WTM 2025 Review: Everything You Need to Know

Summary

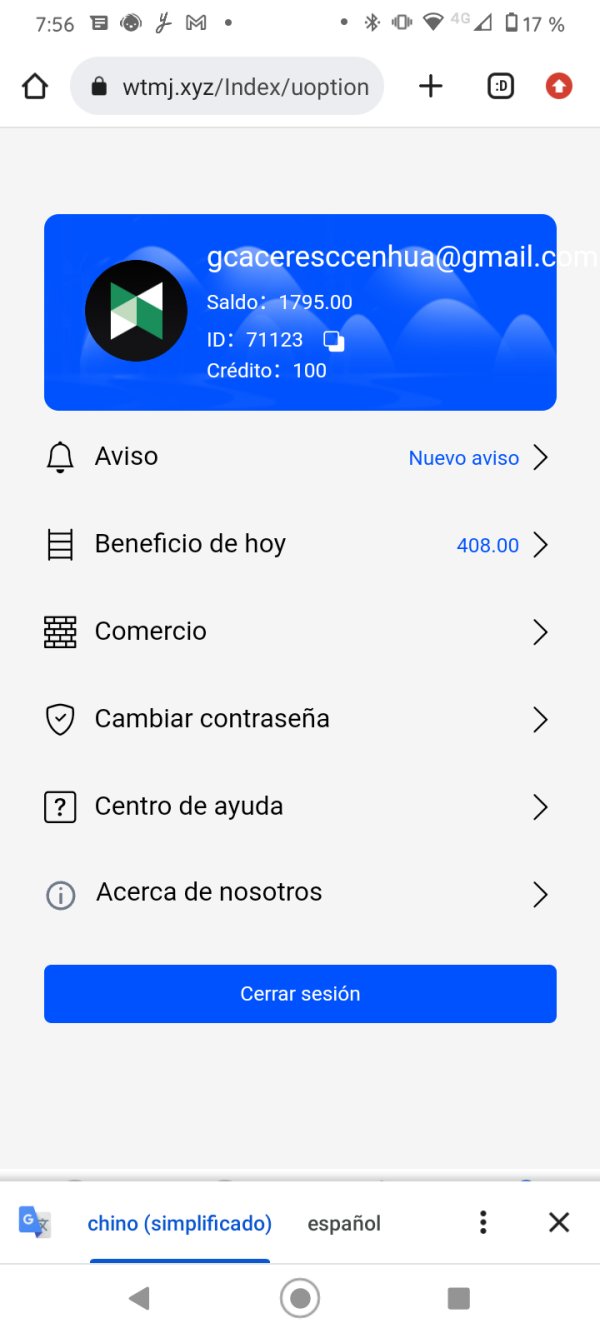

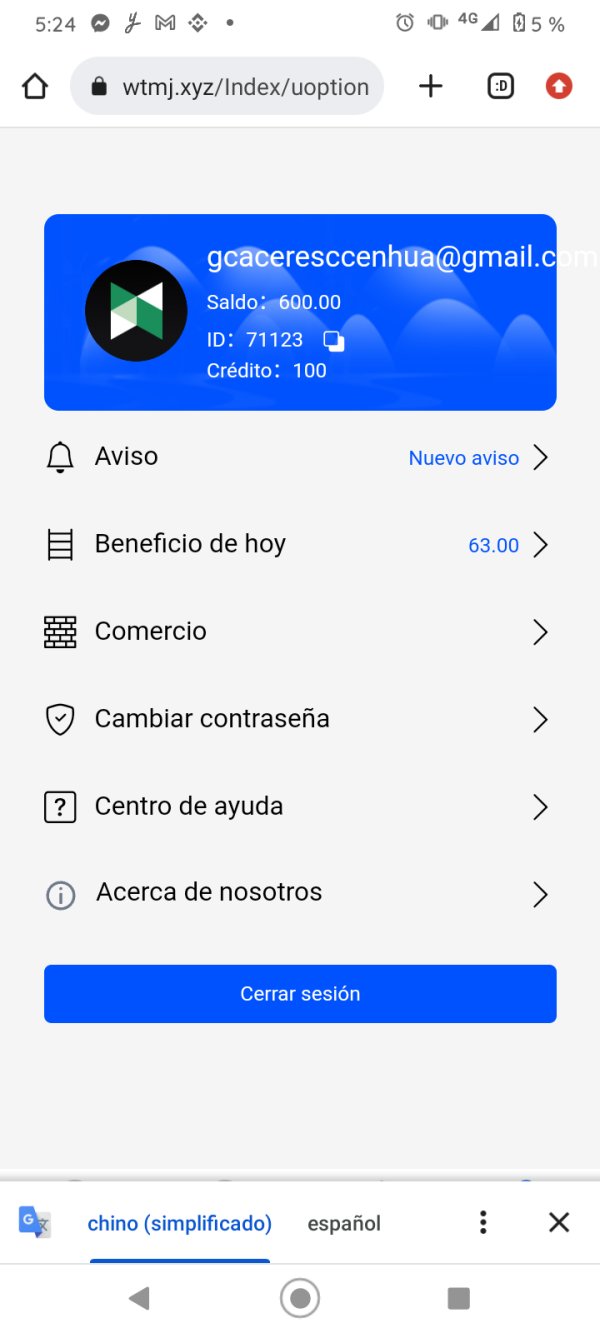

This wtm review shows a broker with mixed user feedback and unclear regulatory standing. WTM works as a multi-faceted financial services provider, offering both CFD trading through their Wave to Markets platform and educational programs via their Way to Million project. The broker presents a complex profile that needs careful examination by potential users.

WTM's main offerings include MT4 CFD trading capabilities and affiliate marketing training programs designed for beginners and intermediate traders. The platform targets individuals seeking to learn trading basics while building potentially profitable marketing businesses. However, user experiences vary a lot, with some praising the educational aspects while others raise serious concerns about legitimacy.

According to available information, WTM IT Reviews shows a rating of 4.7/5, suggesting positive user experiences in certain areas. However, this rating contrasts sharply with claims found on scam advisory websites, creating a split perception of the broker's credibility. The broker mainly serves newcomers to trading and those interested in affiliate marketing opportunities, positioning itself as an educational platform rather than a traditional brokerage.

The company's regulatory status remains unclear, with no specific licensing information readily available in current market data. This regulatory confusion significantly impacts the overall assessment and raises important considerations for potential users regarding fund security and legal protections.

Important Notice

Regional Variations: WTM's regulatory compliance and operational legality may vary significantly across different areas. The lack of clear regulatory information in available sources suggests potential compliance issues in certain regions. Prospective users should verify local regulations and the broker's licensing status in their specific area before engaging with any services.

Review Methodology: This assessment is based on available user feedback, online reviews, and publicly accessible information about WTM's services. Due to limited comprehensive data, some aspects of the broker's operations could not be thoroughly evaluated. Users are advised to conduct independent research and due diligence before making any financial commitments.

Rating Framework

Broker Overview

WTM operates as a UK-based commercial financial broker providing funding arrangement services and trading platform access. The company has developed a dual approach to financial services, combining traditional CFD trading capabilities with educational affiliate marketing programs. This business model positions WTM uniquely in the market, targeting users who seek both trading opportunities and income generation through marketing activities.

The broker's establishment date and detailed company background information are not clearly specified in available sources. However, WTM Finance operates within the UK financial services sector, suggesting compliance with local business registration requirements. The company's primary focus appears to be on providing accessible trading education and platform services to newcomers in the financial markets.

WTM's main trading platform uses the popular MetaTrader 4 system through their Wave to Markets service. This platform choice aligns with industry standards and provides users with familiar trading tools and interfaces. The broker offers CFD trading capabilities, though specific asset classes and instrument details are not fully detailed in current available information. The absence of clear regulatory oversight information raises questions about the broker's compliance status and operational transparency.

Regulatory Status: Current sources do not provide specific information about WTM's regulatory oversight or licensing authorities. This absence of clear regulatory information represents a significant concern for potential users seeking regulated trading environments.

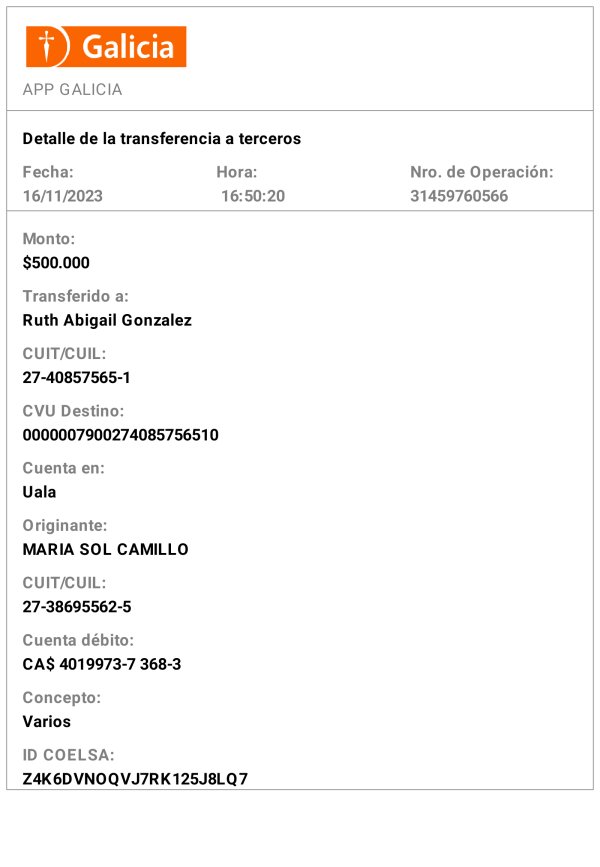

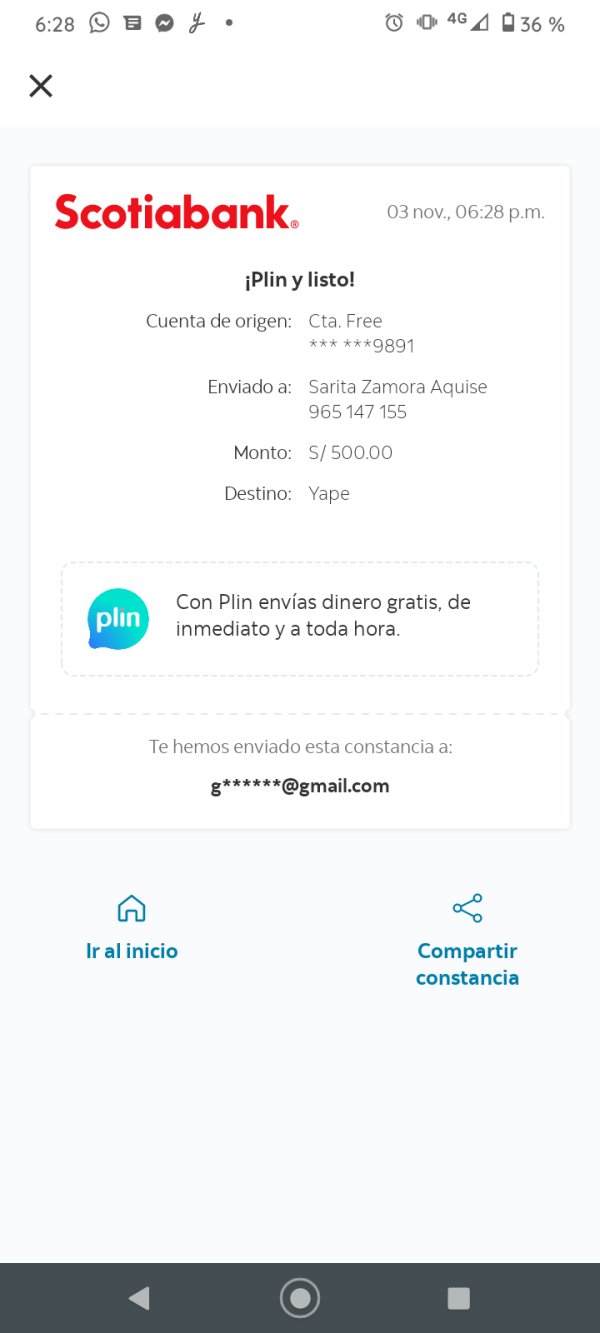

Deposit and Withdrawal Methods: Specific information about available payment methods, processing times, and associated fees is not detailed in available sources. Users should inquire directly about supported payment options before account opening.

Minimum Deposit Requirements: The minimum deposit threshold for account opening is not specified in current market information. This detail would typically be available on the broker's official website or through direct customer service contact.

Promotional Offers: Information about welcome bonuses, trading incentives, or promotional campaigns is not available in current sources. Potential users should verify current promotional offerings directly with the broker.

Tradeable Assets: While CFD trading is mentioned, specific details about available currency pairs, commodities, indices, or other financial instruments are not fully covered in available information.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not available in current sources. This wtm review cannot provide specific cost comparisons due to insufficient data availability.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available information, representing an important knowledge gap for potential traders.

Platform Choices: The primary platform offering is MT4 through Wave to Markets, providing standard trading functionality expected from this popular platform.

Geographic Restrictions: Specific information about restricted countries or regional limitations is not detailed in current sources.

Customer Support Languages: Available customer service languages are not specified in current market information.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of WTM's account conditions faces significant limitations due to insufficient information in available sources. Traditional account types, such as standard, premium, or VIP tiers, are not clearly outlined in current market data. This lack of transparency makes it challenging for potential users to understand what account options might be available and their respective features.

Minimum deposit requirements, which typically vary by account type, remain unspecified. This information gap prevents meaningful comparison with industry standards or assessment of accessibility for different user segments. Account opening procedures and required documentation are similarly unclear, making it difficult to evaluate the onboarding process complexity.

Special account features, such as Islamic accounts for Sharia-compliant trading or demo accounts for practice trading, are not mentioned in available sources. These features are increasingly important for brokers serving diverse global markets. The absence of clear account condition information significantly impacts this wtm review and suggests potential users should seek detailed clarification directly from the broker before proceeding.

WTM's tools and resources offering centers around the MT4 platform through Wave to Markets, which receives positive user feedback according to available reviews. The MT4 platform provides standard trading tools including technical analysis indicators, charting capabilities, and automated trading support through Expert Advisors. This platform choice aligns with industry standards and offers familiarity for experienced traders.

The Way to Million educational program represents a unique resource offering, focusing on affiliate marketing training alongside trading education. This dual approach distinguishes WTM from traditional brokers by providing alternative income generation strategies. User feedback suggests appreciation for the educational components, though complete curriculum details are not available in current sources.

Research and analysis resources, market commentary, and economic calendar features are not specifically detailed in available information. These tools are typically important for informed trading decisions, and their absence from current data represents a limitation in evaluating WTM's analytical support capabilities. The broker's approach to automated trading support through MT4 provides standard functionality, though specific restrictions or enhancements are not clearly outlined.

Customer Service and Support Analysis

Customer service evaluation for WTM faces significant limitations due to insufficient information in available sources. Standard support channels such as live chat, email support, phone assistance, and response time benchmarks are not detailed in current market data. This absence of service information makes it challenging to assess the broker's commitment to customer support quality.

Response time performance, which is crucial for trading-related inquiries, cannot be evaluated based on available information. Similarly, service quality metrics and customer satisfaction indicators are not present in current sources. The lack of specific customer service feedback in user reviews represents a notable gap in understanding the broker's support capabilities.

Multilingual support availability, which is increasingly important for international brokers, is not specified in current information. Operating hours for customer service and regional support variations are similarly unclear. This information gap significantly impacts the ability to provide a complete customer service assessment in this evaluation.

Trading Experience Analysis

User feedback regarding WTM's trading experience presents mixed perspectives, with some negative evaluations noted in available sources. While the MT4 platform provides standard trading functionality, user experiences appear to vary significantly. The platform's stability and execution quality receive limited specific feedback in current reviews, making complete performance assessment challenging.

Order execution quality, including slippage rates and fill speeds, is not specifically detailed in available user feedback. These factors are crucial for trading experience evaluation, particularly for active traders. The MT4 platform's basic functionality provides standard features expected from this popular trading system, though any broker-specific enhancements or limitations are not clearly outlined.

Mobile trading experience and platform accessibility across devices are not specifically addressed in current sources. Given the importance of mobile trading for modern users, this represents a significant information gap. Overall trading environment factors, including server stability and platform downtime, lack sufficient detail for complete assessment in this wtm review.

Trust and Reliability Analysis

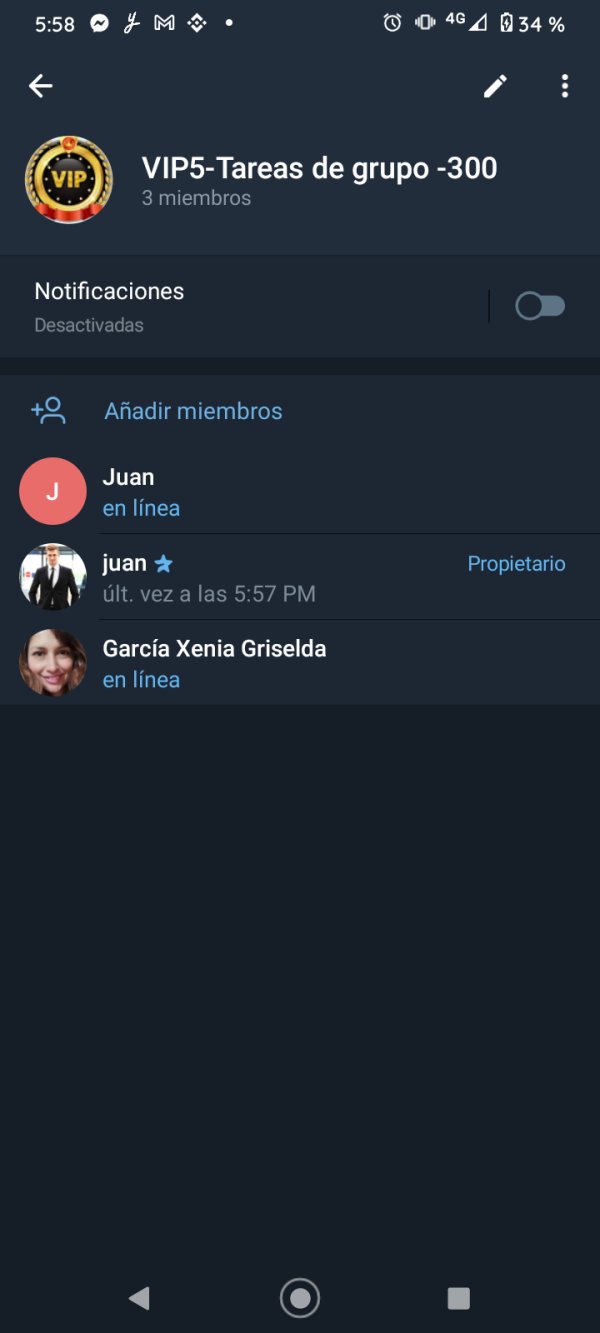

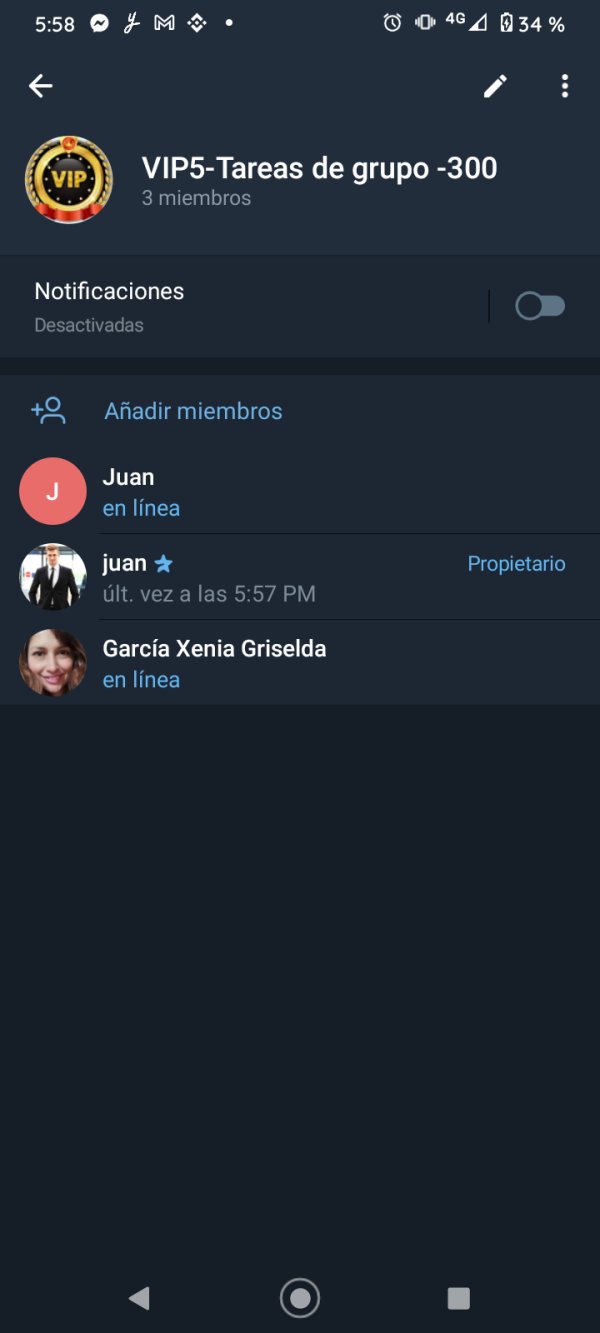

Trust and reliability assessment for WTM reveals significant concerns based on available information. Scam claims found on advisory websites substantially impact the broker's credibility rating. These claims, while not definitively proven, create serious questions about the company's operational integrity and user fund security.

The absence of clear regulatory oversight information compounds trust concerns. Regulated brokers typically provide transparent licensing details and regulatory compliance information, which appears lacking in WTM's case. This regulatory confusion significantly impacts user confidence and legal protections available to clients.

Fund security measures, including segregated account policies and client money protection protocols, are not detailed in available sources. These protections are fundamental for broker trustworthiness and their absence from current information raises important safety concerns. The company's transparency regarding business operations and financial reporting also lacks sufficient detail for complete trust evaluation.

Industry reputation assessment is complicated by conflicting information, with positive educational feedback contrasting sharply with scam claims. This split suggests potential users should exercise extreme caution and conduct thorough independent verification before engaging with WTM's services.

User Experience Analysis

User experience evaluation for WTM presents a complex picture with contrasting feedback elements. Positive evaluations focus primarily on the educational aspects of the Way to Million program, suggesting value for users seeking trading and affiliate marketing education. These users appreciate the learning resources and structured approach to skill development provided by the platform.

However, legitimacy concerns significantly impact overall user satisfaction. Questions about the company's credibility create uncertainty that affects user confidence and long-term engagement. This tension between educational value and trust concerns defines much of the user experience discussion surrounding WTM.

Interface design and platform usability receive limited specific feedback in available sources. The MT4 platform provides familiar functionality for experienced users, though newcomers may require additional support and guidance. Registration and verification processes are not detailed in current information, preventing assessment of onboarding efficiency.

The target user profile appears to focus on beginners and intermediate traders interested in both trading and affiliate marketing opportunities. This dual focus creates a unique user base that values educational content alongside practical trading capabilities. However, legitimacy concerns may deter risk-averse users seeking established, regulated brokers with clear compliance records.

Conclusion

This wtm review reveals a broker with significant complexity and mixed market perception. WTM offers educational value through its Way to Million program and provides MT4 trading access, appealing to users seeking complete learning opportunities. However, serious trust concerns arising from scam claims and unclear regulatory status substantially impact the overall assessment.

The broker appears most suitable for users prioritizing educational content and willing to accept higher risk levels associated with regulatory uncertainty. Beginners interested in both trading and affiliate marketing may find value in WTM's unique approach, though they should proceed with extreme caution given the credibility concerns.

Primary advantages include educational resources and MT4 platform access, while significant disadvantages include legitimacy questions, unclear regulatory status, and limited transparency. Potential users should conduct thorough independent research and consider regulated alternatives before making any financial commitments with WTM.