VTradeFX 2025 Review: Everything You Need to Know

Executive Summary

VTradeFX is an unregulated forex broker that presents significant risks for traders. This vtradefx review gives the platform an overall negative assessment. Multiple sources including WikiBit and ForexBrokerz show that the platform operates without proper regulatory oversight despite being registered in the UK.

The broker offers a minimum deposit requirement of $200 and provides leverage up to 1:200, targeting primarily beginner and intermediate traders seeking access to multiple asset classes including forex, commodities, CFDs, and stocks. Our analysis reveals concerning patterns across user feedback and regulatory verification.

The platform provides MetaTrader 4 and MetaTrader 5 trading platforms with spreads starting from 0 pips, but these seemingly attractive conditions are overshadowed by fundamental trust and safety issues. Multiple review platforms have flagged VTradeFX as potentially fraudulent, with users reporting difficulties in withdrawals and poor customer service experiences.

The lack of regulatory protection means traders have limited recourse if issues arise, making this broker unsuitable for most retail traders seeking secure trading environments.

Important Disclaimer

VTradeFX operates as a UK-registered broker but lacks supervision from recognized regulatory authorities. This requires extreme caution from potential traders.

This review is based on available user feedback, market analysis, and publicly accessible information, which may contain information asymmetries. Traders should be aware that unregulated brokers pose inherent risks including potential loss of funds and limited legal protection.

The information presented here reflects the current state of available data and may not capture all aspects of the broker's operations.

Rating Framework

Broker Overview

VTradeFX presents itself as a UK-registered forex broker. Specific founding details remain unclear in available documentation.

WikiBit and ForexReview sources show that the company operates as an online trading platform offering access to multiple financial markets. The broker's business model centers on providing retail traders with access to forex, commodities, indices, and stock trading through popular MetaTrader platforms.

However, the lack of proper regulatory oversight raises immediate concerns about the legitimacy and safety of operations. The platform targets traders seeking diverse asset exposure with relatively low entry barriers, evidenced by the $200 minimum deposit requirement.

VTradeFX attempts to attract clients through competitive-seeming conditions including zero-pip spreads and high leverage ratios. However, this vtradefx review reveals that these apparent advantages are significantly undermined by fundamental operational and regulatory deficiencies that pose substantial risks to trader capital and overall trading experience.

Regulatory Status: VTradeFX operates without proper regulatory supervision despite UK registration. This creates significant legal and financial risks for clients.

Deposit and Withdrawal Methods: Specific payment methods are not detailed in available sources, though the minimum deposit is confirmed at $200.

Minimum Deposit: The platform requires a minimum deposit of $200. This positions itself in the mid-range for entry-level requirements.

Bonus and Promotions: No specific promotional offers or bonus structures are mentioned in available documentation.

Tradeable Assets: The broker provides access to forex pairs, commodities, stock indices, and individual stocks across multiple markets.

Cost Structure: Trading spreads reportedly start from 0 pips. Commission structures and additional fees are not clearly specified in available sources.

Leverage Ratios: Maximum leverage reaches 1:200. This is relatively high but standard for unregulated brokers.

Platform Options: VTradeFX offers MetaTrader 4 and MetaTrader 5 platforms for desktop and mobile trading.

Geographic Restrictions: Specific regional limitations are not detailed in current documentation.

Customer Support Languages: Available support languages are not specified in accessible materials.

This vtradefx review notes that many crucial operational details remain unclear, which itself raises concerns about transparency and professional standards.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

VTradeFX's account structure lacks the diversity and transparency expected from professional brokers. The $200 minimum deposit requirement, while not excessive, comes without clear differentiation between account types or tiers.

Available sources do not specify whether the broker offers multiple account categories, Islamic accounts, or specialized trading conditions for different trader segments. This lack of clarity suggests limited account customization options.

The absence of detailed account specifications in promotional materials indicates poor transparency in terms and conditions. Professional brokers typically provide comprehensive account comparison charts, fee schedules, and clear benefit structures.

VTradeFX's failure to present this information publicly raises concerns about hidden costs and unclear trading conditions that may only become apparent after deposit. User feedback suggests that account opening processes may lack proper verification standards, which, while potentially convenient, raises additional regulatory and security concerns.

The combination of unclear account structures and regulatory gaps creates an environment where traders cannot fully understand their trading conditions before committing funds, contributing to the below-average rating in this vtradefx review.

The broker provides access to MetaTrader 4 and MetaTrader 5 platforms. These are industry-standard tools offering comprehensive charting, analysis, and automated trading capabilities.

These platforms include built-in technical indicators, expert advisors, and multi-timeframe analysis tools that meet basic trading requirements for most retail traders. The MT4/MT5 offering represents the primary strength in VTradeFX's tool portfolio.

However, available sources indicate a significant lack of proprietary research and educational resources. Professional brokers typically supplement trading platforms with market analysis, economic calendars, trading education, and research reports.

VTradeFX appears to rely solely on the basic tools provided within the MetaTrader ecosystem without additional value-added services. The absence of advanced trading tools, market sentiment indicators, or specialized analysis software limits the platform's appeal to more sophisticated traders.

Additionally, no mention of copy trading, social trading features, or advanced order types suggests a basic service offering that may not meet the needs of traders seeking comprehensive trading environments.

Customer Service and Support Analysis (3/10)

User feedback across multiple review platforms indicates significant deficiencies in VTradeFX's customer service operations. Traders report slow response times and ineffective problem resolution according to ForexBrokerz and other sources.

The lack of detailed contact information and support channel specifications on the broker's materials suggests limited accessibility and professional support infrastructure. Without proper regulatory oversight, customers have limited recourse when service issues arise.

This creates an environment where support quality becomes entirely dependent on the broker's voluntary commitment to customer service, which appears insufficient based on available user testimonials. Traders report difficulties in reaching support representatives and receiving timely responses to urgent trading-related queries.

The absence of multilingual support specifications and unclear support hours further compound service accessibility issues. Professional brokers typically provide 24/5 support during market hours with multiple contact methods including live chat, phone, and email.

VTradeFX's apparent limitations in these areas significantly impact the overall trading experience and contribute to user frustration reported across review platforms.

Trading Experience Analysis (4/10)

User reports indicate inconsistent trading conditions including slippage and requoting issues that negatively impact trade execution quality. While VTradeFX advertises competitive spreads starting from 0 pips, actual trading experiences suggest that these conditions may not be consistently maintained during active market periods.

Order execution quality appears to vary significantly based on market conditions and trade sizes. Platform stability concerns emerge from user feedback, with some traders reporting connection issues and platform freezes during critical trading moments.

The MetaTrader platforms themselves are reliable, but the broker's infrastructure and server quality appear to create additional technical challenges that impact trading performance. The trading environment lacks transparency in terms of execution policies, slippage parameters, and order handling procedures.

Professional brokers typically provide detailed execution statistics and trade reporting that allows traders to assess execution quality objectively. VTradeFX's apparent lack of such transparency makes it difficult for traders to evaluate whether they receive fair execution, contributing to the below-average rating in this vtradefx review.

Trust and Safety Analysis (2/10)

The most significant concern regarding VTradeFX is its unregulated status. This provides no investor protection or regulatory oversight of business practices.

WikiBit verification shows that the broker operates without authorization from recognized financial regulators, creating substantial risks for client fund safety and business conduct standards. This regulatory gap eliminates standard protections including segregated client accounts and compensation schemes.

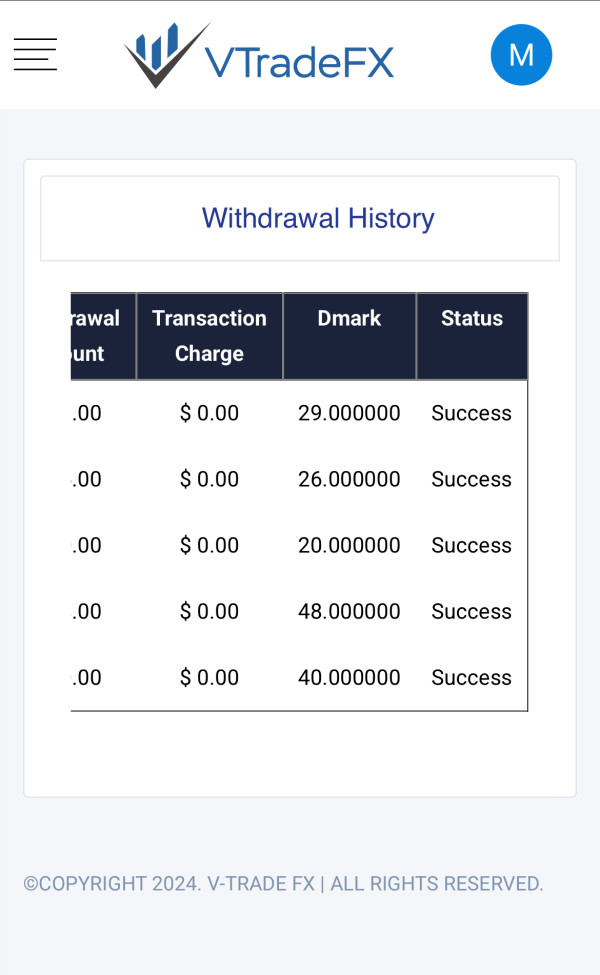

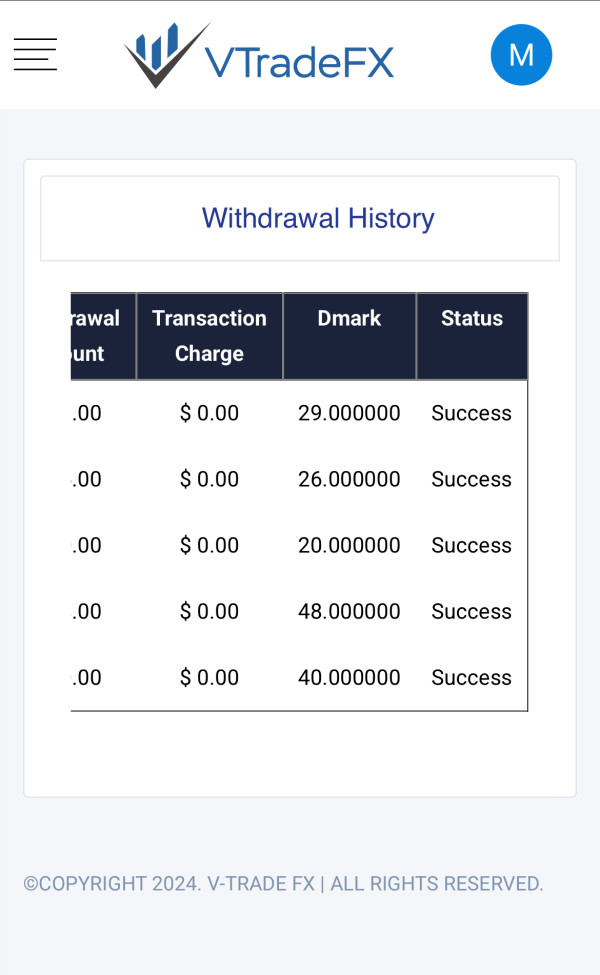

Multiple review platforms have flagged VTradeFX as potentially fraudulent, with specific warnings about withdrawal difficulties and questionable business practices. The pattern of negative reviews and regulatory warnings creates a concerning profile that suggests significant operational and ethical issues.

These red flags are particularly serious given the complete absence of regulatory oversight. Company transparency remains poor, with limited disclosure about ownership, financial backing, or operational procedures.

The combination of regulatory gaps, negative industry reports, and poor transparency creates an environment where trader funds face substantial risk without adequate protection mechanisms.

User Experience Analysis (3/10)

Overall user satisfaction with VTradeFX appears significantly below industry standards based on available feedback across review platforms. Traders report frustration with multiple aspects of the service including platform performance, customer support, and withdrawal processes.

The accumulation of negative experiences suggests systemic issues rather than isolated problems. Interface design and usability are limited to the standard MetaTrader offerings without additional customization or enhancement.

While MT4/MT5 platforms provide functional trading interfaces, VTradeFX appears to offer no additional user experience improvements or proprietary interface developments that might enhance trading convenience or efficiency. Common user complaints focus on withdrawal difficulties, poor communication, and technical issues that impact trading effectiveness.

The pattern of negative feedback suggests that VTradeFX fails to meet basic expectations for professional trading services, making it unsuitable for traders seeking reliable and user-friendly trading environments.

Conclusion

This comprehensive vtradefx review reveals significant concerns that make VTradeFX unsuitable for most retail traders. The broker's unregulated status, combined with negative user feedback and industry warnings, creates substantial risks that outweigh any potential benefits from competitive trading conditions.

While the platform offers standard MetaTrader access and relatively low minimum deposits, these advantages are overshadowed by fundamental safety and reliability issues. The broker may only be considered by traders with high risk tolerance who fully understand the implications of trading with unregulated entities.

However, given the availability of properly regulated alternatives offering similar or better conditions, there is little justification for accepting the risks associated with VTradeFX. Traders seeking secure and reliable trading environments should prioritize regulated brokers with strong industry reputations and proper investor protections.