Executive Summary

This comprehensive trends creator global review shows major concerns about this Hong Kong-registered forex broker. Potential traders must think carefully before investing their money with this company. Our analysis of user feedback and industry reports reveals that Trends Creator Global has serious red flags that the trading community should know about.

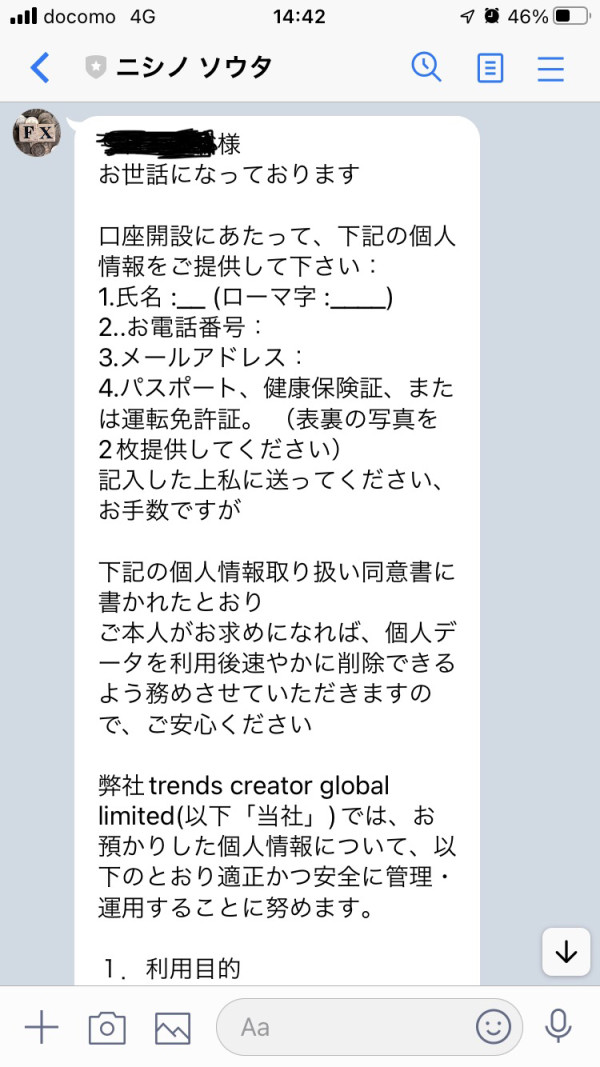

The broker works as an online forex trading platform registered in Hong Kong. It targets investors who want foreign exchange trading opportunities, but our investigation found many user complaints about withdrawal problems and poor customer service. WikiFX and other industry watchdogs have issued high-risk warnings about this broker because of potential fraud risks and regulatory concerns.

User reviews consistently report problems with taking out their funds, unresolved complaints, and bad customer support. The broker's regulatory status in Hong Kong does not provide enough trader protection, especially for international clients who live outside Hong Kong. While the platform claims to offer forex trading services, it lacks transparency about trading conditions, fees, and how it operates, which creates more concerns for potential users.

Given the growing evidence of operational problems and the lack of strong regulatory oversight, this trends creator global review recommends extreme caution. The broker appears unsuitable for both new and experienced traders who want reliable, transparent trading conditions with proper fund security measures that protect their investments.

Important Notice

Regional Entity Differences: Trends Creator Global operates mainly through its Hong Kong registration. This provides limited regulatory protection compared to major financial jurisdictions around the world. The broker's regulatory framework may not offer the same level of investor protection that established regulators in the UK, Australia, or Cyprus provide to their clients.

Review Methodology: This evaluation uses comprehensive analysis of user feedback, industry reports, regulatory warnings, and available public information. Our assessment includes data from WikiFX risk assessments, user complaint databases, and industry monitoring services to give an objective evaluation of the broker's services and reliability for potential clients.

Overall Rating Framework

Broker Overview

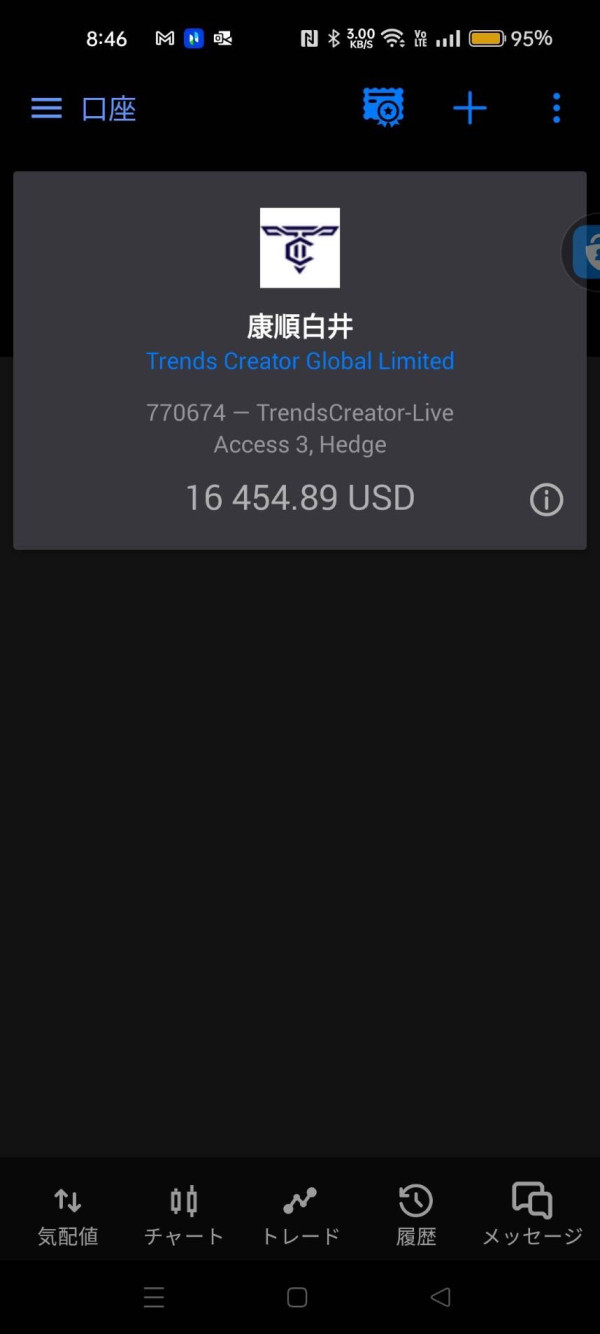

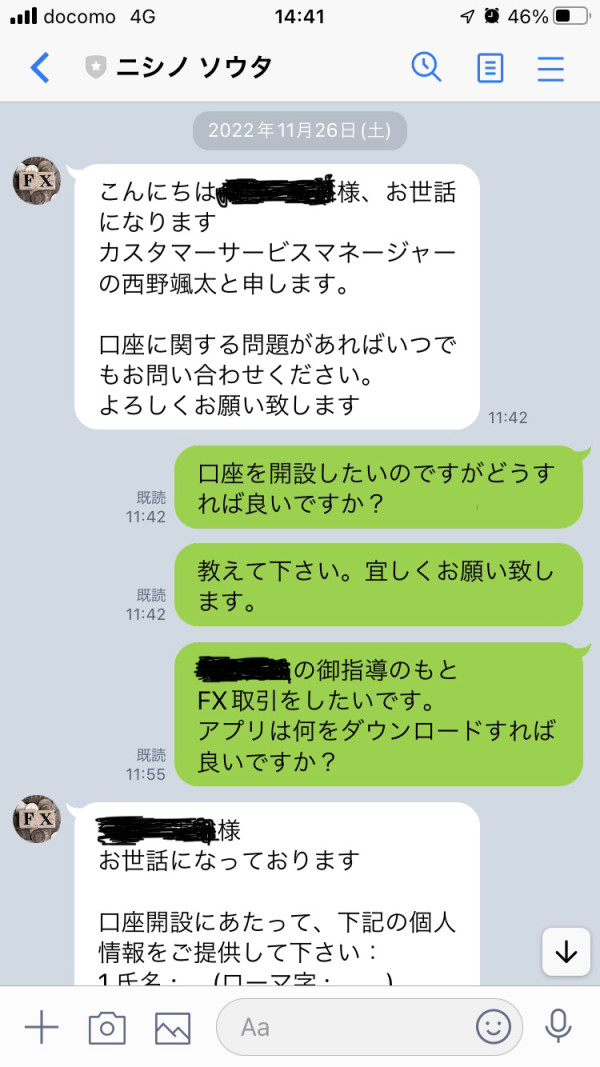

Trends Creator Global presents itself as an online forex broker for international traders who want foreign exchange trading opportunities. The company operates under Hong Kong registration, though specific establishment dates and comprehensive company background information remain unclear in available documentation. The broker's business model focuses on providing forex trading services, though detailed information about their operational structure and corporate history is notably limited.

The platform targets individual investors who are interested in currency trading. It presents itself as a gateway to global forex markets for people who want to trade currencies. However, the lack of comprehensive corporate transparency and detailed operational information raises questions about the broker's commitment to regulatory compliance and client protection standards that are typically expected in the modern forex industry.

From a regulatory perspective, Trends Creator Global operates under Hong Kong jurisdiction. This provides significantly less stringent oversight compared to major financial regulators in other countries. This trends creator global review finds that the broker's regulatory status offers limited protection for international clients, particularly those outside Hong Kong's immediate regulatory reach. The absence of additional regulatory licenses from established financial authorities represents a significant limitation in terms of investor protection and regulatory accountability for clients.

The broker's asset offering appears focused primarily on forex trading. However, comprehensive details about available currency pairs, trading instruments, and market access remain undisclosed in available materials. This lack of transparency regarding core trading offerings represents a concerning gap in essential information that traders typically require when evaluating potential brokers for their trading needs.

Regulatory Jurisdiction: Operating under Hong Kong registration with weak regulatory oversight and multiple industry warnings about compliance issues. The broker faces concerns about trader protection inadequacies that could affect client safety and fund security.

Deposit and Withdrawal Methods: Specific information about accepted payment methods, processing times, and withdrawal procedures not disclosed in available documentation. This raises transparency concerns that potential clients should consider carefully before opening accounts.

Minimum Deposit Requirements: No clear information available regarding minimum deposit amounts or account funding requirements. This indicates poor transparency standards that make it difficult for potential clients to plan their investments.

Bonus and Promotional Offers: Available materials contain no mention of promotional offerings, welcome bonuses, or incentive programs. The broker does not appear to offer special deals for new or existing clients.

Tradeable Assets: Focus appears limited to forex trading, though comprehensive details about available currency pairs, exotic currencies, or additional instruments remain undisclosed. This limits traders' ability to diversify their portfolios through this broker.

Cost Structure: Critical information about spreads, commissions, overnight fees, and additional trading costs not transparently disclosed. This makes cost comparison impossible for potential clients who want to evaluate the broker's competitiveness.

Leverage Options: Leverage ratios and margin requirements not specified in available documentation. This represents a significant information gap for risk assessment that traders need to make informed decisions.

Platform Selection: Trading platform technology, software options, and technical capabilities not detailed in accessible materials. This limits platform evaluation possibilities for traders who need specific technical features.

Geographic Restrictions: Service availability and regional limitations not clearly specified in available documentation. Potential clients cannot determine if the broker serves their country or region.

Customer Service Languages: Multi-language support capabilities and communication options not disclosed in available materials. International clients cannot determine if support is available in their preferred language.

This trends creator global review identifies significant transparency deficiencies across essential trading parameters. Reputable brokers typically disclose this information comprehensively to help clients make informed decisions.

Account Conditions Analysis

The evaluation of Trends Creator Global's account conditions reveals concerning gaps in transparency and disclosure. These gaps significantly impact trader decision-making and make it difficult to evaluate the broker properly. Available documentation fails to provide essential details about account types, tier structures, or differentiated service levels that modern forex brokers typically offer to accommodate varying trader needs and experience levels.

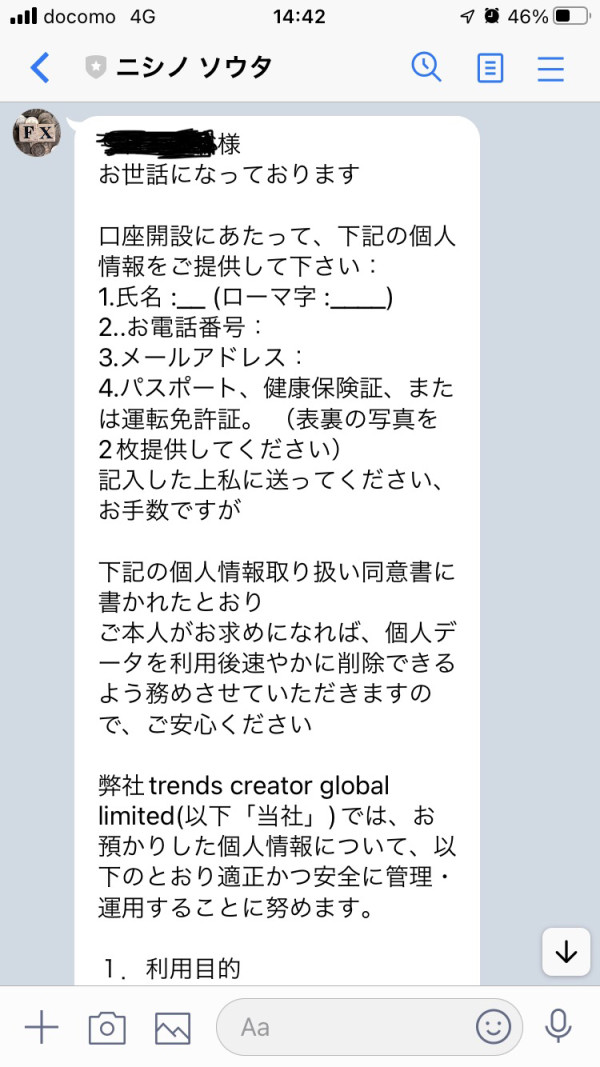

Minimum deposit requirements remain undisclosed. This prevents potential clients from understanding financial commitments required to begin trading with the broker. The lack of transparency extends to account opening procedures, verification requirements, and documentation needed for account activation, which creates confusion for potential clients.

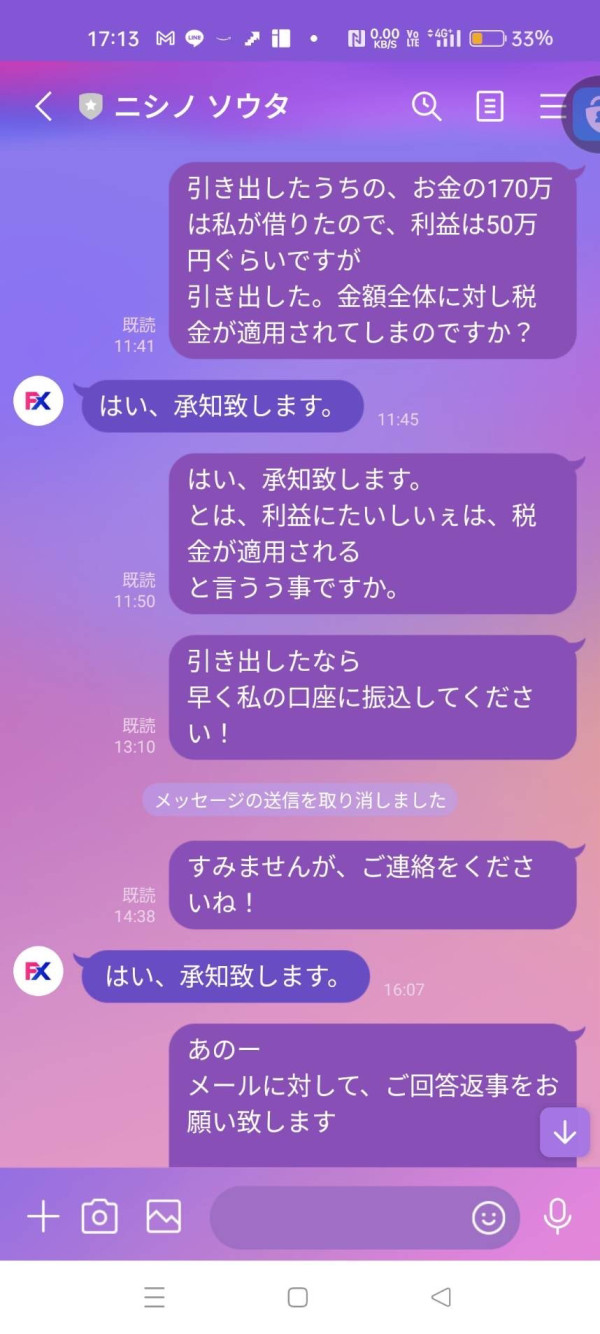

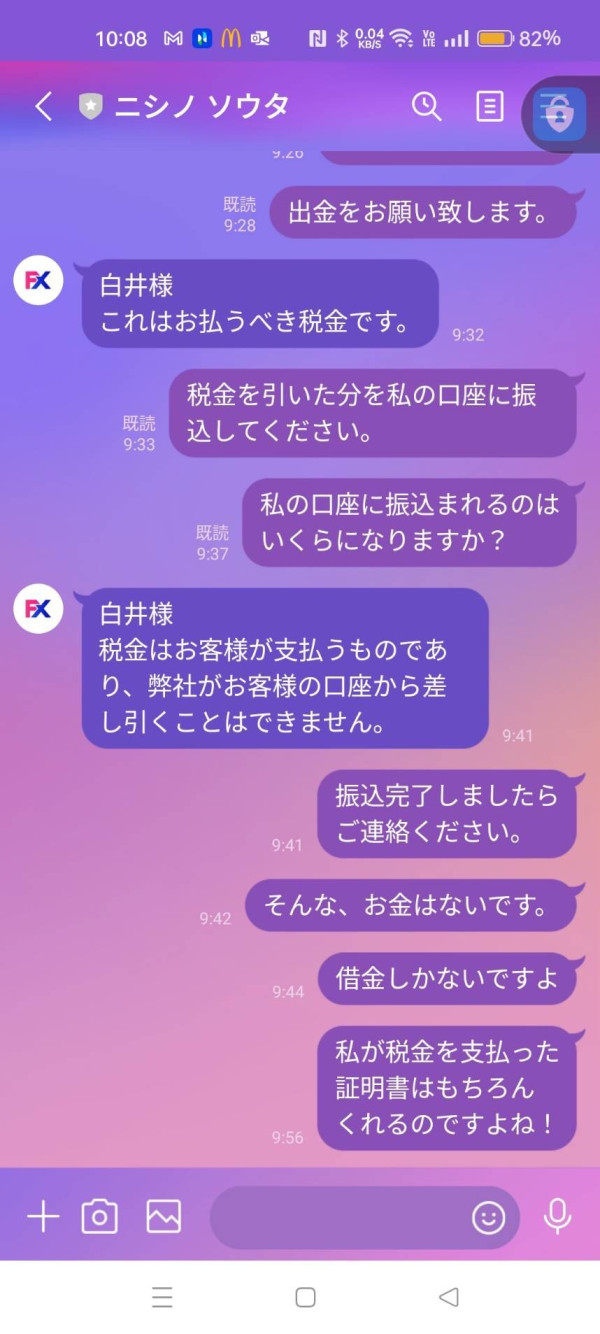

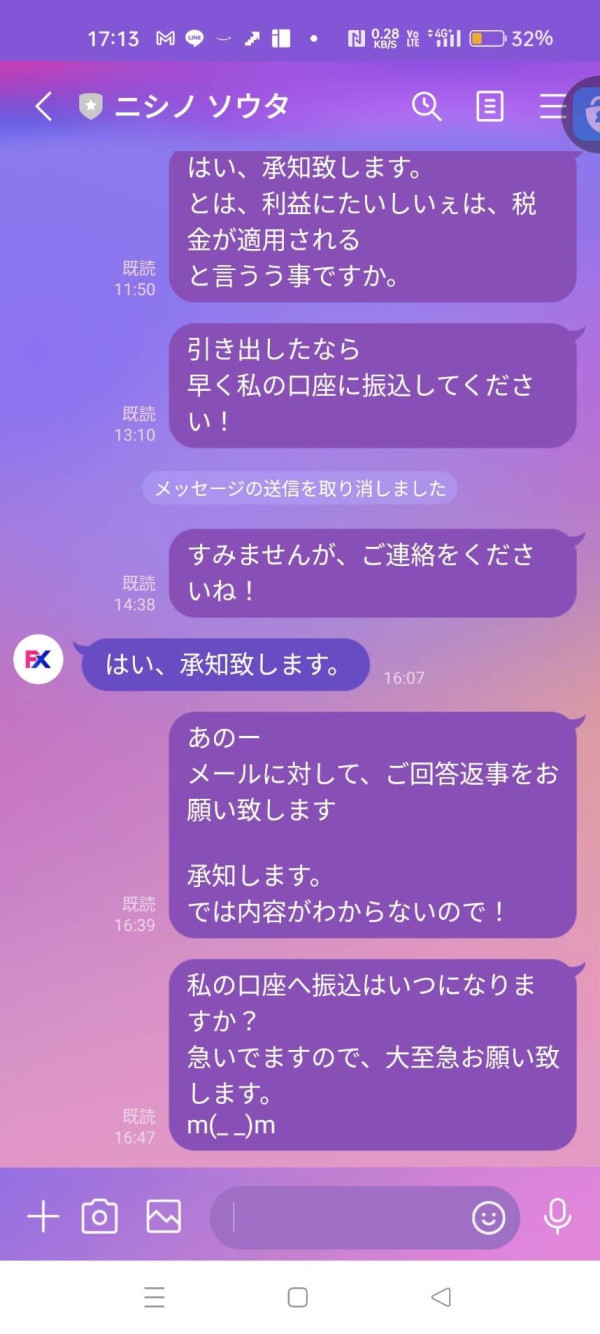

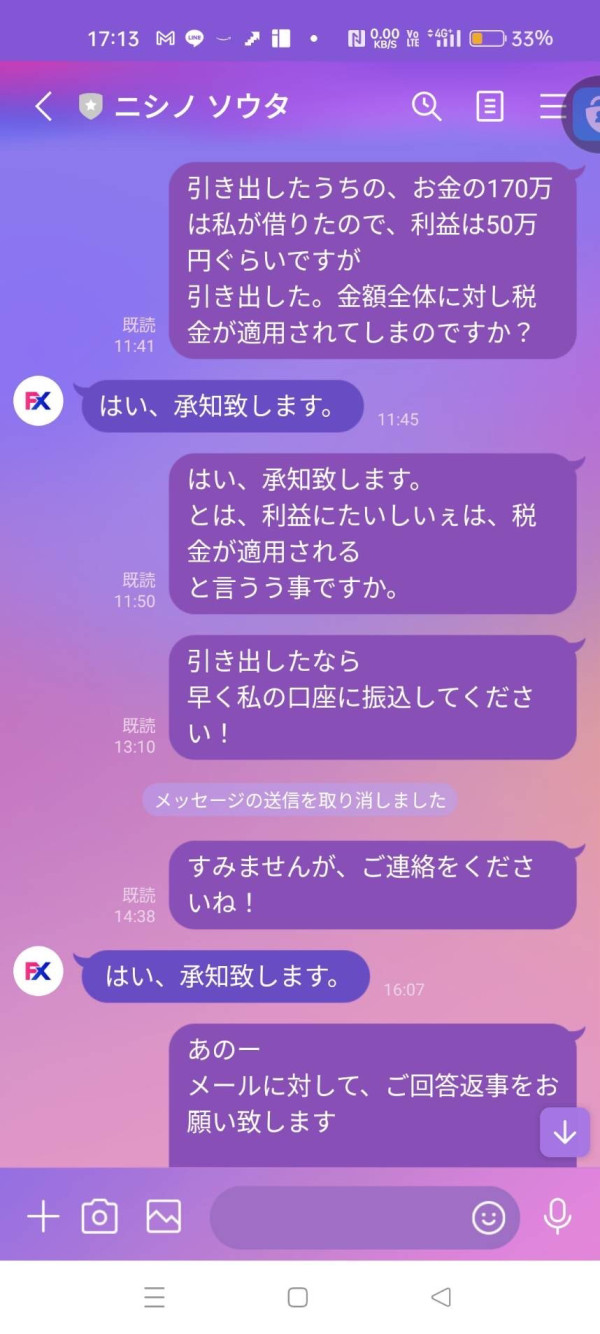

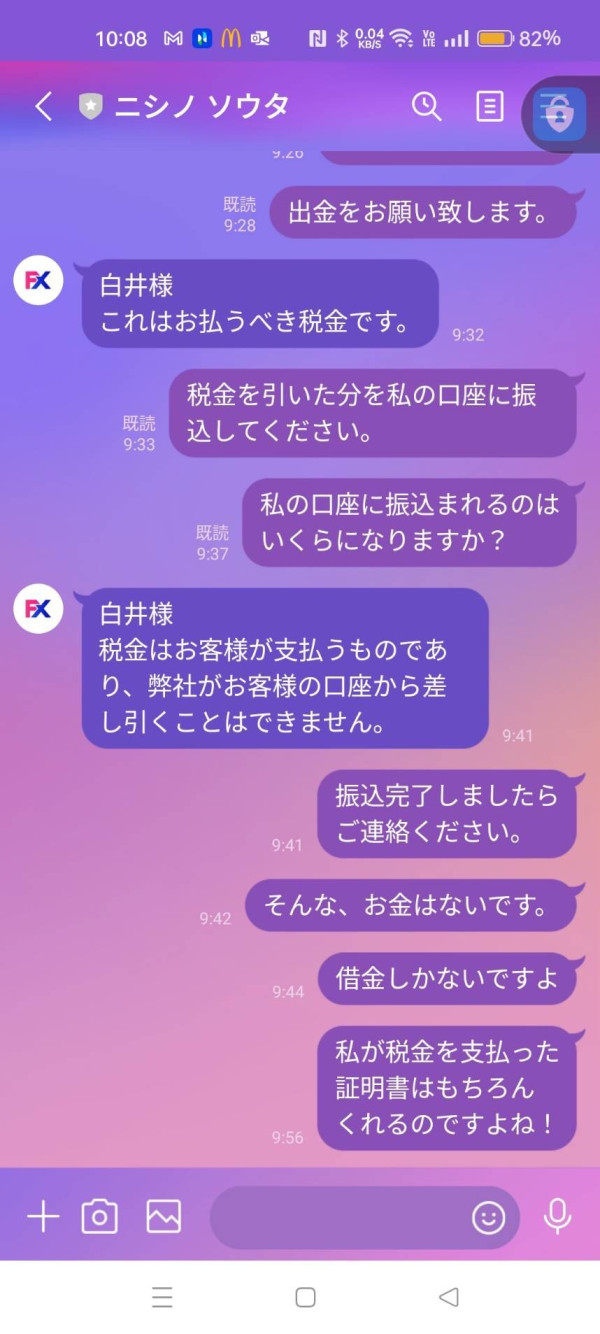

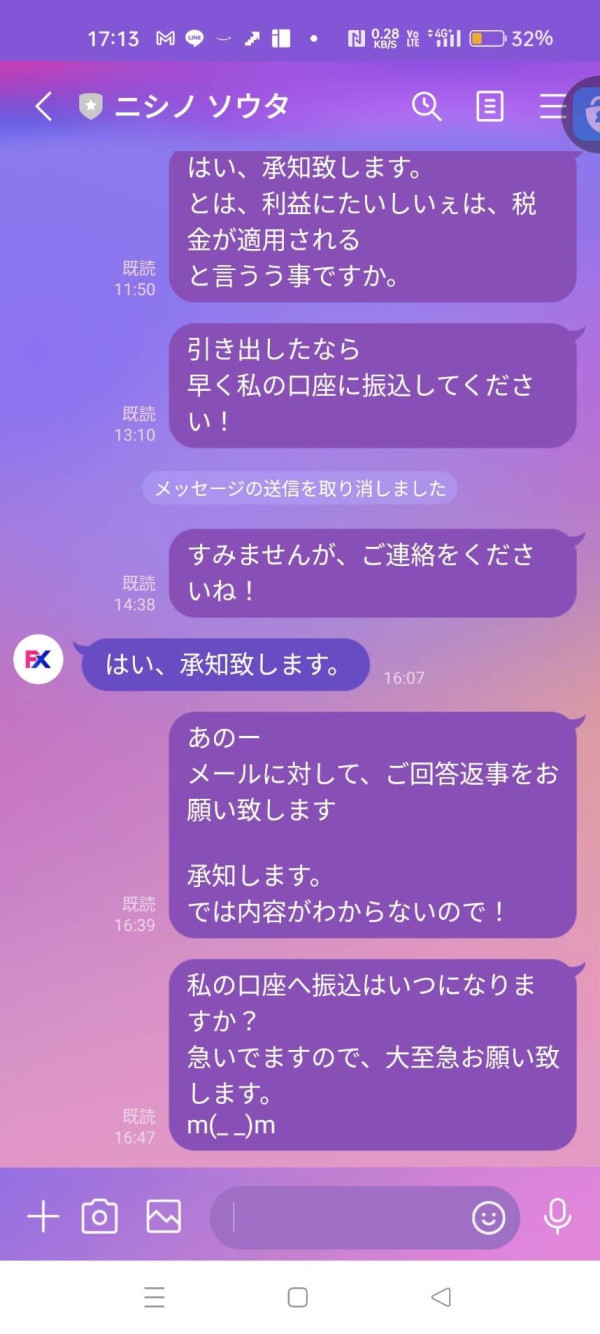

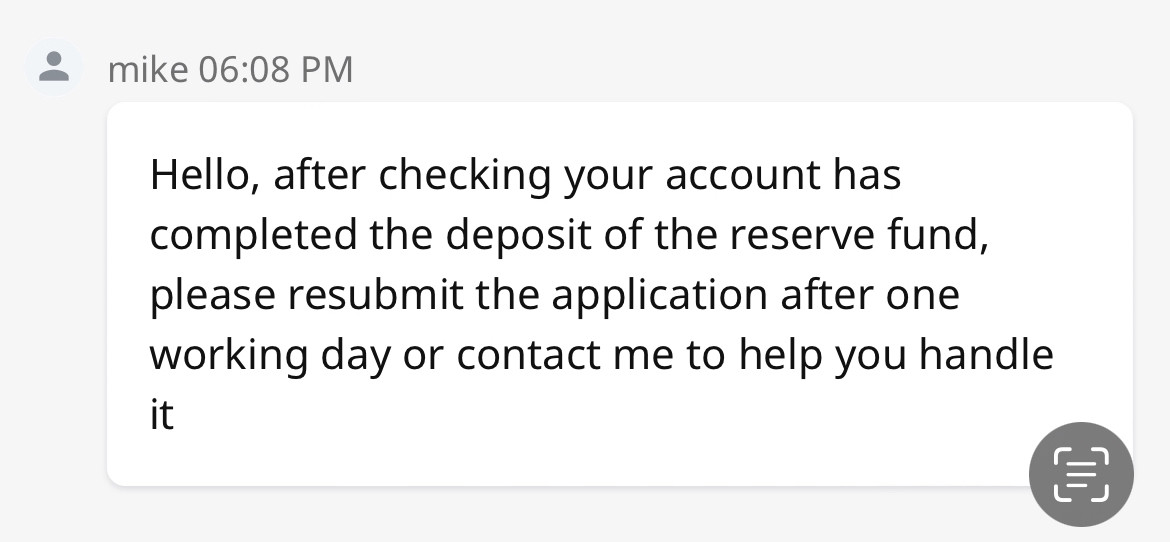

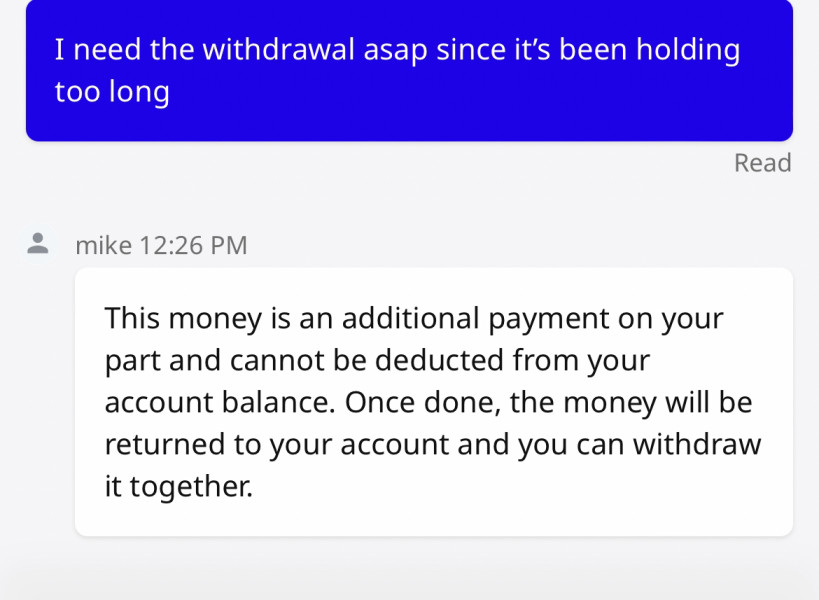

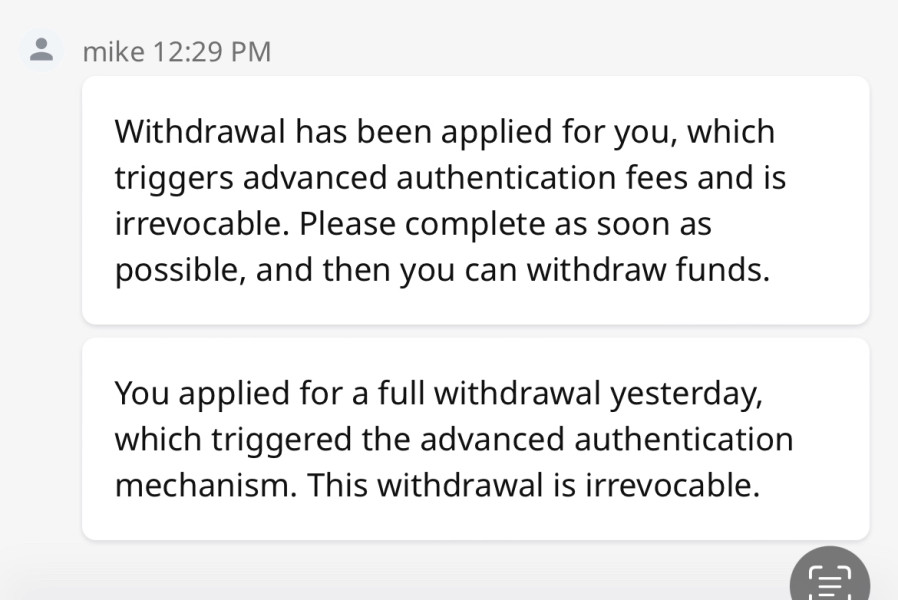

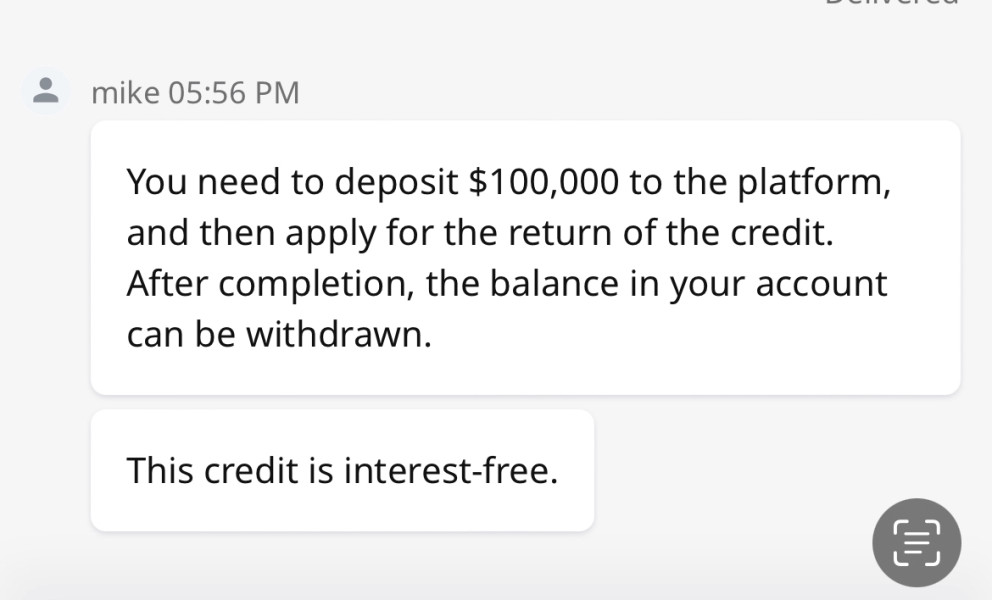

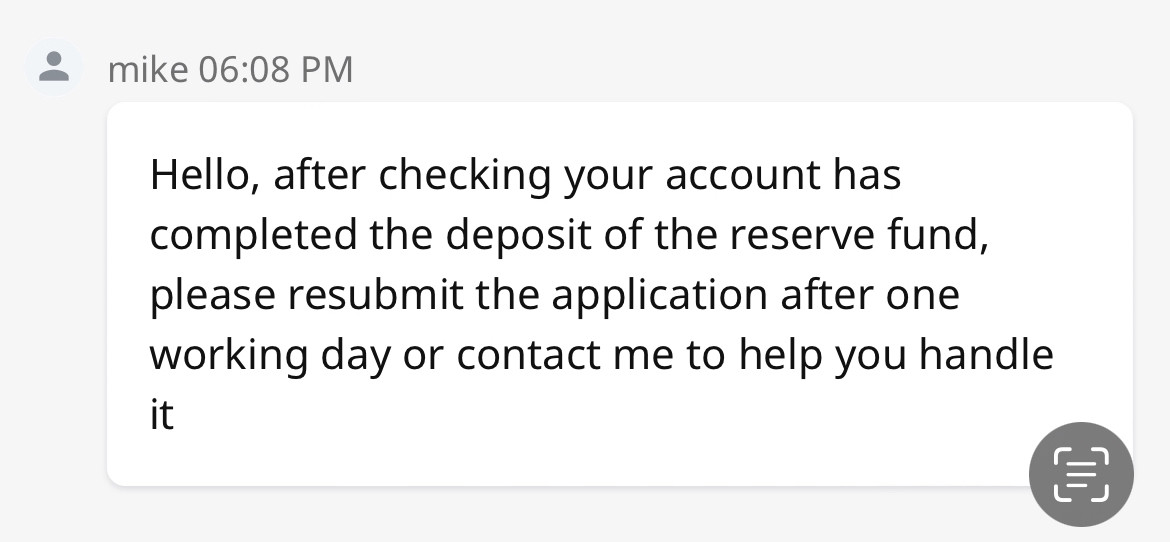

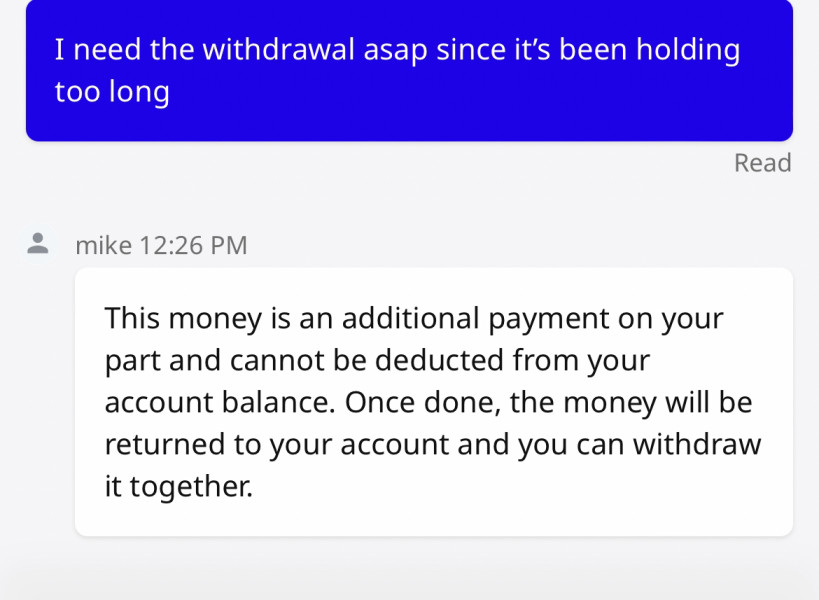

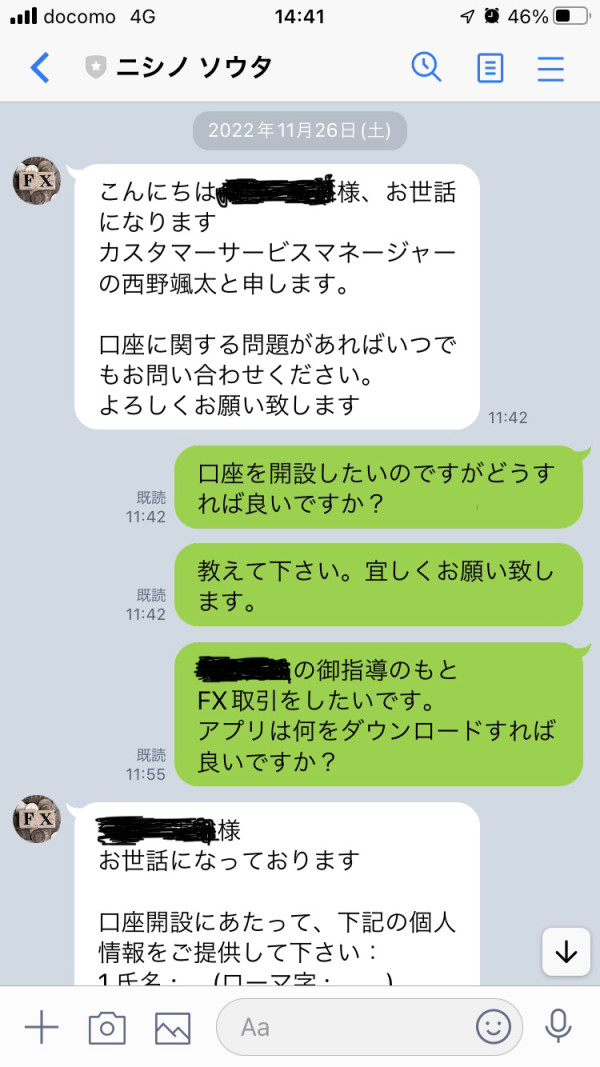

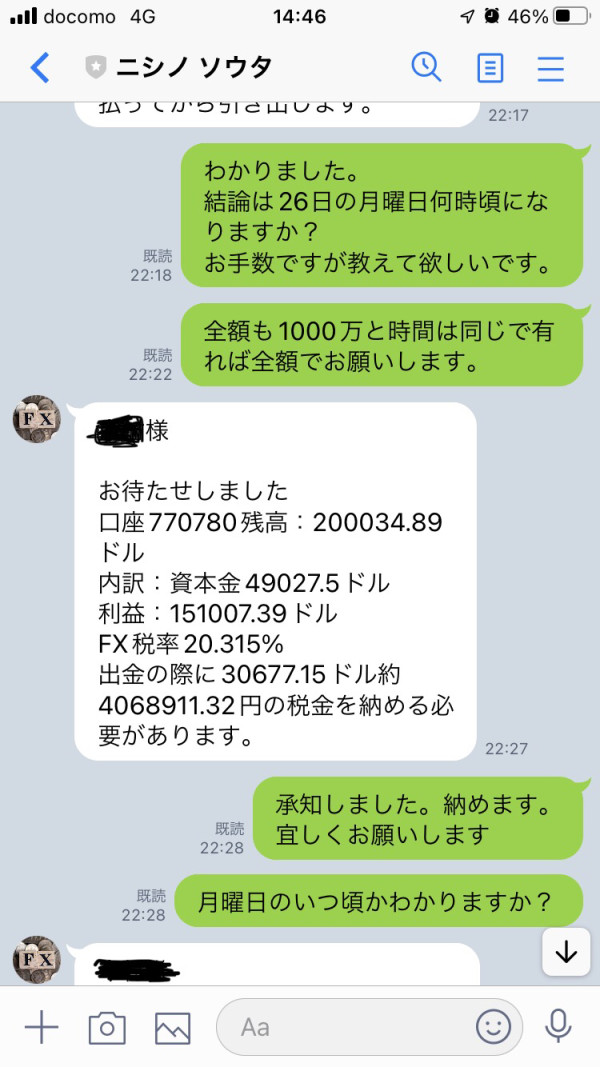

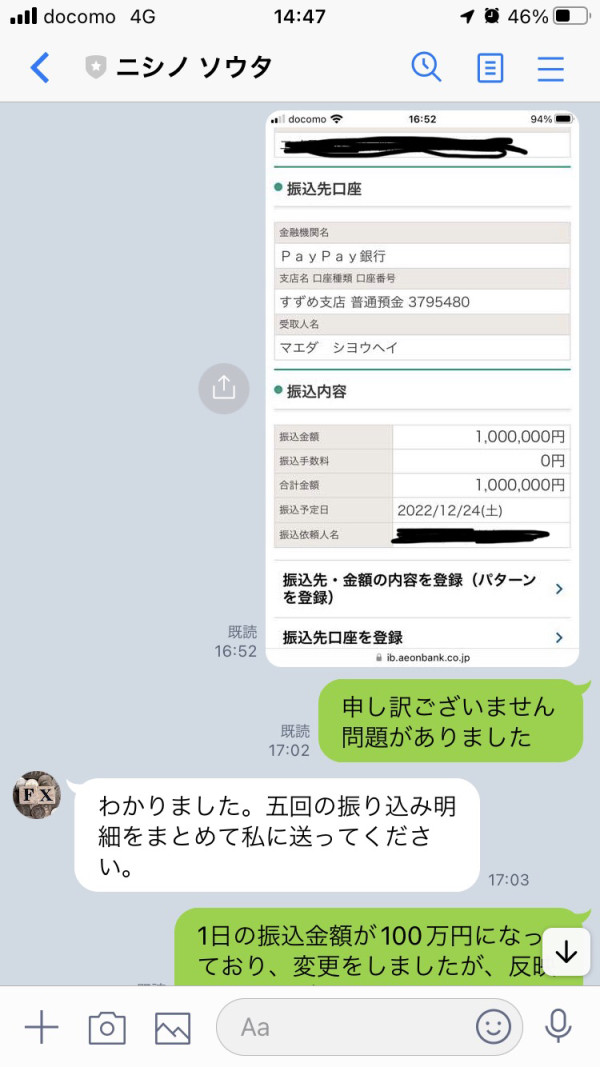

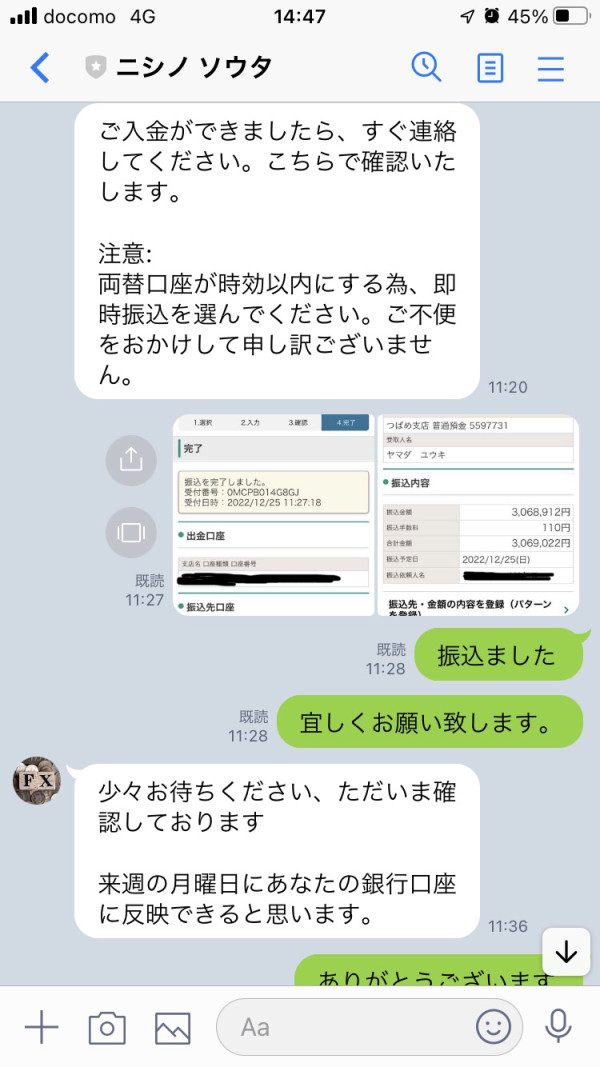

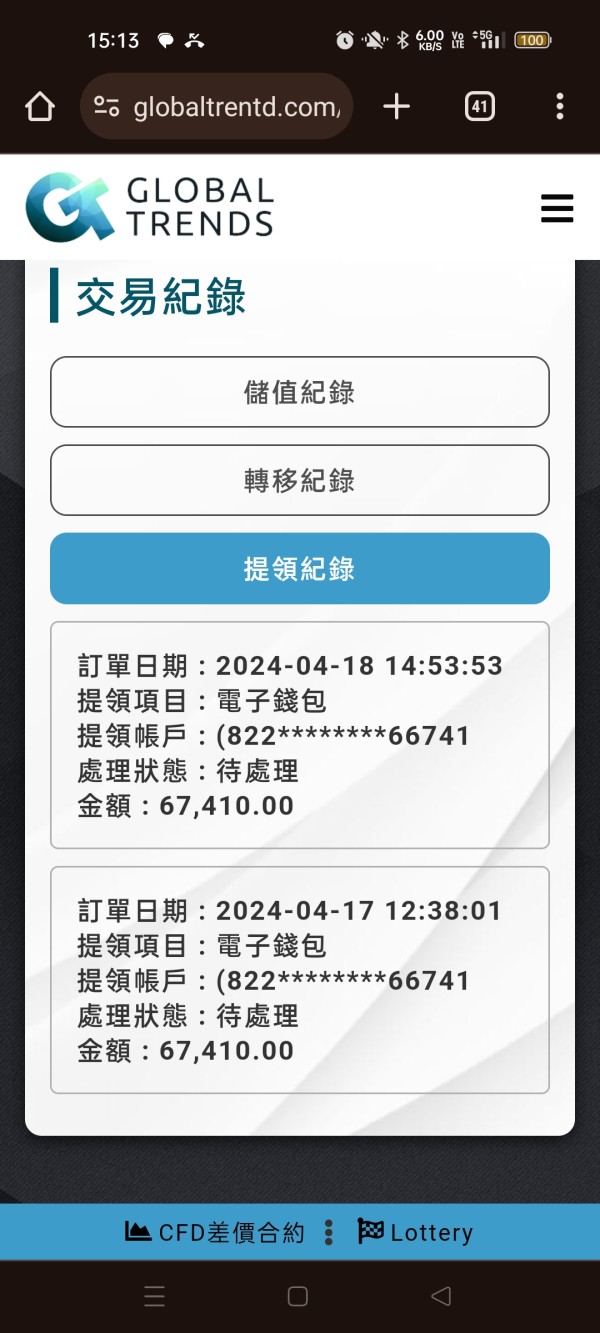

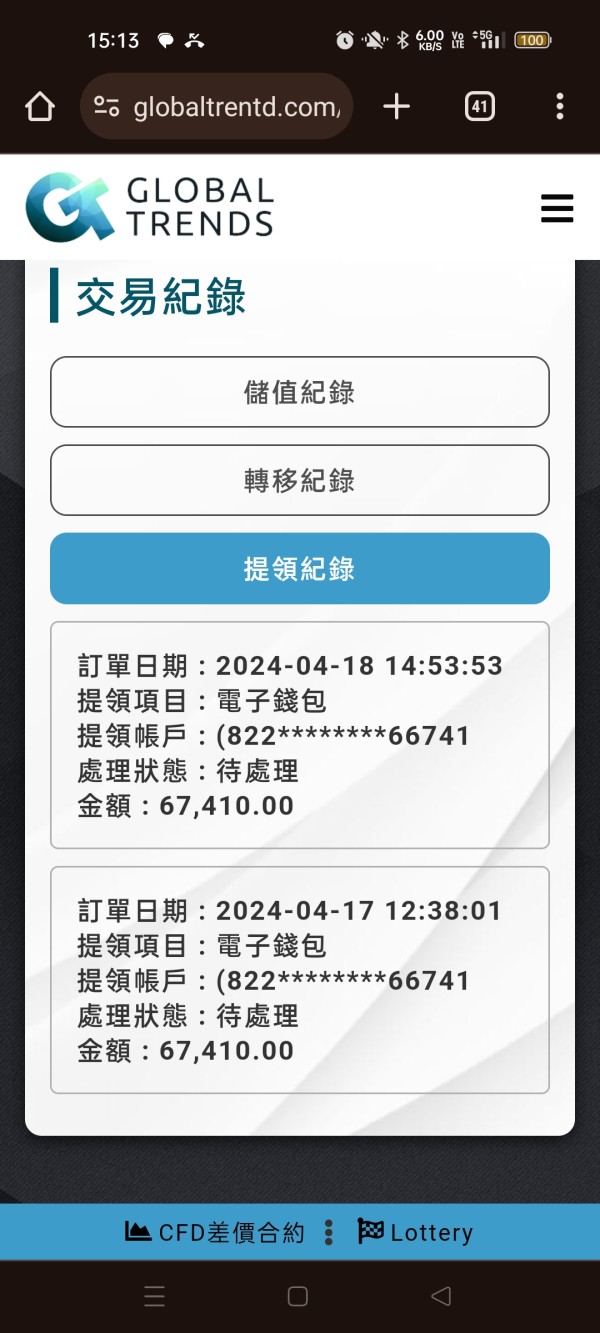

User feedback consistently highlights difficulties with account management, particularly regarding withdrawal processes and fund access. Multiple complaints suggest that account holders experience significant delays and obstacles when attempting to withdraw funds. This indicates potential issues with the broker's financial operations or client fund management procedures that could affect client money.

The broker's documentation contains no mention of specialized account features. These include Islamic accounts for Muslim traders, professional account categories, or institutional trading services that many brokers offer. This limited account structure suggests a basic service offering that may not accommodate diverse trader requirements or religious considerations important to global forex participants.

Account verification and compliance procedures remain unclear. This raises questions about the broker's adherence to anti-money laundering requirements and customer identification standards that are required by financial regulations. This trends creator global review finds that the lack of transparent account condition information, combined with user complaints about fund access, creates significant concerns about account reliability and operational integrity.

The assessment of Trends Creator Global's trading tools and educational resources reveals a notable absence of comprehensive offerings. Established forex brokers typically provide these tools and resources to help their clients succeed in trading. Available information contains no mention of advanced charting packages, technical analysis tools, or market research capabilities that experienced traders rely on for informed decision-making.

Educational resources appear virtually non-existent. There is no indication of trading tutorials, market analysis, webinars, or educational content designed to support trader development and learning. This absence is particularly concerning for novice traders who typically require substantial educational support to develop trading skills and market understanding.

Research and analysis capabilities remain undisclosed. This suggests limited or non-existent market commentary, economic calendar integration, or fundamental analysis resources that traders need. Professional traders typically expect access to institutional-quality research, market insights, and analytical tools that appear absent from this broker's offering.

Automated trading support, expert advisor compatibility, and algorithmic trading capabilities receive no mention in available documentation. This limitation significantly restricts advanced traders who rely on automated strategies or systematic trading approaches for portfolio management and consistent trading execution.

User feedback indicates that the broker's tool and resource limitations contribute to poor trading experiences. The lack of adequate support for developing trading strategies creates problems for clients who want to improve their trading skills. The lack of comprehensive trading infrastructure suggests that Trends Creator Global may not provide the technological foundation necessary for serious forex trading activities.

Customer Service and Support Analysis

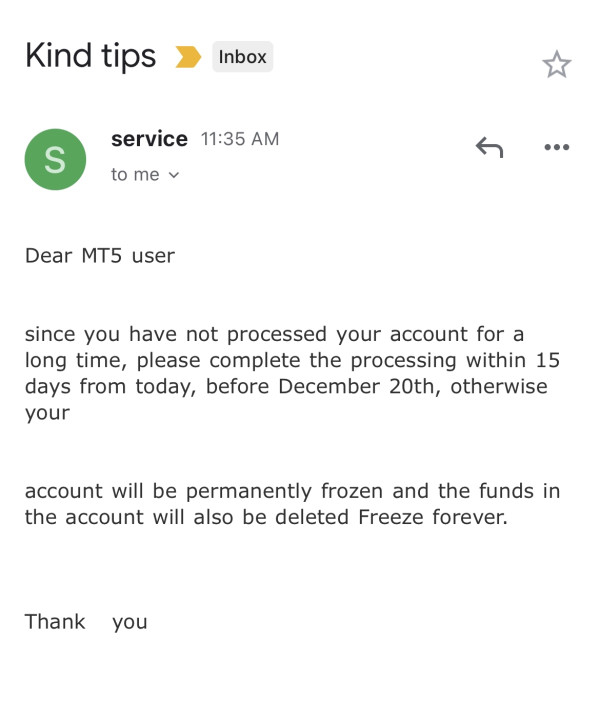

Customer service evaluation reveals the most concerning aspects of Trends Creator Global's operations. Multiple user reports indicate severely inadequate support quality and responsiveness that affects client satisfaction. User complaints consistently describe unresponsive customer service, delayed responses to urgent inquiries, and failure to resolve critical issues related to account access and fund withdrawals.

Available feedback suggests that customer service channels may be limited. There are unclear availability hours and potentially restricted communication options that make it difficult for clients to get help. The absence of comprehensive support infrastructure appears to create significant barriers for clients requiring assistance with trading issues, technical problems, or account-related concerns.

Response time analysis based on user feedback indicates substantial delays in addressing client inquiries. Some users report waiting weeks or months without meaningful responses to critical issues that affect their trading and fund access. This level of service inadequacy represents a fundamental failure in customer relationship management and operational support standards.

Problem resolution capabilities appear severely compromised. Multiple reports show unresolved complaints and ongoing issues that remain unaddressed despite repeated client contact attempts. The broker's apparent inability to effectively resolve customer concerns suggests systemic operational deficiencies that impact client satisfaction and trust in the company.

Multi-language support capabilities remain unclear. This potentially limits accessibility for international clients who require assistance in their native languages for better communication. The lack of comprehensive customer service infrastructure, combined with consistently negative user feedback, indicates that Trends Creator Global fails to meet basic customer support standards expected in the modern forex industry.

Trading Experience Analysis

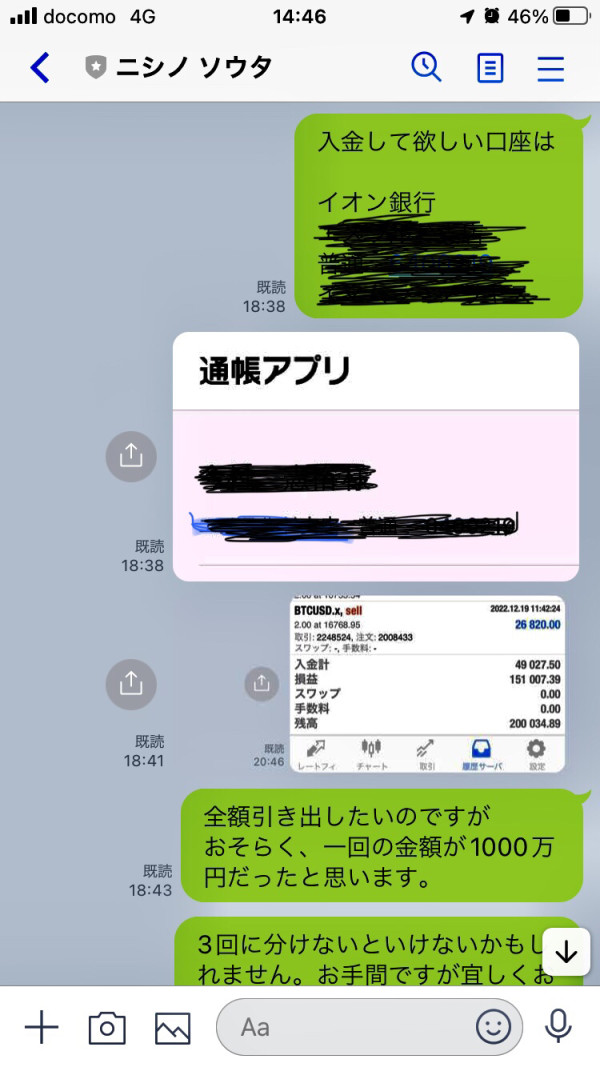

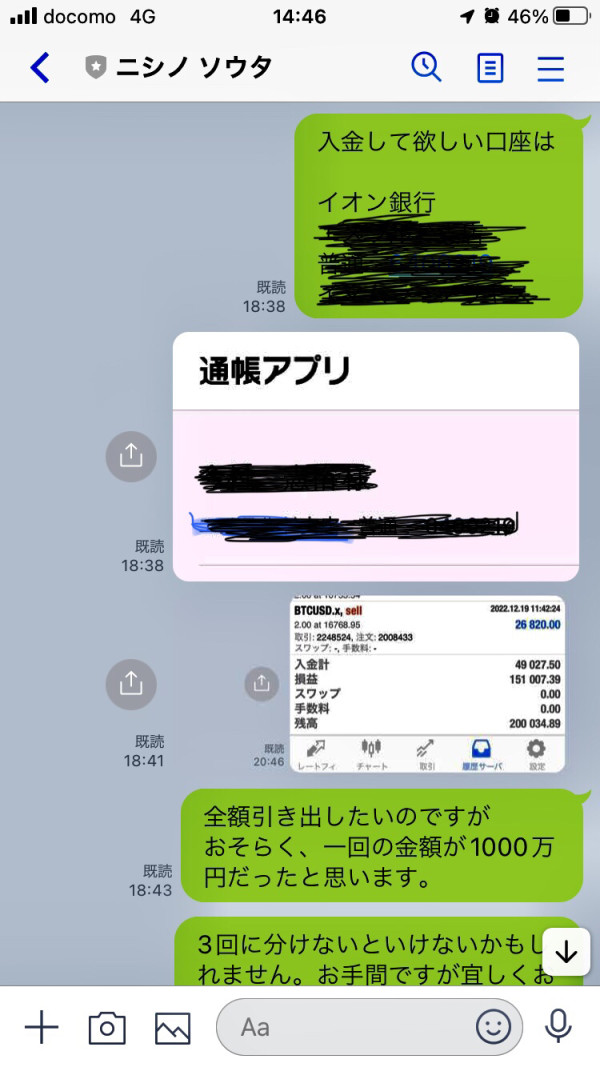

The evaluation of Trends Creator Global's trading experience reveals significant concerns based on user feedback and available operational information. User reports consistently indicate poor trading conditions that affect successful trading activities. Complaints about platform stability, execution quality, and overall trading environment reliability create problems for traders who need dependable market access.

Platform performance appears problematic based on user feedback. Reports suggest potential issues with order execution speed, price accuracy, and system reliability during active trading sessions. These technical concerns can significantly impact trading outcomes and create additional risks for active traders seeking reliable market access to global forex markets.

Order execution quality receives negative feedback from users. Reports indicate potential slippage issues, execution delays, and pricing discrepancies that can adversely affect trading performance and profitability. Professional traders require precise execution capabilities that appear compromised based on available user testimonials and experiences.

Mobile trading experience and platform accessibility remain unclear based on available documentation. This limits assessment of modern trading convenience features that contemporary traders expect from their brokers. The absence of clear information about mobile capabilities suggests potential limitations in trading flexibility and market access options for traders who need to trade on the go.

Overall trading environment feedback indicates user dissatisfaction with core trading functions. This suggests that the broker may not provide the reliable, professional trading conditions necessary for successful forex trading activities. This trends creator global review finds that trading experience concerns, combined with technical limitations, create substantial risks for traders seeking dependable market access and execution quality.

Trust and Reliability Analysis

Trust and reliability assessment reveals the most critical concerns regarding Trends Creator Global's operations and regulatory standing. The broker's Hong Kong registration provides minimal regulatory protection compared to established financial jurisdictions that have stronger oversight. This creates significant gaps in investor protection and regulatory oversight that could affect client safety and fund security.

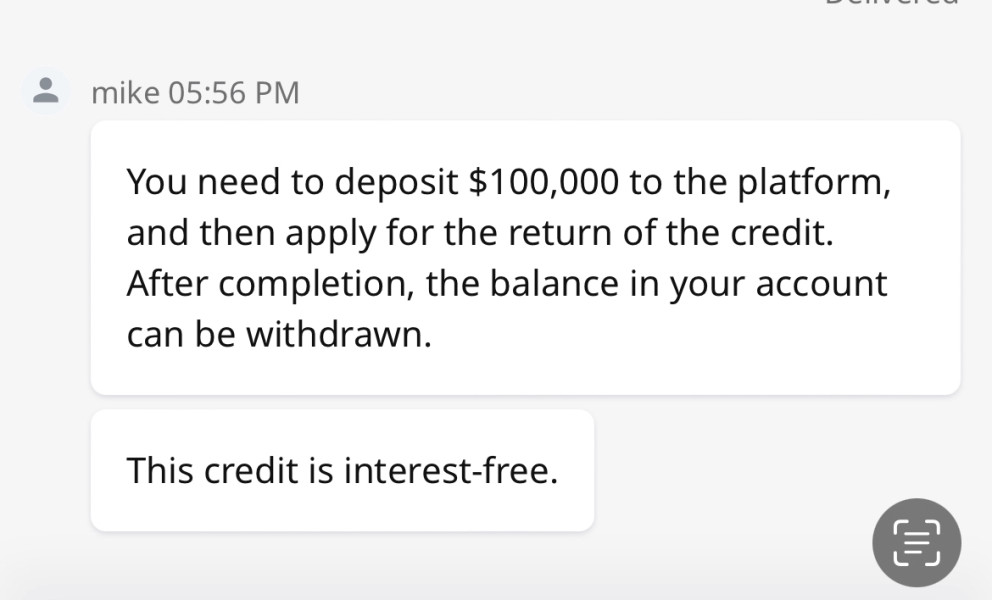

Industry warnings from WikiFX and other monitoring services classify Trends Creator Global as high-risk. They cite concerns about operational integrity, regulatory compliance, and potential fraud risks that could affect client funds. These third-party assessments represent serious red flags that potential clients must carefully consider before engaging with the broker's services.

Regulatory compliance appears inadequate based on available information and industry warnings. This suggests potential deficiencies in adhering to financial services standards, client fund protection requirements, and operational transparency obligations that protect clients. The lack of additional regulatory licenses from established authorities limits accountability and recourse options for international clients who may need legal protection.

Company transparency remains severely limited. There is minimal disclosure about corporate structure, operational procedures, financial standing, or management background that clients typically expect. This opacity contrasts sharply with transparency standards maintained by reputable forex brokers who provide comprehensive corporate information and regulatory documentation.

User trust indicators consistently point to negative experiences. Multiple complaints about fund security, withdrawal difficulties, and unresolved operational issues create a pattern of problems. The accumulation of negative feedback and industry warnings creates a pattern of reliability concerns that potential clients must seriously consider when evaluating broker selection options.

User Experience Analysis

Comprehensive user experience analysis reveals predominantly negative feedback across multiple operational areas. This indicates systematic deficiencies in service delivery and client satisfaction that affect the overall broker experience. User testimonials consistently report frustrating experiences with fundamental broker functions, including account management, customer service, and fund operations.

Overall user satisfaction appears extremely low based on available feedback. Multiple reports show unresolved issues, poor communication, and inadequate resolution of client concerns that affect user trust. The pattern of negative experiences suggests systemic operational problems rather than isolated incidents that might be expected with any financial service provider.

Interface design and platform usability receive limited positive feedback. User reports suggest potential difficulties with platform navigation, functionality, and user-friendly design elements that make trading more difficult. Modern traders expect intuitive, professional platform interfaces that appear to be lacking based on available user testimonials.

Registration and account verification processes appear problematic based on user feedback. Reports show unclear procedures, documentation requirements, and verification delays that create barriers to account activation and trading commencement. These problems make it difficult for new clients to start trading quickly and efficiently.

Fund operation experiences represent the most critical user concern. Multiple reports show withdrawal difficulties, processing delays, and unresolved fund access issues that affect client money. These experiences indicate potential problems with the broker's financial operations and client fund management procedures.

User demographic analysis suggests that Trends Creator Global is unsuitable for both novice and experienced traders. Traders seeking reliable, professional forex trading services should look elsewhere for better options. The consistent pattern of negative feedback and operational concerns makes this broker inappropriate for traders prioritizing security, reliability, and professional service standards.

Conclusion

This comprehensive trends creator global review concludes that the broker presents substantial risks and operational deficiencies. These problems make it unsuitable for serious forex trading activities that require reliable service and fund security. The combination of weak regulatory oversight, multiple industry warnings, and consistently negative user feedback creates a pattern of concerns that potential clients must carefully consider.

The broker appears most unsuitable for safety-conscious investors seeking reliable, transparent forex trading services. These investors need proper regulatory protection and professional operational standards that this broker does not provide. Both novice and experienced traders would benefit from considering alternative brokers with stronger regulatory standing and positive user feedback.

Primary disadvantages include withdrawal difficulties, poor customer service quality, limited regulatory protection, and low overall trustworthiness based on industry assessments and user experiences. The absence of disclosed advantages or positive operational features further reinforces the recommendation to seek alternative forex trading solutions. Traders should look for brokers with better operational track records and regulatory compliance standards that protect client interests and funds.