Eagle Trades 2025 Review: Everything You Need to Know

Executive Summary

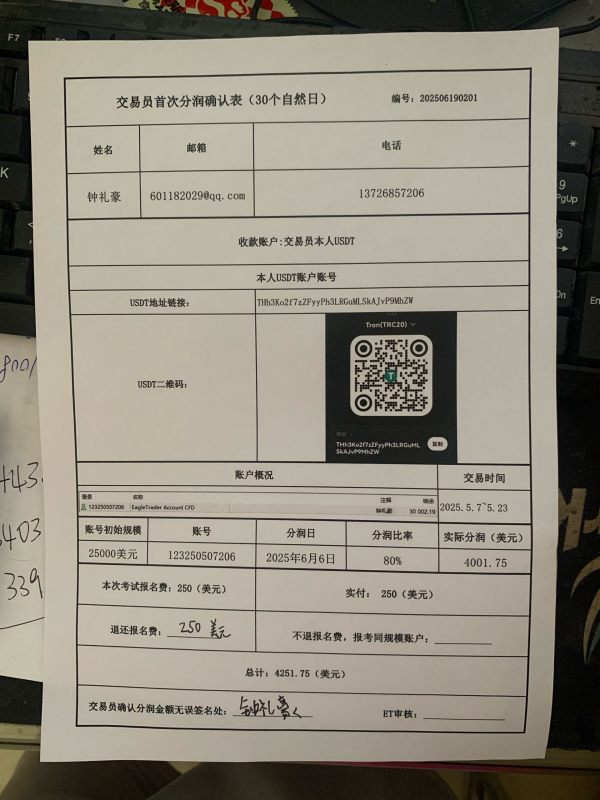

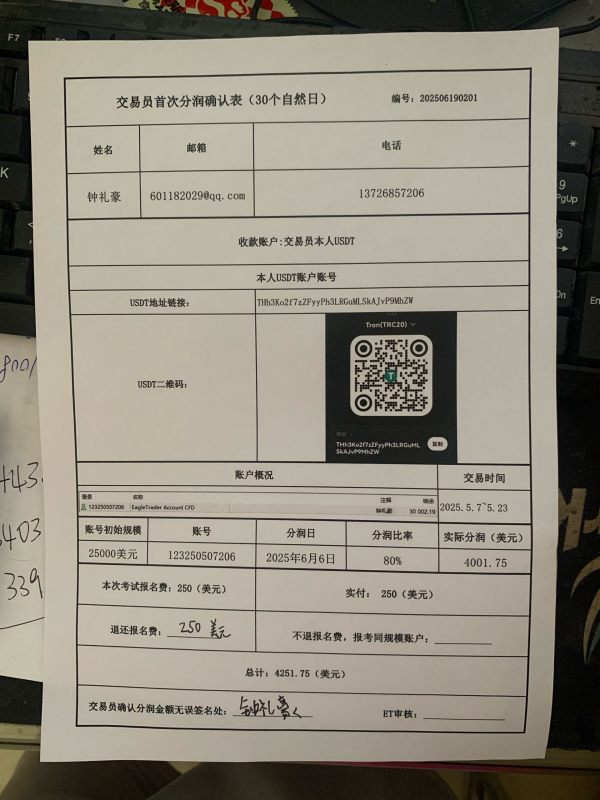

This comprehensive eagle trades review shows a concerning picture of an unregulated forex broker. The broker has received significant negative attention from the trading community. Eagle Trades operates as an online forex trading platform offering currency pairs and other financial instruments, but it lacks the fundamental regulatory oversight that traders should expect from a legitimate broker.

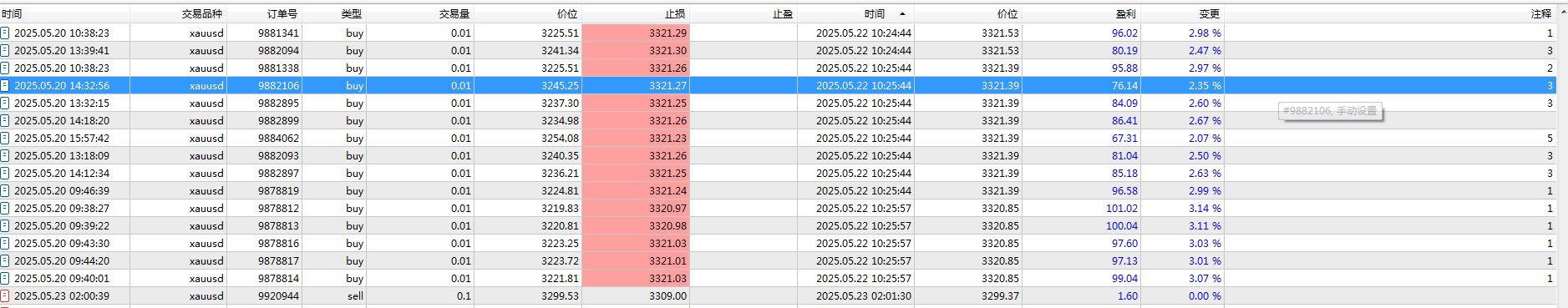

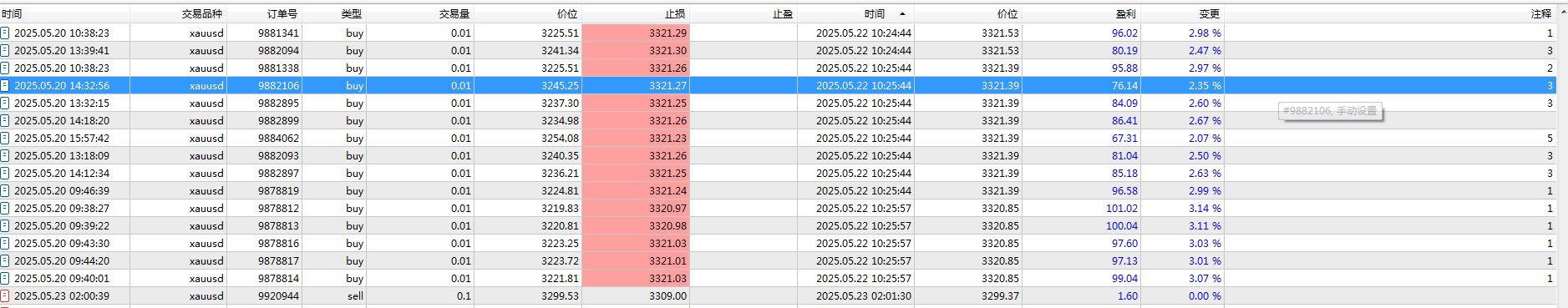

Our investigation found that Eagle Trades has received multiple user complaints. These complaints focus particularly on withdrawal difficulties and poor customer service. The platform maintains a moderate trust score of 50/100, which reflects the mixed but predominantly negative feedback from users. All trades on the platform are reportedly executed manually, which raises questions about execution efficiency and transparency.

The broker primarily targets forex traders and investors interested in diversified asset trading. However, the absence of proper regulation creates serious concerns. Combined with documented user complaints about withdrawal refusals, this makes Eagle Trades a high-risk choice for most traders. The platform's lack of transparency regarding fees, spreads, and operational procedures further compounds these concerns.

Based on our analysis, Eagle Trades appears unsuitable for most retail traders. This is particularly true for those seeking a secure and regulated trading environment.

Important Notice

This eagle trades review is based on available public information and user feedback as of 2024. Eagle Trades operates without regulatory oversight from recognized financial authorities. This may significantly impact user protection and service quality across different regions. The absence of regulatory supervision means that trader protections typically afforded by licensed brokers may not be available.

Our review methodology incorporates user testimonials, industry reports, and publicly available information about the broker's operations. Given the limited transparency from Eagle Trades regarding their business practices, some information may be incomplete or subject to change without notice.

Rating Framework

Broker Overview

Eagle Trades presents itself as an online forex trading platform. However, detailed information about the company's background remains notably scarce. The broker's website and promotional materials provide limited insight into the company's founding date, corporate structure, or operational history. This lack of transparency is particularly concerning for potential clients seeking to understand the broker's credentials and track record.

The platform operates primarily as a forex broker. It offers currency pair trading alongside other financial instruments. However, the specific range of assets, trading conditions, and operational procedures are not clearly outlined in publicly available materials. This opacity extends to fundamental aspects of the business, including fee structures, account types, and trading platforms used.

Eagle Trades operates without regulatory oversight from recognized financial authorities. This positions the broker in the unregulated segment of the forex market. This regulatory status significantly impacts the level of protection and recourse available to traders, as unregulated brokers are not subject to the same operational standards and client protection measures required by licensed financial institutions. The absence of regulatory supervision also means that standard industry practices regarding fund segregation, dispute resolution, and operational transparency may not apply.

Regulatory Status: Eagle Trades operates without regulation from recognized financial authorities. This represents a significant red flag for potential clients. The absence of regulatory oversight means traders lack the protections typically provided by licensed brokers.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not clearly outlined in available materials. User reports suggest difficulties with withdrawal processing. This is particularly concerning given the unregulated status.

Minimum Deposit Requirements: The broker has not disclosed specific minimum deposit requirements in publicly available information. This makes it difficult for potential clients to understand account opening requirements.

Bonuses and Promotions: No specific information about promotional offers or bonus programs is available in current materials. This suggests either the absence of such programs or poor communication of available incentives.

Trading Assets: Eagle Trades offers forex trading and claims to provide access to other financial instruments. However, the specific range of available assets is not comprehensively detailed in available documentation.

Cost Structure: Critical information about spreads, commissions, and other trading costs remains undisclosed in publicly available materials. This lack of transparency makes it impossible for traders to accurately assess the true cost of trading with this broker.

Leverage Options: Specific leverage ratios offered by Eagle Trades are not mentioned in available materials. This represents another significant information gap for potential clients.

Trading Platforms: The specific trading platforms or software used by Eagle Trades are not clearly identified in current documentation. However, user reports suggest manual trade execution processes.

Geographic Restrictions: Information about geographic limitations or restricted jurisdictions is not available in current materials.

Customer Support Languages: Specific details about supported languages for customer service are not disclosed in available documentation.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions offered by Eagle Trades receive a poor rating. This is due to the significant lack of transparency surrounding basic account features. Unlike reputable brokers that clearly outline their account types, minimum deposits, and trading conditions, Eagle Trades provides minimal information about these fundamental aspects of their service.

The absence of clear information about account tiers, minimum deposit requirements, and account-specific benefits makes it extremely difficult for potential clients to make informed decisions. This lack of transparency extends to crucial details such as spread ranges, commission structures, and any special features that might differentiate various account types.

User feedback suggests that the account opening process lacks the professional standards expected from established brokers. The manual processing of trades, as reported by users, indicates potentially outdated operational procedures that may impact trading efficiency and execution quality.

Compared to regulated brokers that must maintain transparent fee schedules and clear account terms, Eagle Trades falls significantly short of industry standards. The absence of detailed account documentation and terms of service further compounds concerns about the broker's professional operations and commitment to client transparency.

Eagle Trades receives a below-average rating for tools and resources. This is primarily due to the limited information available about their trading infrastructure and support materials. While the broker claims to offer forex and other asset trading, specific details about trading tools, analytical resources, and educational materials are notably absent from available documentation.

The lack of clear information about trading platforms, charting tools, and market analysis resources suggests either a limited offering or poor communication of available services. Professional traders typically require access to advanced charting capabilities, technical indicators, and market research, none of which are clearly outlined in Eagle Trades' available materials.

Educational resources appear to be either non-existent or poorly promoted. These resources are crucial for trader development and success. Reputable brokers typically provide comprehensive educational materials, webinars, and market analysis to support their clients' trading journey.

The manual execution of trades, as reported by users, suggests a potentially outdated technological infrastructure. This may limit the availability of modern trading tools and automated features that traders have come to expect from contemporary brokers.

Customer Service and Support Analysis (2/10)

Customer service represents one of Eagle Trades' most significant weaknesses. It earns a poor rating based on multiple user complaints and reported service failures. User feedback consistently highlights difficulties in reaching customer support and unsatisfactory responses to inquiries and concerns.

The most concerning aspect of customer service relates to withdrawal processing issues. Multiple users have reported difficulties in accessing their funds. Some claim that withdrawal requests have been denied or significantly delayed without adequate explanation. This represents a fundamental failure in customer service and operational integrity.

Response times to customer inquiries appear to be inadequate based on user reports. Some clients express frustration over delayed or non-responsive communication from the support team. The lack of multiple communication channels and limited availability further compounds these service issues.

Professional dispute resolution mechanisms appear to be absent or ineffective. These mechanisms are standard among regulated brokers. Users reporting problems have indicated difficulty in achieving satisfactory resolutions to their concerns, suggesting systemic issues with customer service protocols and procedures.

Trading Experience Analysis (4/10)

The trading experience with Eagle Trades receives a below-average rating. This is due to several operational concerns that impact trade execution and overall platform performance. The most significant issue is the reported manual execution of all trades, which contradicts modern expectations for electronic trading and may lead to delays and execution inconsistencies.

Platform stability and performance are areas of concern based on user feedback. Some traders report technical issues that impact their trading activities. The lack of detailed information about the trading infrastructure makes it difficult to assess the reliability and capabilities of the trading environment.

Order execution quality appears to be compromised by the manual processing approach. This may result in slower fill times and potential slippage issues. Modern traders expect instant electronic execution, and the manual approach represents a significant disadvantage compared to contemporary broker offerings.

The absence of detailed information about trading conditions makes it difficult for traders to accurately assess the quality of the trading environment. This includes typical spreads during different market conditions. This lack of transparency extends to execution statistics and performance metrics that reputable brokers typically provide to demonstrate their execution quality.

Trust and Safety Analysis (3/10)

Trust and safety concerns represent perhaps the most critical weakness in this eagle trades review. The broker's unregulated status immediately raises red flags about client protection and operational oversight. Without regulatory supervision, traders lack the fundamental protections typically provided by licensed financial institutions.

The absence of regulatory oversight means that standard industry practices may not be implemented. This includes fund segregation, client money protection, and operational transparency. This creates significant risks for client funds and trading activities, as there is no regulatory authority to ensure compliance with industry standards.

User complaints about withdrawal difficulties further erode confidence in the broker's trustworthiness. When clients report problems accessing their own funds, it raises serious questions about the broker's operational integrity and commitment to client service.

The lack of transparency regarding company ownership, financial backing, and operational procedures compounds trust concerns. Reputable brokers typically provide detailed information about their corporate structure, regulatory compliance, and financial stability to build client confidence.

User Experience Analysis (3/10)

Overall user experience with Eagle Trades receives a poor rating. This is based on consistent negative feedback across multiple aspects of the service. User satisfaction appears to be significantly below industry standards, with complaints spanning various operational areas from account management to customer service.

The registration and account verification processes appear to lack the streamlined efficiency that modern traders expect. User reports suggest potential complications and delays in account setup procedures. This can frustrate new clients and create barriers to trading activity.

Fund management represents a particularly problematic area of user experience. Multiple reports describe withdrawal difficulties and processing delays. The ability to efficiently deposit and withdraw funds is fundamental to a positive trading experience, and failures in this area significantly impact overall satisfaction.

Interface design and platform usability information is limited. However, user feedback suggests room for improvement in the overall digital experience. The manual trade execution approach may contribute to a less sophisticated user interface compared to modern electronic trading platforms that offer advanced features and automation capabilities.

Conclusion

This comprehensive eagle trades review reveals a broker with significant operational and regulatory concerns. These issues make it unsuitable for most retail traders. The combination of unregulated status, negative user feedback, and lack of transparency creates a high-risk environment that contradicts the fundamental requirements for safe and professional forex trading.

Eagle Trades may only be appropriate for highly experienced traders who fully understand the risks associated with unregulated brokers. These traders must be comfortable with the potential challenges in fund recovery and dispute resolution. However, for the vast majority of traders, particularly those seeking security and professional standards, numerous better-regulated alternatives are available in the market.

The primary advantages of Eagle Trades appear limited to the availability of forex and other asset trading. Meanwhile, the disadvantages significantly outweigh any potential benefits. Key concerns include the absence of regulatory oversight, reported withdrawal difficulties, poor customer service, and overall lack of operational transparency that professional traders require for successful and secure trading activities.