TDX Global 2025 Review: Everything You Need to Know

Summary

TDX Global has become a controversial figure in the foreign exchange trading world. This TDX Global review shows a platform that operates with questionable regulatory transparency, which raises red flags among industry watchdogs and experienced traders alike.

The company was established in 2020 and has its headquarters in London. TDX Global positions itself as a forex and CFD trading provider, claiming operations under FinCEN and ASIC regulations. However, multiple sources indicate that the broker operates without proper regulatory oversight. This has earned it a WikiScore of 6 and warnings from various trading communities.

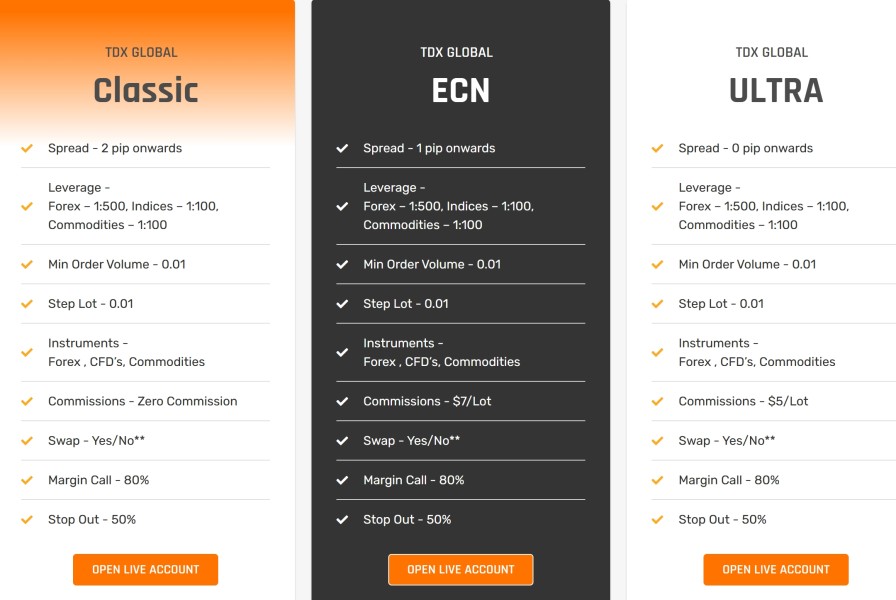

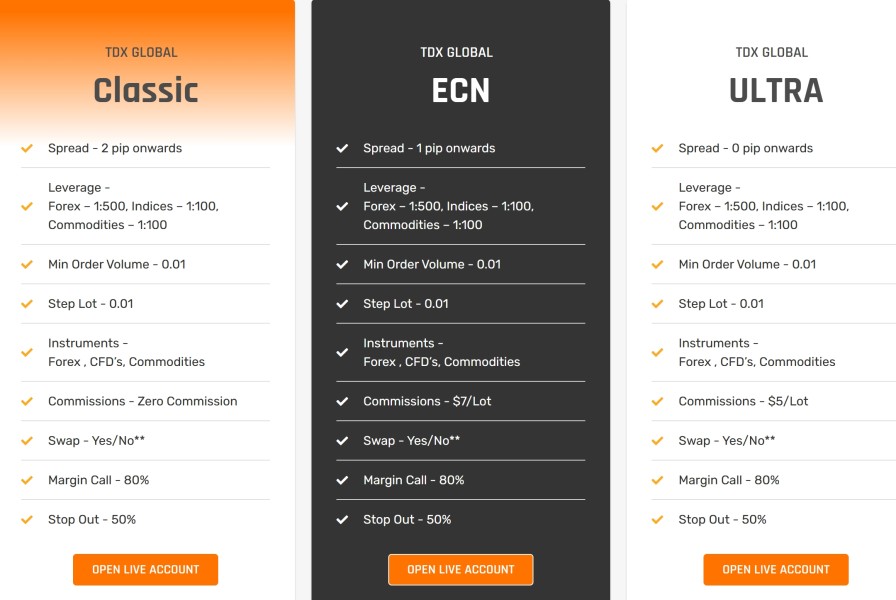

The platform's most appealing feature is its low barrier to entry, with a minimum deposit requirement of just $100. This makes it accessible to novice traders. TDX Global offers three distinct account types: Classic, ECN, and Ultra-low accounts, designed to cater to different trading preferences and experience levels.

Despite these seemingly attractive features, the broker faces significant criticism regarding its transparency and operational legitimacy. User feedback presents a mixed picture. Some traders appreciate the AI-driven trading signals while others express concerns about customer service quality and platform reliability. The company's restriction from serving clients in the United States, Belgium, North Korea, and the United Kingdom further limits its global reach and raises questions about its regulatory standing.

Important Notice

This review is based on publicly available information, user feedback, and industry reports as of 2025. TDX Global does not provide services to residents of the United States, Belgium, North Korea, the United Kingdom, and other jurisdictions where legal restrictions apply. These geographical limitations may significantly impact trader accessibility and should be considered before engaging with the platform.

The information presented in this analysis does not constitute investment advice or recommendations. Potential traders should conduct their own due diligence and consider consulting with financial advisors before making any trading decisions. Given the concerns raised about TDX Global's regulatory status, extra caution is advised.

Rating Framework

Broker Overview

TDX Global entered the competitive forex trading market in 2020. The company established its headquarters in London while claiming regulatory compliance under FinCEN and ASIC frameworks. However, industry investigations have revealed significant discrepancies between the company's regulatory claims and its actual status, with multiple sources identifying it as an unregulated broker operating outside proper oversight mechanisms.

The company's business model centers on providing forex and Contract for Difference (CFD) trading services to international clients. This excludes those from restricted jurisdictions. TDX Global markets itself as a technology-forward broker, emphasizing AI-driven trading signals and algorithmic trading capabilities, though detailed information about these features remains limited in available documentation.

According to various industry reports, TDX Global's operational structure raises several red flags typical of high-risk trading platforms. The company's lack of transparent regulatory documentation, combined with mixed user experiences, has led to warnings from platforms like TraderKnows, which advises potential clients to exercise extreme caution. This TDX Global review aims to provide a comprehensive analysis of these concerns while examining the platform's actual offerings and user experiences.

The broker's target demographic appears to be traders willing to accept higher risk levels in exchange for potentially lower entry barriers and flexible account options. However, the company's regulatory uncertainties and limited transparency make it unsuitable for risk-averse traders or those seeking fully compliant trading environments.

Regulatory Status: TDX Global claims operation under FinCEN and ASIC regulations. However, independent verification reveals it operates as an unregulated broker, raising significant compliance and safety concerns for potential traders.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods is not detailed in available resources. This represents a significant transparency gap that potential traders should investigate before account opening.

Minimum Deposit Requirements: The platform maintains a competitive $100 minimum deposit requirement. This makes it accessible to traders with limited initial capital and appealing to those testing new platforms with minimal financial exposure.

Bonuses and Promotions: Available documentation does not specify current bonus offerings or promotional activities. This suggests either limited marketing incentives or inadequate disclosure of such programs to potential clients.

Tradeable Assets: TDX Global provides access to forex and CFD markets. However, the specific range of currency pairs, commodities, indices, and other instruments available for trading requires direct platform investigation for complete details.

Cost Structure: Critical information regarding spreads, commissions, overnight fees, and other trading costs remains undisclosed in available materials. This creates uncertainty about the true cost of trading with this TDX Global review subject.

Leverage Ratios: Specific leverage offerings are not mentioned in available documentation. This requires potential traders to contact the broker directly for this crucial trading information.

Platform Options: The trading platforms offered by TDX Global are not specifically identified in available resources. This leaves questions about whether they provide MetaTrader, proprietary platforms, or other trading software solutions.

Geographic Restrictions: The broker explicitly excludes clients from the United States, Belgium, North Korea, and the United Kingdom. This limits its global accessibility and market reach.

Customer Support Languages: Available documentation does not specify the languages supported by customer service teams. This potentially limits accessibility for non-English speaking traders.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

TDX Global's account structure demonstrates both accessibility and concerning gaps in transparency. The broker offers three primary account types: Classic, ECN, and Ultra-low accounts, each supposedly designed for different trader profiles and experience levels. This variety suggests an attempt to cater to diverse trading needs, from beginners to more experienced traders seeking specific execution models.

The $100 minimum deposit requirement stands as the platform's most competitive feature. This is significantly lower than many established brokers who require $250 or more. This low barrier makes TDX Global accessible to traders with limited capital or those wanting to test the platform without substantial financial commitment. However, this apparent advantage must be weighed against the platform's regulatory uncertainties.

A critical weakness in the account conditions lies in the lack of detailed information about spreads, commissions, and account-specific features. Potential traders cannot make informed decisions without understanding the true cost structure of each account type. The absence of information about Islamic accounts, demo account availability, and account upgrade procedures further diminishes the platform's transparency.

User feedback regarding account conditions presents mixed perspectives. Some appreciate the low entry requirements while others express frustration about hidden costs and unclear terms. This TDX Global review finds that while the account accessibility appears attractive, the lack of detailed cost information significantly undermines the overall account offering quality.

The trading tools and resources offered by TDX Global present a complex picture of potential capabilities hampered by limited documentation and mixed user experiences. The platform claims to provide AI-driven trading signals, which some users have reported as beneficial for their trading strategies. However, the lack of detailed information about these tools' functionality, accuracy rates, and implementation methods raises questions about their actual effectiveness.

TDX Global's offering of forex and CFD trading suggests access to multiple asset classes. However, the specific instruments, market depth, and trading conditions remain poorly documented. The absence of detailed information about research resources, market analysis, educational materials, and trading calculators indicates either limited offerings or inadequate disclosure of available tools.

User feedback shows divided opinions about the platform's tools quality. While some traders appreciate certain features like the mentioned AI signals, others report dissatisfaction with the overall tool suite and platform functionality. The lack of information about automated trading support, API access, and third-party tool integration limits the platform's appeal to more sophisticated traders.

The platform's resource limitations become particularly apparent when compared to established brokers who typically provide comprehensive educational materials, market research, economic calendars, and advanced charting tools. This gap suggests that TDX Global may be more suitable for experienced traders who rely on external resources rather than those seeking comprehensive platform-based support.

Customer Service and Support Analysis (4/10)

Customer service represents one of TDX Global's most significant weaknesses. User feedback consistently highlights inadequate support quality and responsiveness. Available information does not specify the customer service channels offered, leaving potential clients uncertain about how to access help when needed. This lack of transparency about support mechanisms raises concerns about the broker's commitment to client assistance.

Response time issues emerge as a recurring theme in user feedback, with multiple reports indicating slow resolution of client inquiries and problems. The absence of detailed information about support hours, multilingual assistance, and escalation procedures further compounds these concerns. For a broker operating in international markets, the lack of clear support structure information represents a significant operational deficiency.

The quality of customer service interactions, based on available user reports, appears inconsistent and often unsatisfactory. Traders have expressed frustration with the level of expertise demonstrated by support staff and their ability to resolve technical and account-related issues effectively. This pattern suggests inadequate training or insufficient staffing of customer service operations.

Professional traders typically require reliable, knowledgeable support for platform issues, account problems, and trading-related questions. TDX Global's apparent deficiencies in this area make it unsuitable for traders who depend on responsive customer service, particularly those managing larger accounts or conducting high-frequency trading activities.

Trading Experience Analysis (5/10)

The trading experience offered by TDX Global presents a mixed picture based on available user feedback and platform information. User reports indicate varying levels of satisfaction with platform stability, with some traders experiencing smooth operations while others report technical difficulties and connectivity issues. This inconsistency suggests potential infrastructure limitations that could impact trading performance.

Order execution quality remains a concern area. However, specific data about slippage rates, execution speeds, and requote frequency is not available in current documentation. Some users report satisfactory execution during normal market conditions, while others express concerns about performance during high volatility periods. The lack of detailed execution statistics makes it difficult to assess the platform's true performance capabilities.

Platform functionality appears limited compared to industry standards. Users note the absence of advanced features commonly found on established trading platforms. The lack of detailed information about available technical indicators, charting tools, and order types suggests either limited functionality or poor documentation of available features.

Mobile trading experience information is notably absent from available resources, which is particularly concerning given the importance of mobile access in modern trading. The overall trading environment appears to suffer from transparency issues, with users expressing uncertainty about actual trading conditions and costs. This TDX Global review finds that while some traders report positive experiences, the overall trading environment lacks the consistency and transparency expected from professional trading platforms.

Trust and Reliability Analysis (3/10)

Trust and reliability represent TDX Global's most significant challenges. Multiple factors contribute to serious concerns about the broker's legitimacy and safety. The primary issue stems from the discrepancy between the company's claimed regulatory status and independent verification results. While TDX Global claims operation under FinCEN and ASIC oversight, industry investigations indicate it operates without proper regulatory authorization.

The WikiScore of 6 reflects industry concerns about the platform's reliability and regulatory compliance. This rating, combined with warnings from platforms like TraderKnows advising users to avoid TDX Global, indicates serious red flags that potential traders should carefully consider. Such warnings are typically reserved for brokers with significant operational or regulatory issues.

Fund safety measures remain unclear, with no detailed information available about client fund segregation, insurance coverage, or compensation schemes. This lack of transparency about financial protections is particularly concerning for traders considering depositing funds with the platform. Established, regulated brokers typically provide clear documentation about client protection measures.

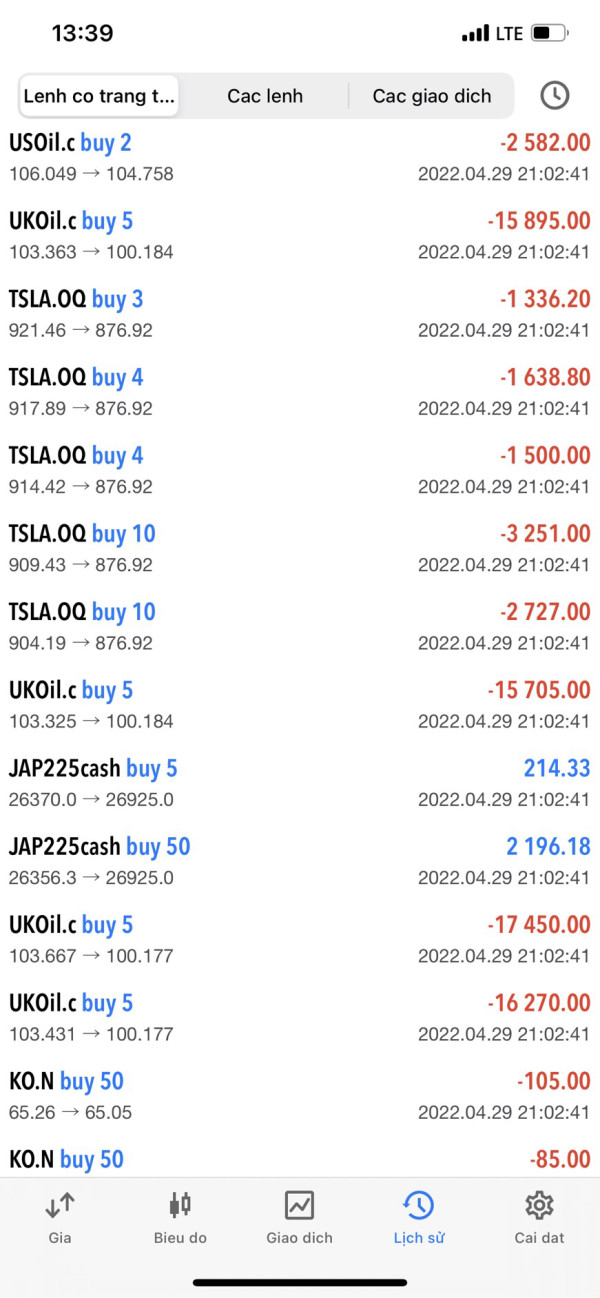

The company's overall transparency falls well below industry standards, with limited disclosure about company ownership, financial statements, regulatory documentation, and operational procedures. Reports suggesting involvement in questionable financial activities further compound trust concerns. These factors combine to create a high-risk environment unsuitable for traders prioritizing security and regulatory compliance.

User Experience Analysis (4/10)

User experience with TDX Global presents a complex landscape of mixed feedback and concerning gaps in platform usability and transparency. Overall user satisfaction appears low, with negative feedback outweighing positive experiences in available reports. This pattern suggests systemic issues with the platform's design, functionality, or operational management that impact user satisfaction.

The platform's interface design and usability information is notably absent from available documentation. This makes it difficult to assess the quality of user interaction design. Modern traders expect intuitive, responsive interfaces that facilitate efficient trading operations. The lack of information about platform design suggests either poor documentation or limited investment in user experience development.

Registration and account verification processes are not detailed in available materials. This creates uncertainty about the onboarding experience for new traders. Efficient, transparent account opening procedures are essential for positive user experiences, and the absence of this information raises concerns about potential complications or delays in account activation.

Funding operations experience remains unclear due to limited information about deposit and withdrawal processes, processing times, and associated fees. Users have expressed concerns about platform transparency and operational clarity, suggesting that basic account management functions may not meet modern trading standards.

The user demographic best suited for TDX Global appears to be experienced traders with high risk tolerance who can navigate uncertain regulatory environments. However, even these traders should exercise extreme caution given the platform's transparency issues and regulatory concerns. Improvements in transparency, customer service quality, and regulatory compliance would be necessary to enhance the overall user experience significantly.

Conclusion

This comprehensive TDX Global review reveals a trading platform that presents significant risks alongside limited benefits for potential traders. While the broker offers attractive features such as low minimum deposits and multiple account types, these advantages are overshadowed by serious concerns about regulatory compliance, transparency, and operational reliability.

The platform may appeal to experienced traders with high risk tolerance who understand the implications of trading with unregulated brokers. However, the combination of questionable regulatory status, poor customer service feedback, and limited transparency makes TDX Global unsuitable for most traders, particularly those prioritizing security and regulatory protection.

The primary advantages include accessibility through low deposit requirements and account variety. However, significant disadvantages encompass regulatory uncertainties, poor customer service quality, and limited operational transparency. Potential traders should exercise extreme caution and consider regulated alternatives that provide better protection and service quality.