Is Actitrades safe?

Business

License

Is ActivTrades A Scam?

Introduction

ActivTrades is a well-established online trading broker that has been operating since 2001. Headquartered in London, UK, it specializes in providing a platform for trading forex, contracts for difference (CFDs), and spread betting. With over two decades of experience in the financial markets, ActivTrades has built a reputation as a reliable broker, serving clients across more than 170 countries. However, as the financial industry continues to evolve, traders must remain vigilant and carefully evaluate the credibility of their chosen brokers. This is particularly important in the forex market, where the potential for scams and fraudulent activities can have significant financial repercussions. In this article, we will investigate the safety and legitimacy of ActivTrades, using a comprehensive assessment framework that includes regulatory compliance, company background, trading conditions, customer fund security, and client experiences.

Regulation and Legitimacy

The regulatory environment is a crucial aspect of any brokerage's legitimacy. ActivTrades is regulated by several reputable authorities, including the UK's Financial Conduct Authority (FCA), the Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg, and the Securities Commission of the Bahamas (SCB). Regulatory oversight is vital as it ensures that brokers adhere to strict standards of conduct, safeguarding client funds and promoting fair trading practices. Below is a summary of ActivTrades' regulatory information:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | 434413 | UK | Verified |

| CSSF | 1001 | Luxembourg | Verified |

| SCB | 199667 B | Bahamas | Verified |

| CMVM | 433 | Portugal | Verified |

| CVM | 198 | Brazil | Verified |

The quality of regulation at ActivTrades is notable, particularly due to its oversight by the FCA, which is recognized as a top-tier regulator. This enhances the broker's credibility and provides clients with a high level of investor protection. Furthermore, the broker has not faced significant compliance issues historically, which adds to its reputation as a trustworthy entity in the forex market.

Company Background Investigation

ActivTrades was founded in Switzerland in 2001 and relocated its headquarters to London in 2005. Over the years, the company has expanded its operations and established a presence in various regions, including Europe, the Middle East, and South America. The ownership structure of ActivTrades is transparent, with Alex Pusco serving as the founder and CEO. His extensive experience in the financial sector has guided the company's growth and development.

The management team at ActivTrades is composed of professionals with significant expertise in finance, trading, and regulatory compliance. This strong leadership is crucial in fostering a culture of transparency and accountability within the organization. ActivTrades also demonstrates a commitment to client education and support, offering a range of resources to help traders enhance their skills and knowledge.

In terms of transparency, ActivTrades provides clear information about its services, fees, and trading conditions on its website. However, some users have noted that financial data is not publicly disclosed, which could be a concern for potential clients seeking comprehensive insights into the broker's financial health. Overall, the company's history and management structure contribute positively to its reputation in the trading community.

Trading Conditions Analysis

When evaluating a broker's trustworthiness, the trading conditions offered are of paramount importance. ActivTrades employs a competitive pricing structure, with spreads starting from 0.5 pips on major currency pairs. The broker does not charge commissions on forex trades, which can be attractive for traders looking to minimize costs. Below is a comparison of ActivTrades' core trading costs against the industry average:

| Cost Type | ActivTrades | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 0.8 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Standard Rates | Varies |

While the spreads are generally competitive, it is essential to note that some trading instruments, particularly cryptocurrencies, may have wider spreads compared to industry averages. Additionally, ActivTrades imposes an inactivity fee of £10 after one year of no trading activity, which could be a drawback for infrequent traders.

Understanding the fee structure is crucial for traders, as hidden costs can significantly impact profitability. Overall, ActivTrades offers a transparent and competitive trading environment, but traders should be aware of the potential for higher costs on specific instruments and the inactivity fee.

Client Fund Security

The safety of client funds is a critical consideration when assessing the legitimacy of a broker. ActivTrades implements several measures to ensure the security of its clients' funds. All client funds are held in segregated accounts, separate from the broker's operational funds. This segregation helps protect client money in the event of the broker's insolvency.

Additionally, ActivTrades offers negative balance protection, ensuring that clients cannot lose more than their account balance, even during extreme market volatility. This feature is particularly important for traders engaged in leveraged trading, as it mitigates the risk of incurring significant losses.

Furthermore, ActivTrades provides additional insurance coverage through Lloyd's of London, offering up to $1 million in protection for client funds exceeding $10,000. This level of insurance is relatively rare among brokers and adds an extra layer of security for clients.

Historically, ActivTrades has maintained a strong track record regarding fund security, with no significant incidents reported that would raise concerns about the safety of client funds. Overall, the broker's commitment to safeguarding client assets contributes positively to its reputation in the forex market.

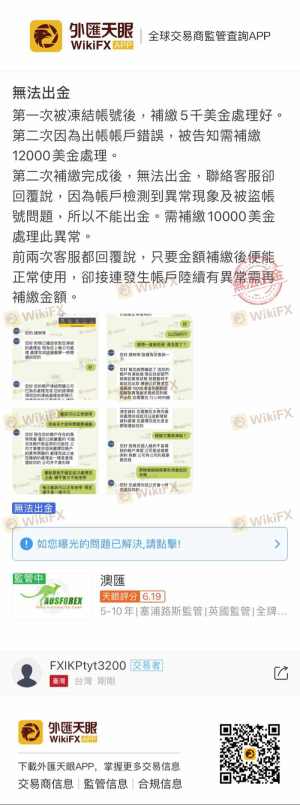

Customer Experience and Complaints

Client feedback is an essential aspect of evaluating a broker's reliability. ActivTrades generally receives positive reviews from users, particularly regarding its customer service and user-friendly trading platforms. However, like any broker, it is not without its complaints. Common issues reported by clients include withdrawal delays and concerns about the inactivity fee. Below is a summary of the main complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Prompt response, but issues persist |

| Inactivity Fee Concerns | Low | Company explains policy clearly |

One notable case involved a client who experienced delays in withdrawing funds, which was attributed to verification processes. While ActivTrades addressed the issue promptly, the client expressed frustration over the time taken to resolve the matter. Overall, the broker's customer support team has been rated positively, with many clients appreciating the responsiveness and professionalism of the staff.

Platform and Trade Execution

The performance of a trading platform is a critical factor in a trader's overall experience. ActivTrades offers multiple trading platforms, including its proprietary ActivTrader platform and the widely used MetaTrader 4 and 5. The platforms are known for their user-friendly interfaces and robust functionalities, catering to traders of all levels.

In terms of order execution, ActivTrades boasts an average execution time of under 0.004 seconds, which is impressive and contributes to a seamless trading experience. However, some users have reported experiencing slippage during high volatility periods. Additionally, there are no indications of platform manipulation, and the broker operates on a no-dealing desk model, which further enhances transparency in trade execution.

Risk Assessment

Engaging with any broker involves inherent risks, and it is essential to understand these risks before trading. Below is a summary of the key risk areas associated with ActivTrades:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Strong regulatory oversight from reputable authorities. |

| Fund Security Risk | Low | Segregated accounts and insurance coverage provide robust protection. |

| Trading Cost Risk | Medium | Potential for high costs on specific instruments and inactivity fees. |

| Platform Risk | Low | No indications of manipulation; reliable execution. |

To mitigate these risks, traders are advised to thoroughly understand the fee structure, utilize demo accounts to practice trading strategies, and maintain regular trading activity to avoid inactivity fees.

Conclusion and Recommendations

In conclusion, ActivTrades is a well-regulated broker with a solid reputation in the forex market. Based on the evidence presented, there are no significant signs of fraud or misconduct associated with the broker. The combination of strong regulatory oversight, robust fund security measures, and positive client feedback indicates that ActivTrades is a safe option for traders.

However, potential clients should remain aware of the inactivity fee and the possibility of higher costs on specific instruments. For traders seeking a reliable and secure trading environment, ActivTrades is a commendable choice. Nevertheless, those looking for a broader range of assets or more competitive pricing might consider exploring alternatives such as IG, Saxo Bank, or OANDA, which also offer strong regulatory compliance and diverse trading options.

Ultimately, traders must conduct their own research and assess their individual needs to determine if ActivTrades aligns with their trading goals.

Is Actitrades a scam, or is it legit?

The latest exposure and evaluation content of Actitrades brokers.

Actitrades Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Actitrades latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.