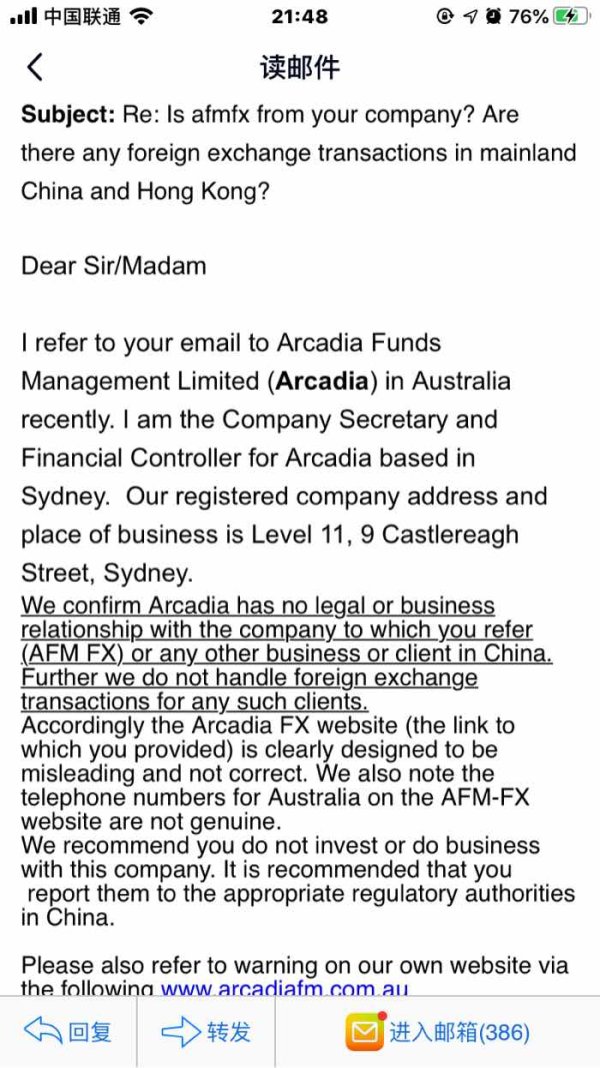

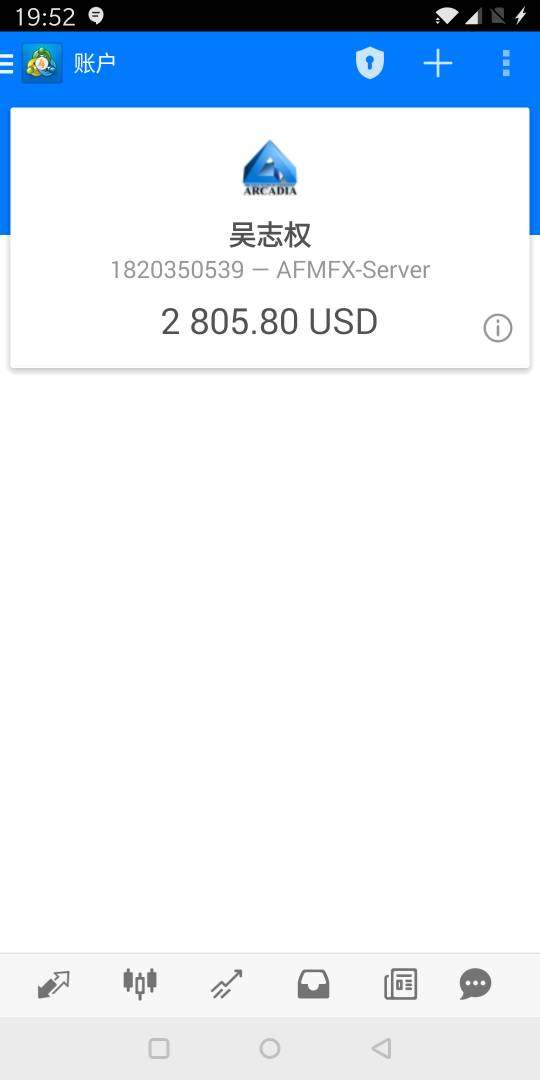

Trustworthiness Analysis

AFMFX's regulatory status under ASIC provides a significant foundation for trustworthiness assessment. ASIC regulation typically includes requirements for client fund segregation, adequate capitalization, and regular regulatory reporting. These contribute to overall broker reliability and client protection.

The broker's focus on risk control and transfer solutions suggests an understanding of risk management principles. However, specific implementation details and client protection measures beyond regulatory requirements are not detailed in available materials. The international scope of operations indicates experience in managing complex regulatory and operational requirements across different areas.

Specific information about fund security measures, insurance coverage, and transparency practices remains limited in available materials. While ASIC regulation provides a regulatory framework, potential clients should verify specific client protection measures. They should also check the broker's track record in handling client relationships and regulatory compliance over time.

User Experience Analysis

The assessment of AFMFX's user experience faces limitations due to limited available information. We lack details about interface design, account management processes, and overall client satisfaction levels. User experience encompasses various aspects including website functionality, account opening procedures, and ongoing account management capabilities.

We don't have specific user feedback or detailed information about registration processes, account verification procedures, and fund management interfaces. This makes it challenging to evaluate how user-friendly AFMFX's services are in practice. The broker's international operations suggest some level of experience in serving diverse client needs. However, specific implementation quality remains unclear.

Platform accessibility, mobile functionality, and the overall ease of conducting trading and account management activities are not detailed in available materials. Potential clients would benefit from direct evaluation of the user experience through demo accounts or initial small-scale engagement. This would help assess whether AFMFX's interface and procedures align with their preferences and requirements.

Conclusion

AFMFX presents as an ASIC-regulated international broker offering CFD trading services to global institutional and retail clients. The broker's regulatory compliance and focus on complete trading solutions provide a foundation for consideration. However, significant information gaps limit the ability to conduct a complete assessment.

The broker appears most suitable for traders specifically interested in CFD trading across spot and futures markets who value regulatory oversight through ASIC. However, the absence of detailed information regarding trading conditions, costs, platforms, and customer service quality makes direct inquiry and evaluation necessary before making commitment decisions.

AFMFX's regulatory status and international operations suggest legitimacy and experience. Potential clients should conduct thorough research regarding specific trading conditions, platform capabilities, and service quality. This will help determine suitability for their individual trading requirements and expectations.