Xinfx 2025 Review: Everything You Need to Know

In the rapidly evolving world of forex trading, choosing the right broker is crucial for success. This review of Xinfx reveals a host of concerns regarding its legitimacy, regulatory status, and overall user experience. With a lack of regulatory oversight and numerous negative user experiences, potential traders should exercise caution before engaging with this broker.

Note: It is important to recognize that Xinfx operates across different jurisdictions, which can affect user experience and regulatory compliance. The analysis presented here is based on various sources to ensure fairness and accuracy.

Ratings Overview

How We Rated the Broker: Ratings are based on a combination of user reviews, expert opinions, and factual data gathered from multiple sources.

Broker Overview

Founded recently, Xinfx operates under the name Xin Market Ltd. and is based in the United States. However, it lacks proper regulatory oversight, which is a significant red flag for potential clients. The broker claims to offer the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are popular among traders for their advanced features. The range of tradable assets includes forex pairs, commodities, and CFDs, but the absence of a regulatory framework raises serious concerns about safety and reliability.

Detailed Analysis

Regulatory Status

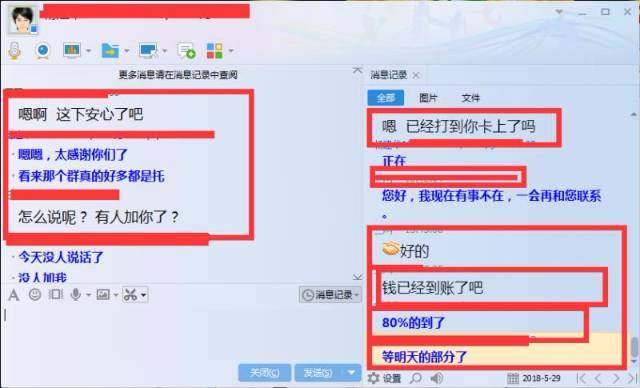

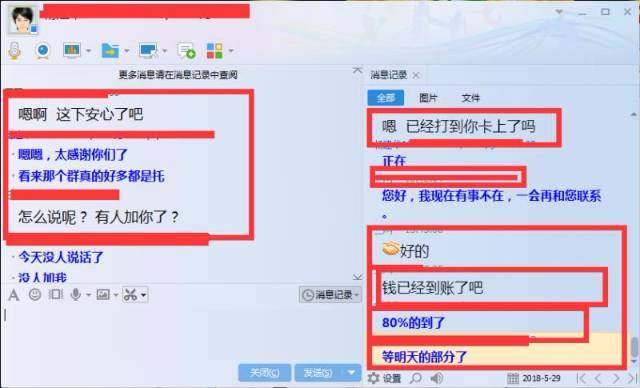

Xinfx is not regulated by any recognized financial authority, which poses a significant risk to traders. According to WikiFX, the broker is operating without a valid license and has been flagged for its low score. This unregulated status means that clients have little to no recourse in the event of disputes or issues related to fund withdrawals.

Deposit/Withdrawal Currencies and Cryptocurrencies

The broker does not provide clear information on accepted deposit or withdrawal methods, leading to uncertainty among users. Additionally, there is no mention of cryptocurrency trading options, which could be a disadvantage for traders looking to diversify their portfolios.

Xinfx has not clearly stated its minimum deposit requirements, which can deter potential clients. Furthermore, there are no promotions or bonuses offered, making it less attractive compared to other brokers that provide incentives for new clients.

Tradable Asset Classes

The broker claims to offer a variety of asset classes, including forex, commodities, and CFDs. However, the lack of regulatory oversight raises questions about the integrity of these offerings. Many users have reported difficulties in executing trades, which may indicate underlying issues with the trading platform.

Costs (Spreads, Fees, Commissions)

There is limited information available regarding the cost structure of trading with Xinfx. Without transparency in spreads, fees, and commissions, traders may find themselves facing unexpected costs that could significantly impact their profitability.

Leverage

While the broker does not specify leverage options, it's essential to note that high leverage can amplify both potential gains and losses. Traders should be cautious when dealing with unregulated brokers that may offer high leverage without adequate risk management practices.

Xinfx claims to support popular trading platforms like MT4 and MT5. However, user reviews suggest that the platform's performance may not be reliable, leading to frustration for traders attempting to execute their strategies effectively.

Restricted Regions

There is no clear information about the regions where Xinfx operates, but the absence of regulation suggests that it may not be suitable for traders in jurisdictions with strict financial regulations.

Available Customer Service Languages

Customer service appears to be one of the weakest aspects of Xinfx. Users have reported difficulties in reaching out for support, with complaints about unresponsive customer service and a lack of assistance in resolving issues.

Rating Summary

Detailed Breakdown

-

Account Conditions: With no clear minimum deposit and a lack of regulatory backing, users face significant risks when opening accounts with Xinfx.

Tools and Resources: The availability of MT4 and MT5 is a positive aspect, but the platform's reliability is questionable, leading to a lower rating.

Customer Service & Support: The inability to provide adequate customer support is a critical flaw, with many users reporting unresponsiveness.

Trading Experience: Users have expressed dissatisfaction with the trading experience, citing issues with execution and overall platform performance.

Trustworthiness: The lack of regulation and numerous user complaints contribute to a very low trustworthiness score, making it a risky choice for traders.

User Experience: Overall, user experiences have been largely negative, with many advising against engaging with this broker.

In summary, this Xinfx review highlights several significant concerns regarding the broker's legitimacy and reliability. Potential traders should proceed with caution and consider more reputable alternatives to safeguard their investments.