myfin 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

In the evolving landscape of financial services, myfin distinguishes itself as a comprehensive provider catering to the diverse needs of individuals and businesses alike. With offerings that encompass accounting, mortgage broking, and personalized financial advice, it presents an appealing one-stop solution for those seeking tailored financial guidance. This is particularly attractive for clients who value a holistic approach to their financial health. However, potential clients must carefully weigh this versatility against significant risks associated with the broker's operations. The lack of robust regulatory oversight raises serious concerns about fund safety and reliability, making it crucial for investors to exercise caution when navigating their options. Ultimately, while myfin presents unique advantages, its operational transparency—or lack thereof—could place clients at a considerable disadvantage.

⚠️ Important Risk Advisory & Verification Steps

Risk Warning: The operational framework of myfin raises significant red flags, particularly due to its absence of proper regulatory oversight.

- Potential Harms:

- The lack of regulation exposes clients to risks, including unregulated financial practices and potential fund misappropriation.

- High withdrawal fees and undisclosed costs further jeopardize fund safety, impacting overall investor experience.

How to Self-Verify Your Safety:

- Conduct Thorough Research: Always cross-check broker operations and regulatory status through recognized financial regulatory agencies.

- Read User Testimonials: Look for real user experiences discussing fund safety and withdrawal processes.

- Analyze Reviews: Evaluate various platforms‘ reviews to understand common issues or complaints related to myfin.

- Consult Experts: Reach out to financial experts for a professional assessment of myfin’s offerings.

Broker Rating Framework

Broker Overview

Company Background and Positioning

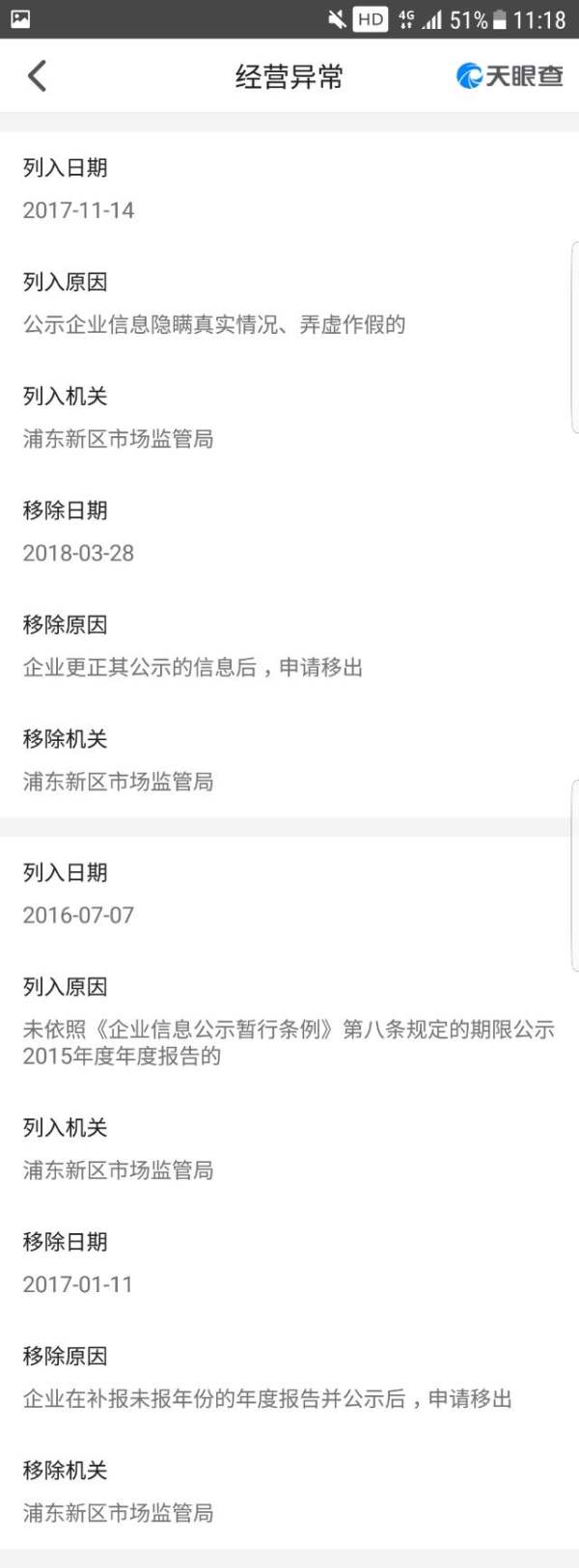

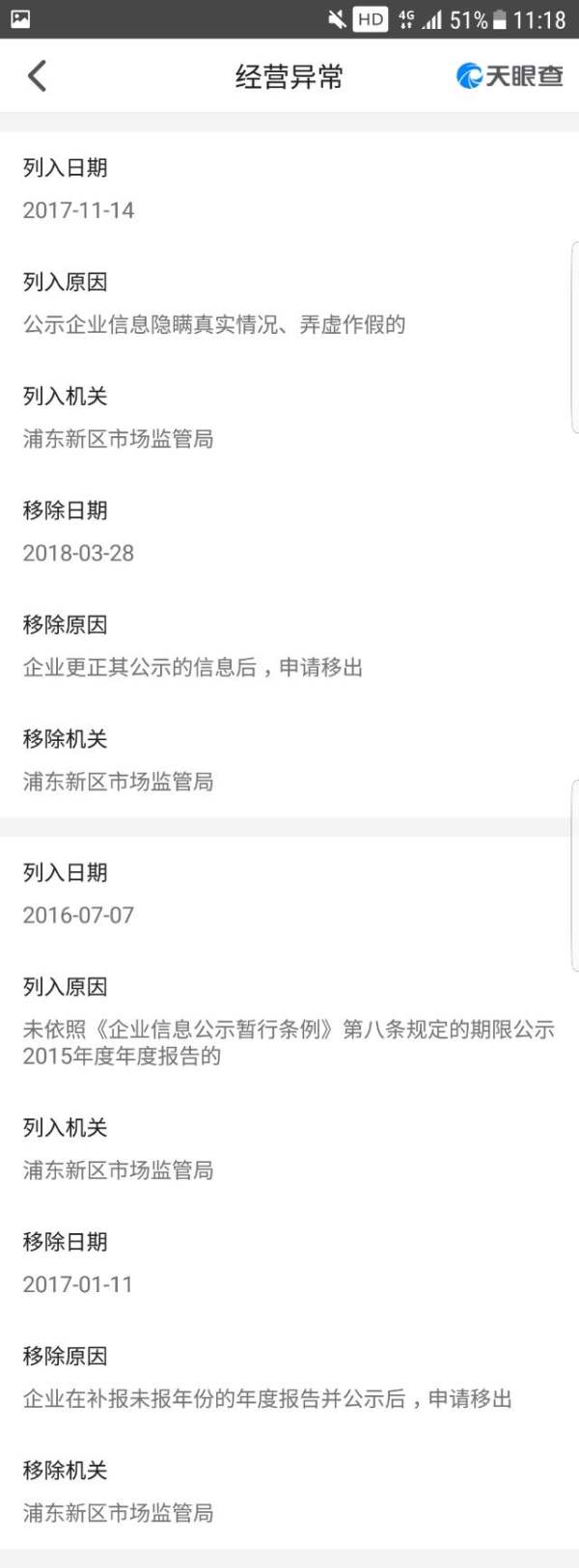

Founded in 2017 and headquartered in the United Kingdom, myfin aims to serve its clients with a comprehensive range of financial services. Despite its relatively short operational history, myfin has positioned itself as a versatile player in the financial landscape. However, notable concerns have arisen regarding its regulatory compliance, leading to mixed perceptions surrounding its long-term reliability. According to reports from WikiFX, myfin lacks valid regulatory oversight, which complicates potential investors' ability to gauge the safety of their funds, making discernment between competitive offerings and potential risks crucial for prospective clients.

Core Business Overview

myfin operates in multiple domains, primarily focusing on accounting, mortgage broking, and providing bespoke financial advice to a wide range of customers. However, its lack of transparent ties to well-established regulatory bodies, as noted by multiple review platforms, raises significant concerns about its operational integrity. The perceived ease of access to financial solutions contrasts sharply with the glaring risks posed by its ambiguous regulatory status and the associated potential for compromised client safety.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

In assessing trustworthiness, it's crucial to begin with the conflicting regulatory information surrounding myfin. Various platforms indicate a lack of regulatory compliance, a significant factor that raises alarm bells for potential clients. The absence of stringent oversight not only hints at possible operational failures but also exposes clients to a plethora of financial risks.

To evaluate the regulatory standing of myfin, users must leverage authoritative resources that detail its licensing benchmarks. Here's how:

- Visit Regulatory Authority Websites: Check for potential licensing or registration under bodies like the FCA, ASIC, or other regional agencies.

- Cross-Check with Constituent Reports: Evaluate reviews from platforms that scrutinize broker operations for any alerts regarding myfin.

- Analyze Online Feedback: Directly review the experiences shared by past users regarding their interactions with myfin.

Users have raised concerns about fund security through direct experiences with myfin. As one user succinctly stated,

"the service was acceptable, but the fund safety was questionable."

Trading Costs Analysis

The trading costs associated with myfin highlight a complex landscape for potential clients. On one hand, the broker boasts competitive commission rates, but users have reported substantial hidden charges that complicate the overall cost structure.

In particular, the broker has been noted for its high withdrawal fees, like user complaints citing withdrawal charges as steep as

$30. Additionally, uncommunicated fees can erode trading profits considerably with every transaction.

For prospective clients, it remains essential to scrutinize all potential trading costs while balancing them against anticipated earnings. This clear analysis can help clients make informed decisions regarding which trading structures suit their investment strategies best.

myfin provides access to a range of platforms and tools designed to enhance the trading experience for both novice and seasoned investors. However, the usability of these tools significantly varies.

The offerings include a robust set of online trading tools; yet, user feedback indicates varying degrees of satisfaction regarding their functionality and intuitiveness. One user states,

"While the tools provided were valuable, the learning curve was steep."

To maximize the benefits from these platforms, clients should make an effort to familiarize themselves with available functionalities through available tutorials and resources. Investing time in understanding how to effectively use the provided tools represents a critical step toward achieving financial success with myfin.

User Experience Analysis

User experience across myfin has received mixed feedback, which is a notable point of contention among clients. Some clients have experienced positive outcomes with their interactions, praising personalized service, while others cite significant hurdles related to service timeliness and quality.

For instance, one user summarized their experience, stating,

"The service quality was decent, but frustrations arose concerning response times during transactions."

Understanding user experiences is vital for potential clients looking to gauge the realities behind myfins services. To make an informed decision, prospective clients are encouraged to analyze testimonials shared across platforms to gain comprehensive insight.

Customer Support Analysis

Customer support has emerged as a critical area for concern related to myfin. Many users have voiced frustrations with slow response times, indicating a reliance on a limited support framework.

Feedback gathered from user surveys often note delayed interactions, leading to an overall unsatisfactory support experience. Due to these factors, its imperative for potential clients to consider the implications of relying on myfin when navigating important financial decisions. The risk of inadequate support could significantly impact the overall user experience, particularly during critical transactions.

Account Conditions Analysis

Account conditions with myfin are designed to provide flexibility; however, they come tainted with potential complications. Despite offering a variety of account types tailored to meet different needs, users have reported considerable fees that can encumber the account's usability.

While the services extend a range of account options, clients could find themselves facing unexpected charges—primarily through withdrawal fees and other conditions tied to promotions or service-level expectations. To mitigate these risks, potential clients should conduct thorough research into account conditions before committing their funds.

Conclusion

In summary, myfin offers an attractive array of services, appealing particularly to users desiring comprehensive financial solutions. However, a concerning lack of regulatory oversight and mixed user feedback casts a shadow over its trustworthiness. For those willing to navigate the waters of financial services with potential risks, myfin could present valuable opportunities; conversely, risk-averse investors may find seeking alternatives more advantageous. Ultimately, caution should be exercised as clients weigh the appealing features against the significant risks communicated throughout various reviews and user experiences surrounding myfins operations.