Brokerpoint, founded in 2017 and headquartered in Germany, has quickly established itself as a significant player in the online trading space. Operating as an introducing broker for Interactive Brokers, Brokerpoint is regulated by the Central Bank of Ireland, providing a level of legitimacy and security for clients. However, it primarily targets a niche of seasoned traders who require sophisticated trading options, making it less accessible to newcomers who may find its platform and account setup challenging.

Brokerpoint offers a comprehensive array of financial instruments for trading, including stocks, ETFs, forex, options, futures, and CFDs. The platform is designed for active trading, featuring advanced charting tools and analytics. Its connection to Interactive Brokers enables broad access to global markets and efficient order executions. However, regulatory transparency remains a concern, with Brokerpoint not publicly disclosing detailed financial information.

Brokerpoint operates as an introducing broker under the regulatory oversight of the Central Bank of Ireland. Despite this, concerns around transparency persist as Brokerpoint does not hold a banking license and is not publicly listed, which raises questions about client asset safety.

- Confirm Brokerpoint's regulatory status on the Central Bank of Ireland website.

- Utilize the NFA's BASIC database to check for any records related to the broker.

- Investigate user reviews on various independent review sites to gauge the reputation associated with Brokerpoint.

Industry Reputation and Summary

"Brokerpoint is mostly competent but has significant room for improvement, especially regarding transparency. — User Review

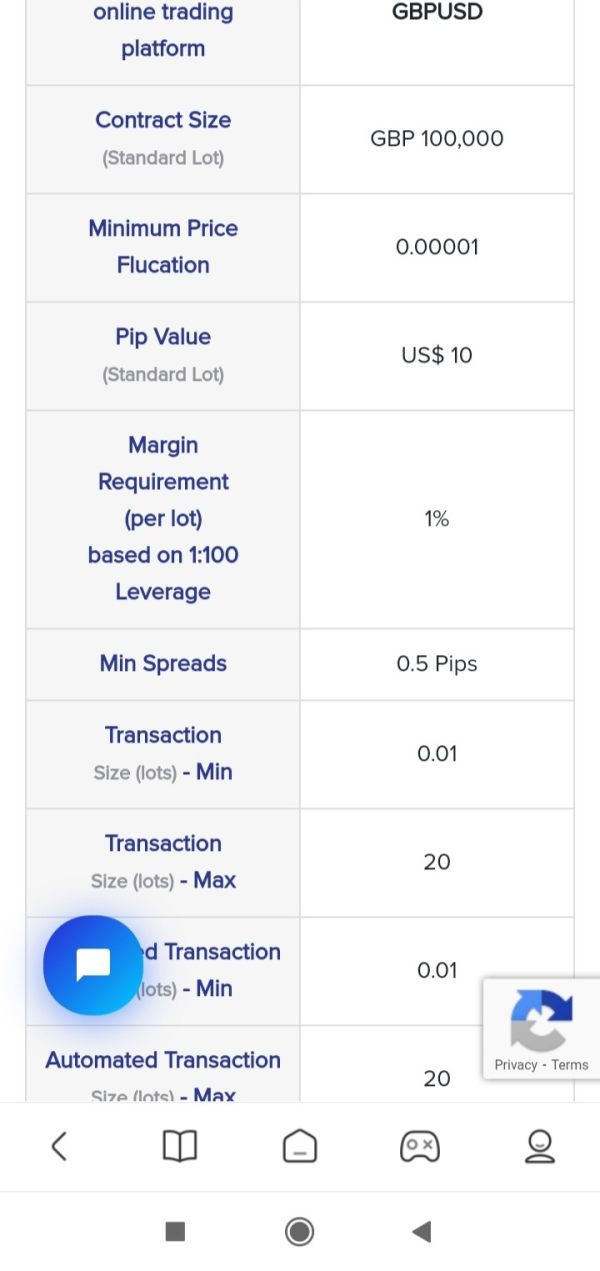

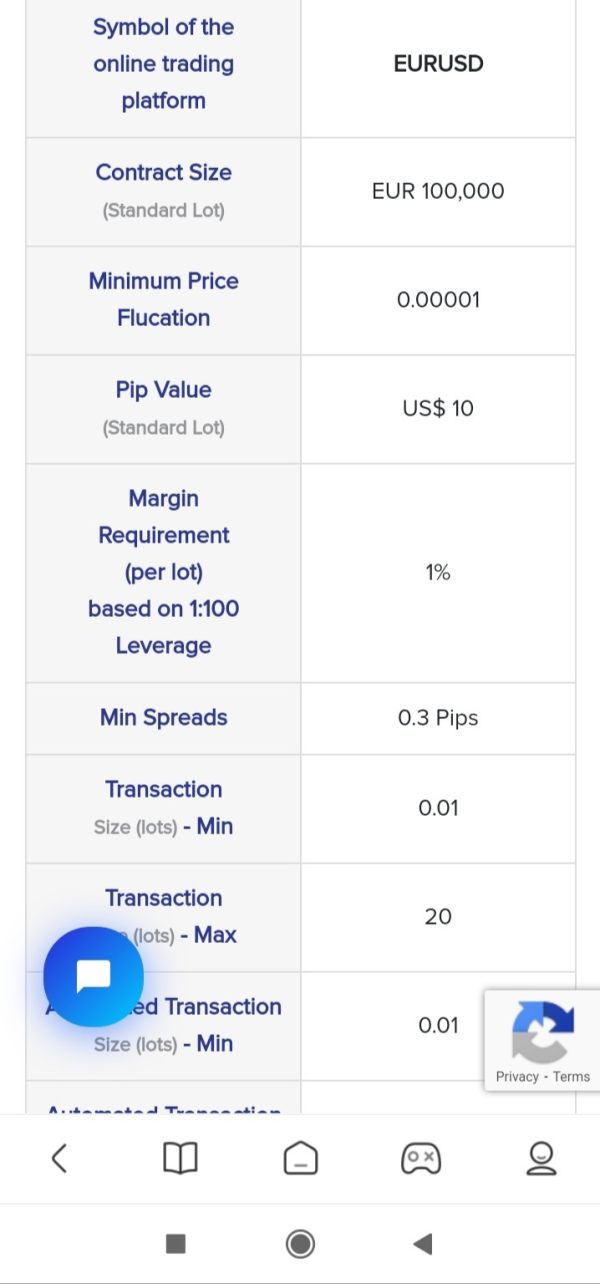

2. Trading Costs Analysis

Advantages in Commissions

Brokerpoint boasts notably low trading fees for stocks and ETFs, with U.S. stock fees at $2.00, significantly below the industry average. The trading model is designed to appeal to volume traders and those looking to minimize costs.

The "Traps" of Non-Trading Fees

However, some users have reported dissatisfaction regarding high fees for certain complex products like futures and options:

“Brokerpoints $20 fee per contract for stock index options is one of the highest I have seen.” — User Complaint

Cost Structure Summary

The overall cost structure is a double-edged sword; while advanced traders may benefit from low commissions, they must also navigate higher fees for options and futures, which may negate the perceived savings from low trading fees.

Brokerpoints platform offerings include Trader Workstation (TWS) and support for more sophisticated trading tools, suitable for experienced users. However, the complexity may create a steep learning curve.

Users have access to numerous analytics and research tools but lacking comprehensive educational resources:

"As a beginner, I felt overwhelmed by the platforms complexity without any guide." — User Feedback

Thus, while the platform offers powerful tools for trade execution, new traders may find it too intricate to use effectively.

4. User Experience Analysis

Onboarding Experience

The account opening process can be overly complicated, resulting in frustration for new users due to a multi-step digital verification process that may exceed three days.

Brokerpoint's trading platform is tailored for seasoned traders, requiring familiarity with advanced trading concepts which could hinder less experienced investors.

Overall User Satisfaction

Feedback indicates a common theme: While experienced traders appreciate the resources, beginners often feel unsupported:

“Getting started was a hassle since theres little guidance.” — User Experience Feedback

5. Customer Support Analysis

Support Channels Availability

Brokerpoint offers customer support via email and live chat, but many users face delays in responses:

"I had to wait days for a simple question to be answered, which is unacceptable." — Customer Review

Customer Service Effectiveness

The absence of phone support is a significant drawback. Users generally report dissatisfaction with the support provided and responsiveness during critical trading times.

6. Account Conditions Analysis

Account Types and Opening Process

Brokerpoint offers various account types without a minimum deposit requirement but presents a cumbersome verification process that can last over three business days.

Deposit and Withdrawal Methods

The trading platform only accepts bank transfers, with no credit or debit card options, which can limit accessibility for some traders.

Conclusion on Account Conditions

While Brokerpoint facilitates some flexibility with no minimum deposits, the user experience is largely marred by a complex registration and verification process.

Final Thoughts

In summary, Brokerpoint presents a paradox for traders. The low fees and extensive product offerings position it as a potentially attractive option for seasoned traders looking for cost-effective solutions. That said, the complexities of the account setup, inadequate customer support, and transparency issues might deter novice investors. The decision to engage with Brokerpoint ultimately hinges on one's trading experience and ability to navigate the less-than-forgiving platform environment.