Is 10Brokers safe?

Business

License

Is 10Brokers A Scam?

Introduction

10Brokers positions itself as an online trading platform offering a variety of financial instruments, including forex, CFDs, commodities, indices, and cryptocurrencies. As the forex market continues to expand globally, traders are increasingly faced with a multitude of brokers, making it essential to evaluate their legitimacy and safety. The rise of online trading has also led to an increase in scams and fraudulent platforms, which can result in significant financial losses for unsuspecting traders. Therefore, it is crucial for potential investors to conduct thorough due diligence before engaging with any broker. This article employs a comprehensive assessment framework based on the latest research and expert reviews to determine whether 10Brokers is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is a vital indicator of its legitimacy and reliability. A regulated broker is subject to oversight by financial authorities, which provides a layer of protection for traders. Unfortunately, 10Brokers operates without any credible regulatory oversight, raising significant concerns about its trustworthiness.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

10Brokers claims to be based in Estonia; however, investigations reveal that it is not registered with the Estonian Financial Supervisory Authority (EFSA). Furthermore, the company is linked to Euro Wealth OÜ, which has been associated with several other names, all of which have faced regulatory scrutiny. The absence of a valid license means that traders using this platform have no recourse in the event of disputes or fraudulent activities. Moreover, the UK's Financial Conduct Authority (FCA) has issued warnings against 10Brokers, stating that it is not authorized to conduct regulated activities, further underscoring the potential risks involved. The lack of regulatory oversight is a red flag that should not be overlooked by potential investors.

Company Background Investigation

10Brokers is operated by Euro Wealth OÜ, a company that claims to be registered in Tallinn, Estonia. However, the lack of transparency regarding its ownership structure and management team raises further concerns. The company has been linked to multiple names, including All Protech OÜ and Nostro Technology OÜ, both of which have been blacklisted by various regulatory authorities.

The management team behind 10Brokers remains largely anonymous, with little information available regarding their qualifications or experience in the financial industry. This lack of transparency is alarming, as reputable brokers typically provide clear information about their leadership and operational history. The absence of such details makes it challenging for potential investors to assess the company's credibility and reliability. Furthermore, the companys website has been reported as inactive, indicating a possible cessation of operations. This inactivity could signify that 10Brokers is no longer operational, making it imperative for traders to exercise caution.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions it offers is essential. 10Brokers advertises a minimum deposit requirement of $50, which is relatively low compared to industry standards. However, discrepancies have been noted, with some sources indicating that the minimum deposit could be as high as $500.

| Fee Type | 10Brokers | Industry Average |

|---|---|---|

| Spread on Major Pairs | 3 pips | 1.6 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread on major currency pairs is reported to start at 3 pips, significantly higher than the industry average of 1.6 pips. This high cost can erode potential profits and indicates that traders may not receive competitive pricing. Furthermore, the commission structure is unclear, which is concerning as transparency in fees is a hallmark of reputable brokers. The lack of clarity around fees and the high spreads suggest that 10Brokers may not be the most favorable choice for traders seeking cost-effective trading conditions.

Client Funds Security

The safety of client funds is paramount in the trading industry. Reputable brokers implement strict measures to protect client deposits, such as segregating client funds from operational funds and offering investor protection schemes. Unfortunately, 10Brokers does not provide any information regarding its fund security measures.

The absence of fund segregation raises significant concerns, as it means that client funds could be at risk in the event of the broker's insolvency. Additionally, there are no indications of negative balance protection policies, which can leave traders vulnerable to losing more than their initial investments. Historical complaints and warnings from regulatory bodies suggest that 10Brokers has not prioritized client fund security, further highlighting the risks associated with trading on this platform.

Customer Experience and Complaints

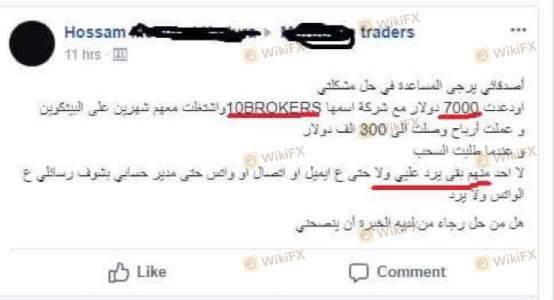

Customer feedback is a critical component in assessing a broker's reliability. Reviews and testimonials from users of 10Brokers reveal a pattern of negative experiences, particularly concerning withdrawal issues. Many clients have reported difficulties in retrieving their funds, with some claiming that the broker has ceased communication altogether after initial deposits.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | High | Poor |

| High Spreads and Fees | Medium | Minimal |

One notable case involved a trader who deposited $7,000 and reported making significant profits, only to find that their withdrawal requests were repeatedly denied. Such complaints are indicative of potential fraudulent practices, as they align with common tactics employed by scam brokers to retain client funds. The overall negative sentiment surrounding customer support and responsiveness further underscores the risks associated with 10Brokers.

Platform and Trade Execution

The trading platform offered by 10Brokers is the widely used MetaTrader 4 (MT4), known for its user-friendly interface and robust trading tools. However, the quality of trade execution remains a concern, particularly given the high spread costs. Reports of slippage and order rejections have surfaced, leading to questions about the platform's reliability.

Traders have also expressed concerns regarding potential platform manipulation, where brokers may interfere with trade execution to benefit from client losses. Such practices are often associated with unregulated brokers, raising further alarms about the integrity of 10Brokers' trading environment.

Risk Assessment

Engaging with 10Brokers presents several risks that traders should be aware of. The absence of regulation, high fees, and poor customer feedback contribute to an overall high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No credible oversight or protection |

| Financial Risk | High | High spreads and unclear fees |

| Operational Risk | Medium | Inactive website and withdrawal issues |

To mitigate these risks, potential investors should consider alternative brokers that are regulated and have established positive reputations in the industry. Conducting thorough research and seeking out reputable trading platforms can significantly reduce the likelihood of falling victim to scams.

Conclusion and Recommendations

In conclusion, the evidence suggests that 10Brokers exhibits several characteristics commonly associated with scam brokers. The lack of regulation, high fees, and numerous customer complaints raise significant red flags. It is advisable for traders to approach this broker with extreme caution, if at all.

For those seeking reliable trading options, it is recommended to consider alternatives such as brokers regulated by reputable authorities like the FCA or ASIC. These brokers typically offer better security for client funds, more transparent fee structures, and a commitment to regulatory compliance. Overall, potential investors should prioritize safety and transparency when selecting a trading platform, and it is clear that 10Brokers is not safe for trading.

Is 10Brokers a scam, or is it legit?

The latest exposure and evaluation content of 10Brokers brokers.

10Brokers Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

10Brokers latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.