Regarding the legitimacy of ActivoTrade forex brokers, it provides CNMV and WikiBit, .

Is ActivoTrade safe?

Pros

Cons

Is ActivoTrade markets regulated?

The regulatory license is the strongest proof.

CNMV Market Making License (MM)

Comisión Nacional del Mercado de valores

Comisión Nacional del Mercado de valores

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

ACTIVOTRADE VALORES, SOCIEDAD DE VALORES, SOCIEDAD ANÓNIMA

Effective Date:

2010-01-15Email Address of Licensed Institution:

atcliente@activotrade.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

919496235Licensed Institution Certified Documents:

Is Activo Trade Safe or a Scam?

Introduction

Activo Trade is a forex and CFD broker that has established itself within the competitive landscape of the online trading market. Founded in Spain, it aims to provide a diverse range of trading instruments and platforms to its clients. As the forex market continues to grow, traders must be vigilant when selecting a broker, as the risks of fraud and mismanagement are ever-present. This article will explore the safety and legitimacy of Activo Trade, providing a comprehensive analysis based on regulatory status, company background, trading conditions, and customer feedback. The investigation is based on a review of various sources, including regulatory disclosures, customer reviews, and expert analyses.

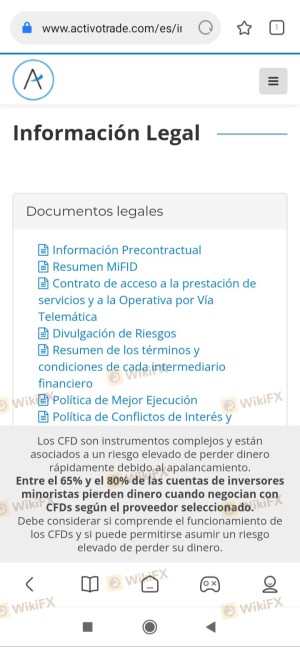

Regulation and Legitimacy

The regulatory framework surrounding a broker is essential in determining its legitimacy and safety. Activo Trade claims to operate under the supervision of the Comisión Nacional del Mercado de Valores (CNMV) in Spain. However, there are concerns regarding the actual enforcement of these regulations and the broker's compliance history.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CNMV | Not specified | Spain | Unverified |

The absence of a clear license number raises questions about the broker's regulatory compliance. Regulation is crucial as it provides a safety net for traders, ensuring that their funds are protected and that the broker adheres to specific operational standards. Brokers that lack robust regulatory oversight often pose higher risks to traders, as they may not be subject to regular audits or scrutiny.

Company Background Investigation

Activo Trade was established in 2020 and has since aimed to cater to a global clientele. The ownership structure is not extensively disclosed, and this lack of transparency can be a red flag for potential investors. The management teams background is another critical factor; however, details regarding their experience and qualifications are sparse.

A thorough background check on the company's history reveals that it has faced scrutiny regarding its operational practices. The lack of detailed information about the management team and their expertise further compounds the concern regarding the broker's transparency. Without clear disclosures, potential clients may find it challenging to assess the credibility of Activo Trade.

Trading Conditions Analysis

When evaluating the trading conditions offered by Activo Trade, it is essential to consider the overall fee structure and any unusual policies that may exist. Activo Trade presents itself as a competitive option, but traders should be aware of the potential hidden costs.

| Fee Type | Activo Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1-2 pips |

| Commission Model | Not specified | 0.1% - 0.5% |

| Overnight Interest Range | Not specified | Varies |

The lack of clarity regarding spreads and commission structures may lead to unexpected costs for traders. It is crucial for traders to fully understand the fee schedule before committing their funds, as hidden fees can significantly impact profitability. The absence of detailed information on overnight interest rates also raises concerns about the broker's transparency.

Customer Funds Security

The safety of customer funds is paramount when assessing a broker's reliability. Activo Trade claims to implement measures to protect client funds, including segregated accounts and potential investor compensation schemes. However, the effectiveness of these measures remains unclear.

The absence of a clear outline of how funds are protected, including whether negative balance protection is offered, is a significant concern. Traders should be cautious, as any historical incidents involving fund mismanagement or disputes could indicate deeper issues within the brokerage.

Customer Experience and Complaints

Customer feedback is an invaluable resource when evaluating a broker's trustworthiness. Activo Trade has received mixed reviews from users, with some praising its platform and others reporting issues with withdrawals and customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Platform Stability | Medium | Addressed |

| Customer Service Issues | High | Unresolved |

Common complaints include withdrawal delays and inadequate customer support, which can create frustration among traders. The companys response to these complaints has often been criticized as slow or ineffective, raising concerns about its commitment to customer satisfaction.

Platform and Trade Execution

The performance and reliability of the trading platform are crucial for a positive trading experience. Activo Trade offers various platforms, but users have reported mixed experiences regarding stability and execution quality.

Traders have expressed concerns about order execution speed, slippage, and the occurrence of rejected orders. These issues can significantly affect trading outcomes, especially for those employing high-frequency trading strategies. Signs of platform manipulation or instability can further exacerbate these concerns.

Risk Assessment

Using Activo Trade comes with a set of risks that potential clients must consider carefully. The lack of robust regulation, combined with customer complaints and transparency issues, creates a complex risk landscape.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unclear licensing and oversight |

| Fund Security | Medium | Segregated accounts, but unclear protections |

| Customer Support | High | Frequent complaints about responsiveness |

Traders should be aware of these risks and consider implementing risk mitigation strategies, such as starting with a demo account or limiting initial investments until they are confident in the broker's reliability.

Conclusion and Recommendations

In conclusion, while Activo Trade presents itself as a viable option for forex trading, there are significant concerns regarding its regulatory status, transparency, and customer feedback. The lack of clear regulation, coupled with customer complaints about withdrawal issues and inadequate support, suggests that traders should proceed with caution.

For those considering trading with Activo Trade, it is advisable to conduct thorough research and consider alternative brokers with more robust regulatory frameworks and positive user reviews. Reliable options include brokers that are well-regulated, offer transparent fee structures, and have a solid reputation for customer service. As always, ensure that you understand the risks involved and only invest what you can afford to lose.

Is ActivoTrade a scam, or is it legit?

The latest exposure and evaluation content of ActivoTrade brokers.

ActivoTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ActivoTrade latest industry rating score is 4.24, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.24 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.