Mmig 2025 Review: Everything You Need to Know

Summary: The Mmig review reveals a broker that raises significant concerns regarding its legitimacy and user experience. Established in 2017 and based in New Zealand, Mmig operates under the Financial Service Providers Register (FSPR), but has faced multiple complaints related to withdrawals and customer service. Users have reported a lack of responsiveness and issues with account access, leading to a low trust rating.

Note: It is crucial to consider that Mmig operates across different regions with various entities, which may impact regulatory oversight and user experiences. The analysis presented here is based on a thorough examination of multiple sources to ensure fairness and accuracy.

Ratings Overview

We assess brokers based on user experiences, expert opinions, and factual data derived from various reputable sources.

Broker Overview

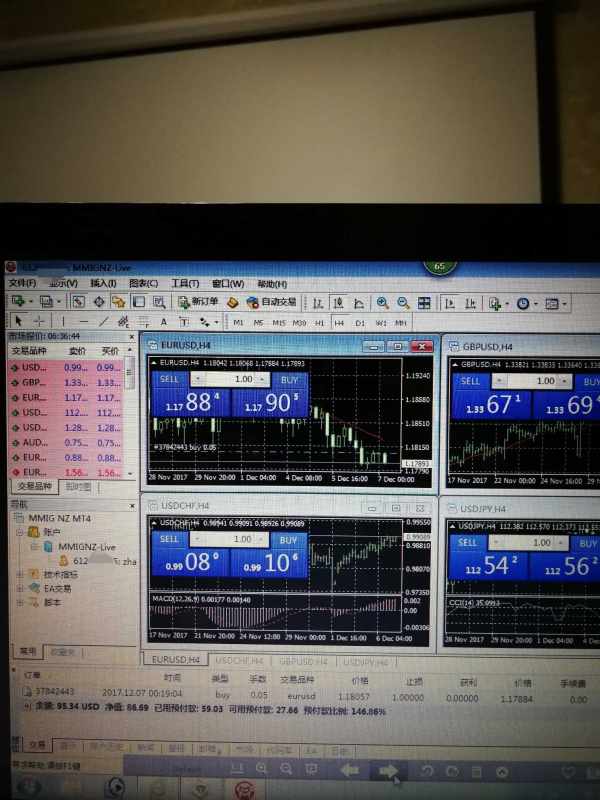

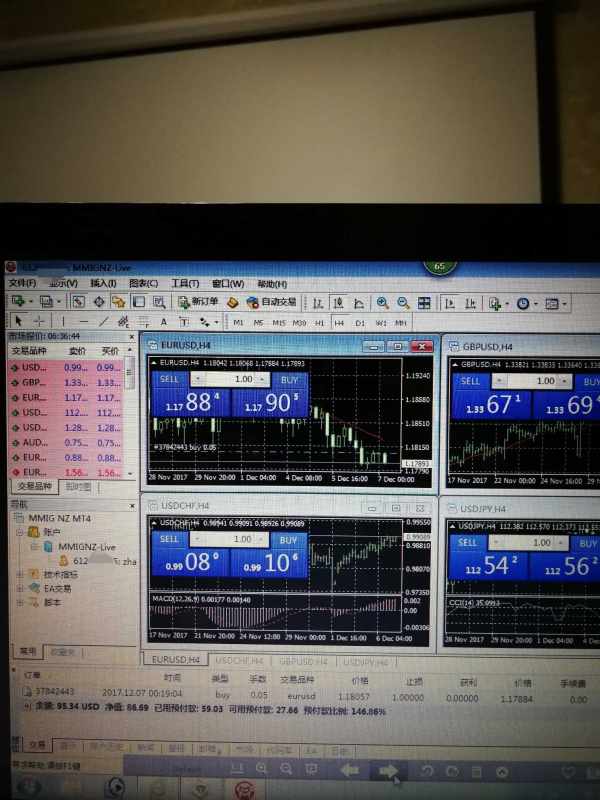

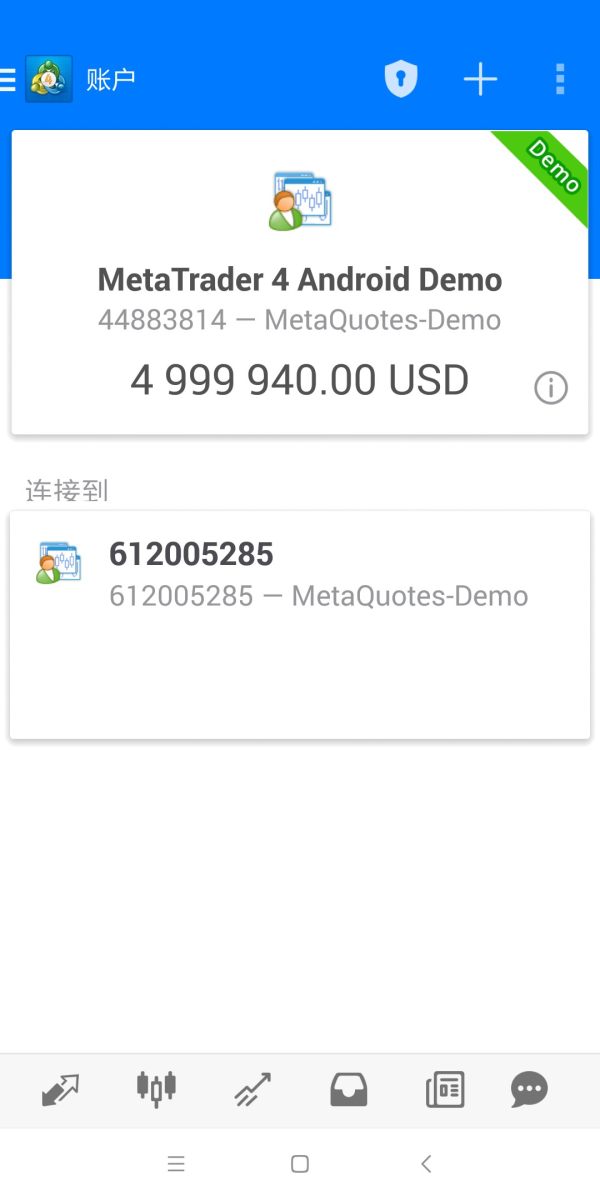

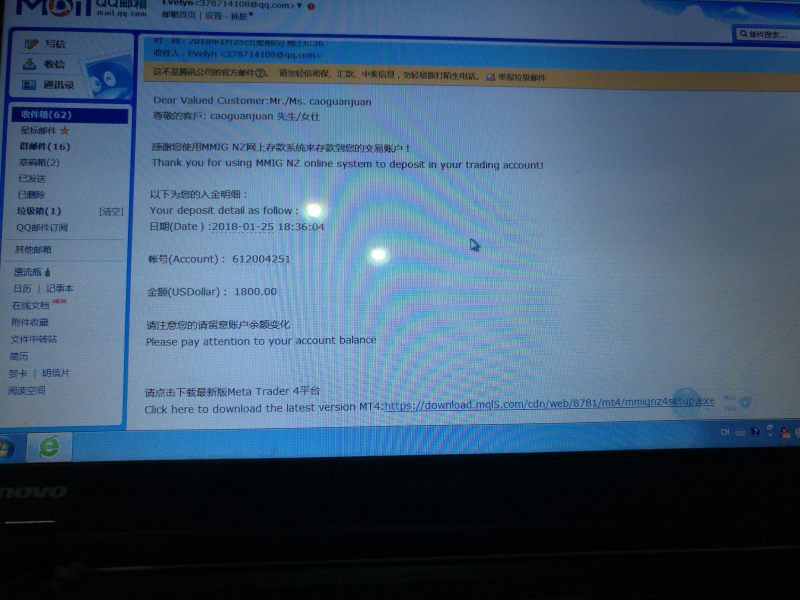

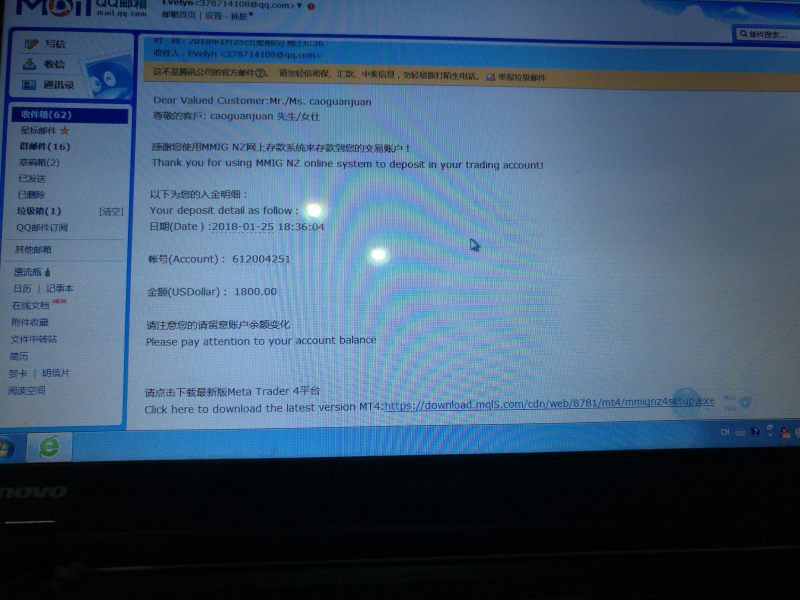

Founded in 2017, Mmig (Market Maker International Group) is a broker based in New Zealand, primarily offering forex trading services. The broker provides access to the financial markets through popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Users can trade a variety of assets, including forex, indices, precious metals, and energy. However, regulatory scrutiny is a significant concern, as the broker has been reported to operate without proper oversight in certain jurisdictions. The FSPR has revoked Mmig's regulatory status, raising red flags about its legitimacy.

Detailed Breakdown

Regulatory Regions

Mmig claims to operate under the FSPR in New Zealand, but its regulatory status has been revoked, which is a significant concern for potential investors. The broker has also been flagged as a suspicious clone by the National Futures Association (NFA) in the United States and the Australian Securities and Investments Commission (ASIC). This lack of credible regulation raises serious questions about the safety of funds and the integrity of trading practices.

Deposit/Withdrawal Methods

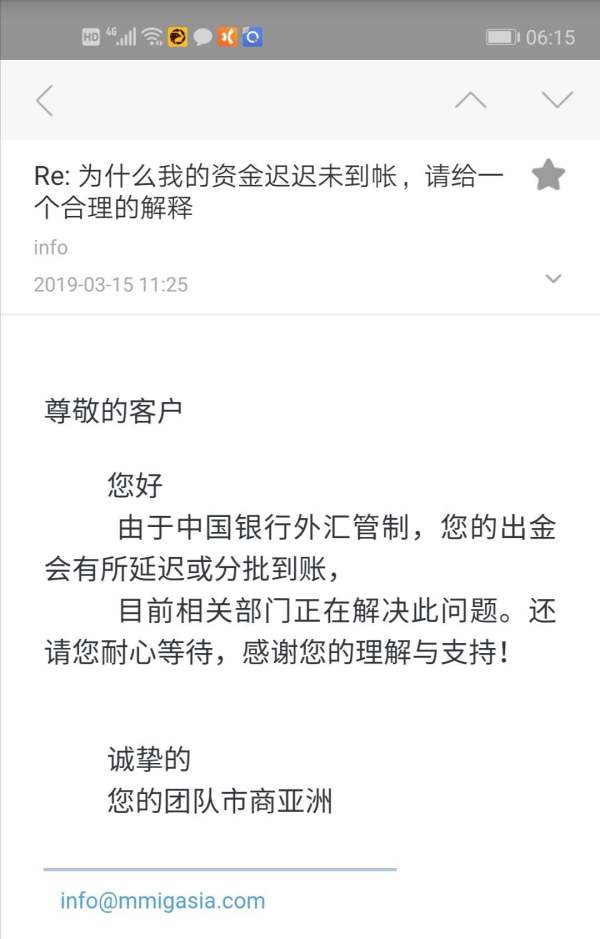

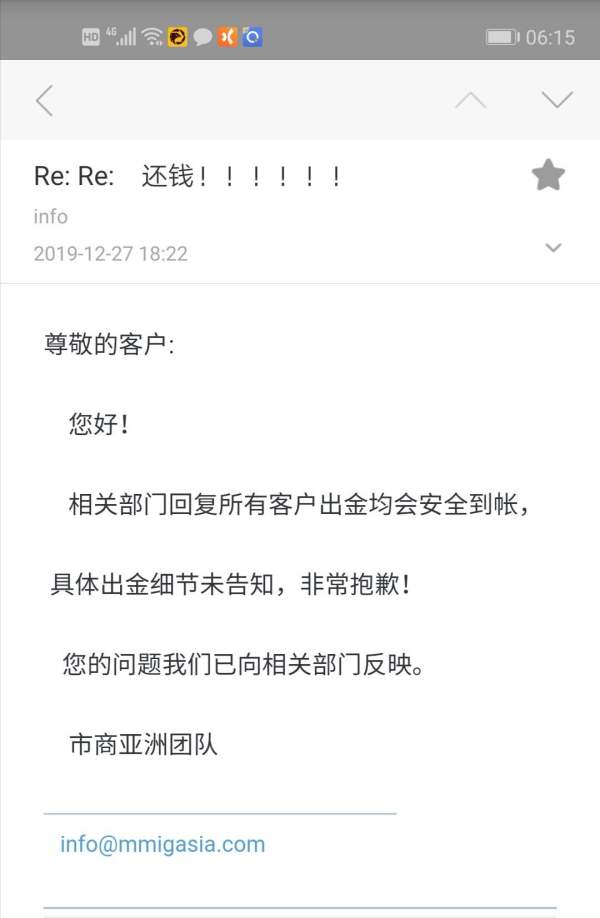

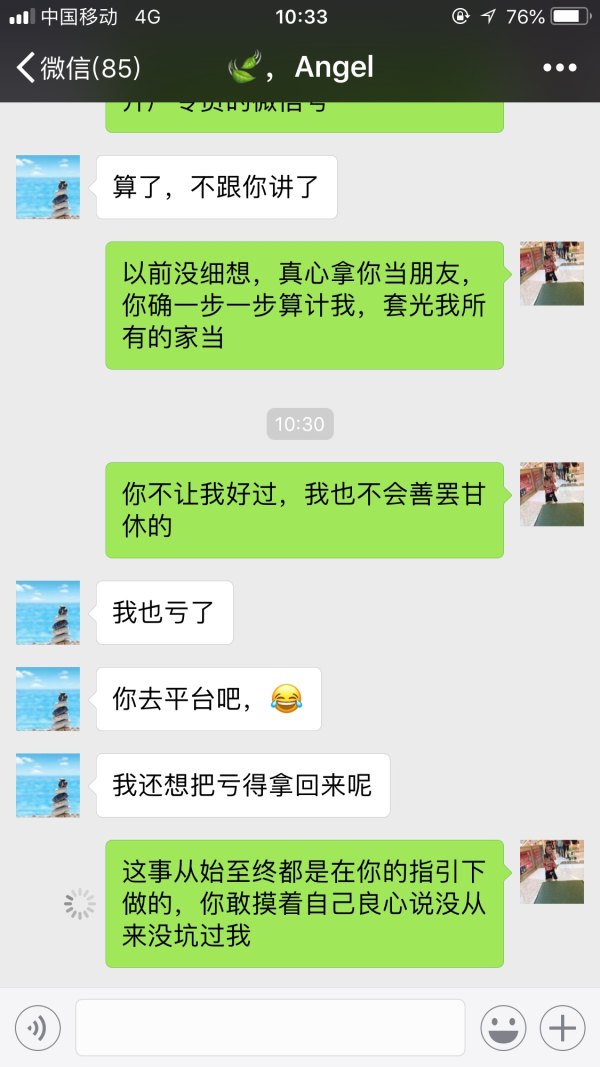

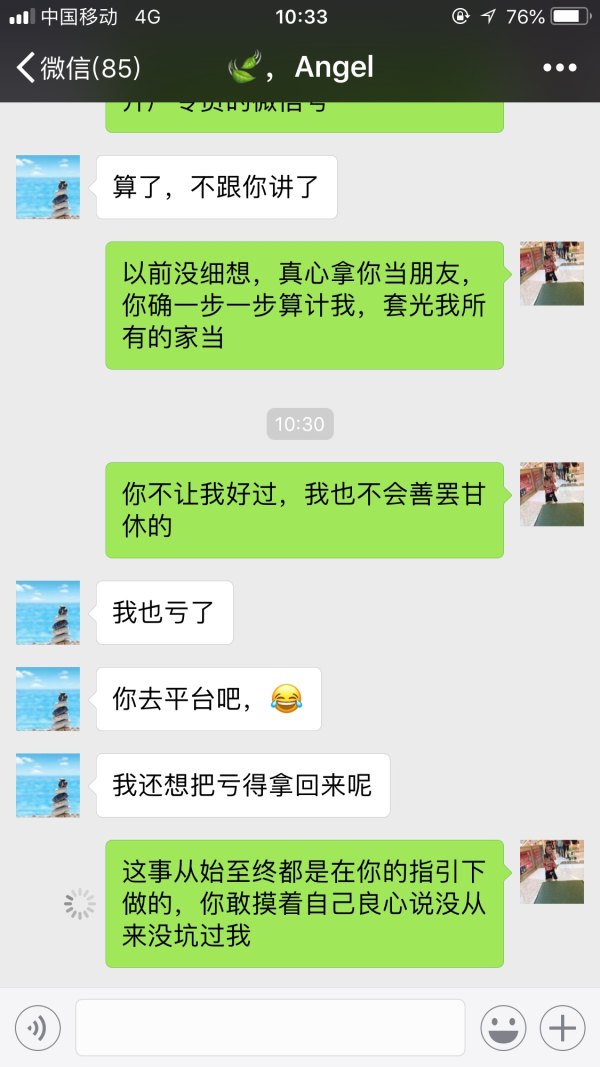

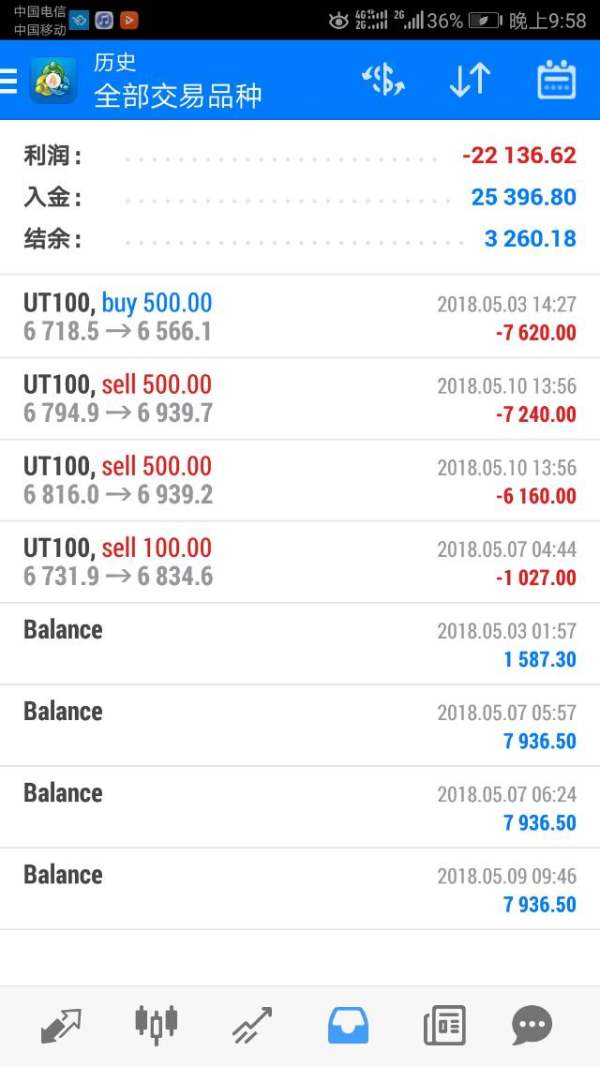

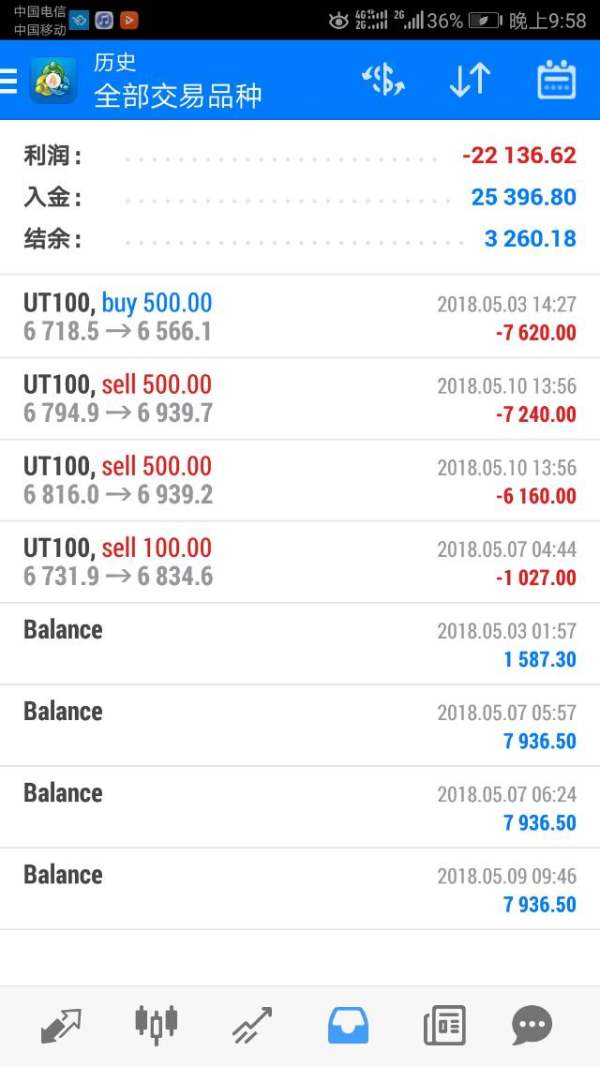

The broker offers various deposit and withdrawal options, although specific details on supported currencies and cryptocurrencies are scarce. Users have reported significant difficulties in withdrawing funds, with some complaints citing delays of over a year. This has led to a growing sentiment of distrust among users.

Minimum Deposit

While specific minimum deposit requirements are not consistently reported across sources, it is generally noted that brokers like Mmig may require a minimum to open an account. However, the absence of clear information on this aspect raises further concerns about transparency.

Information regarding bonuses or promotional offers is limited, and the legitimacy of such promotions should be approached with caution, especially given the broker's troubled reputation.

Tradable Asset Classes

Mmig allows trading in various asset classes, including forex, precious metals, and energy. However, the range of available assets may not be as extensive as that offered by more reputable brokers, which can limit trading strategies and opportunities.

Costs (Spreads, Fees, Commissions)

The specifics of spreads and commissions charged by Mmig are not well-documented. However, the general consensus indicates that users may face higher costs compared to more established brokers, which could impact overall profitability.

Leverage

Leverage options are not explicitly detailed in the sources reviewed, but it is essential for traders to consider the risks associated with high leverage, especially with a broker that has a questionable reputation.

Mmig primarily supports MT4 and MT5 for trading, both of which are widely recognized platforms among forex traders. However, the lack of additional features or enhancements in the trading experience may deter some users.

Restricted Areas

While specific restricted regions are not clearly outlined, the broker's regulatory issues may affect its ability to serve clients in various jurisdictions, particularly in regions with strict financial regulations.

Available Customer Support Languages

Customer support is reportedly available in simplified Chinese, but users have expressed dissatisfaction with response times and the effectiveness of support provided. Complaints about unresponsive customer service have been prevalent, further diminishing the trustworthiness of the broker.

Repeat Ratings Overview

Detailed Analysis

-

Account Conditions: The account conditions are subpar, with a score of 4.0 due to the lack of transparency regarding minimum deposits and withdrawal issues reported by users. Many have experienced significant delays in accessing their funds, which heavily impacts user trust.

Tools and Resources: Scoring 5.0, the tools offered through MT4 and MT5 are standard for the industry. However, the absence of advanced trading tools or educational resources diminishes the trading experience, especially for novice traders.

Customer Service and Support: With a low score of 3.0, customer service has been a major pain point for users. Reports of unresponsiveness and long wait times for assistance have led many to question the reliability of Mmig.

Trading Setup (Experience): Users rated the trading experience at 5.5, indicating some satisfaction with the basic functionality of the trading platforms. However, the lack of additional features and customization options may not meet the needs of advanced traders.

Trustworthiness: The trustworthiness of Mmig is critically low at 2.0 due to its revoked regulatory status and numerous complaints about withdrawal issues. This has led to an overall perception of Mmig as a potentially unsafe broker.

User Experience: Overall user experience is rated at 3.5, reflecting dissatisfaction with account access, customer service, and withdrawal processes. Many users have expressed concerns about the broker's legitimacy, which further diminishes the overall experience.

In conclusion, the Mmig review paints a concerning picture of a broker that may not be suitable for traders seeking a reliable and trustworthy trading environment. The combination of regulatory issues, poor customer service, and persistent withdrawal complaints suggests that potential users should approach with caution or consider alternative brokers with a stronger reputation.