Theo 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive theo review examines a broker that presents unique challenges in evaluation. Limited information is available about its forex trading operations. Based on the available data, theo appears to be associated with restaurant operations rather than traditional forex brokerage services. This makes it difficult to provide a standard broker assessment.

The information available primarily relates to "Restaurant Theo," described as a Michelin restaurant in Copenhagen. This raises questions about the entity's primary business focus. Without clear regulatory information, trading conditions, or platform specifications, we cannot provide a definitive evaluation of theo's forex trading capabilities.

This theo review aims to present the available information transparently. We also highlight the significant information gaps that potential traders should be aware of before considering this broker.

Important Notice

This review is based on extremely limited information available about theo as a forex broker. The search results primarily returned information about Restaurant Theo, a dining establishment, rather than forex trading services. Readers should exercise caution and conduct additional research before making any trading decisions.

The evaluation methodology for this theo review relies on standard broker assessment criteria. However, specific information about theo's trading services remains unavailable in current sources.

Rating Framework

Broker Overview

The available information about theo presents a complex picture that requires careful examination. According to search results, the primary entity associated with the name "Theo" appears to be Restaurant Theo, located in Copenhagen and recognized as a Michelin restaurant.

This creates significant confusion regarding theo's role as a forex broker. The available information does not clearly establish its presence in the financial services sector. The disconnect between restaurant operations and forex trading services raises important questions about the broker's legitimacy and primary business focus that potential traders must consider.

Further investigation reveals that specific details about theo's forex trading operations are not readily available in current sources. This includes company establishment date, regulatory status, and business model. This lack of transparency is concerning for potential traders who require clear information about their broker's background and credentials.

The absence of detailed company information in this theo review reflects the challenges faced when evaluating a broker with limited public presence or documentation in the forex industry.

Regulatory Status: Available sources do not provide specific information about theo's regulatory oversight or licensing from recognized financial authorities. This represents a significant concern for potential traders seeking regulated broker services.

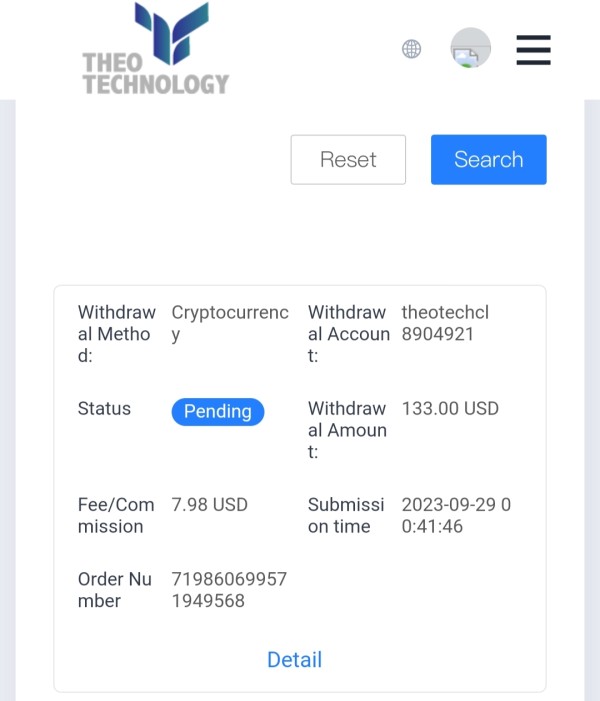

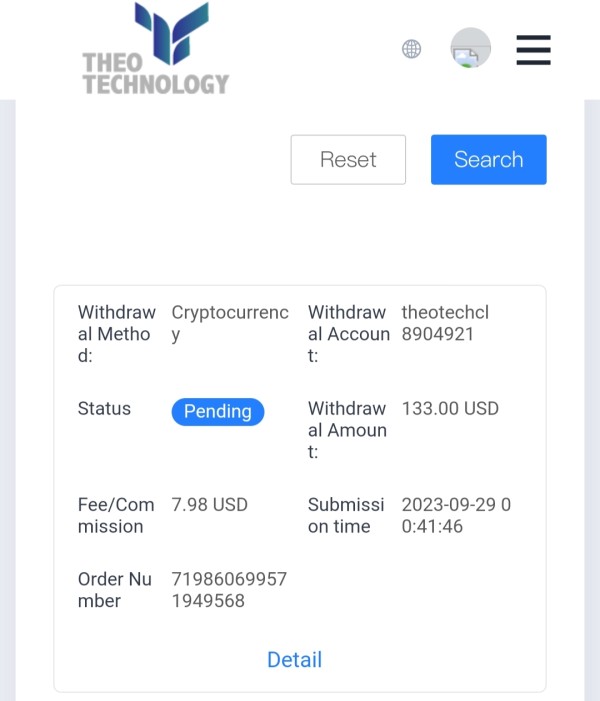

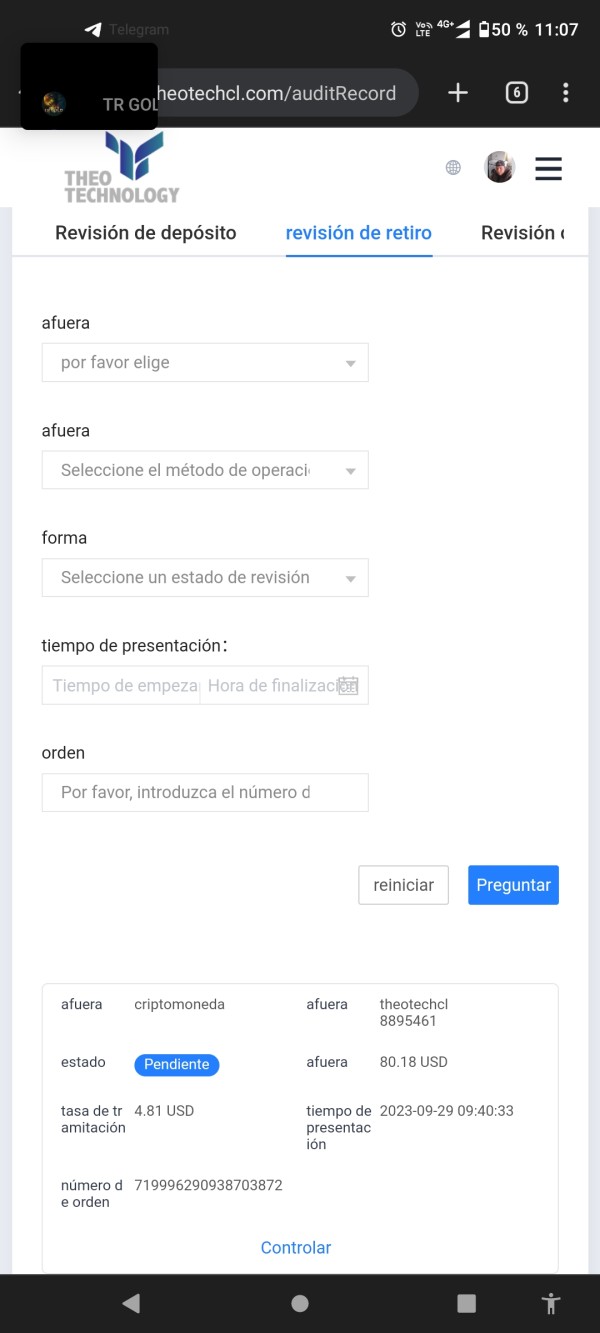

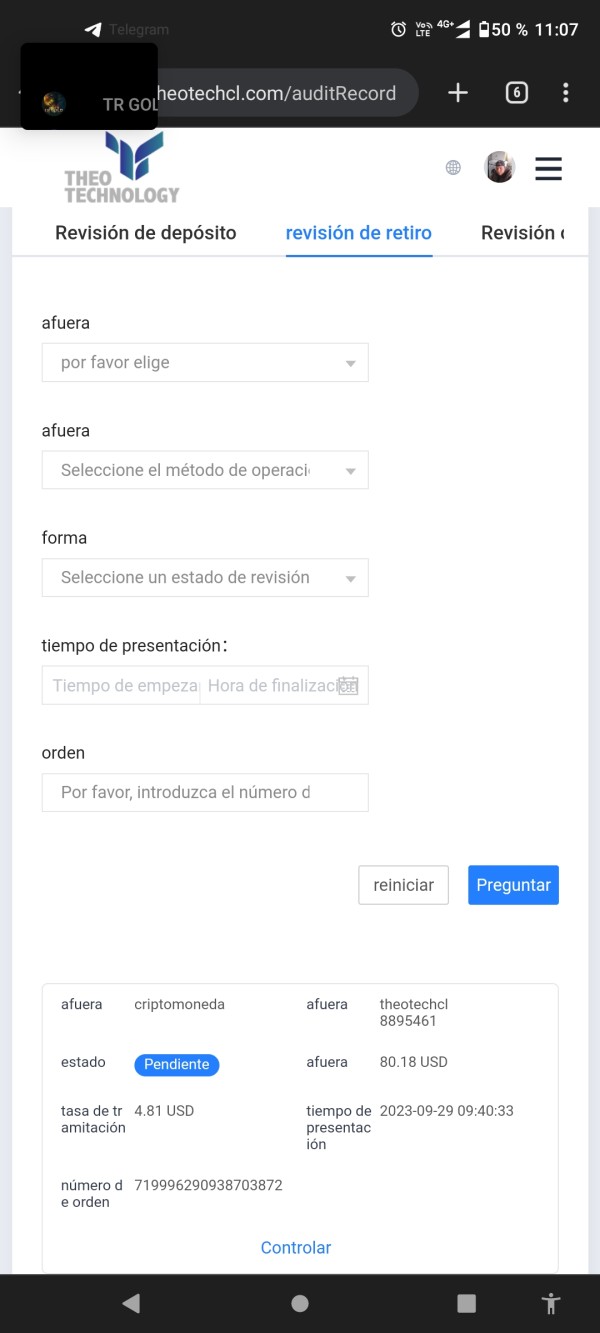

Deposit and Withdrawal Methods: Specific information about funding options, processing times, and associated fees is not available in current sources. This makes it impossible to evaluate the convenience and cost-effectiveness of financial transactions.

Minimum Deposit Requirements: No information found regarding minimum deposit amounts or account funding requirements. These are crucial factors for trader decision-making.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not specified in available materials.

Available Assets: Information about tradeable instruments is not provided in current sources. This includes currency pairs, commodities, indices, or other financial products.

Cost Structure: Specific details about spreads, commissions, overnight fees, or other trading costs are not available. This makes it impossible to assess the broker's competitiveness in pricing.

Leverage Options: No information found regarding maximum leverage ratios or margin requirements offered to traders.

Platform Options: Trading platform availability, features, and compatibility information is not specified in available sources.

Geographic Restrictions: Details about service availability in different regions or countries are not provided.

Customer Support Languages: Information about multilingual support options is not available in current materials.

This theo review must emphasize that the lack of specific forex trading information represents a significant limitation in providing a comprehensive broker evaluation.

Account Conditions Analysis

The evaluation of theo's account conditions faces substantial challenges due to the absence of specific information in available sources. Traditional forex brokers typically offer multiple account types designed for different trader profiles. These range from beginner-friendly accounts with lower minimum deposits to professional accounts with enhanced features and tighter spreads.

However, no such information is available for theo in current sources. This makes it impossible to assess the variety and suitability of account options for different trader needs. Account opening procedures, verification requirements, and documentation standards are crucial factors that traders consider when selecting a broker.

Unfortunately, these details are not specified in available materials about theo. This creates uncertainty about the onboarding process and compliance procedures. The absence of information about special account features further limits our ability to evaluate theo's accommodation of diverse trader requirements.

These features include Islamic accounts for Muslim traders or demo accounts for practice trading. Minimum deposit requirements and account maintenance fees are fundamental considerations for traders, particularly those with limited capital. The lack of specific information about these financial requirements in this theo review prevents potential traders from making informed decisions about account affordability and ongoing costs.

Without clear details about account conditions, traders cannot adequately assess whether theo's offerings align with their trading goals and financial capabilities.

Trading tools and analytical resources are essential components of a comprehensive forex trading experience. They enable traders to make informed decisions and execute effective strategies. However, available information about theo does not include specific details about trading tools, technical analysis features, or research resources provided to clients.

This absence of information makes it challenging to evaluate theo's technological capabilities and support for trader decision-making processes. Educational resources are valuable offerings that distinguish professional brokers from basic service providers. These include webinars, tutorials, market analysis, and trading guides.

The lack of information about educational support in available sources suggests either limited offerings or insufficient transparency about available resources. This gap in information is particularly concerning for novice traders who rely heavily on educational support to develop their trading skills and market understanding. Automated trading support has become increasingly important in modern forex trading.

This includes Expert Advisor compatibility and algorithmic trading features. Unfortunately, no specific information is available about theo's support for automated trading systems or third-party trading tools. The absence of details about API access, trading signals, or partnership with trading tool providers further limits our ability to assess theo's technological sophistication and trader support capabilities.

Customer Service and Support Analysis

Customer service quality and accessibility are critical factors in forex broker evaluation. Traders require reliable support for technical issues, account inquiries, and trading assistance. Unfortunately, available sources do not provide specific information about theo's customer service channels, availability hours, or response time standards.

This lack of transparency about support services raises concerns about the broker's commitment to client service and problem resolution capabilities. Multilingual support is increasingly important in the global forex market. Traders from diverse linguistic backgrounds require assistance in their preferred languages.

The absence of information about language support options in available materials makes it difficult for international traders to assess whether theo can provide adequate communication support. Additionally, no information is available about specialized support for different trader categories or account types. Response time and service quality are crucial metrics for evaluating customer support effectiveness.

This is particularly important in the fast-paced forex trading environment where timely assistance can impact trading outcomes. The lack of user feedback or service quality metrics in this theo review prevents a meaningful assessment of support performance. Without specific information about customer service standards, complaint resolution procedures, or client satisfaction measures, potential traders cannot adequately evaluate theo's support capabilities.

Trading Experience Analysis

The trading experience encompasses platform stability, execution speed, order management, and overall user interface quality. All of these are critical factors for successful forex trading. However, available information about theo does not include specific details about trading platform performance, execution quality, or user experience features.

This absence of technical information makes it impossible to assess theo's ability to provide reliable and efficient trading conditions for its clients. Platform functionality significantly impacts trader satisfaction and performance. This includes charting tools, order types, risk management features, and mobile accessibility.

Unfortunately, no specific information is available about theo's platform capabilities or technological infrastructure. The lack of details about trading platform options creates uncertainty about the tools and features available to traders. This includes whether they use proprietary or third-party solutions like MetaTrader.

Order execution quality are fundamental aspects of trading experience that directly affect trading profitability. This includes fill rates, slippage control, and price accuracy. The absence of performance data or user feedback about execution quality in this theo review prevents a meaningful evaluation of theo's trading environment.

Without specific information about trading conditions, latency, or execution standards, potential traders cannot assess whether theo can meet their performance expectations and trading requirements.

Trust and Reliability Analysis

Regulatory oversight and licensing from recognized financial authorities are fundamental requirements for broker trustworthiness and client protection. Unfortunately, available sources do not provide specific information about theo's regulatory status, licensing details, or compliance with financial services standards. This lack of regulatory transparency raises significant concerns about client fund safety and legal protections available to traders.

Fund security measures are crucial protections that regulated brokers typically provide. These include segregated client accounts, deposit insurance, and investor compensation schemes. The absence of information about these safety measures in available materials creates uncertainty about client fund protection and risk management.

Without clear details about financial safeguards, potential traders cannot adequately assess the security of their deposits and trading capital. Company transparency contributes to broker trustworthiness. This includes clear communication about business operations, ownership structure, and financial stability.

The limited information available about theo's business background and corporate structure raises questions about transparency and accountability. This is combined with the confusion about its primary business focus. This lack of clear corporate information represents a significant concern for traders seeking reliable and trustworthy broker relationships.

User Experience Analysis

Overall user satisfaction and feedback are valuable indicators of broker performance and service quality. However, available information about theo includes limited user feedback related to forex trading services. The primary user reviews found relate to Restaurant Theo, where customers noted concerns about crowded seating arrangements and service quality issues.

While these reviews provide insight into customer service approaches, they do not directly relate to forex trading experiences or platform usability. Interface design and platform usability significantly impact trader satisfaction and performance. This is particularly true for active traders who spend considerable time using trading platforms.

Unfortunately, no specific information is available about theo's platform design, navigation features, or user interface quality. The absence of user experience feedback about trading platforms prevents a meaningful evaluation of theo's technological user-friendliness and design effectiveness. Registration and verification processes are important aspects of user experience that affect trader onboarding and ongoing account management.

This includes fund management procedures as well. The lack of specific information about these processes in available sources creates uncertainty about the ease and efficiency of account setup and maintenance. Without clear details about user experience elements, potential traders cannot assess whether theo provides convenient and user-friendly services that meet their operational needs and preferences.

Conclusion

This comprehensive theo review reveals significant information gaps that prevent a standard broker evaluation and raise important concerns for potential traders. The absence of specific details about regulatory status, trading conditions, platform features, and customer services creates substantial uncertainty about theo's capabilities and legitimacy as a forex broker. The confusion between restaurant operations and forex trading services further complicates the assessment and suggests the need for additional research and verification.

Based on the limited information available, theo cannot be recommended for traders seeking transparent, well-documented broker services with clear regulatory oversight and comprehensive trading support. The lack of essential information about account conditions, trading costs, and platform features makes it impossible to determine whether theo can meet the needs of retail or professional forex traders. Potential clients should exercise extreme caution and conduct thorough independent research before considering any engagement with this broker.