Is XINFX safe?

Pros

Cons

Is Xinfx Safe or Scam?

Introduction

Xinfx is a forex broker that has emerged in the trading market, positioning itself to attract both novice and experienced traders. As the forex market continues to grow, the number of brokers has surged, making it essential for traders to meticulously assess the legitimacy and reliability of these platforms. Given the potential for financial losses and the prevalence of fraudulent schemes, it is crucial for traders to conduct thorough due diligence before committing their funds. This article will investigate Xinfx's regulatory status, company background, trading conditions, client safety measures, and customer feedback to determine whether Xinfx is safe or a potential scam.

To evaluate Xinfx, we employed a comprehensive investigation method, analyzing various online sources, regulatory databases, and user reviews. Our assessment framework focuses on key areas such as regulation, company history, trading conditions, and customer experiences. By synthesizing this information, we aim to provide a balanced view of Xinfxs operational integrity.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. Regulation serves to protect traders by ensuring that brokers adhere to strict operational guidelines and maintain transparency in their dealings. In the case of Xinfx, our research indicates that it operates without any significant regulatory oversight, which is a red flag for potential investors.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a valid regulatory license means that Xinfx is not subject to the same scrutiny and consumer protection measures as regulated brokers. This lack of oversight raises concerns about the broker's legitimacy and operational practices. Furthermore, the broker's website does not provide any information regarding its compliance with industry standards, making it difficult for traders to assess its trustworthiness. Given these factors, it is advisable for potential clients to exercise caution when considering whether Xinfx is safe for trading.

Company Background Investigation

A thorough examination of a broker's company background can reveal important insights into its reliability. Xinfx, which operates under the name Xin Market Ltd., has limited information available regarding its history, ownership structure, and management team. Such opacity is often associated with unregulated brokers that may not prioritize transparency.

While the broker claims to be based in the United States, there are no verifiable details about its establishment or the credentials of its management team. This lack of transparency can be concerning, as it may indicate a reluctance to disclose essential information that could help potential clients make informed decisions. Without a clear understanding of the company's history and the expertise of its management, traders may be left wondering whether Xinfx is safe or simply another untrustworthy entity in the forex market.

Trading Conditions Analysis

Understanding a broker's trading conditions is vital for assessing its overall value proposition. Xinfx's fee structure appears to be less competitive than that of established brokers, which could impact traders' profitability.

| Fee Type | Xinfx | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | High | Low |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The high spreads and lack of a transparent commission structure suggest that traders may incur higher costs when trading with Xinfx. Moreover, the absence of clear information regarding overnight interest rates raises questions about potential hidden fees that could further erode profits. Given these trading conditions, it is crucial for traders to critically evaluate whether Xinfx is safe for their trading activities.

Client Funds Safety

The safety of client funds is paramount when considering a broker. Reliable brokers typically implement strict measures to ensure the security of their clients' deposits. However, in the case of Xinfx, there is a lack of information regarding its fund protection policies.

Traders should look for features such as segregated accounts, investor protection schemes, and negative balance protection. Unfortunately, Xinfx does not provide any details on these critical safety measures, which raises serious concerns about the security of clients' funds. In the absence of such protections, traders may find themselves vulnerable to potential losses without any recourse. Therefore, it is essential to consider the risks involved and question whether Xinfx is safe before investing.

Customer Experience and Complaints

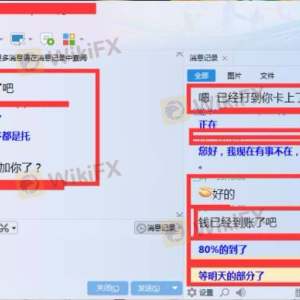

Customer feedback is an invaluable resource for assessing a broker's reliability. In the case of Xinfx, user reviews are mixed, with several complaints highlighting issues related to withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

Common complaints include difficulties in accessing funds, which is a significant red flag for any broker. Additionally, the quality of customer service has been reported as subpar, with clients experiencing long wait times for responses. Such patterns can indicate a lack of professionalism and may suggest that Xinfx is not safe for traders who require timely support.

Platform and Execution

The trading platform is another critical aspect that can influence a trader's experience. Xinfx appears to offer a standard trading platform; however, there are concerns regarding its performance and reliability. Traders have reported issues related to order execution quality, including slippage and rejected orders.

These execution problems can significantly impact trading outcomes, especially in volatile market conditions. Moreover, any signs of platform manipulation should be taken seriously, as they can undermine a trader's confidence in the broker. Given these factors, potential clients should carefully consider whether Xinfx is safe for their trading needs.

Risk Assessment

Engaging with any broker carries risks, and it is essential to evaluate these risks comprehensively.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Financial Risk | Medium | High trading costs can erode profits. |

| Fund Safety Risk | High | Lack of transparency in fund protection. |

The overall risk assessment indicates that trading with Xinfx may involve considerable risks. Traders should be aware of these potential pitfalls and take steps to mitigate them, such as starting with a small investment or seeking alternative brokers with better safety records.

Conclusion and Recommendations

In conclusion, the evidence suggests that Xinfx is not safe for traders. The lack of regulatory oversight, transparency in company operations, high trading costs, and numerous customer complaints raise significant red flags. Potential clients should approach this broker with caution and consider the risks involved before proceeding.

For traders seeking reliable alternatives, it is advisable to explore brokers with strong regulatory credentials, transparent fee structures, and positive customer feedback. Brokers such as XM or OANDA are examples of platforms that have established themselves as trustworthy options in the forex market. Ultimately, thorough research and careful consideration are critical for ensuring a safe trading experience in the forex market.

Is XINFX a scam, or is it legit?

The latest exposure and evaluation content of XINFX brokers.

XINFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XINFX latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.