Is Absolute Markets safe?

Pros

Cons

Is Absolute Markets A Scam?

Introduction

Absolute Markets is a forex broker that emerged in 2021, claiming to provide a user-friendly trading environment with a broad array of financial instruments, including currency pairs, commodities, and cryptocurrencies. Given the volatile nature of the forex market and the prevalence of fraudulent schemes, traders must exercise caution when selecting a broker. The importance of assessing a broker's legitimacy cannot be overstated, as it directly impacts the safety of the traders funds and their overall trading experience. This article investigates the credibility of Absolute Markets by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory environment for forex brokers is crucial in determining their legitimacy and reliability. Absolute Markets is registered in Saint Vincent and the Grenadines and claims to be regulated by the SVG Financial Services Authority (SVG FSA). However, it is important to note that the SVG FSA does not provide comprehensive oversight for forex trading, raising concerns about the broker's legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | N/A | Saint Vincent | Not Validated |

The lack of stringent regulation poses significant risks for traders, as they have limited recourse in the event of disputes or financial losses. Reports indicate that Absolute Markets has faced numerous allegations of failing to fulfill withdrawal requests and other obligations to its clients. This lack of regulatory oversight contributes to the perception that Absolute Markets may not be a safe option for traders.

Company Background Investigation

Absolute Markets LLC was founded by a group of individuals with purported experience in the trading industry. However, the specifics regarding the management team and their expertise remain unclear, leading to questions about the transparency of the company's operations. The absence of detailed information about the founders and their professional backgrounds raises concerns about the broker's credibility.

Moreover, the company's operational history is relatively short, which may be a red flag for potential investors. A broker with a longer track record is typically viewed as more reliable, as it has endured various market conditions and established a reputation among its clients. The lack of accessible information regarding the company's ownership structure and operational practices further complicates the assessment of whether Absolute Markets is safe for trading.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Absolute Markets claims to provide competitive spreads and a variety of account types. However, a closer examination reveals potential issues in their fee structure that may not be immediately apparent to new traders.

| Fee Type | Absolute Markets | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.4 pips | 1.0 pips |

| Commission Model | $10 per lot (ECN) | $7 per lot |

| Overnight Interest | Varies | Varies |

The spreads offered by Absolute Markets are on the higher end compared to industry averages, particularly for standard accounts. Additionally, the commission structure may not be as favorable as it appears, especially for traders utilizing the ECN account type, which incurs a $10 commission per round lot. Such fees can significantly affect profitability, particularly for high-frequency traders. Moreover, the broker's inactivity fee of $5 after six months of no trading activity can be viewed as an additional burden on traders.

Customer Fund Safety

The safety of customer funds is paramount when considering a broker. Absolute Markets claims to implement measures such as segregated accounts and negative balance protection. Segregated accounts are designed to keep client funds separate from the broker's operational funds, which is a standard practice among reputable brokers. However, the effectiveness of these measures is questionable given the broker's lack of stringent regulatory oversight.

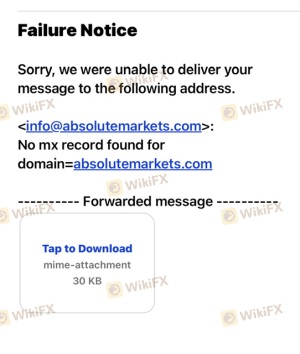

Historical complaints from customers indicate that there have been significant issues with fund withdrawals, with several users reporting that their requests were either denied or delayed without adequate explanation. Such incidents highlight potential vulnerabilities in the broker's operational practices and raise concerns about the safety of client funds.

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reliability. A review of user experiences with Absolute Markets reveals a mixed bag, with many traders expressing dissatisfaction regarding withdrawal processes and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delay | Medium | Average |

Common complaints include difficulties in withdrawing funds and unresponsive customer service. For instance, one user reported that after depositing a significant amount, their withdrawal request was ignored, leading to frustration and financial loss. Another trader noted that while the platform initially appeared reliable, issues began to surface once they attempted to withdraw their profits. These patterns of complaints raise significant concerns about whether Absolute Markets is safe for potential investors.

Platform and Execution

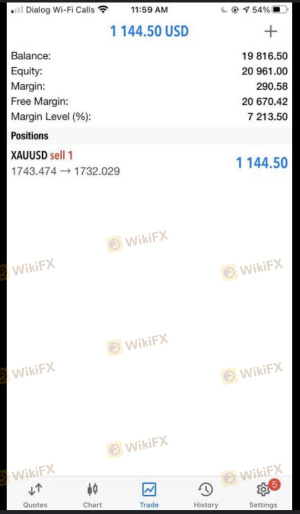

The performance of a trading platform is crucial to a trader's success. Absolute Markets offers the widely-used MetaTrader 4 (MT4) platform, known for its user-friendly interface and comprehensive trading tools. However, reports suggest that users have experienced issues with order execution, including slippage and rejections during volatile market conditions.

The quality of order execution is a critical factor for traders, particularly those engaged in scalping or high-frequency trading strategies. Instances of slippage can erode profits, and frequent rejections may indicate underlying technical issues within the platform. Traders should be cautious and consider these factors when evaluating whether Absolute Markets is a safe option for their trading activities.

Risk Assessment

Engaging with any forex broker entails inherent risks, and Absolute Markets is no exception. The following risk assessment highlights key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of stringent oversight raises concerns. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues. |

| Execution Risk | Medium | Reports of slippage and rejections during trades. |

To mitigate these risks, potential traders should conduct thorough research and consider starting with a smaller investment. Additionally, utilizing demo accounts to familiarize themselves with the platform before committing real funds can be beneficial.

Conclusion and Recommendations

In conclusion, while Absolute Markets presents itself as a viable option for forex trading, the evidence suggests that it may not be a safe choice for traders. The lack of robust regulation, combined with numerous complaints regarding withdrawals and customer service, raises significant red flags.

Traders should exercise caution and consider alternative brokers that are well-regulated and have established track records. For those seeking reliable trading options, brokers regulated by reputable authorities such as the FCA or ASIC should be prioritized. Ultimately, the safety of one's capital should always come first, and thorough due diligence is essential in the selection process.

Is Absolute Markets a scam, or is it legit?

The latest exposure and evaluation content of Absolute Markets brokers.

Absolute Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Absolute Markets latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.